Significantly more active new apartment market in June

June 2020, the second month in a row, saw an increase in realization volumes in the market of newly built apartments in Vilnius and Kaunas. In contrast, in Klaipėda the volumes remained at a similar level as in May 2020.

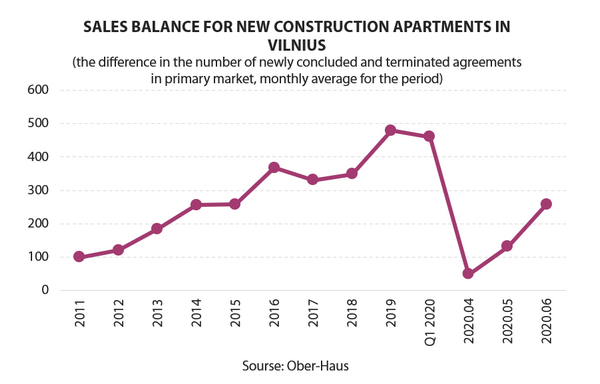

According to Ober-Haus, in June this year, the sales balance (the difference in the number of newly concluded and terminated agreements) for apartments in already completed buildings or projects in progress in Vilnius was 258 apartments or 95% more compared to May 2020. Meanwhile, compared to April this year, the figure in June was 5.3 times higher in the capital city. Looking at the monthly sales indicators for new apartments in April (48 apartments), May (132 apartments) and June (258 apartments), it appears that, following a sharp decrease in activity in April, buyers started to return to the new build sector in Vilnius.

“It is clear that the overall sales indicators of Q2 2020 are extremely modest compared to previous periods. If in Q2 2019, deals for over 1,400 new apartments were concluded in the primary market in Vilnius, so the result this year is down by almost 70%,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

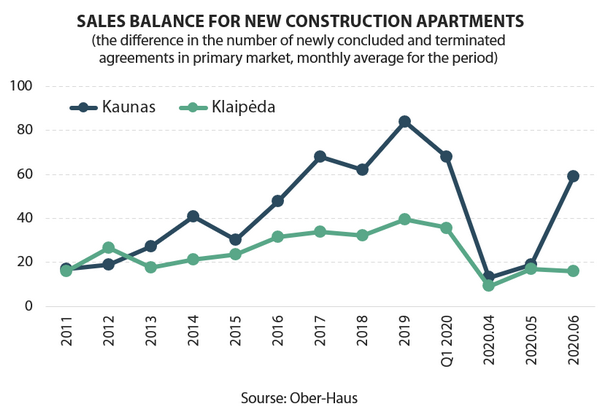

In recent months, the same market activity trends can be observed in Kaunas. According to Ober-Haus, in June, the overall sales balance for apartments in Kaunas, calculating sold and reserved apartments in already completed buildings or projects in progress, in the primary apartment market, was 59 apartments or 3.1 times more than in May. Compared to April 2020, 4.5 times more apartments were realized in Kaunas in June. Like it is the case in Vilnius, the overall sales indicators for Q2 2020 are also modest. If in 2019, deals for the purchase of nearly 250 new apartments were concluded in the primary market in Kaunas on average in a quarter, so the result of Q2 this year is down by 63%.

Meanwhile in Klaipėda, no major changes in the number of transactions for new apartments were recorded in June. According to Ober-Haus, in June the sales balance for apartments in Klaipėda, calculating sold and reserved apartments in already completed buildings or projects in progress, in the primary apartment market, was 16 apartments or 6% less than in May (17 apartments). If in 2019, deals for the purchase of nearly 120 new apartments were concluded in the primary market in Klaipėda on average in a quarter, so the result of Q2 this year is down by 64%.

Meanwhile in Klaipėda, no major changes in the number of transactions for new apartments were recorded in June. According to Ober-Haus, in June the sales balance for apartments in Klaipėda, calculating sold and reserved apartments in already completed buildings or projects in progress, in the primary apartment market, was 16 apartments or 6% less than in May (17 apartments). If in 2019, deals for the purchase of nearly 120 new apartments were concluded in the primary market in Klaipėda on average in a quarter, so the result of Q2 this year is down by 64%.

“One of the reasons why there is no faster recovery in the market activity in the city of Klaipėda over the past three months is much smaller construction volumes of apartment buildings than in other major cities,” Reginis pointed out. According to the representative of Ober-Haus, if the construction of apartment buildings in Vilnius and Kaunas has not stopped and developers regularly offer new projects to the market, the developers in Klaipėda are not so optimistic. Suspension of the construction of previously planned projects may lead to a very small number of apartments built in 2021, but the overall realization indicators have already been affected.

Sharp decline in the market activity increased sales of unsold apartments

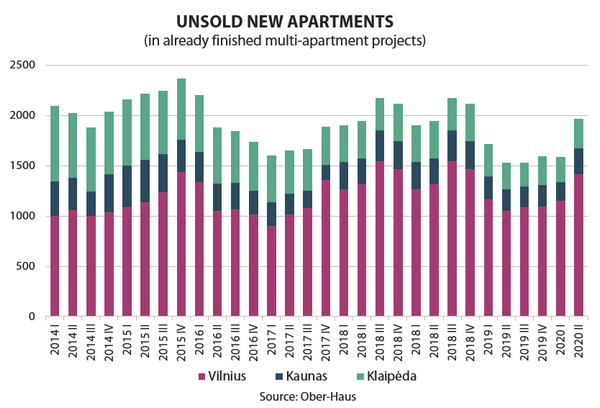

“Over the past three months or, we may say during the lockdown period, the developers have essentially not stopped their work and have tried to work normally. Since the overall market activity has decreased significantly, but the construction of apartments or their completion continued, an increase in the number of unsold apartments in already completed apartment buildings was observed in Q2 2020 in all major cities of the country,” Reginis pointed out.

According to Ober-Haus estimates, a total of 1,413 apartments were available for sale in Vilnius in the completed projects at the end of Q2 2020 or 22% more than at the end of Q1 2020. The figure in Kaunas at the end of Q2 2020 was 259 apartments or 43% more than at the end of at the end of Q1 2020 and in Klaipėda – 293 apartments or almost 17% more than at the end of Q1 2020.

“Historically, the number of unsold apartments should not yet give rise to greater concern of developers,” Reginis said. For example, in Vilnius and Kaunas more unsold apartments were recorded at the end of 2018 (1,467 and 276 apartments respectively), while in Klaipėda – at the end of Q1 2019 (318 apartments).

“Of course, the relatively slow demand for newly built apartments in the country’s major cities and the construction of projects at an undiminished pace are likely to lead to a further increase in the number of unsold apartments in the near future. However, as the figures for the past few months show, the confidence of buyers in the sector of newly built apartments is returning. At the same time, a clear message is sent to the market that this was a sudden, but short interruption in this sector. We can now observe how quickly the market will bounce back from the rock bottom of this decade in its activities,” Reginis said.

Latest news

All news

All news

The return of buyers to the housing market has caused prices to rise more quickly

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.7% in June 2025. The annual apartment price growth in the biggest cities of Lithuania was 6.7% (a 6.4% increase was recorded in May 2025). In June 2025 apartment prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys increased by 0.6%, 1.0%, 0.9%, 0.5% and 0.7%, respectively, with the average price per square meter reaching EUR 2,768 (+17 EUR/sqm), EUR 1,926 (+19 EUR/sqm), EUR 1,816 (+16 EUR/sqm), EUR 1,212 (+7 EUR/sqm) and EUR 1,192 (+8 EUR/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 5.8% in Vilnius, 8.4% in Kaunas, 7.6% in Klaipėda, 7.2% in Šiauliai and 8.1% in Panevėžys. "The country's housing market is showing an impressive recovery this year, characterised by increased sales volumes and accelerated price growth. Although the number of housing transactions fell by 13% in June compared to May, the annual growth rate remains in double digits. According to data from the State Enterprise Centre of Registers, the number of houses purchased in June this year was 13%…

What impact will the rising cost of parking in Vilnius have on office workers?

[caption id="attachment_69748" align="aligncenter" width="2000"] Ugnė Liaudanskienė, Office Leasing Manager at Ober-Haus[/caption] In Vilnius, the 66% increase in the cost of short- and long-term on-street parking from 1 July will inevitably lead to higher prices at offices and private car parks. However, as the desire to drive to work remains strong, the new prices will primarily result in additional costs and inconvenience, or the need to find ingenious solutions. Despite aspirations to promote the sustainable movement of people in cities, the Vilnius office market shows that this is not yet being achieved. Although 'parking' is not a decisive factor in Ober-Haus' office negotiation practice, it is certainly one of the most important issues for tenants. It is not a matter of personal whims or privileges of managers — in a competitive labour market, companies are simply trying to meet the real needs of their employees. The cost of land, changing regulations and design considerations mean that the number of parking spaces near business centres is actually decreasing. Just two decades ago, large developers could build large multi-storey car parks in central business districts and allow tenants to park for free, with a limit on the number of spaces per company. According…

A new housing project Pašilaičių SOLO has been launched in the northern part of the Pašilaičiai

Construction has started on a new residential project called Pašilaičių SOLO in the northern part of Pašilaičiai in Vilnius. This five-storey apartment building, which has only 40 apartments, is distinguished by its cosy atmosphere, well-designed dwellings, and extremely convenient city location. This project is ideal for those looking for a comfortable, quiet city life. The smaller population, highest energy class A++ rating, underfloor heating and tidy surroundings create the feeling of a sustainable, quality home. Every detail has been considered to ensure the comfort of modern residents, from the home's layout to the provision of everyday conveniences," says Marius Čiulada, the project's Sales Manager. Buyers can choose from one- to four-room apartments (from 31 to 77 m²), all of which have balconies or terraces. The apartments are sold with partial finishing, but buyers also have the option of full finishing. Underground and surface parking spaces are planned for cars and electric vehicles, as well as storage facilities. The courtyard will feature a seating area and a children's playground. The Pašilaičių SOLO project is being implemented by UAB Hiltus, an experienced general contracting company that ensures quality and durable solutions at every stage of construction. The Ober-Haus team is responsible for…

All news

All news