Flexible Vilnius: the Beginning, the Emptiness, the Start

Written by Raimondas Reginis, Ober-Haus Research Manager for the Baltics

Contents:

- Intro

- From the First Steps 16 Years Ago to the Full Spectrum of Workplaces

- From Global Cities to Smaller Ones

- Vilnius vs Warsaw

- Picking Up a Centrally Located Coworking Space in Vilnius

- What Vilnius is Missing on Coworking Spaces?

- More on Coworking Stuff

- Epilogue

Intro

Do you hear the buzz? The global workplace revolution has started as the coworking movement has exploded recently. And everyone is talking about it. Especially those who are involved in the real estate industry. Independent workers, smaller companies or representatives of bigger businesses want more flexible and cost-effective working spaces, which can offer a social environment and a work community in advance. And if there is a demand – here comes the option.

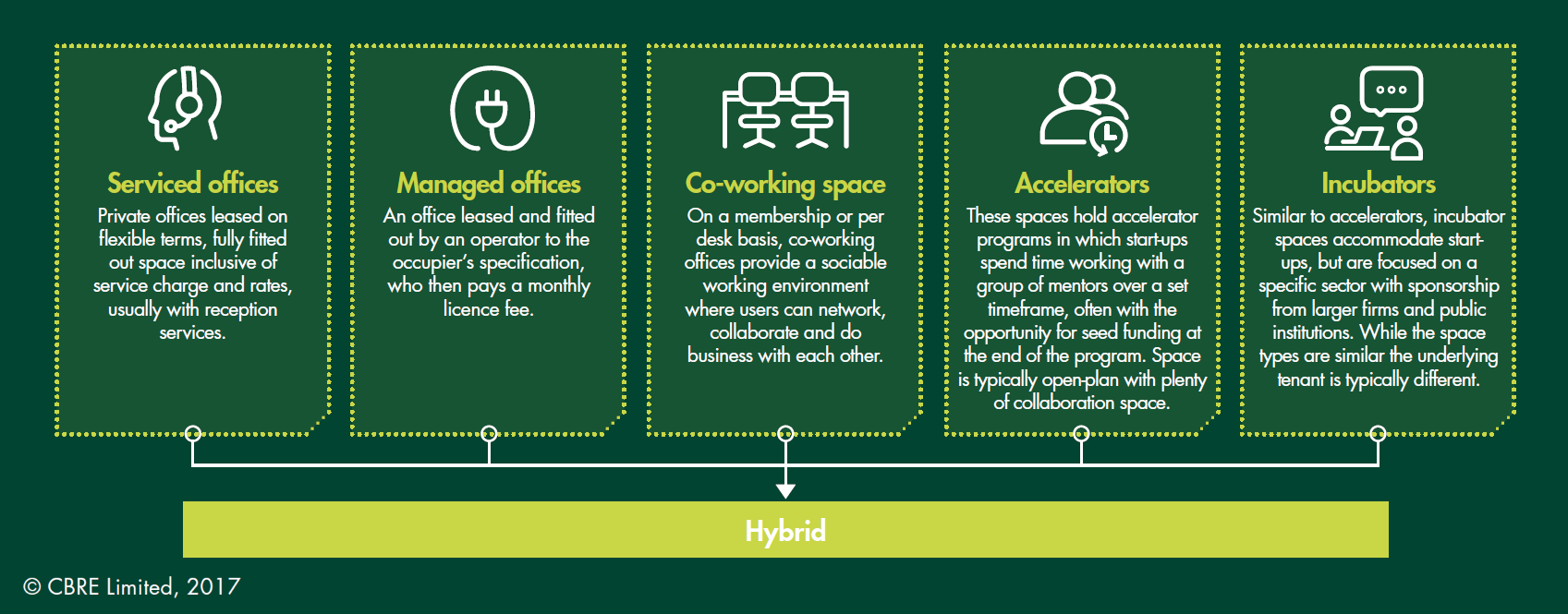

Over the past decade there has been noticeable growth in the flexible office sector globally with the real boom happening in the last 3-5 years. The economy, millennials and technology have all pushed landlords, serviced office operators and small investors toward the new business models. Traditional serviced offices, coworking spaces, incubators, accelerators and so on. From micro-coworking spaces to mega start-up campuses. From just the price of a cup of coffee for a hot desk for an hour to hundreds of euros for a private office per month. Different types with different names, still the core is the same – flexible workspace for everyone. And it’s not about square meters anymore. People are taking their suits off and moving from monotone inflexible offices to places providing interactions and a warm vibe. Globally.

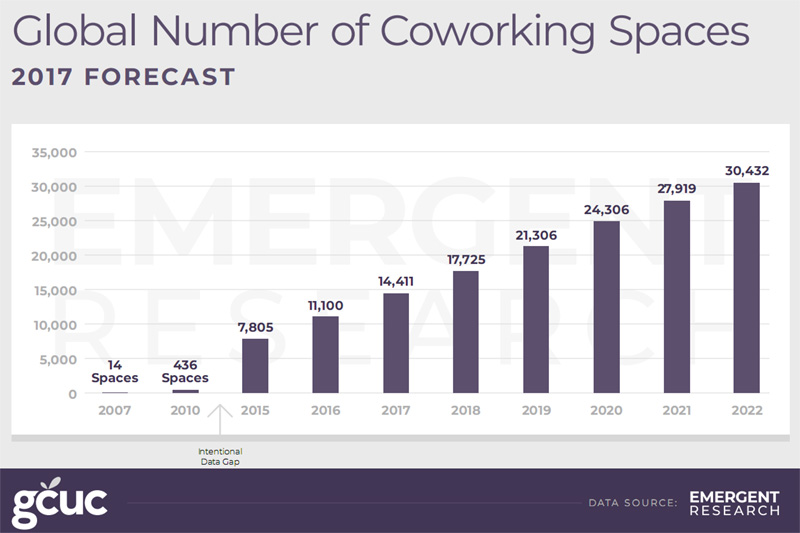

This coworking movement drives the flexible space market to new heights with tremendous growth recently and estimated further rapid expansion. The forecast report released by GCUC shows that the number of global coworking spaces will double in the next five years reaching over 30,000 spaces in 2022 (representing an average annual growth rate of 16%). At the same time the number of global coworking members will triple to reach 5.1 million.

From the First Steps 16 Years Ago to the Full Spectrum of Workplaces

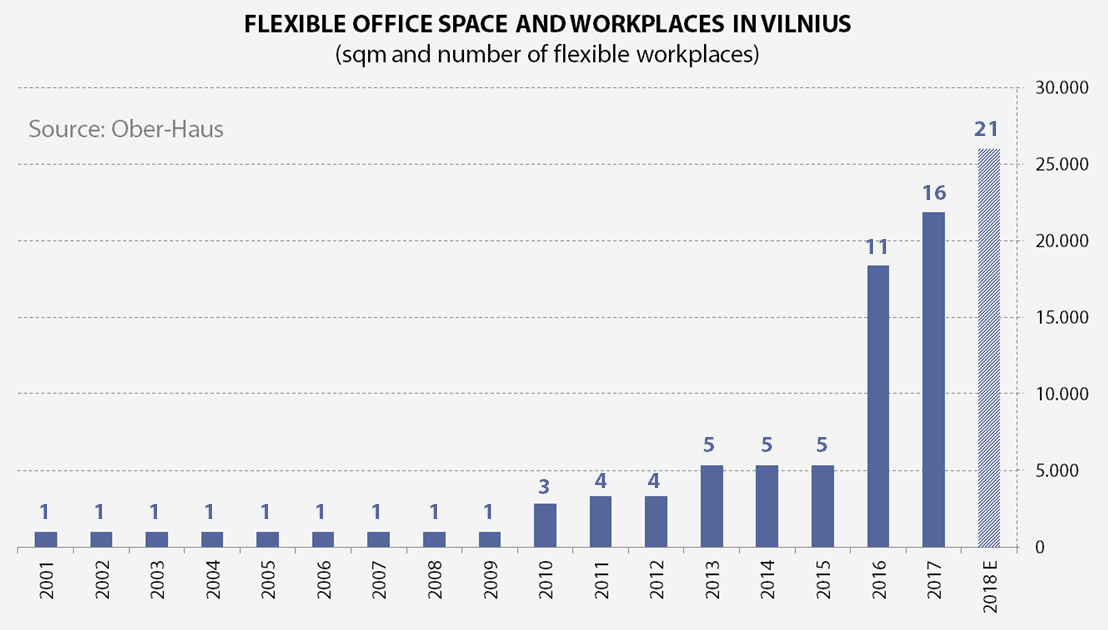

Is Lithuania’s capital far behind this global trend? Let’s see. Do you know when the first flexible offices were introduced in Vilnius? It was 16 years ago – at the start of development of the modern office market. The first professionally managed serviced offices were introduced to the market in 2001. The developer of the newly built 8-storey office building (Business Center 2000) in the heart of the city offered fully fitted and serviced offices of 1,000 sqm and named it START OFFICE. This space is still operating and enjoying full occupancy. So, it was the start… and the end. The early bird remained alone for almost 10 years!

The period 1998-2002 was a tough one here in Lithuania. The Russian crisis, lack of businesses, low incomes and high rents for modern offices. And the continuous arrival of new office projects in the capital city led to decreasing rents and record high vacancy rates. Offering something more flexible to the market was something new, still one option was enough at that time. Later, the improving economy and demand triggered the fast expansion of the modern office market and everyone was just happy renting spaces with long-term leases.

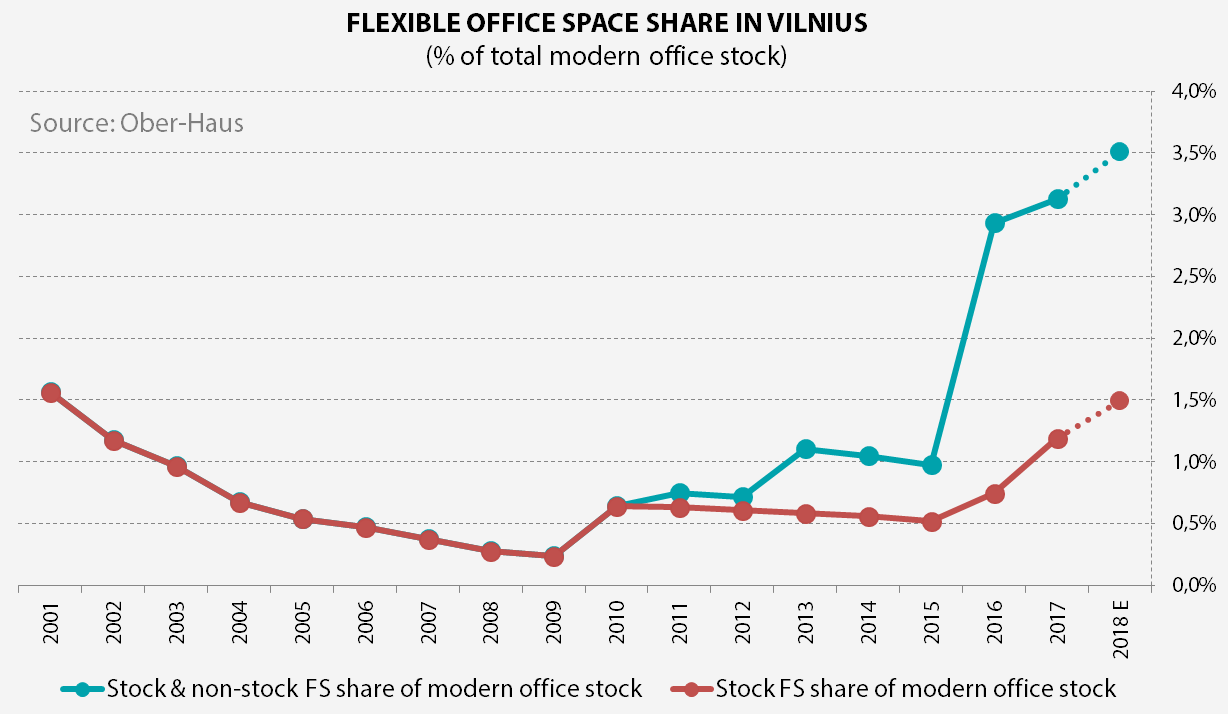

The flexible office market started again (actually the real start) in 2010. The world’s largest flexible workspace provider Regus entered Vilnius and there was a further traditional serviced office option from a local landlord. Also, in 2010-2013 the first coworking spaces started to appear in Vilnius. First steps, which have actually only become stronger and more visible since 2016. In just two years (2016-2017) total flexible office space in Vilnius quadrupled reaching almost 22,000 sqm at the end of 2017. Vilnius now has the full spectrum of flexible workplaces: from the smallest coworking place Coffice to the biggest ICT start-up hub in the region Vilnius Tech Park.

From Global Cities to Smaller Ones

If you read reports from different sources you will find different and misleading figures, data and other information about flexible spaces (like any other stuff in any industry). That’s normal, as different expertise, knowledge, subject coverage and approach will give you different databases, classifications, definitions, which will lead to different results. The biggest headache for analysts is comparing the data of different cities or regions, which is provided by different data providers. Each city, region or country has its own individuality with established standards and comparing mega cities in developed markets with small cities in frontier markets, makes things quite complicated. Still, we all do it every day. Just take this into account and always look at these indicators with some awareness and caution.

So, how does Vilnius compare to the global and emerging cities? London is the dominant leader in terms of flexible spaces and according to The Instant Group survey this city provides 1,136 flexible workplaces with New York in second place with 330 centres. We should take into account that these figures represent data from 2016 and some smaller, and not listed flexible options were not included in the statistics. And for sure, the numbers keep increasing every day. It’s 2018 already! But this is not the case for Vilnius city with a population of over 547,000, which at the end of 2017 offered just 16 flexible workplaces. It isn’t hard to pick them all and convert them to statistics. You know, small market advantage.

According to JLL, in London flexible workspace operators now occupy 3.5% of total office stock whilst across the Big 6 markets it is currently just 1.9%. Within London, the City market has the highest concentration of flexible office providers, representing 4.0% of all office stock. The latest Colliers report on flexible workspaces states that the biggest cities in Asia have shown tremendous growth of flexible spaces in the last year. The share of flexible spaces in CBD’s tops almost 18% in 2018 (Shanghai – 8.0%, Jakarta – 9.7% and Begaluru – 17.6%).

In general, flexible office space accounts for between 1% to 5% of total office stock varying from capital to capital (globally), still the more precise definitions are missing. Is it modern office stock dedicated to flexible office space or total flexible office space in the market divided by total modern office stock? The more common figure provided by real estate consulting firms is the share of flexible office space in total take-up of the leasing market.

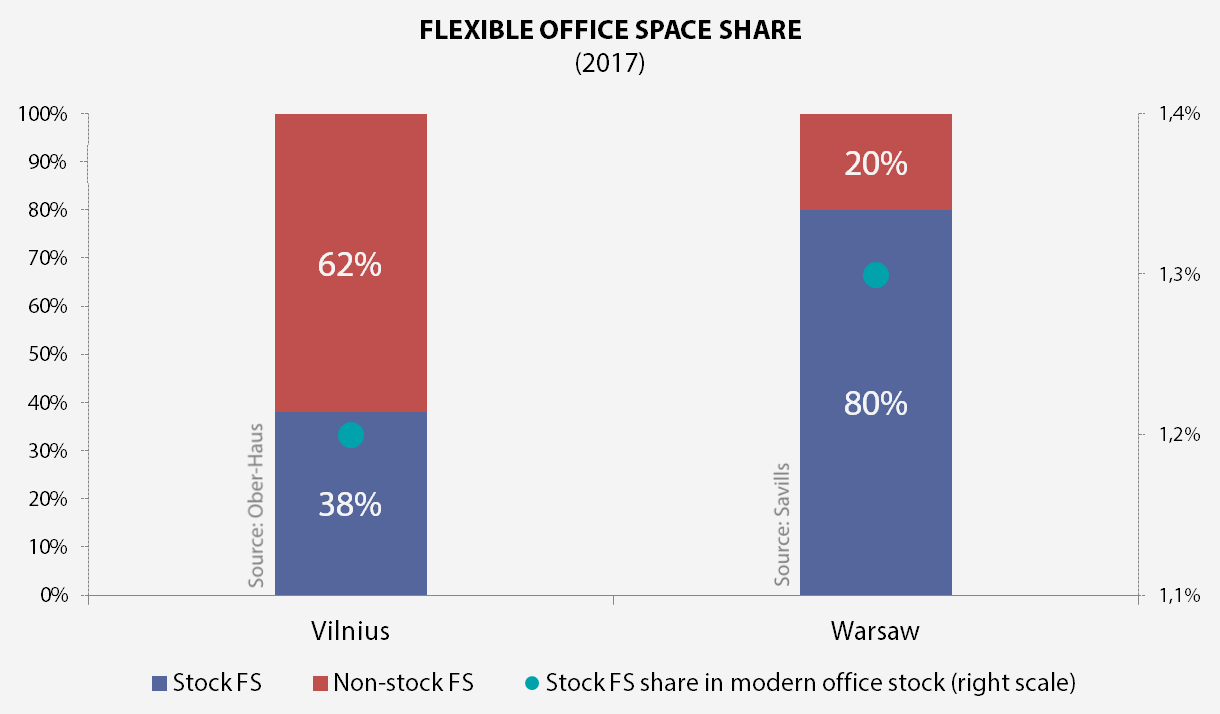

Savills report on flexible workplaces in Poland gave me comparable data and suggestions for terms like, ‘Stock’ and ‘Non-stock’, which Ober-Haus will use from now on to give easy understandable and comparable data about flexible office space to others. Ober-Haus definitions of flexible workplaces are as follows:

Flexible offices – all types of spaces (serviced offices, coworking spaces, incubators, accelerators and others), which provide fully equipped and managed working spaces without requiring a long-term commitment for the space users.

Stock FS – flexible office space located in modern office or multi-functional buildings, which provides modern office space and which are considered as modern office stock.

Non-stock FS – flexible office space located in other facilities, which do not provide modern office space.

So, according to Ober-Haus data and definitions listed above, the share of flexible office space located in modern buildings (stock FS) in total modern office stock in Vilnius has doubled in the last few years and at the end of 2017 reached 1.2%. If we take the non-stock flexible space into account then this share jumps to 3.1% at the end of 2017. Or almost 22,000 sqm of flexible office space in 16 different locations within the city limits. During 2018 total flexible office space could increase to 26,000 sqm in 21 different locations and at the end of the year 1.5% of total modern stock will be dedicated to flexible office space.

Vilnius vs Warsaw

Let’s go back to our neighbouring country and its capital Warsaw with Savills’ figures. Almost four times more flexible office space compared to Vilnius doesn’t say much, right? Space per 1,000 population? Not a substantial difference: Warsaw – 48 sqm, Vilnius – 40 sqm. Maybe, different spaces per population? Yes, substantial difference. Counted per population Warsaw can offer almost twice as many flexible places as Vilnius: Warsaw – 5.4 places, Vilnius – 2.9 places per 100,000 pop.

Hey, but Vilnius has the biggest ICT startup hub in the region Vilnius Tech Park! Great, this campus concentrates over 40% of Vilnius total flexible office space in one place. Not so great at all. I mean it’s great for the ICT industry, but it doesn’t improve the availability in the market for other space users from different industries or professions. Warsaw wins with a score of 3:0. Vilnius, you’re not as flexible as I thought!

Categorizing flexible spaces by different types makes less and less sense as these spaces are evolving and transforming very fast. You always want to keep everything “under analytical control” and try to classify the subject of analysis by putting it on the right shelf. Not this time. The current flexible space sector is literally “flexible”. While we have had traditional serviced offices since the early ‘80s, in the last decade other types of spaces have changed a lot and expanded dramatically. Coworking spaces, incubators, accelerators and serviced offices are becoming hybrid by connecting with each other and offering different formats for a greater range of occupiers. Jaroslaw Pilch from Savills also pointed out the evolution of flexible spaces:

For example, the global serviced office giant Regus is increasingly dedicating more and more of its occupied space to coworking and offers hybrid options. The coworking behemoth WeWork went even further by dipping its feet into residential (WeLive), fitness business (WeWork Wellness) and even education (WeGrow). What’s next? Putting all this together and creating huge community type schemes with residences, shared offices, gyms, kindergartens, schools, cafes, shops, cinemas? Cool, but I’m too old for such things…

Picking Up a Centrally Located Coworking Space in Vilnius

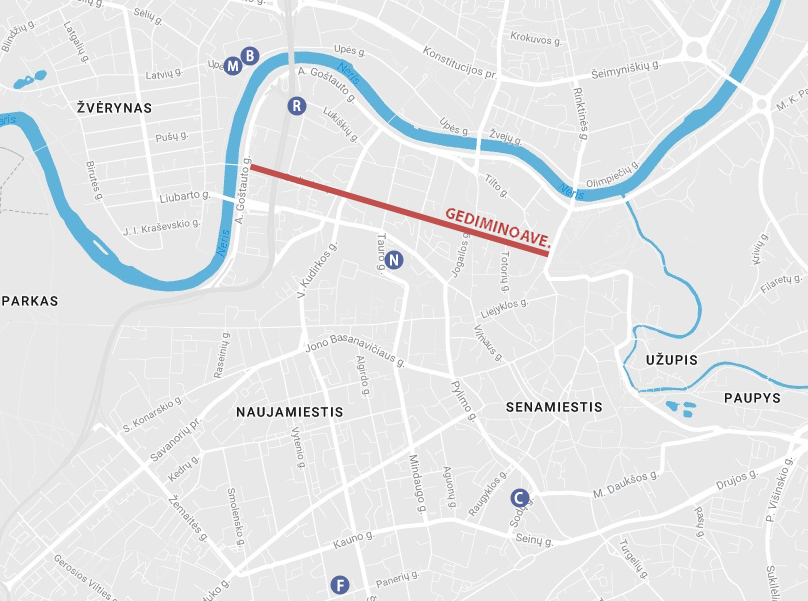

Let’s say you are some kind of entrepreneur or freelancer and need an affordable cosy coworking place in the centre of Vilnius. So, what do we have here? At the end of 2017 Vilnius had 16 different flexible workplaces, but now at the start of 2018 you can choose from almost 19 options (Blockchain Centre Vilnius and Monday Office were opened at the start of 2018 and AltSpace is opening in a month). 19 options, let’s go!

Serviced offices with suited snobs – NO. Coworking spaces outside the city centre – OUT.

6 options left out of 19:

Monday Office (Upes St. 23) – Located in the newly opened office building Green Hall 2, which is close to the city centre (a 15-minute walk to Gedimino Ave.). Provides luxury type private offices and coworking space. From 27 Eur/day for a hot desk in an open plan office. Too extravagant for a regular user.

Blockchain Centre Vilnius (Upes St. 23) – Located in the same building as Monday Office, this place is the coolest in the entire galaxy! A state-of-the-art coworking and shared office space for blockchain start-ups. Can you imagine the place, which is represented by all the recent trendiest movements? COWORKING+BLOCKCHAIN+STARTUP! I already imagine hordes or crypto fans squeezing through the door. Antanas Guoga definitely knows what he’s doing. Still, if you’re not blockchain orientated, you won’t get the approval from the Board of this centre. Even offering them 200 Eur per month.

Rise Vilnius (Gyneju St. 14) – A purpose-built workspace for the FinTech community established by Barclays. Coworking + FinTech also sounds very trendy. This accelerator is in a good location (a 4-5-minute walk to Gedimino Ave.), has various spaces and provides mentoring for its users. Affordable (up to 120 Eur/month per place), but very much oriented to the FinTech industry. I guess you won’t get membership here if you’re not working on an innovative startup.

Fridge (Paneriu St. 39) – Affordable place for 129 Eur/month per membership and suitable for all types of professionals. Why is this place so affordable? Well, 1) it is located in the southern part of Naujamiestis district (a 2.5 km or 35-minute walk to Gedimino Ave.) 2) It’s in an old administrative building with simple fit-out/design space (-es). Simple and quite far from the heart of the city. Still, the community is awesome. Just look on their Facebook page. The introduction of new members, events, entertainments and a warm vibe all over the place. I love this place just by looking at their happy faces. This workplace represents the essence of coworking spaces.

NVO Avilys (Tauro St. 12) – A non-governmental organization (NGO) and social innovators’ space. Very good location, just a few minutes from Gedimino Ave. Located in a historic building and offers spaces with a very simple fit-out/design. Their previously occupied space in GO9 shopping centre was awesome (prime location with cosy fit-out/design). Despite the move to the new location, this community still looks very friendly and sociable. Not sure what the requirements for new members are.

Coffice (Sodu St. 3A) – One of the smallest coworking places in Vilnius. One-room retro style space located next to the bus/train station (20-minute walk to Gedimino Ave.). The name of this place (coffee+office) and business model says everything. Space per cup of coffee. When this place was opened in 2016, you could stay here for an hour just by buying a coffee from them or paying 8 euros for the day (+unlimited coffee included). At the moment, this space is fully occupied by longer-term users with a price of 80 Eur + VAT per month.

What Vilnius is Missing on Coworking Spaces?

Looking at all these options one thing comes to mind. All these spaces are very different and there does not seem to be a middle ground. They are either industry specific, too luxurious and expensive, too simple or increasingly distant from the city centre. Let’s say you’re a professional who works in PR, marketing, advertising, sales, writing or some other profession and need an inspiring, affordable and cosy place in Vilnius (especially if you are a foreigner). What could be better than Gedimino Avenue or it’s adjacent streets? If you’re on this main street of Vilnius or close to it, then you are definitely in the heart of the city. Historical buildings, cafes, bars, shops with people walking around. Ideas and inspiration start to flow immediately.

One of the most expensive retail streets with its surroundings and an affordable place to work?! Sounds hardly possible, right? If you’re planning to open a coworking space in the best location, in a nice looking or new building with big windows facing the main street, then you are unlikely to offer space in the mid-price range. International Workplace Group (IWG) owned and operated brand Spaces will open a high-quality flexible workspace in a multi-functional project Live Square on Gedimino Avenue sometime in 2019. Prime location, new project and higher class space provider. Don’t expect this flexible space to be mid-priced.

How to solve this price/quality “problem”? Just look around or check the property listings. You will definitely find great options for setting up a new coworking space in the heart of the city. Basement premises or premises on top floors, which are not attractive for typical commercial activity could be great for coworking spaces. Just walk along Gedimino Avenue to a less business desirable zone and you’ll find premises on the ground/first floor and even with spacious windows facing the main street. And for much lower rental or selling prices compared to the most expensive zone of Gedimino Avenue. And who said that your space should be on the main street of Vilnius?? Turn left or right and you’ll find even more options at an affordable price.

In November 2017 one of my friends together with his partners opened a craft beer bar Local Pub on J. Jasinskio Street, in just 150 meters from Gedimino Avenue. The bar is located in a very “tired” two-storey brick building, still the bar concept, friendly staff and cosy fit-out/design makes this place really great. Average quality properties in less desirable locations could give you an advantage, as you do not overpay for the property. Of course, you need the right concept for people begin to flow into the house. So, why couldn’t a coworking space be in such a place? At the moment, there are even premises available in the same building as Local Pub.

Be creative. Your bar, pub or club is full of clients on weekends and empty on work days? Convert your empty bar into coworking space by letting in the operator. Or do it yourself. Vidmantas, maybe this idea is even better than Local Pub workday lunches?

Just don’t forget about the essence of coworking. Cat Johnson got right to the point when she said: „After all, coworking without community is just working“. If you’re don’t have a collection of engaged people who care about the space and each other and a co-manager, then you are definitely not in this movement. A strong community can‘t exist without a leader(s). Community Manager. This role is very important as the community manager helps the community to be effective by picking up and introducing the new members, organizing networking events and providing all other technical and mentoring support that the community needs. You know, to keep a vibrant and balanced atmosphere in the house and keep it financially secure. And of course, spreading the word about the brand, community or available spaces on social media channels.

More on Coworking Stuff

Have you noticed that the coworking concept has already moved to office buildings? Companies trying to fill their occupied spaces with vibe and attract young workers (now companies honour them by calling them ‘Talents’). Ok, talents. Less formal outfits, no dedicated desks, open spaces, fully fitted kitchens, coffee machines, lounge zones, gym and gaming rooms painted in energetic colours and so on.

People involved in this movement even dispute how this magic word should be written. Coworking, co working, co-working or maybe co+working? Always ask the Inventor(s). As Brad Neuberg said – coworking. Or was it Bernard DeKoven? Still, we should also give some credit to the great artists from the late middle ages and their Renaissance workshops (read the great article by Piero Formica).

If you feel that your space is as cool as it can be, then take part in the Coworky Awards (check the nomination categories in which you can compete).

Epilogue

Vilnius, you are flexible. You are a great city full of potential spaces, creative and innovative people, cosiness and much more. And you’re becoming more flexible every day. With the rest of the world.

Discuss here: www.linkedin.com/flexible-vilnius-beginning-emptiness-start

Contacts:

Raimondas Reginis

Ober-Haus Research Manager for the Baltics

+370 699 73 377

raimondas.reginis@ober-haus.lt

Naujienos

Visos naujienos

Visos naujienos

Būsto rinkos aktyvumui mažėjant, butų pardavimo kainos sugeba paaugti

„Ober-Haus“ Lietuvos butų kainų indekso (OHBI), fiksuojančio butų kainų pokyčius penkiuose didžiausiuose Lietuvos miestuose (Vilniuje, Kaune, Klaipėdoje, Šiauliuose ir Panevėžyje), 2024 metų kovo mėnesio reikšmė paaugo 0,2%. Bendras butų kainų lygis Lietuvos didmiesčiuose per pastaruosius 12 mėnesių augo 2,4% (2024 metų vasarį metinis augimas siekė 2,2%). 2024 metų kovo mėnesį Vilniuje, Klaipėdoje, Šiauliuose ir Panevėžyje butų pardavimo kainos atitinkamai augo 0,2%, 0,7%, 0,4% ir 0,5%, vidutinė kvadratinio metro kaina sudarė 2.593 (+4 Eur/m²), 1.662 (+11 Eur/m²), 1.100 Eur (+5 Eur/m²) ir 1.081 Eur (+6 Eur/m²). Tuo tarpu Kaune kovo mėnesį užfiksuotas 0,1% butų kainų sumažėjimas ir vidutinė kvadratinio metro kaina sudarė 1.749 Eur (-2 Eur/m²). Per metus (2024 metų kovo mėnesį, palyginti su 2023 metų kovo mėnesiu) butų kainos augo visuose šalies didmiesčiuose: Vilniuje – 1,9%, Kaune – 2,7%, Klaipėdoje – 3,8%, Šiauliuose – 1,9% ir Panevėžyje – 2,3%. „Nepaisant šalies būsto rinkoje ir toliau fiksuojamo bendro aktyvumo mažėjimo, būsto pardavimo kainos šalies didmiesčiuose rodo atsparumą ir net sugeba toliau po truputį kopti aukštyn. VĮ Registrų centro duomenimis, 2024 metų pirmąjį ketvirtį, palyginti su 2023 metų pirmuoju ketvirčiu, Lietuvoje tiek butų, tiek ir namų įsigyta 13% mažiau. Senesnės statybos butų per tą patį laikotarpį įsigyta beveik 5% mažiau, tuo metu…

2023 ir 2024 metais pirkėjams palankesnis būsto kainų ir atlyginimo santykis

„Ober-Haus“ Lietuvos butų kainų indekso (OHBI), fiksuojančio butų kainų pokyčius penkiuose didžiausiuose Lietuvos miestuose (Vilniuje, Kaune, Klaipėdoje, Šiauliuose ir Panevėžyje), 2024 metų vasario mėnesio reikšmė paaugo 0,2%. Bendras butų kainų lygis Lietuvos didmiesčiuose per pastaruosius 12 mėnesių augo 2,2% (2024 metų sausį metinis augimas siekė 2,1%). 2024 metų vasario mėnesį Vilniuje, Kaune ir Klaipėdoje butų pardavimo kainos atitinkamai augo 0,3%, 0,3% ir 0,1%, vidutinė kvadratinio metro kaina sudarė 2.589 (+8 Eur/m²), 1.751 (+6 Eur/m²) ir 1.651 Eur (+1 Eur/m²). Tuo tarpu Šiauliuose vasario mėnesį užfiksuotas 0,2% butų kainų sumažėjimas ir vidutinė kvadratinio metro kaina sudarė 1.095 Eur (-3 Eur/m²). Panevėžyje butų kainos per mėnesį nesikeitė ir vidutinė kvadratinio metro kaina išliko 1.075 Eur. Per metus (2024 metų vasario mėnesį, palyginti su 2023 metų vasario mėnesiu) butų kainos augo visuose šalies didmiesčiuose: Vilniuje – 1,8%, Kaune – 3,2%, Klaipėdoje – 3,0%, Šiauliuose – 1,7% ir Panevėžyje – 1,8%. „Nors šalies būsto rinką sukaustęs šaltukas dar niekur nesitraukia, tačiau vienas būsto pirkėjams svarbus rodiklis jau rodo teigiamus pokyčius. 2023 metais būsto rinka didele dalimi buvo vėsinama itin aukštų paskolų palūkanų normų, kurios mažino būsto pirkėjų galimybes įsigyti būstą skolintomis lėšomis. Tačiau žvelgiant į būsto kainų ir atlyginimo santykį, 2023 metais šis rodiklis…

Kelis metus smukusio būsto rinkos aktyvumo rezultatas – apie 40% mažesnės statybų apimtys 2024 metais

Pastaruosius kelis metus Lietuvoje stebėjome sparčiai besitraukiantį būsto rinkos aktyvumą, kuris jau atsiliepia ir naujo būsto plėtros apimtims. Pastaruoju metu su didžiausiais iššūkiais susidūrė šalies didmiesčiuose daugiabučius plėtojančios įmonės, kurios 2022–2023 metais fiksavo itin kuklius butų realizacijos rodiklius. „Ober-Haus“ duomenimis, palyginti su būsto rinkoje rekordiškai aktyviais 2021 metais, 2023 metais Vilniaus pirminėje rinkoje realizuota 68% mažiau, Kaune – 55% mažiau, o Klaipėdoje – 57% mažiau butų. „Tačiau nepaisant 2–3 kartus susitraukusių naujos statybos butų realizacijos apimčių, 2023 metais šalies didmiesčiuose dar buvo baigtas statyti itin gausus butų skaičius. Kadangi buvo baigti plėtoti projektai, kurie pradėti statyti 2021–2022 metais“, – sako Raimondas Reginis, „Ober-Haus“ rinkos tyrimų vadovas Baltijos šalims. „Ober-Haus“ duomenimis, 2023 metais Vilniuje plėtotojai daugiabučiuose pardavimui pastatė 4.915 butų arba 18% daugiau nei 2022 metais. Žvelgiant į pastaruosius 20 metų, tai yra vienas aukščiausių rodiklių, kuris nusileido tik 2007, 2008 ir 2020 metams, kuomet faktiškai pardavimui buvo pastatoma po daugiau nei 5.000 butų. 2023 metais pirkėjai galėjo kurtis 52-uose skirtinguose daugiabučių projektuose (skaičiuojant ir tęstinius projektų etapus). Šalies sostinė gali pasigirti ne tik pardavimui statomų daugiabučių gausa, bet ir nuomai plėtojamų projektų skaičiumi. Po aktyvios plėtros 2022 metais sostinės būsto nuomos segmentas 2023 metais sulaukė dar gausesnio papildymo. Sostinėje buvo…

Visos naujienos

Visos naujienos