The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in November 2017. The annual apartment price growth in the major cities of Lithuania was 4.0% (the annual apartment price growth in October 2017 was 4.1%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in November 2017. The annual apartment price growth in the major cities of Lithuania was 4.0% (the annual apartment price growth in October 2017 was 4.1%).

Q3 2017 in the Lithuanian housing market did not bring any major surprises. The housing market indicators and the prevailing mood remain essentially high as a result of the excellent performance in 2016–2017. Several indicators however signal the first stability signs in the housing market. Compared to 2016, the number of transactions for apartments in 2017 was smaller, similarly an increase in house purchase loans was not rising so rapidly.

Q3 2017 in the Lithuanian housing market did not bring any major surprises. The housing market indicators and the prevailing mood remain essentially high as a result of the excellent performance in 2016–2017. Several indicators however signal the first stability signs in the housing market. Compared to 2016, the number of transactions for apartments in 2017 was smaller, similarly an increase in house purchase loans was not rising so rapidly.

According to the data of the State Enterprise Centre of Registers, in Q3 2017, the number of transactions of apartments was 5% smaller and the number of transactions of houses was 4% higher in Lithuania compared with Q3 2016. In Q3 2017, on average 967 transactions for houses and 2,868 transactions for apartments were concluded in Lithuania. The volume of new mortgages in Lithuania also stabilised. According to the data of the Bank of Lithuania, new mortgage loans (including revolving loans) totalled EUR 325 million in Q3 2017, which is 12% less than in Q2 2017, but almost 2% more than in the same period in 2016.

Q3 2017 saw a further moderate price increase. According to the information available to Ober-Haus, the total apartment price increase in this quarter in five major cities in the country was 1.2%. In July, August and September 2017, the fastest increase in apartment prices by an average of 1.4% was recorded in Kaunas, apartment prices in Klaipėda increased by 1.3%, in Vilnius – 1.2%, in Šiauliai – 0.7%, and in Panevėžys the prices remained the same. Over a period of one year (September 2017 compared to September 2016), apartment prices in Vilnius and Kaunas increased by 4.5%, in Šiauliai – 3.3%, in Klaipėda – 3.2% and in Panevėžys – 2.5%.

In the meantime, the sales volumes of new apartments in five major cities of the country decreased for a second successive quarter. The overall poorer results were determined by the situation in the capital city where, it seems, the ceiling for both the demand and supply had been reached. According Ober-Haus, in Q3 2017, 1,028 new apartments in completed apartment buildings and apartment buildings in progress were sold or reserved directly from developers in the five major Lithuanian cities. This is 16% less than those realised in Q2 2017 and 20% less than those realised in Q3 2016. However, the assessment of the activities in the new apartment market and its prospects in different cities of the country clearly shows a different situation and trends.

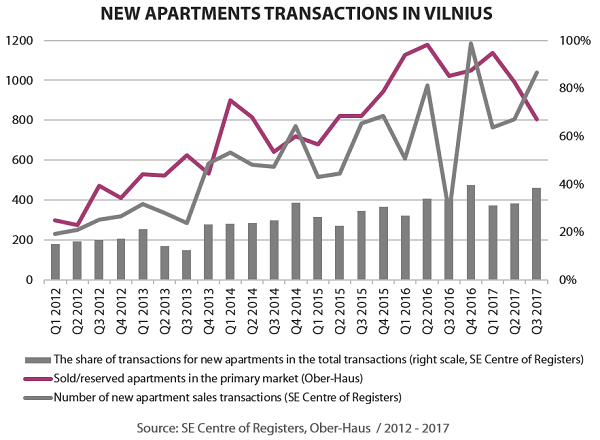

With rapid increase in 5 consecutive years, the share of newly built apartments in the capital city stalled

In Vilnius, 805 new apartments were sold or reserved in Q3 2017 in completed apartment buildings and apartment buildings in progress. That is nearly 19% less than those realised in Q2 2017 and 21% less than in the same period last year. This was the second consecutive quarter the decreasing sales volumes were recorded.

It must be noted that the major part of these sales will reflect in the official statistics of the Centre of Registers later, because 80% of the sales concluded in Q3 involved apartments in the buildings in progress. Since sales were concluded on the basis of the preliminary contracts, the officially registered data still show a somewhat different situation – a quarterly growth in the number of transactions for new apartments in Vilnius. As a result, according to the data of the State Enterprise Centre of Registers, 1,039 transactions for new apartments were recorded in Vilnius which is the best quarter this year (based on the methodology of the Centre of Registers, new housing includes the buildings constructed in the previous year and the current year, and also transactions for unfinished housing).

In the past five years, a particularly fast increase of the portion of new apartments in the overall statistics for the apartment sale transactions in Vilnius has been recorded. According to the data of the State Enterprise Centre of Registers, in 2011 the share of new apartments accounted only for 11% of the overall registered apartment sales transactions. The share continued to increase each year totalling 34% in 2016, the largest share since 2011.

In the past five years, a particularly fast increase of the portion of new apartments in the overall statistics for the apartment sale transactions in Vilnius has been recorded. According to the data of the State Enterprise Centre of Registers, in 2011 the share of new apartments accounted only for 11% of the overall registered apartment sales transactions. The share continued to increase each year totalling 34% in 2016, the largest share since 2011.

The increase was determined by both rapidly increasing construction volumes of new apartments and the wishes and capabilities of customers to acquire property after the economic recession had passed. For example, according to Ober-Haus, only 769 apartments were built in the apartment buildings in Vilnius in 2011, while in 2016 the figure increased almost five times to 3,709 apartments. According to Ober-Haus estimates, construction of up to 4,300–4,500 new apartments should be completed in 2017 or 15–20% more than in 2016.

Looking at the share of new and older apartments in the overall statistics of registered transactions in 2017, the portion of transactions for new apartments has stopped growing and has remained at the same level as in 2016. Over 2,600 transactions for new apartments were recorded in Vilnius in the first nine months of 2017, 34% of the total number of sold apartments. Given that a record supply of new apartments since 2008 has been planned in Vilnius this year and a similar number (but probably not more) of apartments (about 4,000–4,200) should be built in 2018, it is likely that the official statistics will show the rise in the sale of new apartments (both nominal and relative) in the nearest future.

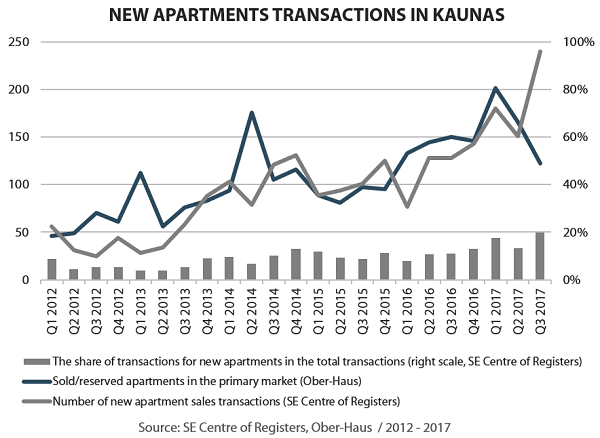

A leap in the number of registered new apartment transactions in Kaunas

Similar trends to those in Vilnius were recorded in Kaunas, although the increase of the portion of new apartments in the overall statistics has been recorded here only this year. This is the result of the increase of investment in new housing in Kaunas in recent years.

According to the information available to Ober-Haus, 600–700 new apartments in apartment buildings should be completed in Kaunas this year, twice as higher as in 2016. A total of 122 new apartments in newly built apartment buildings or in buildings in progress were sold or reserved in Q3 2017. Although this is 26% less than those realised in Q2 2017, but the total figure for the first nine months of the year is 14% higher than that in the same period in 2016. Unlike in Vilnius, where the total apartment sales results both in Q3 and over a period of the first nine months are poorer than in previous periods, Kaunas has retained a growth trend.

The data on the transactions for new apartments recorded at the Centre of Registers show a sufficiently rapid increase in the portion of new housing in Kaunas, which at its lowest in 2010 and 2012 accounted for only 4% and 5% of the total apartment transactions concluded in Kaunas. Over a period of 2013–2016, the figure increased to 11% (2016) and in 2017 – to 17% (first nine months of 2017). If the intensity of development of new apartments in apartment buildings remains at current levels, we will see further increase both in the number of apartments sold or reserved in the projects in progress and in the number officially recorded transactions in 2018.

The data on the transactions for new apartments recorded at the Centre of Registers show a sufficiently rapid increase in the portion of new housing in Kaunas, which at its lowest in 2010 and 2012 accounted for only 4% and 5% of the total apartment transactions concluded in Kaunas. Over a period of 2013–2016, the figure increased to 11% (2016) and in 2017 – to 17% (first nine months of 2017). If the intensity of development of new apartments in apartment buildings remains at current levels, we will see further increase both in the number of apartments sold or reserved in the projects in progress and in the number officially recorded transactions in 2018.

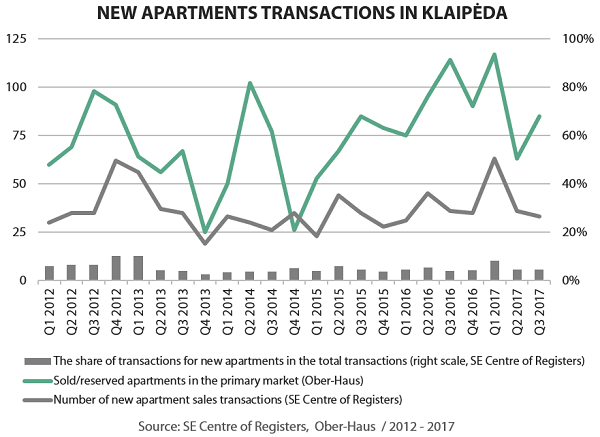

On average only 200 new apartments built annually in Klaipėda

The situation in the new apartment market in Klaipėda is slightly different. Unlike in Vilnius and Kaunas, no major changes in this segment have been recorded in the third largest city in Lithuania. According Ober-Haus data, 85 new apartments were sold or reserved in Klaipėda in Q3 2017. Although this is 35% more than in Q2 2017, the overall result shows a decrease of 9% compared to the same period in 2016.

Due to small-scale, yet not increasing volumes of construction, the sales statistics in Klaipėda remains fluctuating without a clearer direction. This year, about 200 new apartments should be completed in Klaipėda, retaining the 2011–2016 annual average (200 apartments). A greater leap in supply can be expected in 2018 when over 300 apartments are planned to be built.

The almost unchanged situation is confirmed by the data of the State Enterprise Centre of Registers – the share of transactions for new apartments in the total number of apartments transactions reached the lowest level in Klaipėda city in 2014 and accounted for only 4%. During 2015-2016, the situation has not changed substantially – the share of transactions for new apartments in that period increased only to 5% and in 2017 – to 6% (first nine months of 2017), significantly lower than in Vilnius and Kaunas.

It should be noted that poor construction and sales results for new apartments in the official statistics do not mean that the overall activity and liquidity in the housing market in Klaipėda is low and unpromising. On the contrary, more than 2,300 purchase and sale transactions of apartments were recorded in Klaipėda in the first three quarters of 2017, 15.3 transactions per 1,000 residents of the city. At the same time, this indicator in Vilnius and Kaunas is lower – 14.1 and 11.6 transactions per 1,000 residents respectively. There was a large number of unsold new apartments in Klaipėda since previous years, which in the event of a sale were attributed to the sale of old apartments in the official statistics.

Housing supply curve: upwards to the peak in Vilnius, faster ascent in Kaunas and in anticipation at the lower point in Klaipėda

In summary, it can be said that the situation in the three major cities of Lithuania is very different. A decrease in the sale of new apartments and the stabilisation in the ratio of the new and old property sales have been recorded in Vilnius in 2017. In the meantime, in Kaunas the share of new apartments in the overall statistics has seen the highest increase as a result of more active steps by developers and increasing volumes of construction in the city. There are still miniscule signs of recovery of the new apartment market in Klaipėda, because developers lack trust in the capabilities of the market in this seaport city to absorb a greater supply of new housing than it was up to now.

Thus, housing developers have a choice in Lithuania today: continue pushing each other at the most liquid point in Lithuania, join Kaunas on the ascending supply curve or try to restart the market locomotive in Klaipėda?

Lithuania Residential Market Commentary Q3 2017

Q3 2017 was active in the modern offices market. Projects of various sizes contributed to the increase of the modern office space in the major cities of the country. The largest projects were implemented in the capital city, where construction of four new office buildings was actually completed in Q3: Liepyno Verslo Namai, Narbuto 5, Eleven 11 and Green Hall 2. These projects contributed a total of 19,200 sqm of usable office area to the market in Vilnius which now totals 666,600 sqm.

Q3 2017 was active in the modern offices market. Projects of various sizes contributed to the increase of the modern office space in the major cities of the country. The largest projects were implemented in the capital city, where construction of four new office buildings was actually completed in Q3: Liepyno Verslo Namai, Narbuto 5, Eleven 11 and Green Hall 2. These projects contributed a total of 19,200 sqm of usable office area to the market in Vilnius which now totals 666,600 sqm.

At the end of Q3 2017, the occupancy rate in these four newly completed buildings was 78% (over 4,200 sqm of the usable office space was vacant). These latest projects did not have a major impact on the overall market indicators and the general vacancy rate over Q3 2017 increased from 5.1% to a mere 5.3%. The vacancy rate for A class offices was 3.5% and B class – 6.3%.

According to Ober-Haus, the current office vacancy rate in Vilnius (5.3%) remains fairly stable and exceeds the average of the past ten quarters (4.8%) only by half a percentage point. ‘The business centres that will be completed by the end of 2017 will not make a major difference to the situation in the market, because these buildings have already been leased. In the context of the current development rate of companies, the supply of new office space in 2018 does not appear threatening – the projects scheduled for the coming year will offer nearly 62,000 sqm of usable office space’, Saulius Vagonis, Head of Valuation & Analysis Department at Ober-Haus, said.

‘New projects are attractive to the companies which aim to optimize their physical workspace costs and to attract (or retain) employees by offering them modern, technologically smart and attractive workspace. So the trends are sufficiently clear – in order to compete in today’s market, owners of new office buildings must offer an appropriate product and those of older office buildings must upgrade their property. Steady and significant increase in supply is useful both for potential tenants and the economic climate in Vilnius in general,’ Mr Vagonis said.

Competition between business centres determines that the base rent for office space has not changed substantially since the end of 2015. According to Ober-Haus, currently stands at 8.0–13.0 EUR/sqm for B class offices and 13.5–16.5 EUR/sqm for A class offices.

However, in order to attract larger and better known tenants, building owners must be much more flexible in the negotiations with the tenants, especially compared to the 2014–2015 period. The medium and larger leasing transactions concluded today for the new and top-class office buildings usually feature rents under 15.0–16.0 EUR/sqm. ‘If the landlord agrees to negotiate on the base rent, the standing practice in the market is that the tenant will pay all additional building maintenance costs (particularly in top-class business centres). That is, the tenants will compensate not only operation and maintenance costs of the building and premises, but also real estate and land taxes, property insurance, and property management costs. Tenants also normally pay a fee for all parking spaces allocated to them,’ Mr Vagonis said.

Kaunas offers some choices: increase in the number of vacant office premises and a broad range prices

In anticipation of the completion and opening of lager office building projects in Kaunas, smaller scale projects keep supplementing the market. According to Ober-Haus, two projects were completed in Q3 2017 (Jonava 30 on Jonavos Street and S3 on Studentų Street), which offered 3,800 sqm of useful office space totalling 115,600 sqm of modern office space in Kaunas.

After a sudden increase in the vacancy rate in Q2 2017 (from 2.4% to 7.9%), it stabilised and stood at 7.5% in Q3. It is likely that due to active implementation of new office projects in Kaunas, the vacancy rate will remain relatively high in the future.

‘It would be too optimistic to expect that the market in Kaunas will be able to absorb the office space offered to the market in a short period of time (even with the help of international companies). However, a sufficiently broad choice of office premises should be seen as the economic growth potential in Kaunas, because workspaces which meet the needs of the market is one of the essential factors for business development. Some office building developers may face competitive challenges – while certain projects will enjoy high occupancy rates and well-known tenants, others may have to be more pro- active in attracting prospective tenants,’ Mr Vagonis said.

In all, 11 projects of different scale and for different purpose are planned in Kaunas in 2017. They will offer a total of 35,700 sqm of modern office space. Although the new and top-class business centres slightly increased rents in the city of Kaunas, the price range for modern office premises remains very broad. According to Ober-Haus, at the end of Q3 2017, rent for A class offices stood at 11.0–14.0 EUR/sqm and for B class – 6.0–10.5 EUR/sqm.

Small signs of recovery in Klaipėda office market

Development of small projects continues to dominate in the modern office market of Klaipeda. In Q3 2017, development of a new 1,000 sqm building was completed on S. Nėries Street. The premises were leased to a dental clinic, a sports and wellness studio and other tenants.

‘Although slowly, businesses are trying to activate the stagnating market by repurposing the existing sites and buildings,’ Mr Vagonis said. For example, Vakarų Laivų Gamykla (Western Shipyard) together with Klaipėda Science and Technology Park founded the Pilies dirbtuvės in an old administrative building on Pilies Street which offers premises to the representatives of creative industries for a small fee. A former industrial site on Liepų Street will accommodate a technology park (Innovation and Business Valley) for educational institutions which train specialists in information technology, digital design and other innovative areas. The site will also accommodate the co-working centre Spiečius to be completed in mid-2018. Meanwhile this year, Stemma Management plans to complete reconstruction of an old administrative building on the former site of Klaipėdos Kranai (Verslo Biurai 103) and offer about 2,500 sqm of retail and office premises to the market. If this project is implemented successfully, by the end of 2017 the modern office space area in Klaipėda will total 68.500 sqm (annual growth rate of almost 4%).

Although at the end of Q3 2017 the vacancy rate of modern office space in Klaipėda was 17.9%, a large portion of vacant offices are in the buildings constructed earlier (mostly before 2009) (e.g. Business Centre Vitė) and negotiations regarding the property lease in these buildings have not been fruitful for various reasons. So newly developed projects and more flexible approach of the owners to the customer’s needs can contribute to a more successful implementation of new projects in Klaipėda than shown by the general market indicators. According to Ober-Haus, office rents remain stable in Klaipėda and currently the rents in B class buildings stand at 6.0–9.0 EUR/sqm, and in A class buildings – 9.0–12.5 EUR/sqm.

Lithuania Commercial Market Commentary Q3 2017

The improving financial performance of companies which are directly related with the sector of warehousing premises and the growing need for modern premises have recently determined faster development of this real estate segment, announced the Ober-Haus review of commercial real estate. According to Statistics Lithuania, during the first halfyear of 2017 revenues of warehousing and storage companies amounted to EUR 71.4 million (excluding VAT) or respectively 15.7% and 18.0% more compared to the same period in 2016 and 2015.

The improving financial performance of companies which are directly related with the sector of warehousing premises and the growing need for modern premises have recently determined faster development of this real estate segment, announced the Ober-Haus review of commercial real estate. According to Statistics Lithuania, during the first halfyear of 2017 revenues of warehousing and storage companies amounted to EUR 71.4 million (excluding VAT) or respectively 15.7% and 18.0% more compared to the same period in 2016 and 2015.

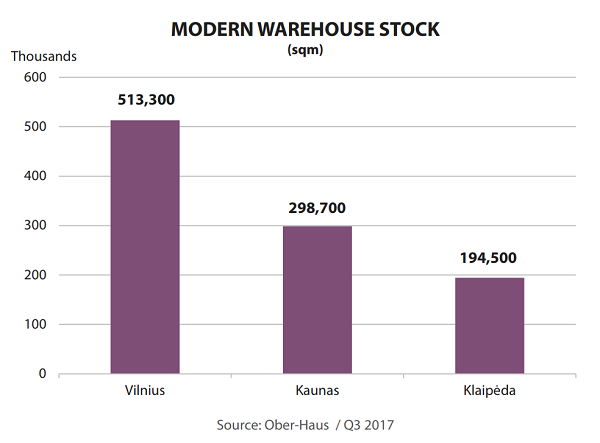

During the first three quarters of 2017, seven warehousing and logistics premises projects were completed in Vilnius and Kaunas regions. Four new projects implemented by Ad Rem, Baltic Sea Properties, Arvydo Paslaugos and Woodline were completed in Vilnius region. According to data from Ober-Haus, after the implementation of these projects, the market of the capital city was supplemented with 31,900 sqm of new warehousing premises at the end of Q3 2017 totalling 513,300 sqm in Vilnius and its environs. Meanwhile, three projects with a combined floor area of roughly 19,000 sqm were completed in Kaunas region. All projects implemented in Kaunas region were intended for own needs of the companies (Vetmarket, Analizė and Aibė). At the end of Q3 2017, the area of modern warehousing premises in Kaunas city and its environs totalled 298,700 sqm.

‘Although in recent years more active development of warehousing premises has been recorded in Vilnius and Kaunas regions, more investment is also planned in Klaipėda region. Like in Kaunas, the projects developed in Klaipėda region are predominantly for own company needs rather than for the market’, Saulius Vagonis, Head of Valuation & Analysis Department at Ober-Haus, said.

‘Although in recent years more active development of warehousing premises has been recorded in Vilnius and Kaunas regions, more investment is also planned in Klaipėda region. Like in Kaunas, the projects developed in Klaipėda region are predominantly for own company needs rather than for the market’, Saulius Vagonis, Head of Valuation & Analysis Department at Ober-Haus, said.

The SBA Holding plans to start development of its logistics centre and a plant for furniture components near Klaipėda in early 2018. In phase one of the project, a 28,000 sqm central warehouse and a 12,000 sqm plant of the SBA Group is planned to be build. Over the next 10 years, the area of both the logistics centre and manufacturing premises will be gradually increased. The logistics centre will serve both the needs of the SBA Group of companies and other furniture manufacturers. Vakarų Medienos Grupė is planning the construction of a large industrial park in Klaipėda district to accommodate factories and a logistics centre. The company will store and distribute its products through its logistics centre.

‘Looking at further development of the warehousing premises sector in Vilnius and Kaunas regions, the number of planned projects and projects in progress is rather large. The companies which plan various projects in these regions aim to expand the sector of new and modern warehousing facilities considerably’, Mr Vagonis said. According to data from Ober-Haus, by the end of 2017 and in 2018, another 12 projects with a combined floor area of roughly 100,000 sqm are planned in Vilnius and Kaunas regions, of which two thirds of the floor area will be developed in Vilnius region. A total of 30% of the floor area will be projects for own needs of the companies and build-to-suit projects.

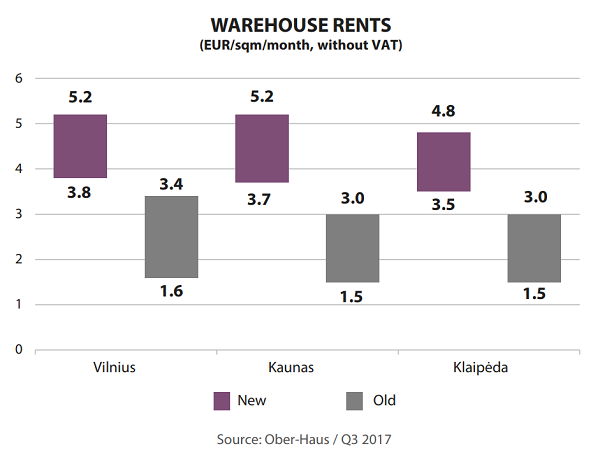

‘High financial performance indicators of the logistics and warehousing premises sector encourage the development of new sites and investment in the renovation of older buildings. Increasing construction costs also contribute to the moderate increase in the rental and sales prices of warehousing premises. During the past 9 months of 2017, the rents of new and old warehousing premises in Vilnius region increased by 3–4% and in Kaunas and Klaipėda regions – by 1–2%’, Mr Vagonis said.

According to data from Ober-Haus, newly built warehousing premises in Vilnius are offered for rent at 3.8–5.2 EUR/sqm and old warehousing premises at 1.6–3.4 EUR/sqm. In Kaunas new warehouses are offered at 3.7–5.2 EUR/sqm, old ones – 1.5–3.0 EUR/sqm, in Klaipėda new warehouses go for 3.5–4.8 EUR/sqm, old ones – 1.5–3.0 EUR/sqm.

Ober-Haus has offered the first cottages in Bendorėliai project to the customers back in 2011, and it has just sold the last cottage, which represents completion of stage 2 of the project. To date this neighbourhood with area of 8.14 ha remains the largest multifunctional cottage settlement in Vilnius with total area of cottages and apartments amounting to approx. 25,000 m². The settlement is now a home to approximately 230 families, and total investment in the project exceeds EUR 15 million.

Ober-Haus has offered the first cottages in Bendorėliai project to the customers back in 2011, and it has just sold the last cottage, which represents completion of stage 2 of the project. To date this neighbourhood with area of 8.14 ha remains the largest multifunctional cottage settlement in Vilnius with total area of cottages and apartments amounting to approx. 25,000 m². The settlement is now a home to approximately 230 families, and total investment in the project exceeds EUR 15 million.

The third and final development stage in Bendorėliai was launched in November 2017; it will mark a full completion of the concept of the settlement planned 7 years ago. 68 spacious and cost efficient terraced apartments will be made available to potential customers. This last stage will also include erection of a kindergarten and small supermarket, offering space for a number of service providers. Expected completion of the project is December 2018. Kerema UAB, developer of the project, is expected to invest approximately EUR 5 million.

According to Remigijus Pleteras, managing director of Ober-Haus “The project will offer some of the most competitive apartment prices in Vilnius, per square meter. The population density can hardly be compared to one found in the city, since the project and surrounding environment include low-rise residential construction in natural environment, but also offering public transport, shops, a kindergarten and a primary school. This is definitely a good opportunity for families and those not fascinated by noisy urban environment”.

The first project dedicated to cottages and apartments of such scale in Vilnius has been developed in two stages, in the period of 2011 to 2013 and 2014 to 2017. 72 cottages were completed during the first stage. Another 61 cottages and 98 apartments appeared during stage 2 of the project. To quote R. Pleteras “2-story high apartment buildings found in the vicinity of the cottages present a complete innovation on the market (since they are on the urban periphery), and the apartments that come with a reasonable layout and quality were very successful and popular with the customers”.

Pleteras adds “This is a truly unique project in both its scope and multifunctional approach. There is an acoustic partition separating the settlement from Ukmergės street, a private yard, and an entire multifunctional residential neighbourhood, offered with sports facilities, a site for children to play, and a park, already formed and planted.”

Development of constructions was accompanied by urban infrastructure coming closer to Bendorėliai settlement, including pave roads, urban gas supply, water supply and sewage disposal, a kindergarten was built and besides the developer has taken steps to coordinate public transportation and the settlement is now served by a city bus.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in October 2017. The annual apartment price growth in the major cities of Lithuania was 4.1% (the annual apartment price growth in September 2017 was 4.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in October 2017. The annual apartment price growth in the major cities of Lithuania was 4.1% (the annual apartment price growth in September 2017 was 4.2%).

In October 2017 the price increase was recorded in Panevėžys, Kaunas and Vilnius, where prices increased by 1.0%, 0.6% and 0.2% respectively with the average price per square meter reaching EUR 571 (+5 Eur/sqm), EUR 1,025 (+6 Eur/sqm) and EUR 1,465 (+2 EUR/sqm). Apartments prices in Klaipėda and Šiauliai remained stable and were the same as in last month – EUR 1,037 and EUR 609.

In the past 12 months, the prices of apartments grew in all major cities: 4.4% in Vilnius, 4.6% in Kaunas, 3.0% in Klaipėda, 3.1% in Šiauliai and 3.5% in Panevėžys.

‘A greater annual increase in apartment prices in Kaunas than in Vilnius has been recorded for the first time since 2008. In the post-crisis years, Vilnius was the evident apartment price growth leader among all main Lithuanian cities. This year however the annual price growth in Vilnius has been gradually slowing down because the current price level no longer allows expecting any further rapid growth. In Kaunas, on the other hand, apartment prices started to grow more rapidly in 2015 and 2016 only, and currently the greatest annual apartment price growth among all main Lithuanian cities is recorded in Kaunas. Apartment prices in Kaunas may continue to increase due to the increasing business activity in Kaunas region’, Saulius Vagonis, Head of Valuation & Analysis Department at Ober-Haus, said.

Lithuanian Apartment Price Index, October 2017

In recent years, various Lithuanian regions or cities have been recording significantly different qualitative and quantitative changes in housing supply and demand. “While some cities see a rapid growth in supply and demand for new housing, other cities show marginal changes or none at all. Analysis of the housing markets of the country’s three major cities also illustrates that they are in totally different stages of development. One reliable housing market indicator can be the development of more expensive housing and, definitely, demand for it,” Raimondas Reginis, senior market analyst of Ober-Haus, said.

In recent years, various Lithuanian regions or cities have been recording significantly different qualitative and quantitative changes in housing supply and demand. “While some cities see a rapid growth in supply and demand for new housing, other cities show marginal changes or none at all. Analysis of the housing markets of the country’s three major cities also illustrates that they are in totally different stages of development. One reliable housing market indicator can be the development of more expensive housing and, definitely, demand for it,” Raimondas Reginis, senior market analyst of Ober-Haus, said.

A survey on expensive housing in Vilnius carried out by Ober-Haus has shown that in recent years the capital of the country has recorded a stable increase in the demand for the most expensive apartments; i.e. every half-year recorded an increasingly higher number of such property transactions as well as increasing amounts of money spent on the acquisition of such assets.

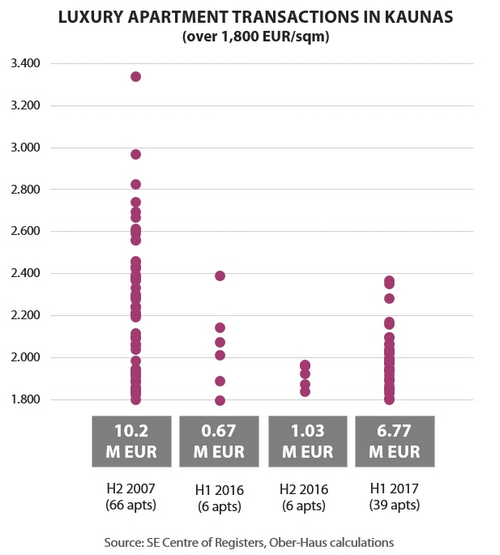

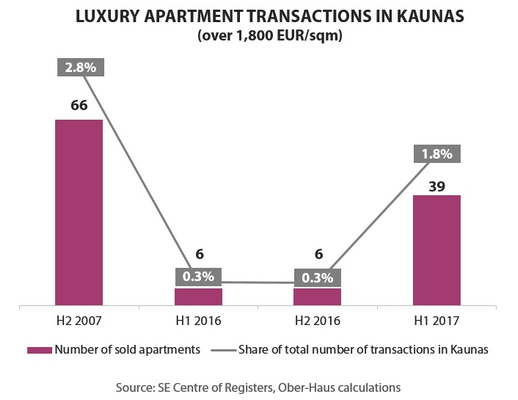

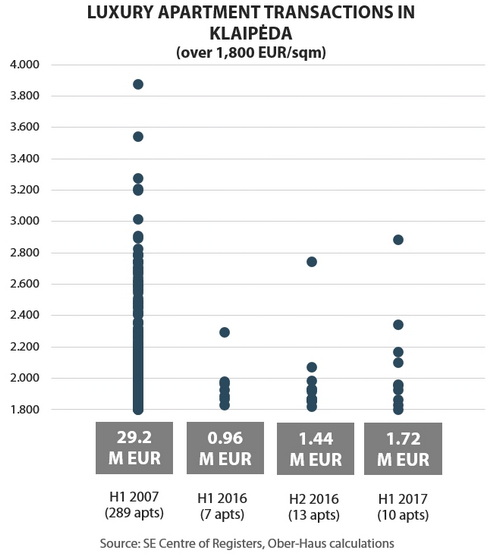

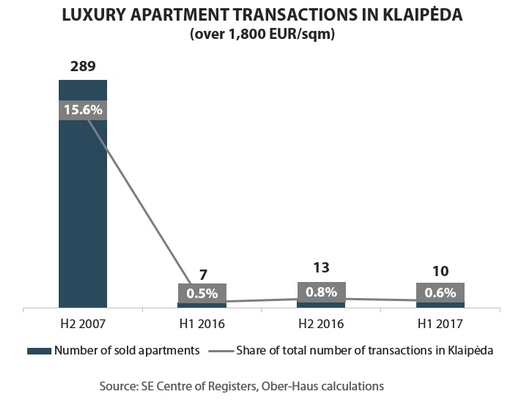

What about the situation in the other biggest cities of Lithuania – Kaunas and Klaipėda – if we compare today, namely, the 2016–2017 period and the situation 10 years ago? To this end, Ober-Haus selected and analysed all transactions on apartments registered in the years 2016 and 2017 (data source: SE Centre of Registers) and compared them to the second half-year of 2007 (when the highest housing prices were recorded in the Lithuanian housing market). All registered apartment transactions where the price of one square metre exceeded EUR 1,800 were selected during the period under consideration in Kaunas and Klaipėda (excluding the price of a car parking places, storage facilities and other apartment appurtenances from the total transaction price).

“The results show that Kaunas recorded a particularly steep rise in the sales of more expensive apartments in 2017. While only 12 such apartments where the price per square metre exceeded EUR 1,800 were purchased in Kaunas in 2016, in the first half of 2017, 39 such apartments were purchased,” Mr Reginis said. Accordingly, the acquisition price of such housing also rose; almost EUR 673,000 were paid for the assets acquired over the first half of 2016 (for 6 apartments and their appurtenances), meanwhile, in the second half of 2016, EUR 1.03 million were paid for the same number of purchases (6 apartments and their appurtenances). Moreover, over the first half of 2017, EUR 6.77 million were paid for such housing (39 apartments and their appurtenances).

The first half of 2017 in Kaunas distinguished itself for not only the rapid growth in the number of purchased objects, but also for the prices. While the highest price per one square metre recorded in the second half of 2016 in Kaunas was around EUR 2,000, the highest prices in the first half of 2017 exceeded 2,300 EUR/sqm.

In terms of the price per one square metre, the most expensive apartments in Kaunas in the first half of 2017 were sold in newly developed projects. An apartment with an area of 68 sqm in the reconstructed and newly built project Gedimino 46 (on Gedimino Street) in the central part of the city, including car spaces, was sold for almost EUR 180,000 (around 2,350 EUR/sqm). Another expensive apartment was also sold in a newly developed project – Piliamiestis (on Brastos Street) – over EUR 343,000 were paid for an apartment of almost 140 sqm with car spaces (around 2,350 EUR/sqm).

These newly implemented residential housing projects in prestigious areas of Kaunas increased the volumes of sales of more expensive apartments in 2017. Out of 39 apartments which were sold over the first half of 2017 and whose price exceeded 1,800 EUR/sqm, 33 apartments belonged to projects completed in the 2016–2017 period (Piliamiestis, Kauno Senamiesčio Apartamentai, Gedimino 46).

Meanwhile, comparing the sales indicators of more expensive housing in Kaunas city in 2016-2017 and 10 years ago – the very peak of real estate purchases and the apex of apartment prices – shows that the 2007 indicators were considerably higher. Over the second half of 2007, 66 apartments were acquired in Kaunas at a cost of EUR 10.2 million or 50% more than was paid for the same assets over the first half-year of this year. In terms of the price per square metre, the most expensive apartments were then sold in a new residential and commercial purpose project –Bokštas (on Kęstučio Street). For instance, an apartment with an area of 67 sqm in this project was sold for EUR 223,000 (over 3,300 EUR/sqm).

Whereas Kaunas is now seeing trends in luxury housing indicators similar to those in Vilnius (the growth in transactions which was determined by the increase in supply of new more expensive projects), the situation in Klaipėda is totally different. Over the first half of 2016, 7 higher-end apartments (where the price per square metre exceeded EUR 1,800) were sold in Klaipėda (EUR 0.96 million were paid for these apartments including their appurtenances), over the second half of 2016, 13 such apartments were sold (for EUR 1.44 million), and in the first half of 2017, 10 luxury apartments (for EUR 1.72 million) were sold in Klaipėda.

In terms of the price per one square meter, the most expensive apartment during the analysed 2016–2017 period in Klaipėda was sold this year. An apartment with an area of slightly over 200 sqm, in one of the top floors of the multi-functional project K ir D and built in 2006 (on Naujojo Sodo Street), was sold for EUR 585,000 (almost 2,900 EUR/sqm). As there has not been that much construction of new housing in Klaipėda recently, compared to Vilnius and Kaunas, the choice of higher–end projects is consequently also limited (and the number of such transactions is low).

Comparing the situation today with the situation 10 years ago in the main cities of Lithuania shows that the biggest difference is seen in Klaipėda. Over the second half-year of 2007, 289 apartments, whose price exceeded 1,800 EUR/sqm, were purchased in Klaipėda with a total purchase price of EUR 29.2 million. This is 17 times more than over the first half of 2017.

Analysis of the transactions shows that 10 years ago apartments purchased (at prices greater than 1,800 EUR /sqm) were located not only in the most valuable locations of the city or in new construction projects, but purchasers also paid such prices for standard old-construction apartments in residential areas of the city. For instance, out of 289 apartments whose price per square metre in the second half of 2007 exceeded EUR 1,800, a quarter of them were purchased in typical five or nine-storey multi apartment buildings which were constructed between 1968 and 1994 in the southern part of the city.

“These transactions fairly accurately illustrate the situation which had developed in Klaipėda ten years ago – prices for standard housing were almost the same as prices in the capital city, and the housing affordability (price-to-income) was the lowest among all major cities of the country. Evidently, the recent downturn was most damaging to the real estate market in the city in which, unlike Vilnius and Kaunas, no sustainable signs of market recovery have been seen, not to mention in the luxury housing sector,” Mr Reginis said.

The housing market in Vilnius is currently experiencing its second renaissance with increasing indices of supply and demand and, certainly, sales prices being recorded. However, one of the most interesting housing segments which often stirs the imagination of market participants and others, is the smallest and luxury property segment – the most expensive apartments in the largest city of the country.

The housing market in Vilnius is currently experiencing its second renaissance with increasing indices of supply and demand and, certainly, sales prices being recorded. However, one of the most interesting housing segments which often stirs the imagination of market participants and others, is the smallest and luxury property segment – the most expensive apartments in the largest city of the country.

“Due to its particularly small share of the market, the most expensive housing segment is often surrounded by various speculations when previously unheard of prices being asked or prices for already completed transactions are discussed both in public and in closed groups,” Raimondas Reginis, senior market analyst of Ober-Haus, said.

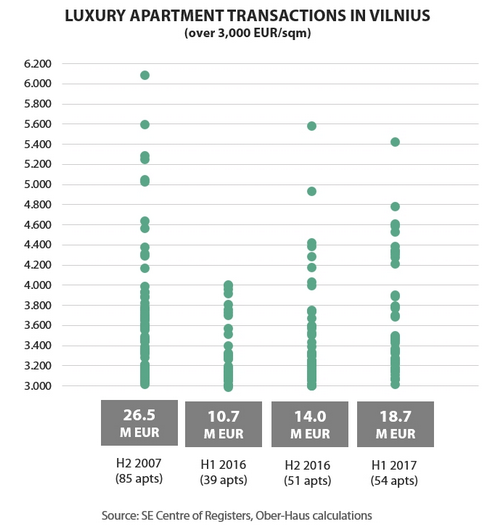

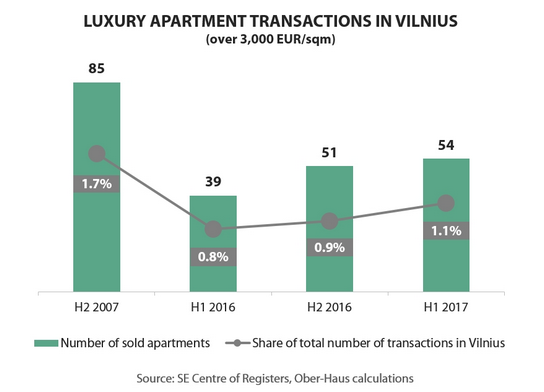

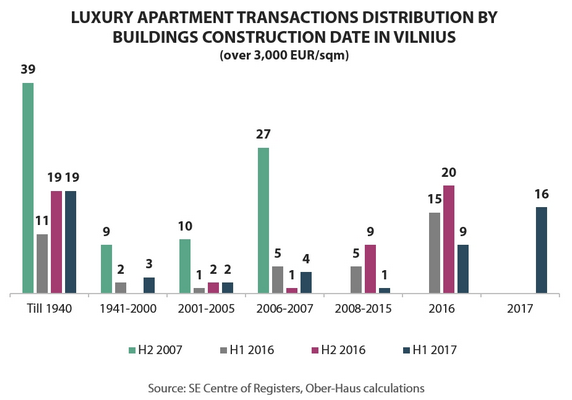

So, what is the current situation with the most expensive housing segment of the largest city and what was the situation 10 years ago – at the very top of the former real estate boom? Information on the registered apartment sales-purchase transactions reveals the situation in the luxury apartment segment precisely enough. Ober-Haus has selected and analysed all apartment transactions registered in 2016–2017 (data source: State Enterprise Centre of Registers) and compared them with the second half-year of 2007 (when the recorded residential prices were the highest). All registered apartment transactions where the price of one square metre exceeded EUR 3,000 were selected during the period under consideration in Vilnius (eliminating the price of a car parking places, storage facilities and other apartment appurtenances from the total transaction price).

“The results obtained show that currently there is stable growth in the number of such property transactions with increased values,” Mr Reginis said. During the first half of 2016, 39 luxury apartments (where the price per square metre exceeded EUR 3,000) were purchased in Vilnius, during the second half of 2016 51 such apartments were purchased and 54 during the first half of 2017. According to Ober-Haus, the purchase price of such property has grown accordingly: a total of almost EUR 10.7 million was paid for the property purchased in the first half of 2016 (39 flats and their appurtenances), in the second half of 2016 – EUR 14.0 million, and EUR 18.7 million paid for luxury apartments purchased in the first half of 2017.

“In Vilnius, the second half of 2016 and the first half of 2017 are not only notable by the number of purchased objects but with their price too. In the second half of 2016 the highest recorded price per square metre was EUR 4,000; however, in the second half of 2016 and in the first half of 2017 the highest prices already exceeded 5,000 EUR/sqm,” Mr Reginis said. If we look at the price per square metre, the most expensive apartment in Vilnius in the second half-year of 2016 was sold in the historical building in Etmonų St. (the Old Town) – EUR 550,000 was paid for an apartment with an area of almost 100 sqm (almost 5,600 EUR/sqm). In the first half of 2017 the most expensive apartment was sold in the Old Town, Labdarių St. This apartment with the total area of more than 230 sqm with a garage was sold for EUR 1,300,000 (over 5,400 EUR/sqm).

“In Vilnius, the second half of 2016 and the first half of 2017 are not only notable by the number of purchased objects but with their price too. In the second half of 2016 the highest recorded price per square metre was EUR 4,000; however, in the second half of 2016 and in the first half of 2017 the highest prices already exceeded 5,000 EUR/sqm,” Mr Reginis said. If we look at the price per square metre, the most expensive apartment in Vilnius in the second half-year of 2016 was sold in the historical building in Etmonų St. (the Old Town) – EUR 550,000 was paid for an apartment with an area of almost 100 sqm (almost 5,600 EUR/sqm). In the first half of 2017 the most expensive apartment was sold in the Old Town, Labdarių St. This apartment with the total area of more than 230 sqm with a garage was sold for EUR 1,300,000 (over 5,400 EUR/sqm).

What was the situation in the Vilnius luxury apartment segment 10 years ago, i.e. in the second half of 2007, when prices for apartments in Vilnius were at an all-time high? According to Ober-Haus, during this period, a total of 85 apartments were purchased, for which buyers paid EUR 26.5 million or 40% more than the price for a similar property was paid in the first half of this year. When assessing according to the price per square metre, the most expensive apartment sold in the second half of 2007 in Vilnius was in the renovated historical building in A. Strazdelio St. (the Old Town) – more than EUR 400,000 (almost 6,100 EUR/sqm) was paid for the 66 sqm apartment.

When estimating the number of luxury apartment transactions in the statistics of total apartment sales in Vilnius it can be seen that their number increased steadily in 2016–2017, however, it has not yet reached the level of the second half of 2007. According to Ober-Haus, in the first half of 2016 in Vilnius the share of the transactions of the most expensive apartments (per square meter) in the total number of apartment transactions was 0.8%, in the second half of 2016 – 0.9% and in the first half of 2017 – 1.1%. In the second half of 2007 this share was 1.7%.

“Analysing the transactions, it can be seen that buyers most of all welcome and pay most for apartments which are in historical buildings. Most often, such already equipped apartments are in the upper storeys of renovated or good condition buildings in the Old Town or the central part of the city,” Mr Reginis said. Meanwhile in the new construction projects finished in 2016–2017 the highest prices were up to 4,600 EUR/sqm in the first half of 2017. For instance, the highest prices this year for newly constructed apartments were recorded in the project of “Pilies apartamentai” (Olimpiečių St.), “Šaltinių namai” (Šaltinių St.), “Basanavičiaus 9A” (J. Basanavičiaus St.), “Mindaugo 14” (Mindaugo St.).

“Analysing the transactions, it can be seen that buyers most of all welcome and pay most for apartments which are in historical buildings. Most often, such already equipped apartments are in the upper storeys of renovated or good condition buildings in the Old Town or the central part of the city,” Mr Reginis said. Meanwhile in the new construction projects finished in 2016–2017 the highest prices were up to 4,600 EUR/sqm in the first half of 2017. For instance, the highest prices this year for newly constructed apartments were recorded in the project of “Pilies apartamentai” (Olimpiečių St.), “Šaltinių namai” (Šaltinių St.), “Basanavičiaus 9A” (J. Basanavičiaus St.), “Mindaugo 14” (Mindaugo St.).

Growing sales volumes of luxury apartments are connected not only with the general growth of the real estate market, but also with the developing supply of this property segment. According to Ober-Haus, of the 90 most expensive apartments sold in Vilnius in 2016 42% of them were sold in the newest residential projects (2015–2016 construction). Of the 54 apartments sold in the first half of 2017 the share of the sold apartments in the newest projects (2016–2017 construction) was 47%. The second half of 2017 and the future results of 2018 also should not disappoint the developers of luxury accommodation.

“It is likely that in the near future we will see even more record transactions in the highest-class projects. The previous transactions show that in the market there are certainly those who are able and wish to acquire exceptional residential property,” Mr Reginis said.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in September 2017. The annual apartment price growth in the major cities of Lithuania was 4.2% (the annual apartment price growth in August 2017 was 4.0%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in September 2017. The annual apartment price growth in the major cities of Lithuania was 4.2% (the annual apartment price growth in August 2017 was 4.0%).

In September 2017 the largest price increase was recorded in Vilnius and Kaunas, where prices increased by 0.6% with the average price per square meter reaching EUR 1,463 (+8 Eur/sqm) and EUR 1,019 (+6 EUR/sqm). Apartments prices in Šiauliai, Klaipėda and Panevėžys in September grew by 0.5%, 0.4% and 0.2% respectively with the average price per square meter reaching EUR 609 (+3 EUR/sqm), EUR 1,037 (+5 EUR/sqm) and EUR 566 (+2 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 4.6% in Vilnius, 4.5% in Kaunas, 3.2% in Klaipėda, 3.3% in Šiauliai and 2.5% in Panevėžys.

‘Despite the growing prices of apartments in all cities of the country, the gap between the capital and other regions of the country is rapidly increasing. For instance, five years ago, in 2012, the difference in the average prices of apartments between the capital and the other four large cities of the country was 230–660 Eur/m² depending on the specific city. This year this difference is already 440–880 Eur/m² with apartment prices 30–60 per cent lower in regional cities compared to the capital’, Saulius Vagonis, Head of Valuation & Analysis Department at Ober-Haus, said.

Lithuanian Apartment Price Index, September 2017

Swiss bank UBS has reported about the rising risk of housing bubble in some major cities across the world. According to the bank’s index (Global Real Estate Bubble Index), the bubble risk has grown in Toronto, Stockholm, Munich, Vancouver, Sydney, London and Hong Kong. In contrast, housing is fairly valued in Milan, New York, Singapore and Boston.

The attractiveness of economically strongest cities across the world remains high and increases the bubble risk in the real estate market. “Great interest in housing both from foreign investors and local market participants, positive expectations about future housing prices, and historically low mortgage costs rapidly increase housing prices, which in some cases have already reached or are in excess of the price levels that were a decade ago. The demand for buy-to-let property and slow supply of new housing significantly increase the gap between the big cities and the remaining regions of the countries and at the same time reduce the possibilities of the residents of major cities to buy residential property,” Raimondas Reginis, senior market analyst of Ober-Haus, said.

Meanwhile in Lithuania, similar trends have been observed since 2010: a growing gap between the housing prices in Vilnius and other regions of the country, demand for buy-to-let property, record low mortgage interest rates, and largely moderate or positive expectations about future housing prices. “These factors determine housing price growth in the country, particularly in the capital city. However, our most active regions are protected against greater price changes by sufficient supply of new housing and the real implementation of macroprudential policy. Although over the past seven years housing prices in Vilnius increased by 25% on average, even faster wage growth keeps the housing affordability levels record high,” Mr Reginis said. According to Ober-Haus, today an inhabitant of Vilnius can purchase 5.9 sqm in a medium class apartment for his average net annual salary. This indicator is nearly twice as high as that in 2006–2007, since both nominal and real prices are far behind the price level recorded 10 years ago.

“However, with faster growth of housing prices the Bank of Lithuania may introduce stricter lending criteria for mortgages in an attempt to cool the housing market. The rise of “frozen” interest rates could also be effective in naturally controlling both the Lithuanian real estate market and the markets of the regions at risk of a bubble,” Mr Reginis said.

Search

Search