Renaissance of luxury apartments in Vilnius – now and 10 years ago

The housing market in Vilnius is currently experiencing its second renaissance with increasing indices of supply and demand and, certainly, sales prices being recorded. However, one of the most interesting housing segments which often stirs the imagination of market participants and others, is the smallest and luxury property segment – the most expensive apartments in the largest city of the country.

The housing market in Vilnius is currently experiencing its second renaissance with increasing indices of supply and demand and, certainly, sales prices being recorded. However, one of the most interesting housing segments which often stirs the imagination of market participants and others, is the smallest and luxury property segment – the most expensive apartments in the largest city of the country.

“Due to its particularly small share of the market, the most expensive housing segment is often surrounded by various speculations when previously unheard of prices being asked or prices for already completed transactions are discussed both in public and in closed groups,” Raimondas Reginis, senior market analyst of Ober-Haus, said.

So, what is the current situation with the most expensive housing segment of the largest city and what was the situation 10 years ago – at the very top of the former real estate boom? Information on the registered apartment sales-purchase transactions reveals the situation in the luxury apartment segment precisely enough. Ober-Haus has selected and analysed all apartment transactions registered in 2016–2017 (data source: State Enterprise Centre of Registers) and compared them with the second half-year of 2007 (when the recorded residential prices were the highest). All registered apartment transactions where the price of one square metre exceeded EUR 3,000 were selected during the period under consideration in Vilnius (eliminating the price of a car parking places, storage facilities and other apartment appurtenances from the total transaction price).

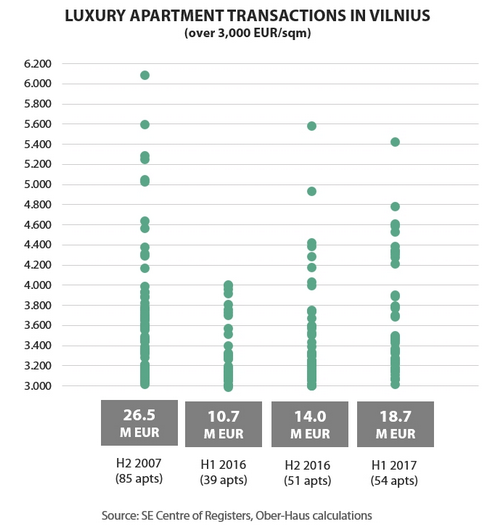

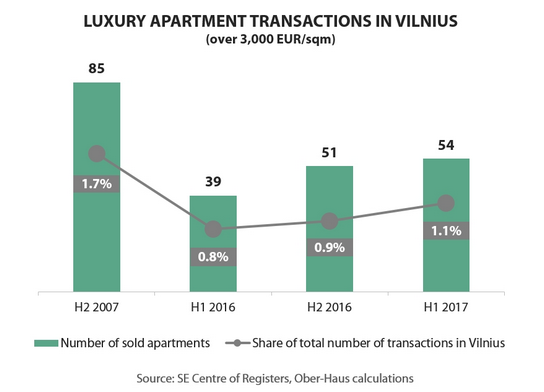

“The results obtained show that currently there is stable growth in the number of such property transactions with increased values,” Mr Reginis said. During the first half of 2016, 39 luxury apartments (where the price per square metre exceeded EUR 3,000) were purchased in Vilnius, during the second half of 2016 51 such apartments were purchased and 54 during the first half of 2017. According to Ober-Haus, the purchase price of such property has grown accordingly: a total of almost EUR 10.7 million was paid for the property purchased in the first half of 2016 (39 flats and their appurtenances), in the second half of 2016 – EUR 14.0 million, and EUR 18.7 million paid for luxury apartments purchased in the first half of 2017.

“In Vilnius, the second half of 2016 and the first half of 2017 are not only notable by the number of purchased objects but with their price too. In the second half of 2016 the highest recorded price per square metre was EUR 4,000; however, in the second half of 2016 and in the first half of 2017 the highest prices already exceeded 5,000 EUR/sqm,” Mr Reginis said. If we look at the price per square metre, the most expensive apartment in Vilnius in the second half-year of 2016 was sold in the historical building in Etmonų St. (the Old Town) – EUR 550,000 was paid for an apartment with an area of almost 100 sqm (almost 5,600 EUR/sqm). In the first half of 2017 the most expensive apartment was sold in the Old Town, Labdarių St. This apartment with the total area of more than 230 sqm with a garage was sold for EUR 1,300,000 (over 5,400 EUR/sqm).

“In Vilnius, the second half of 2016 and the first half of 2017 are not only notable by the number of purchased objects but with their price too. In the second half of 2016 the highest recorded price per square metre was EUR 4,000; however, in the second half of 2016 and in the first half of 2017 the highest prices already exceeded 5,000 EUR/sqm,” Mr Reginis said. If we look at the price per square metre, the most expensive apartment in Vilnius in the second half-year of 2016 was sold in the historical building in Etmonų St. (the Old Town) – EUR 550,000 was paid for an apartment with an area of almost 100 sqm (almost 5,600 EUR/sqm). In the first half of 2017 the most expensive apartment was sold in the Old Town, Labdarių St. This apartment with the total area of more than 230 sqm with a garage was sold for EUR 1,300,000 (over 5,400 EUR/sqm).

What was the situation in the Vilnius luxury apartment segment 10 years ago, i.e. in the second half of 2007, when prices for apartments in Vilnius were at an all-time high? According to Ober-Haus, during this period, a total of 85 apartments were purchased, for which buyers paid EUR 26.5 million or 40% more than the price for a similar property was paid in the first half of this year. When assessing according to the price per square metre, the most expensive apartment sold in the second half of 2007 in Vilnius was in the renovated historical building in A. Strazdelio St. (the Old Town) – more than EUR 400,000 (almost 6,100 EUR/sqm) was paid for the 66 sqm apartment.

When estimating the number of luxury apartment transactions in the statistics of total apartment sales in Vilnius it can be seen that their number increased steadily in 2016–2017, however, it has not yet reached the level of the second half of 2007. According to Ober-Haus, in the first half of 2016 in Vilnius the share of the transactions of the most expensive apartments (per square meter) in the total number of apartment transactions was 0.8%, in the second half of 2016 – 0.9% and in the first half of 2017 – 1.1%. In the second half of 2007 this share was 1.7%.

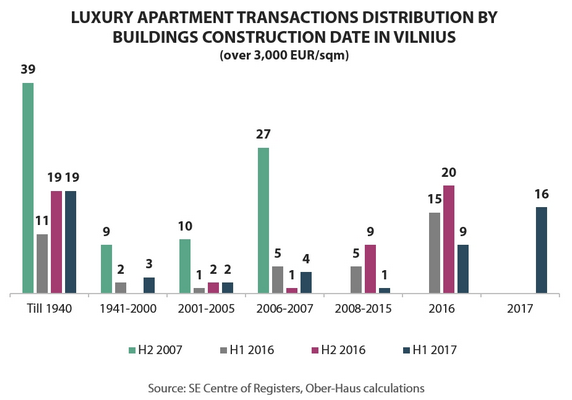

“Analysing the transactions, it can be seen that buyers most of all welcome and pay most for apartments which are in historical buildings. Most often, such already equipped apartments are in the upper storeys of renovated or good condition buildings in the Old Town or the central part of the city,” Mr Reginis said. Meanwhile in the new construction projects finished in 2016–2017 the highest prices were up to 4,600 EUR/sqm in the first half of 2017. For instance, the highest prices this year for newly constructed apartments were recorded in the project of “Pilies apartamentai” (Olimpiečių St.), “Šaltinių namai” (Šaltinių St.), “Basanavičiaus 9A” (J. Basanavičiaus St.), “Mindaugo 14” (Mindaugo St.).

“Analysing the transactions, it can be seen that buyers most of all welcome and pay most for apartments which are in historical buildings. Most often, such already equipped apartments are in the upper storeys of renovated or good condition buildings in the Old Town or the central part of the city,” Mr Reginis said. Meanwhile in the new construction projects finished in 2016–2017 the highest prices were up to 4,600 EUR/sqm in the first half of 2017. For instance, the highest prices this year for newly constructed apartments were recorded in the project of “Pilies apartamentai” (Olimpiečių St.), “Šaltinių namai” (Šaltinių St.), “Basanavičiaus 9A” (J. Basanavičiaus St.), “Mindaugo 14” (Mindaugo St.).

Growing sales volumes of luxury apartments are connected not only with the general growth of the real estate market, but also with the developing supply of this property segment. According to Ober-Haus, of the 90 most expensive apartments sold in Vilnius in 2016 42% of them were sold in the newest residential projects (2015–2016 construction). Of the 54 apartments sold in the first half of 2017 the share of the sold apartments in the newest projects (2016–2017 construction) was 47%. The second half of 2017 and the future results of 2018 also should not disappoint the developers of luxury accommodation.

“It is likely that in the near future we will see even more record transactions in the highest-class projects. The previous transactions show that in the market there are certainly those who are able and wish to acquire exceptional residential property,” Mr Reginis said.

Latest news

All news

All news

“e-market city” completes its second phase – the development of a modern “stock office” type shopping town continues

"e-market city", an online and wholesale shopping town located in a business-friendly location at the intersection of Eišiškių pl. and Geologų Street, is rapidly approaching the end of its second phase. The final construction works are currently underway and the first tenants of the new phase are preparing to move in as early as June-July. "The predominant floor areas of e-market city - ranging from 370 to 960 m² - are easily combinable and adaptable to a wide range of commercial activities. Existing and potential tenants appreciate the easy accessibility, high quality of construction and fitting-out, functional layout and solid neighbourhood, where well-known companies such as Assa Abloy, Dextera, Skuba, Skuba, Maidina, Šildymas plius, YE International, etc. are already located. The first phase is already 100% leased, while the second phase is still available - we invite you to get in touch", says Remigijus Valickas, Commercial Real Estate Projects Manager at Ober-Haus. The project is being developed in three phases on an area of 3.9 ha. The total area of the buildings will exceed 20,000 m² and the total investment in the project will amount to more than EUR 25 million. For more information about the project and leasing opportunities,…

The recovery of a very strong-looking housing market may slow down

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.5% in March 2025. The annual apartment price growth in the biggest cities of Lithuania was 4.3% (a 4.1% increase was recorded in February 2025). In March 2025 apartment prices in Vilnius, Kaunas, Šiauliai and Panevėžys increased by 0.4%, 1.3%, 0.4% and 0.2%, respectively, with the average price per square meter reaching EUR 2,680 (+10 EUR/sqm), EUR 1,846 (+24 EUR/sqm), EUR 1,172 (+4 EUR/sqm) and EUR 1,149 (+2 EUR/sqm). In the same month, apartment prices in Klaipėda decreased by 0.1% and the average price per square meter dropped to EUR 1,752 (-2 Eur/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 3.3% in Vilnius, 5.6% in Kaunas, 5.4% in Klaipėda, 6.5% in Šiauliai and 6.4% in Panevėžys. "At the beginning of 2025, the country's housing market is showing impressive results. After a very strong growth in housing transactions in January and February this year, the increase in the number of transactions continued in March. According to the data of the State Enterprise…

Housing market has woken up, but no faster price growth yet

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.4% in February 2025. The annual apartment price growth in the biggest cities of Lithuania was 4.1% (a 4.0% increase was recorded in January 2025). In February 2025 apartment prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys increased by 0.3%, 0.1%, 0.8%, 0.8% and 0.9%, respectively, with the average price per square meter reaching EUR 2,670 (+7 EUR/sqm), EUR 1,822 (+2 EUR/sqm), EUR 1,754 (+13 EUR/sqm), EUR 1,168 (+10 EUR/sqm) and EUR 1,147 (+10 EUR/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 3.2% in Vilnius, 4.1% in Kaunas, 6.2% in Klaipėda, 6.6% in Šiauliai and 6.7% in Panevėžys. ‘As predicted, a rapid annual growth in the number of housing transactions is recorded at the beginning of 2025. According to the data of the State Enterprise Centre of Registers, 40% more apartments were purchased in the country in January this year and 39% more in February this year than in the same month in 2024. It should be noted that in the…

All news

All news