The housing market in the country’s main cities shows signs of stabilisation, but the situation in the coastal region does not look sustainable

This year, with the main indicators of the Lithuanian housing market reaching new highs, market players have seen an extremely intense and exciting period. The substantial amounts poured into the housing market by purchasers, notably active purchase of land plots for the development of new projects and speedily growing residential property prices are reminiscent of the mood which prevailed in the real estate market over a decade ago. However, following the great leap in terms of activity in the housing market seen in the middle of 2021, the third quarter looked slightly calmer and it is expected that this might serve as a sign that the market is transiting to a period of more sustainable development.

This year, with the main indicators of the Lithuanian housing market reaching new highs, market players have seen an extremely intense and exciting period. The substantial amounts poured into the housing market by purchasers, notably active purchase of land plots for the development of new projects and speedily growing residential property prices are reminiscent of the mood which prevailed in the real estate market over a decade ago. However, following the great leap in terms of activity in the housing market seen in the middle of 2021, the third quarter looked slightly calmer and it is expected that this might serve as a sign that the market is transiting to a period of more sustainable development.

According to the data of the Centre of Registers, Q3 2021 saw 11% fewer apartment purchases and 2% more house purchase-sale transactions registered in Lithuania compared to Q2 2021. The decline of transactions was similar for the same period in the main cities of Lithuania both in the apartment segment apartment (22% – in Vilnius, 15% – in Kaunas, 9% – in Klaipėda, 11% – in Šiauliai, and 10% – in Panevėžys), and houses (9% – in Kaunas, 10% – in Klaipėda, 19% – in Šiauliai, and 28% – in Panevėžys). Only Vilnius‘s house segment demonstrated a 5% growth in transactions over this period. Compared to the total number of housing transactions concluded over nine months in 2020, this year 27% more apartments and 33% more houses were purchased in Lithuania.

“The year 2020, was certainly not noted for an abundance of transactions due to the pandemic, which explains why there has been such a fast relative growth in the number of transactions this year. However, if compare the activity of Lithuania‘s housing market in 2021 with the pre-pandemic period, this year growth in the housing market has been particularly fast and has reached new heights”, Head of Market Research for Baltic Countries at Ober-Haus Raimondas Reginis said. Comparing year 2021 with the same period in 2019 shows that this year the purchase of apartments was 11% higher, and 36% more houses were sold.

Slower growth in the prices of apartments is expected

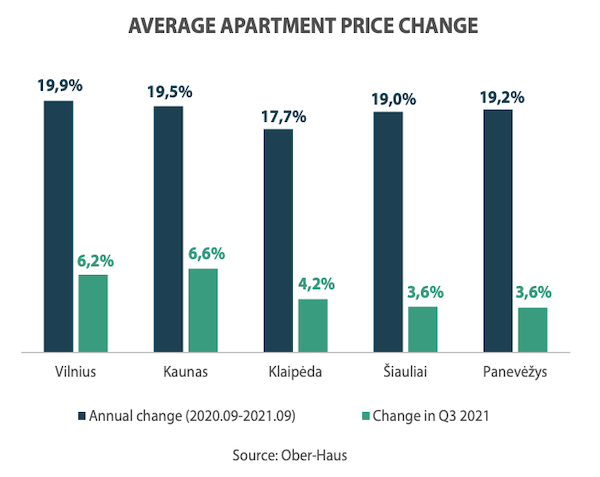

According to Ober-Haus data, the pace of growth of apartment sale prices in the biggest cities of the country in 2021 has evidently increased and significantly exceeded the previous price growth forecasts. Whereas apartment sale prices in the main cities increased by 1.9% on average over Q4 2020, the growth in Q1 2021 amounted to 4.3%, in Q2 – to 6.2%, and in Q3 – to 5.7%. Over Q3 2021, apartment sale prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys grew by 6.2%, 6.6%, 4.2%, 3.6% and 3.6%, respectively.

This scale of growth in the sales prices of apartments was last seen more than a decade ago; however, in September 2021, the average sale price in Vilnius reached an all-time high. Meanwhile, the other main cities of Lithuania see apartment prices ranging from 6% to 25% lower than in the late 2007–early 2008.

This scale of growth in the sales prices of apartments was last seen more than a decade ago; however, in September 2021, the average sale price in Vilnius reached an all-time high. Meanwhile, the other main cities of Lithuania see apartment prices ranging from 6% to 25% lower than in the late 2007–early 2008.

“Given the fact that after reaching its peak in Q2 2021 the activity in the apartment segment stabilised in Q3 2021 and that following a steep increase of prices in the market a considerably higher price level has been set, it is likely that in Q4 2021 and Q1 2022 more modest growth in apartment sale prices will be recorded,” Reginis said.

It should also be noted that expectations of residents have been lowering in recent months. Referring to the data provided by the Department of Statistics, the consumer confidence index reduced by 7 percentage points in the last three months of this year: from 4 in July to minus 3 in October. In October 2021, residents also demonstrated a more pessimistic view with regard to the financial and economic prospects in households.

Apartment rental market of the capital city successfully assimilating the new supply

The apartment rental market in the main cities of the country in 2021 looked as strong as the sales market. According to the data available on the housing rental sector, the current pandemic had no negative impact on the long-term apartment rental segment and the activity of the market this year has been even higher than before the pandemic. For instance, the total number of long-term housing rental transactions concluded by Ober-Haus in Vilnius, Kaunas and Klaipėda over the nine months of 2021, compared with the same period in 2019 and 2020, has increased by 14% and 9% accordingly. And the upsurge in activity of the housing rental market continued to reduce the number of objects available for rent.

Raimondas Reginis, Research Manager for the Baltics at Ober-Haus

At the end of Q3 2021, the number of apartments offered for rent in the real estate listing portal Aruodas in Vilnius, Kaunas and Klaipėda was 25–30% lower than a year ago. This decrease in supply of apartments offered for long-term rent should be assessed with consideration to a few other factors which demonstrate the potential of the Vilnius housing rental market – the biggest in the country.

First, the short-term rental market in Vilnius halved during the pandemic (based on the data of AirDNA), which means that a significant share of housing designated for short-term rent replenished the long-term apartment rental supply.

The housing developers who regularly supply the market of the capital city with new projects offering various sizes of housing should not be forgotten either. In 2021 alone, the rental market will offer about 350 units for rent and by the end of 2021 Vilnius will have slightly more than 700 mid- and long-term rental units managed by professional investors.

“The small investors must also be considered. They regularly increase the supply of rented apartments, for example, by buying apartments in newly constructed projects to let. Taking all these factors into consideration, it could be said that the present potential of the capital city market is more than sufficient to absorb the existing supply,” Reginis said.

High activity in the rental market continues to increase rent prices in the main cities of Lithuania. As the data of Ober-Haus illustrates, rental prices of apartments in Vilnius in Q3 2021 were 14% higher compared to the same period in 2020, and 8%higher in Kaunas and Klaipėda. To compare, the growth in annual sale prices this September was 19.9% in Vilnius, 19.5% – in Kaunas and 17.7 – in Klaipėda.

Record low in the choice of new housing

In 2021, the segment of newly built apartments, which attracts a lot of attention in the housing market, has demonstrated previously unseen potentials. Results of the primary market mainly decreased due to the shortage of supply rather than due to a fall in demand.

Ober-Haus data shows that in Q1 2021 as many as 2,343 apartments of in the primary market were purchased or reserved directly from developers in Vilnius in already built or still being built multi-apartment buildings, in Q2 2021 this number amounted to 2,008 apartments, and in Q3 2021 – 1,369 apartments. Regardless of the volumes of apartment sales that have declined in a year, the result of the nine months this year is truly exceptional – 76% more apartments were sold and reserved than in the same period of 2020, and 34% more than in the same period in 2019.

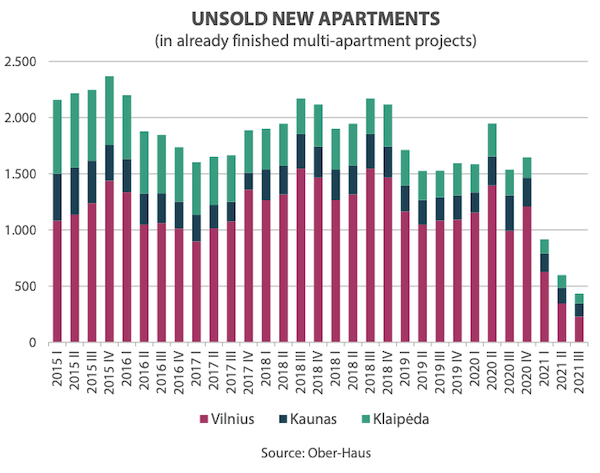

The fast realisation recorded in 2021 has reduced the supply to record lows. According to Ober-Haus, the total number of unsold newly built apartments in already constructed multi-apartment buildings in Vilnius in the end of Q3 2021 was around 250 apartments or almost 5 times less of that at the end of 2020 (around 1,200 apartments). The number of unsold apartments in multi-apartment projects being currently built has also considerably reduced and amounts to only 2,400 apartments. Evidently, the sales of new apartments in the primary market in Q3 2021 has declined, in principle, due to the shortage of supply.

The trends in the primary market of new apartments in Kaunas and Klaipėda were basically identical to the situation seen in Vilnius. According to Ober-Haus data, in Q1 2021 in Kaunas 434 new apartments were purchased or reserved directly from developers in already completed and ongoing projects, this number in Q2 2021 was 349, and 251 – in Q3 2021. In total, 73% more apartments were sold and reserved in nine months of 2021 than in the same period in 2020 and 42% more than in the same period in 2019. The total number of unsold new apartments in already built multi-apartment buildings in Kaunas in the end of Q3 2021 amounted to around 120 apartments or was 2.2 times lower than at the end of 2020.

The trends in the primary market of new apartments in Kaunas and Klaipėda were basically identical to the situation seen in Vilnius. According to Ober-Haus data, in Q1 2021 in Kaunas 434 new apartments were purchased or reserved directly from developers in already completed and ongoing projects, this number in Q2 2021 was 349, and 251 – in Q3 2021. In total, 73% more apartments were sold and reserved in nine months of 2021 than in the same period in 2020 and 42% more than in the same period in 2019. The total number of unsold new apartments in already built multi-apartment buildings in Kaunas in the end of Q3 2021 amounted to around 120 apartments or was 2.2 times lower than at the end of 2020.

Klaipėda saw 167 new apartments in already built or being built multi-apartment buildings purchased or reserved directly from the developers in Q1 2021, 128 apartments – in Q2 2021, and 81 apartments – in Q3 2021. The total number of apartments sold and reserved over nine months of 2021 in the port city was 41% higher compared to the same period in 2020 and 2% higher than over the same period of 2019. The total number of unsold new apartments in already constructed multi-apartment buildings in Klaipėda at the end of Q3 2021 amounted to around 90 apartments or was half the number at the end of 2020.

Private and business investment in housing at the coast has doubled during the pandemic

Indicators of the housing financing sector in Lithuania, like the entire housing market in the country, have demonstrated extremely high results this year. According to the data provided by the Bank of Lithuania, new (real) housing loans issued in the first nine months of 2021 in Lithuania amounted to EUR 1.44 billion or 51% more than in the same period in 2020 and 49% more than in the same period in 2019. The annually increasing scope of borrowing for the purchase of housing in Lithuania should not be surprising since the price of a housing loan remains very attractive. Although 2018-2019 recorded a rise in the interest rate of housing loans in Lithuania with regard to newly granted loans, since the end of 2020, the trend has been of consistently decreasing interest rates. The average annual interest rate of a housing loan was 2.21% in Q1 2021, 2.20% – in Q2 2021, and 2.14% – in Q3 2021. To compare, in 2019–2020, the average interest rate for newly issued housing loans in Lithuania amounted to 2.38%.

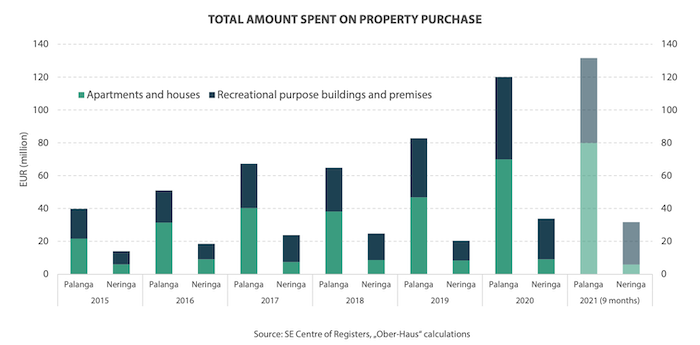

This year the Lithuanian housing market has gained momentum and optimistic views of the market participants have spread from the capital city to the coastal region. Whereas investments of developers in the big cities of the country (construction of residential project starts or purchases of land plots for future projects take place) are currently much needed to balance the ratio between supply and demand of housing, the expansion of the housing market in the coastal region, for example, does not look very sustainable.

“The Lithuanian coastal region is in its heyday due to the limited travelling abroad because of the pandemic, and the number of those who want to direct their investments in the housing sector has significantly increased,” Reginis said. According to the data of the Centre of Registers, in 2019 about EUR 103 million were spent on housing (apartments and houses) and premises/ buildings of recreational purpose purchase in Palanga and Neringa municipalities, in 2020, this number amounted to EUR 154 million, and in the first nine months of 2021 reached EUR 163 million. It means that investments from individuals and business in the coastal region of Lithuania have doubled in the last several years.

“It is likely that when travel abroad gets back on track, the attractiveness of this region might naturally decline as well as the newly found interest in its real estate. If investments in the coastal region of Lithuania will continue to rise further (development of new projects and purchases of housing), such likely “standoff” of demand may end in the unrealised exaggerated expectations of investors,” Reginis said. The extremely sudden growth of any real estate segment also increases the level of risk which becomes evident when the situation in the market changes, especially, when demand staggers.

Full review (PDF): Lithuania Residential Market Commentary Q3 2021

Latest news

All news

All news

A more favourable house price to wage ratio for buyers in 2023 and 2024

Ober-Haus Apartment Price Index for Lithuania (OHBI), which captures changes in apartment prices in the five largest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in February 2024. The overall level of apartment prices in Lithuania's major cities has grown by 2.2% over the last 12 months (annual growth of 2.1% in January 2024). In February 2024, the sales prices of apartments in Vilnius, Kaunas and Klaipėda grew by 0.3%, 0.3% and 0.1%, respectively, and the average price per square metre amounted to EUR 2,589 (+8 Eur/m²), EUR 1,751 (+6 Eur/m²) and EUR 1,651 (+1 Eur/m²). Meanwhile, Šiauliai recorded a 0.2% decrease in apartment prices in February, with the average price per square metre amounting to EUR 1,095 (-3 Eur/m²). In Panevėžys, the average price per square metre remained unchanged at EUR 1,075 per square metre. Over the year (February 2024 compared to February 2023), apartment prices grew in all major cities of the country: in Vilnius - by 1.8%, in Kaunas - by 3.2%, in Klaipėda - by 3.0%, in Šiauliai - by 1.7%, and in Panevėžys - by 1.8%. "Although the cold snap that has gripped the country's housing market is not going away yet,…

The cumulative effect of several years of housing market activity decline, suggests around 40% lower construction volumes in 2024

Over the past few years in Lithuania, we have seen a rapid decline in housing market activity, which has impacted the volume of new housing developments. However, apartment building developers in the country’s major cities have been facing the toughest challenges lately, with very modest apartment sales figures in the period 2022–2023. According to Ober-Haus, compared to the record activity of 2021, in 2023, the sales of apartments in the primary market were down by 68% in Vilnius, 55% in Kaunas, and 57% in Klaipėda. “Despite the two- to three-fold decrease in the sales of newly-built apartments, a very high number of apartments were nevertheless completed in the country’s major cities in 2023, because the development of these projects had begun during 2021 and 2022,” said Raimondas Reginis, Head of Market Research for the Baltics at Ober-Haus. According to Ober-Haus, in 2023, developers in Vilnius built 4,915 apartments for sale – 18% more than in 2022. When considering the last two decades, this is one of the highest figures, second only to those in 2007, 2008 and 2020, when more than 5,000 apartments were built for sale. In 2023, 52 different apartment projects (including ongoing project phases) were available for…

Building permit for the construction of the housing project Vilniaus Džiazas has been obtained

Unique Properties, a real estate development company, has received a permit and started the construction of the Vilniaus Džiazas project in K. Vanagėlio Street in Vilnius Old Town. K. Vanagėlio str. 11 and 18, which consists of a two-storey apartment building with 62 apartments and 11 commercial premises, a 1200 sqm administrative cultural heritage object of interwar construction and public spaces. The project will feature apartments with 4,5 m high ceilings and 4 m high stained-glass windows, the ground floor will have private patios and access to a garden, while the second and third floors will have balconies and the last floor will have private terraces. According to Gediminas Tursa, CEO of Unique Properties, Vilniaus Džiazas aims to revitalise a part of the Old Town that was undeservedly forgotten during the Soviet era, and to reconnect it with the Rasa. The complex not only includes an open and lively commercial street along the north-south axis, but also new pedestrian and cycling connections to the railway station. "After obtaining the building permit, the company received a lot of interest from interested parties and within a couple of weeks it sold several more apartments - currently Vilniaus Džiazas has signed about 20…

All news

All news