Although the indicators of the shopping streets in the capital city worsened, more daring businesses see potential

With more than a year since the first wave of the COVID-19 pandemic, Ober-Haus experts have evaluated how the situation has changed in the main shopping streets of Vilnius where the mood has been largely changeable.

With more than a year since the first wave of the COVID-19 pandemic, Ober-Haus experts have evaluated how the situation has changed in the main shopping streets of Vilnius where the mood has been largely changeable.

“The entire retail and retail property sector in Lithuania has been facing a variety of challenges during this period. Smaller retailers found the period particularly difficult. The rapidly changing pandemic situation in the country, regular need to adapt to changing safety requirements and the limited financial capacity of small businesses have made the tenants of small retail premises particularly vulnerable,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

A survey on the situation in the main shopping streets (Gedimino Ave., Pilies St., Didžioji St., Vokiečių St.) of the city of Vilnius conducted by Ober-Haus in mid-2020 and mid-2021 shows that the situation is still stressful. If in mid-2020 the vacancy rate in these streets stood at 11.0%, so in mid-2021 it slightly increased to 11.9%.

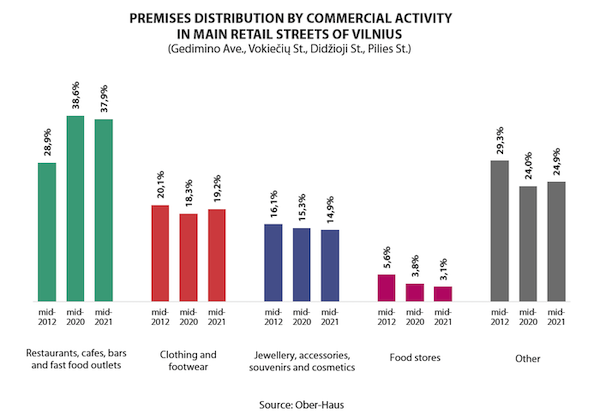

“In the summer of 2020, people returned to shopping streets and injected optimism to retailers, particularly to the largest group of tenants – restaurants, cafes, bars and fast food outlets, which account for 38% of all retail premises in these streets of the capital city,” Reginis said.

With the lifting of the lockdown, people who have missed socializing and recreation occupied outdoor seating areas of retailers who provide food and beverage services and improved the performance indicators of such retailers. According to Statistics Lithuania, the turnover of food and beverage suppliers in Lithuania in H2 2020 increased by 27% compared to H1 2020. However, the overall performance in H2 2020 in this business sector remained 19% lower compared to record indicators in H2 2019. The second wave of the coronavirus made businesses essentially close again and at the end of 2020 the performance indicators noticeably declined again. In H1 2021, the performance indicators of food and beverage suppliers remained modest and were 9% lower than at the same time last year and 32% lower than in H1 2019.

According to Ober-Haus, in mid-2021, the highest vacancy rate was recorded in Pilies Street – at 18.5% and the lowest vacancy rate was recorded in Didžioji Street (9.1%). The vacancy rate in Gedimino Avenue stood at 11.0% and in Vokiečių Street – 10.2%.

Within a year, the highest increase in vacancy rate was in Pilies Street (from 11.3% to 18.5%), where over 50 retail units are based (located on the ground floor of the building, with at least one window facing the street and suitable for commercial activities).

Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus

“Since the overall number of retailers is not large, a few vacant retail premises can significantly change the relative indicator of the vacant space. On the other hand, Pilies Street is probably the most popular street visited by foreign tourists in Vilnius, so during the pandemic, the footfall decreased significantly affecting revenues of retailers,” Reginis noted.

Meanwhile, on Vokiečių Street there was one vacant space less in mid-2021 than a year ago, and the figure for the vacancy rate decreased from 12.5% to 10.2%. Despite the relatively small vacancy rate, the owners and tenants of this street will be facing additional challenges. This year, the renovation of the district heating system started on Vokiečių Street, and cafes and restaurants have to adapt to the works and to relocate or close their outdoor seating spaces. Once the renovation of the heating system is completed, the renovation of the entire Vokiečių Street will start, and the terms of the reconstruction have not yet been finalised.

“It is clear that the renovation works will significantly reduce the flow of potential customers in the street and this will affect all businesses located in the street, which, in addition, will have to deal with the challenges posed by the current pandemic. Therefore, the owners of retail premises on Vokiečių Street may expect the rise in the number of vacant premises in the coming years and the decrease in rental revenues,” Reginis said.

The structure of the tenants in the main shopping streets of the capital city has not changed substantially during the year. According to Ober-Haus, in mid-2021, most of the premises were occupied by restaurants, cafes, bars and fast food outlets and their share during the year decreased slightly from 38.6% to 37.9%. The share of clothing and footwear retailers accounted for 19.2%, jewellery, accessories, souvenirs and cosmetics – 14.9%, food stores – 3.1%, and the remaining 24.9% were beauty salons, offices, pharmacies, banks, bookstores and other retail or services units.

Given that the pandemic situation in the country is either improving or deteriorating, the expectations of the owners of retail premises in respect to the rental income remain uncertain. If some owners of such premises can offer lower rents than they were before to potential tenants, so other owners still expect to sign long-term lease contracts securing pre-pandemic rents.

In mid-2021, rents for medium-sized (about 100–300 sqm) retail premises in the main shopping streets of Vilnius (Gedimino Avenue, Pilies Street, Didžioji Street and Vokiečių Street) stood at 15.0–40.0 EUR/sqm and were on average 12% lower than those at the end of 2019. However, there are cases where owners of the premises sign long-term lease contracts with new tenants at 25-20% lower rents than they could lease before the pandemic started.

The overall indicators show that there is little optimism in the shopping streets of Vilnius, but interest in available retail space is not lost. “Some businesses see long-term prospects of these streets and the current market situation opens up much wider opportunities for them. If it was generally difficult to find suitable premises before the pandemic even by offering historically record rents, today the choice is wider and the rents are more attractive. Therefore, more daring entrepreneurs are trying not to miss their chance and are actively interested in their business development opportunities in the prestigious locations of the city,” Reginis said.

Latest news

All news

All news

“e-market city” completes its second phase – the development of a modern “stock office” type shopping town continues

"e-market city", an online and wholesale shopping town located in a business-friendly location at the intersection of Eišiškių pl. and Geologų Street, is rapidly approaching the end of its second phase. The final construction works are currently underway and the first tenants of the new phase are preparing to move in as early as June-July. "The predominant floor areas of e-market city - ranging from 370 to 960 m² - are easily combinable and adaptable to a wide range of commercial activities. Existing and potential tenants appreciate the easy accessibility, high quality of construction and fitting-out, functional layout and solid neighbourhood, where well-known companies such as Assa Abloy, Dextera, Skuba, Skuba, Maidina, Šildymas plius, YE International, etc. are already located. The first phase is already 100% leased, while the second phase is still available - we invite you to get in touch", says Remigijus Valickas, Commercial Real Estate Projects Manager at Ober-Haus. The project is being developed in three phases on an area of 3.9 ha. The total area of the buildings will exceed 20,000 m² and the total investment in the project will amount to more than EUR 25 million. For more information about the project and leasing opportunities,…

The recovery of a very strong-looking housing market may slow down

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.5% in March 2025. The annual apartment price growth in the biggest cities of Lithuania was 4.3% (a 4.1% increase was recorded in February 2025). In March 2025 apartment prices in Vilnius, Kaunas, Šiauliai and Panevėžys increased by 0.4%, 1.3%, 0.4% and 0.2%, respectively, with the average price per square meter reaching EUR 2,680 (+10 EUR/sqm), EUR 1,846 (+24 EUR/sqm), EUR 1,172 (+4 EUR/sqm) and EUR 1,149 (+2 EUR/sqm). In the same month, apartment prices in Klaipėda decreased by 0.1% and the average price per square meter dropped to EUR 1,752 (-2 Eur/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 3.3% in Vilnius, 5.6% in Kaunas, 5.4% in Klaipėda, 6.5% in Šiauliai and 6.4% in Panevėžys. "At the beginning of 2025, the country's housing market is showing impressive results. After a very strong growth in housing transactions in January and February this year, the increase in the number of transactions continued in March. According to the data of the State Enterprise…

Housing market has woken up, but no faster price growth yet

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.4% in February 2025. The annual apartment price growth in the biggest cities of Lithuania was 4.1% (a 4.0% increase was recorded in January 2025). In February 2025 apartment prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys increased by 0.3%, 0.1%, 0.8%, 0.8% and 0.9%, respectively, with the average price per square meter reaching EUR 2,670 (+7 EUR/sqm), EUR 1,822 (+2 EUR/sqm), EUR 1,754 (+13 EUR/sqm), EUR 1,168 (+10 EUR/sqm) and EUR 1,147 (+10 EUR/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 3.2% in Vilnius, 4.1% in Kaunas, 6.2% in Klaipėda, 6.6% in Šiauliai and 6.7% in Panevėžys. ‘As predicted, a rapid annual growth in the number of housing transactions is recorded at the beginning of 2025. According to the data of the State Enterprise Centre of Registers, 40% more apartments were purchased in the country in January this year and 39% more in February this year than in the same month in 2024. It should be noted that in the…

All news

All news