Ober-Haus Real Estate Advisors has been named Best Overall Advisory and Consultant in Lithuania running at this year’s Euromoney Real Estate Awards organised by the renowned financial publication. Ober-Haus took the first place in Euromoney magazine’s 11th annual Real Estate Survey as:

- Euromoney: Best Overall Advisor & Consultant in Lithuania 2015

- Euromoney: Best Research Advisor & Consultant in Lithuania 2015

- Euromoney: Best Valuation Advisor & Consultant in Lithuania 2015

- Euromoney: Best Agency/Letting Advisor & Consultant in Lithuania 2015

“This award is the result of our focused work to improve our quality of services. Employee empowerment and evaluation in the company creates a work culture that achieves not only the highest quality of services but also the long-term competitive advantage in the market. We are very glad about Euromoney’s award, it demonstrates once again that we are the only company in Lithuania providing strongly developed RE services in all fields, so our customers can solve all issues related to real estate”, – said Remigijus Pleteras, Ober-Haus General manager.

“This award is the result of our focused work to improve our quality of services. Employee empowerment and evaluation in the company creates a work culture that achieves not only the highest quality of services but also the long-term competitive advantage in the market. We are very glad about Euromoney’s award, it demonstrates once again that we are the only company in Lithuania providing strongly developed RE services in all fields, so our customers can solve all issues related to real estate”, – said Remigijus Pleteras, Ober-Haus General manager.

Euromoney magazine’s Real Estate Survey canvassed the opinions of real estate advisers, developers, investment managers, corporate end-users and banks. The survey was filled in at country level by senior executives. Respondents were asked to nominate the companies which they thought were the best in their market over the past 12 months. Ober-Haus is participant of Euromoney’s survey since 2006 and has received few awards.

Ober-Haus Lithuania launched its activities in Lithuania in 1998 and currently, more than 110 employees are employed in 10 offices (in Vilnius (4), Kaunas, Klaipėda, Šiauliai, Panevėžys, Palanga and Druskininkai) of the company. Ober-Haus Real Estate Advisors is a highly experienced provider of the most complete property services including residential and commercial real estate services, property management, property and business valuation services.

Contact person:

Remigijus Pleteras

Ober-Haus General Manager

phone +370 659 35 033

e-mail remigijus.pleteras@ober-haus.lt

The stably growing consumption rates in the Baltic States continue to boost development of retail premises both in capital cities and in other regions of the three countries. If we consider distribution of retail area by individual countries and regions, we can see certain trends that are dictated by the number of population and their purchasing power. Traditional shopping centres of regional and local significance are concentrated in the strongest regions and cities of the countries. Evaluation of the overall indicators of the Baltic States shows that Estonia remains the unbeatable leader. If we consider only the shopping centres that offer customers a variety of goods and services (at least 10 different tenants) and are fairly large (at least 4,000 sqm of useful area), the total area amounts to 1,308,000 sqm in Lithuania, 988,000 sqm in Estonia, and 827,000 sqm in Latvia. If we consider retail area per 1,000 residents of the country however, we can see significant differences between the individual Baltic States: in Estonia, there are 751 sqm of retail area per 1,000 residents; this figure is 444 sqm for Lithuania and 413 sqm for Latvia.

The stably growing consumption rates in the Baltic States continue to boost development of retail premises both in capital cities and in other regions of the three countries. If we consider distribution of retail area by individual countries and regions, we can see certain trends that are dictated by the number of population and their purchasing power. Traditional shopping centres of regional and local significance are concentrated in the strongest regions and cities of the countries. Evaluation of the overall indicators of the Baltic States shows that Estonia remains the unbeatable leader. If we consider only the shopping centres that offer customers a variety of goods and services (at least 10 different tenants) and are fairly large (at least 4,000 sqm of useful area), the total area amounts to 1,308,000 sqm in Lithuania, 988,000 sqm in Estonia, and 827,000 sqm in Latvia. If we consider retail area per 1,000 residents of the country however, we can see significant differences between the individual Baltic States: in Estonia, there are 751 sqm of retail area per 1,000 residents; this figure is 444 sqm for Lithuania and 413 sqm for Latvia.

If we consider the statistics for the largest and most important regions of the countries only, Harju County in Estonia (together with Tallinn and other cities) has as much as 1,026 sqm of retail area per 1,000 residents of the county. Approximately 43% of the Estonian population live in Harju County, and this concentration of shopping centres should therefore not be surprising. On the other hand, approximately 46% of the Latvian population live in Riga region (including Riga, Jurmala and other towns), which are offered 691 sqm of modern retail area. In Vilnius County, which is the largest county in Lithuania with approximately 27% of the country’s population, most shopping centres are located in Vilnius. Only a few large shopping centres can be found in Ukmerge and Elektrenai. However, despite being the largest county in Lithuania, Vilnius County compared to the main regions of Estonia and Latvia, demonstrates the lowest figure – 652 sqm of retail area per 1,000 residents.

Estonia, being the leader in terms of supply of retail premises, is leading in terms of retail area per 1,000 residents not only in the most populated county but also in other parts of the country. The abundance of shopping centres is also observed in other cities of the country (Tartu, Narva, Parnu), where modern retail area per 1,000 residents is from 1,000 to 1,700 sqm (Parnu, where this indicator is as high as 1,711 sqm, is the leader). Statistics do not always reflect the actual situation however, since very often cities themselves and the shopping centres available there become sites attracting customers from other regions of the country and foreign tourists. For instance, the Estonian resort town of Parnu is located between Riga and Tallinn and receives numerous visits from the people travelling between the two capitals. The town of Parnu and Parnu County also have many summer houses whose residents during the summer do not have many options and therefore go to the town of Parnu to do their shopping. Although no other shopping centres have been planned in this region, the owners of the available premises can boast stable rents and successfully operating shopping centres.

Apartment prices in Vilnius increased by 0.5% to 1,304 EUR/sqm in July 2015. During a year apartment prices in Vilnius increased by 1.6% and since the last lowest price level in May 2010, apartment prices are higher by 13.0% (by 150 EUR/sqm). Despite very high market activity in the last two months, the number of apartment transactions in January-July 2015 in Vilnius is lower by 13% compared with the same period in 2014.

Apartment prices in Vilnius increased by 0.5% to 1,304 EUR/sqm in July 2015. During a year apartment prices in Vilnius increased by 1.6% and since the last lowest price level in May 2010, apartment prices are higher by 13.0% (by 150 EUR/sqm). Despite very high market activity in the last two months, the number of apartment transactions in January-July 2015 in Vilnius is lower by 13% compared with the same period in 2014.

In July 2015 apartment prices in Riga increased by 0.1% to the average price of 1,050 EUR/sqm. Over the past 12 months, the average apartment price has decreased 0.4% (in June 2015, the annual growth of apartment prices was 0.2%). In January-July 2015, the number of apartment transactions in Riga is lower by 15% compared with the same period in 2014.

The average apartment price in Tallinn decreased by 2.3% to 1,504 EUR/sqm in July 2015, which means that annual increase is 4.4%. July was the fourth month in a row, when the price decrease was observed. In total there were 4,958 apartment transactions in January-July 2015 in Tallinn, which is 16% more than in the same period of 2014.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), grew 0.3% in July this year. The annual apartment price growth in the major cities of Lithuania was 0.8% (a 0.6% increase was recorded in June).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), grew 0.3% in July this year. The annual apartment price growth in the major cities of Lithuania was 0.8% (a 0.6% increase was recorded in June).

Vilnius, Klaipėda and Šiauliai saw the biggest positive changes in apartment prices recorded in July. Apartment prices in Vilnius grew 0.5% with the average price per square meter reaching EUR 1,304 (+6 EUR/sqm). In the past 12 months, the prices of apartments in Vilnius increased by 1.6% and since the last lowest price level recorded in May 2010 prices have increased by 13% (+150 EUR/sqm). Apartment prices in Klaipėda and Šiauliai grew 0.1% with the average price per square meter reaching EUR 976 (+1 EUR/sqm) and EUR 560 (+1 Eur/sqm). Apartment prices in Kaunas and Panevėžys remained stable and were the same as in June – 940 EUR/sqm and 530 EUR/sqm.

In the past 12 months, the prices of apartments fell 0.1% in Kaunas, 0.3% in Klaipėda and 0.4% in Šiauliai. Meanwhile in Panevėžys the prices of apartments grew by 0.1%.

At the end of Q2 2015, the Lithuanian residential market gained momentum. Although the beginning of the year did not promise any major movement in the market, results in June injected some optimism. According to the State Enterprise Centre of Registers, in Q2 2015, 52% more house purchase and sale transactions and 23% more those of apartments were concluded as compared to Q1 2015 in Lithuania. In Q2 2015, on average 820 transactions for houses and 2,350 transactions for apartments were concluded per month. Of course, early in the year there is usually little activity in the housing market, but the results of Q2 2015 were quite good. Although compared with the same period 2014, the total number of housing transactions in Lithuania was by 12% smaller, the situation was similar to the 2013 indicators, when the market was also active. In June this year, the housing sector was unexpectedly very active – the number of purchase and sale transactions for apartments and houses in Lithuania has been so far the largest this year.

At the end of Q2 2015, the Lithuanian residential market gained momentum. Although the beginning of the year did not promise any major movement in the market, results in June injected some optimism. According to the State Enterprise Centre of Registers, in Q2 2015, 52% more house purchase and sale transactions and 23% more those of apartments were concluded as compared to Q1 2015 in Lithuania. In Q2 2015, on average 820 transactions for houses and 2,350 transactions for apartments were concluded per month. Of course, early in the year there is usually little activity in the housing market, but the results of Q2 2015 were quite good. Although compared with the same period 2014, the total number of housing transactions in Lithuania was by 12% smaller, the situation was similar to the 2013 indicators, when the market was also active. In June this year, the housing sector was unexpectedly very active – the number of purchase and sale transactions for apartments and houses in Lithuania has been so far the largest this year.

Despite geopolitical challenges, the country’s overall economic situation remains positive and this continues to encourage both the construction sector and steady growth in housing demand. It is likely that such improvement in the housing market activity could also be attributed to temporary factors. This year, amendments to Responsible Lending Regulations were proposed to the public that were to take effect in July this year. Tightening of lending conditions may have prompted potential buyers to purchase homes before this date. However it was hardly the essential factor that determined a surge in housing transactions in June, because, according to the Bank of Lithuania, had the planned amendments been in force in 2014, considering possible modifications in loan characteristics, still 99 out of 100 customers would have been granted the entire sum of the loan. This is quite logical, because in recent years the vast majority of buyers do not underestimate their expectations and try to borrow after objective consideration of all risks rather than at the limit of their capabilities. For example, SEB statistics shows that in 2014 residents usually borrowed for a period of 22 years and the average loan for residential property was about EUR 39,000, that is, only by 5% higher than the average loan in 2013. It should also worth to remember that the majority of residential property in Lithuania is purchased using own funds, so these amendments to the terms of borrowing should not, in principle, change the behaviour of the majority of potential buyers, especially where property is purchased in other than the major cities. It has been announced that the Responsible Lending Regulations will take effect in November, but not in July this year, so in summer and autumn a faster decision making regarding residential property can be expected. However, it is hardly possible to expect a more active market because these amendments to regulations will mostly motivate young people (around 25 years of age) who expect to borrow for a period of over 30 years.

Potential buyers may expect further stability in housing sales prices as there have been no significant changes recorded in the country’s major cities and it is unlikely that there will be any in the nearest future. Following negative price changes recorded in the country’s major cities at the end of 2014, the overall price curve is slightly climbing again only in the capital city. In Q2 2015, prices for apartments in Vilnius increased by 1.2%, the average price amounting to 1,298 EUR/sqm (+15 EUR/sqm). Prices for apartments in new residential districts increased most in the first half of the year – by 2.5%. Meanwhile, in the same period in Panevėžys apartment prices rose by 0.1% and the average price increased to 530 EUR/sqm (+1 EUR/sqm). No changes were recorded in Kaunas, Klaipėda and Šiauliai and the average price at the end of Q2 was 940 EUR/sqm, 975 EUR/sqm and 559 EUR/sqm respectively.

Apartment prices in Vilnius increased by 0.3% to 1,298 EUR/sqm in June 2015. The annual pace of apartment price growth has been slowing for ten months in a row to 1.2% in June. Since the last lowest price level in May 2010, apartment prices are higher by 12.5% (by 144 EUR/sqm). In January-June 2015, the number of apartment transactions in Vilnius decreased by almost 18% compared with the same period in 2014.

Apartment prices in Vilnius increased by 0.3% to 1,298 EUR/sqm in June 2015. The annual pace of apartment price growth has been slowing for ten months in a row to 1.2% in June. Since the last lowest price level in May 2010, apartment prices are higher by 12.5% (by 144 EUR/sqm). In January-June 2015, the number of apartment transactions in Vilnius decreased by almost 18% compared with the same period in 2014.

In June 2015 apartment prices in Riga remained stable with the average price of 1,049 EUR/sqm. Over the past 12 months, the average apartment price has increased 0.2% (in June 2014, the annual growth of apartment prices was 5.3%). In January-June 2015, the number of apartment transactions in Riga decreased by 17% compared with the same period in 2014.

The average apartment price in Tallinn decreased by 0.2% to 1,543 EUR/sqm in June 2015, which means that annual increase is 8.1%. In total there were 4,215 apartment transactions in January-June 2015 in Tallinn, which is 15% more than in the same period of 2014.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), grew 0.2% in June this year. The annual apartment price growth in the major cities of Lithuania was 0.6% (a 1.0% increase was recorded in May).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), grew 0.2% in June this year. The annual apartment price growth in the major cities of Lithuania was 0.6% (a 1.0% increase was recorded in May).

Vilnius and Panevėžys saw the biggest positive changes in apartment prices recorded in June. Apartment prices in Vilnius grew 0.3% with the average price per square meter reaching EUR 1,298 (+4 EUR/sqm). In the past 12 months, the prices of apartments in Vilnius increased by 1.2%, which is a rise of 12.5% (+144 EUR/sqm) since the last lowest price level recorded in May 2010. Apartment prices in Panevėžys grew 0.1% with the average price per square meter reaching EUR 530 (+1 EUR/sqm). After a drop in apartment prices in Klaipėda and Šiauliai by 0.1%, the average price fell to 975 EUR/sqm (-1 EUR/sqm) and 559 EUR/sqm. In Kaune apartments prices remained stable and were the same as in May – 940 EUR/sqm.

In the past 12 months, the prices of apartments grew 0.4% in Kaunas and 0.1% in Panevėžys. Meanwhile in Klaipėda and Šiauliai the prices of apartments in the same period fell by 0.4% and 0.5% respectively.

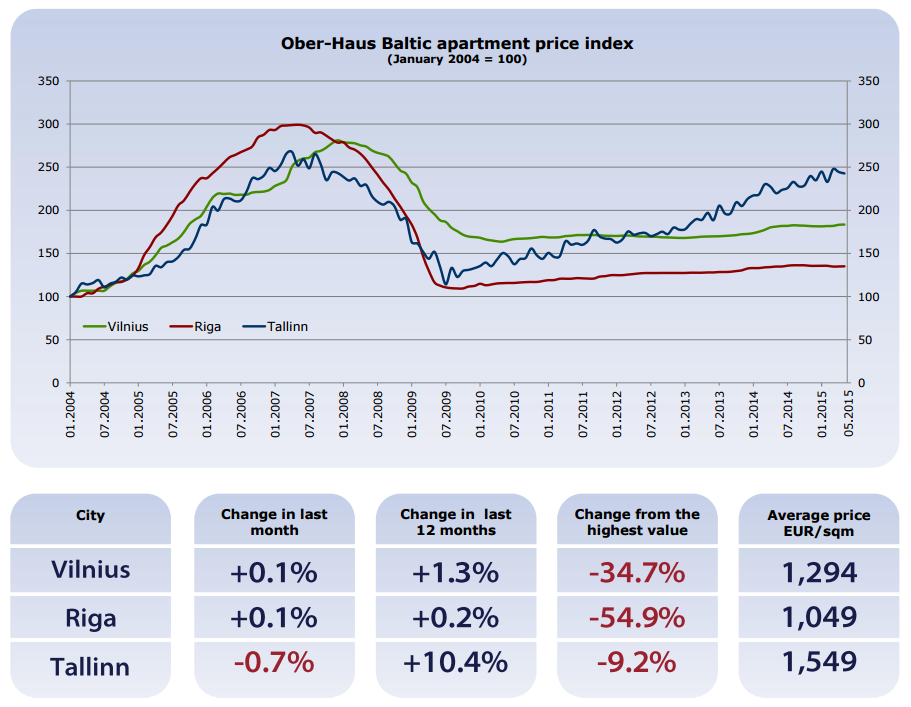

Apartment prices in Vilnius increased by 0.1% to 1,294 EUR/sqm in May 2015. The annual pace of apartment price growth has been slowing for nine months in a row to 1.3% in May. Since the last lowest price level in May 2010, apartment prices are higher by 12.1% (by 140 EUR/sqm). In January-May 2015, the number of apartment transactions in Vilnius decreased by 23% compared with the same period in 2014.

In May 2015 apartment prices in Riga increased by 0.1% to the average price of 1,049 EUR/sqm. Over the past 12 months, the average apartment price has increased 0.2% (in April 2015, the annual growth of apartment prices was 0.5%). In January-May 2015, the number of apartment transactions in Riga decreased by almost 19% compared with the same period in 2014.

The average apartment price in Tallinn decreased by 0.7% to 1,549 EUR/sqm in May 2015, which means that annual increase is 10.4%. In total there were 3,539 apartment transactions in January-May 2015 in Tallinn, which is almost 14% more than in the same period of 2014.

The average apartment price in Tallinn decreased by 0.7% to 1,549 EUR/sqm in May 2015, which means that annual increase is 10.4%. In total there were 3,539 apartment transactions in January-May 2015 in Tallinn, which is almost 14% more than in the same period of 2014.

Apartment prices in Vilnius increased by 0.7% to 1,292 EUR/sqm in April 2015. The annual pace of apartment price growth has been slowing for eight months in a row to 1.7% in April. Since the last lowest price level in May 2010, apartment prices are higher by 12.0% (by 138 EUR/sqm). In January-April 2015, the number of apartment transactions in Vilnius decreased by 26% compared with the same period in 2014.

In April 2015 apartment prices in Riga increased by 0.1% to the average price of 1,048 EUR/sqm. Over the past 12 months, the average apartment price has increased 0.5% (in March 2015, the annual growth of apartment prices was 0.7%). In January-April 2015, the number of apartment transactions in Riga decreased by 19% compared with the same period in 2014.

The average apartment price in Tallinn decreased by 1.3% to 1,560 EUR/sqm in April 2015, which means that annual increase is 7.5%. In total there were 2,729 apartment transactions in January-April 2015 in Tallinn, which is almost 8% more than in the same period of 2014.

The beginning of 2015 was relatively stable in Lithuania’s commercial premises sector and was marked by continued efforts of developers of modern offices to increase the number of design and construction projects involving business centres in the capital. The City business centre on Žalgirio Street, developed by Hanner and scheduled for completion in the second half of 2016, is one of the largest new projects and will offer about 20,000 sqm of modern office space to the market. Another large office building project is the office building complex planned by M.M.M. Projektai on the site of the former bakery on Saltoniškių Street, on completion this will offer up to 65,000 sqm. However, the construction of this business centre will not start before 2016 and both the speed of development and its different stages of development will depend on the situation in the market.

In addition to the above projects under planning or in progress, at least three new projects were implemented in Q1 2015: the Sostena and Vertingis business centres on Ukmergės Street, and the reconstruction of a historical building on J. Basanavičiaus Street, all of which have space for lease. The total area of modern office space in the capital is now 519.000 sqm. Meanwhile, in Kaunas, the telecommunications and real estate development company Mikrovisatos Valda completed a 3,600 sqm business centre on Savanorių Avenue; the total area of modern office space available in Kaunas increased to 91,300 sqm in Q1.

The opening of these new business centers has increased the supply of office space, with the result that for the first time in a while most of the country’s major cities have recorded an increase in vacant office space. Previously it was Kaunas that had the smallest vacancy rate, but in Q1 2015 the vacancy rate there increased from 1.3% to 5.7%. This jump in the vacancy rate was due to newly built office buildings that are still looking for tenants. The liquidity of modern office space in Kaunas is considerably lower compared to Vilnius. There is not sufficient development of local enterprises requiring space in the new business centers, even where there is quite a small vacancy rate on the market. International companies already in the city or planning to establish branches could provide an additional stimulus to the market.

The three newly opened business centers in Vilnius were also responsible for the increased vacancy rate in Q1 2015, which rose from 3.9 % to 4.9 %, an area of 25,500 sqm, at the end of the quarter. In view of the statistics of the past seven years, this amount of vacant space and the increase are not significant enough to speak about oversupply, which could influence the rents. In fact, it is lower class (B) office projects that increase vacancy rates, which currently stand at 6.9%, whereas the vacancy rate in A class business centres is only 1.0%. It is likely that because of this low vacancy rate in A class business centres, an increase in the vacancy rate will be recorded in late 2015/early 2016, when the business centres currently under construction are opened. However, this growth should not be significant, because early interest in these premises remains high and lease agreements are actively signed when construction is still in progress.

The fact that owners of new and existing business centres do not feel any pressure because of vacancies is illustrated by stable office rents. In Q1 2015, rents for modern office space remained stable in Kaunas and Klaipėda, and saw a slight growth, of 1% on average in Vilnius in class A business centres. At the moment, A class office rents in Vilnius are 13.0–15.6 EUR/sqm, B class – 8.0–11.6 EUR/sqm. Meanwhile in Kaunas A class office rents are 9.5-13.0 EUR/sqm, and in Klaipėda about 8.7–11.6 EUR/sqm. B class office rents in Kaunas range 5.2–7.8 EUR/sqm and in Klaipėda – 5.2–7.2 EUR/sqm.

Steadily increasing office rents and decreasing yields gradually increase the value of commercial property in Vilnius. Top-class office rents rose almost 5% in Vilnius in last 12 months, while the yield of such premises during the same period decreased on average by 0.2 percentage points – from 7.6% to 7.4%. Thus, the capital value index over the past 12 months increased by almost 8%; such capital value was last recorded in the second half of 2006 and in early 2009. This shows that at the moment, property values are only lower than the price levels recorded at the peak (i.e. the price level of 2007–2008).

Search

Search