Euromoney, an international publisher on capital and financial markets, has ranked Ober-Haus the best real estate advisor and consultant in Lithuania in 2018. In the annual Euromoney rankings Ober-Haus has earned three awards: the best real estate agency (Overall), the best property valuer (Valuation) and best real estate research and analytics agency (Research) in Lithuania.

Euromoney, an international publisher on capital and financial markets, has ranked Ober-Haus the best real estate advisor and consultant in Lithuania in 2018. In the annual Euromoney rankings Ober-Haus has earned three awards: the best real estate agency (Overall), the best property valuer (Valuation) and best real estate research and analytics agency (Research) in Lithuania.

The 14th annual real estate survey conducted by Euromoney was based on the ratings submitted by the real estate market participants: real estate experts, developers, construction companies and representatives of financial institutions. Ober-Haus has been ranked the best in various categories in 2015, 2016 and 2017.

‘Such high annual rankings show that our organisation is not only capable of achieving the highest goals, but also duly upholds the solid quality standard well received by the participants of both Lithuanian and international markets. We have been in the real estate market for 20 years now. This award has become a form of boost and a motivational tool for maintaining the quality of services and seeking further growth. Of course, I extend my sincere appreciation for this achievement to the entire team,’ Remigijus Pleteras, general manager at Ober-Haus, said.

Ober-Haus has operated in Lithuania for 20 years and is the largest real estate services provider in Lithuania and the Baltic region. The company is part of the Realia Group, one of the largest Finnish real estate groups. The company’s services package consists of brokerage services in buying, selling or letting commercial and residential property, property and business valuation, consultancy and market research.

In the first half of 2018, the trends of the previous year continued to prevail in the retail premises sector – retailers in Lithuania continued to expand and to invest in the renovation of the premises and buildings. Construction of new larger traditional shopping centres in the nearest future is planned only in the country’s capital.

In the first half of 2018, the trends of the previous year continued to prevail in the retail premises sector – retailers in Lithuania continued to expand and to invest in the renovation of the premises and buildings. Construction of new larger traditional shopping centres in the nearest future is planned only in the country’s capital.

Depo, the Latvian retail chain of construction materials and household goods, continues active expansion and in April 2018 opened its third shopping centre in Lithuania, this time in Vilnius. The shopping centre of about 30,000 sqm is located in the western part of Vilnius, between Lazdynai residential district and Gariūnai market. The first two shopping centres of this DIY operator were opened in 2016 (in Klaipėda) and in 2017 (in Panevėžys). Construction of two more Depo shopping centres is in progress with the possible opening at the end of this year or early next year. One shopping centre is being built in Ukmergės Street in the northern part of Vilnius and the other – next to the western bypass in Kaunas. The construction of the Depo shopping centre is also planned in Šiauliai.

In March 2018, the new Žali shopping centre was opened in Balsiai residential area in Vilnius. Baltisches Haus, a real estate development and management company, invested about EUR 6.5 million in this A+ energy class building, infrastructure and landscaping. Over 3,800 sqm of the building is occupied by the retail chain Iki and the rest is leased by 15 smaller tenants. The development of this shopping centre was strongly supported by the local community, which has long been waiting for a new and high quality shopping, services and entertainment space.

The construction of a 5,000 sqm retail building is in progress on the site developed by VNO Business & Retail Park located in the southern part of Vilnius, next to IKEA and Nordika shopping centres. It is planned that the French sports and leisure goods retailer, Decathlon, will open here by the end of this year and it will be the first shop of this retailer in the Baltic countries.

A shopping and entertainment centre of a larger size is planned close to Pilaitė residential district, next to the western bypass in Vilnius. It has been announced that a company of the Ogmios Group is planning to build a four-storey 60,000 sqm building, of which over 30,000 sqm will accommodate the largest outlet centre in Lithuania, a grocer, a sports club, a cinema, cafes and other tenants. The shopping centre could be opened at the end of next year. If this project is implemented as planned, it will be a larger traditional shopping centre in Vilnius opened after more than a three-year gap since the opening of the last large shopping centre in mid-2016 (second stage of the Nordika shopping centre).

A larger shopping centre is also scheduled for construction in Klaipėda. A company managed by the real estate development company VPH plans to build a 20,000 sqm retail trade building next to the intersection of Šiaurės Avenue and Liepų Street. However, a more detailed concept and development schedule of the project has not yet been publicly announced.

Managers of shopping centres actively invest in upgrade of existing projects

It has been about 20 years since the first larger shopping centres opened in Lithuania, therefore opening of new retail spaces encourages owners of old buildings to undertake major renovation and to invest a great deal of money. This year, Senukai has upgraded its first DIY shopping centre in Vilnius. After an upgrade of EUR 5.5 million, the shopping centre which has operated since 2002, was reopened in April this year. In August 2017, a shopping centre of the Maxima retail chain on Mindaugo Street reopened after renovation. The shopping centre of almost 10,000 sqm opened in 1999 and was among the first larger shopping centres in the country’s capital city. A total of EUR 6.7 million was invested in the reconstruction of the building and the new equipment. The shopping centre accommodates the grocery store Maxima, which works 24/7, and over 20 other tenants.

Managers of the largest shopping and entertainment centres also actively invest in the renovation of their retail premises or even plan further expansion of shopping centres. In mid-2017, the Panorama shopping and entertainment centre in Vilnius opened a 1,500 sqm People Fitness Club instead of part of its office premises and in June this year it opened a gourmet food zone instead of the former premises occupied by the Apranga Group shop. The gourmet food zone accommodates 20 new retailers. In the parcels of land located next to Panorama site, an extension is planned which may accommodate a cinema. Considerable investments are planned in the Akropolis shopping and entertainment centre, one of the largest such centres in Kaunas. Renovation of an area of 10,000 sqm has been announced and the investment will amount to EUR 10 million. This year, it has been announced about the planned EUR 14 million renovation of Akropolis shopping and entertainment centre in Vilnius, which is scheduled for next year.

If popular shopping centres get expensive facelifts, there are also cases in the market where the entire concept and use of the project changes. One such example is the Saturnas shopping centre in Klaipėda, which was opened after reconstruction in 2005. After the failure to revive the centre following the economic recession (in 2010, bankruptcy of the manager of the centre was initiated), apartments were fitted out in the second and third levels of the building (Saturno Namai) which are currently being sold. If in the past this 5,600 sqm project was considered as a larger shopping centre where the residents of Klaipėda could purchase various goods and services, today it is a residential building with commercial premises on the ground floor.

Total area of the largest shopping centres in Lithuania – over 1.1 million sqm

The total retail space in larger traditional shopping centres (counting those over 5,000 sqm GLA with over 10 tenants) in Lithuania in mid-2018 amounted to slightly over 1.1 million sqm, 392 sqm/1,000 population of the country. In view of the fact that the retail space in such shopping centres in the past 4-5 years has slightly increased, but the population of the country has decreased, statistically the retail space per capita indicator has increased. For example, at the end of 2013 the indicator was 342 sqm per 1,000 capita, i.e. today there is 14.5% more space per capita.

A total of 93% of large shopping centres are based in five major cities of the country. In mid-2018, the usable retail space in Vilnius amounted to 453,000 sqm (827 sqm/1,000 population), in Kaunas – 248,000 sqm (860 sqm/1,000 population), in Klaipėda – 158,300 sqm (1.063 sqm/1,000 population), in Šiauliai – 109,700 sqm (1.091 sqm/1,000 population), and in Panevėžys – 55,600 sqm (627 sqm/1,000 population).

Retail rents remained stable in H1 2018

In spite of the growing retail trade volumes in the country (according to Statistics Lithuania, in the first half of 2018 the retail trade turnover in Lithuania [except for trade of motor vehicles and motorcycles], compared with the first half of 2017, increased by 9.0%) and very low vacancy rates both in the main shopping centres and in the most popular shopping streets of the major cities, rents have remained stable. For example, in the main shopping streets of Vilnius (Gedimino Avenue, Pilies Street, Didžioji Street and Vokiečių Street) where it is hard to find any vacant premises, the price level in the past six months has not changed and the price interval has remained sufficiently broad. The rents for medium size (about 100–300 sqm) retail premises stand at 17.0–45.0 EUR/sqm. Rents in other major cities of the country have also remained at the same level as at the end of 2017: in Kaunas – 11.0–19.0 EUR/sqm, in Klaipėda – 9.0–15.0 EUR/sqm, and in Šiauliai and Panevėžys – 6.0–11.0 EUR/sqm.

Lithuania Commercial Market Commentary H1 2018 (PDF)

With the operations of warehousing and transport companies in Lithuania soaring, positive developments can be observed in the sector of warehousing premises in the main regions of the country. According to Statistics Lithuania, sales revenues (excl. VAT) of warehousing and storage companies in Lithuania in 2017 totalled over EUR 167 million or 18.3% more than in 2016. In Q1 2018, compared with Q1 2017, earnings increased by 15.3%.

With the operations of warehousing and transport companies in Lithuania soaring, positive developments can be observed in the sector of warehousing premises in the main regions of the country. According to Statistics Lithuania, sales revenues (excl. VAT) of warehousing and storage companies in Lithuania in 2017 totalled over EUR 167 million or 18.3% more than in 2016. In Q1 2018, compared with Q1 2017, earnings increased by 15.3%.

Over the past few years, the most active development of new warehouses has been recorded in Vilnius and Kaunas regions. Construction of 10 projects for various purposes should be completed in these regions this year and will offer over 99,000 sqm warehousing space or 37% more than in 2017. Also, more balanced development of warehousing projects is observed on the market, when not only objects intended for specific enterprises are being built, but also more intensive investments are being made in the development of companies providing complex logistics services and projects for leasing.

Two new warehousing and logistics projects were completed in Vilnius and its environs in the first half of the year with the total area of the premises of about 18,400 sqm. MG Valda has completed phase one in the construction of Vilnius Business Park on Ukmergės Street and the Apranga Group has now moved into the logistics centre and administrative building of a total area of nearly 15,300 sqm (warehousing area ̶ about 12,000 sqm). The second project – M7 warehousing and office building of Avisma, supplier of plastics for construction and materials for the production of advertising, total area of 8,700 sqm (warehousing area ̶ about 6,400 sqm), was completed in Kuprioniškės area of Vilnius District. Avisma occupies a quarter of the building and similar businesses will occupy the remaining part of the building. Following the implementation of these projects, at the end of first half of 2018, the total area of warehousing premises in the city of Vilnius city and its environs increased to 545,900 sqm.

Eight new warehousing or production facility projects are scheduled for 2018–2019 in Vilnius region and will offer about 65,000 sqm warehousing space. Some of these projects are currently under construction and the remaining are still in the design stage or are looking for tenants. Despite a very low vacancy rate of modern warehousing facilities, which in mid-2018 stood at 2.6% in Vilnius region, developers are still slow to start the construction of new projects without the preliminary contracts with the tenants for at least some part of the premises. However, financially stronger developers with experience in the warehousing and transport area (e.g., Sirin Development, Transimeksa) are trying to capitalise on poor supply in the market by taking more active steps and implementing larger scale projects intended for lease.

Two warehousing facility projects completed in Kaunas this year, at least another two pending

Two warehousing projects were implemented in Kaunas and its environs in the first half of 2018 adding 15,200 sqm of modern warehousing premises to the market. The real estate development management company, EPRO Group, implemented the first stage of A1 business complex on Islandijos Road. The complex of a total area of 14,600 sqm is divided into 14 modules rented out to various companies for storage, production and other commercial operations. At the beginning of 2018, a new, pharmaceutical warehouse of a total area of 4,100 sqm was opened in Kaunas Free Economic Zone (FEZ) for ABC Farma. Presently, the modern warehousing space in Kaunas and its environs totals 329,700 sqm.

By the end of the year, a few larger projects are scheduled for completion, which will supplement the warehousing space market in Kaunas region by at least 30,000 sqm. In the second half of 2017, Hegelmann Transporte started the construction of administrative and warehousing buildings in Kaunas district. The 20,000 sqm warehouse is scheduled for completion this year. The logistics centre of Šilas retail chain is another project to be completed in the second half of 2018. Most of the area of this logistics centre – a warehouse with administrative premises – totalling 11,000 sqm and built next to the western bypass of Kaunas will be allocated to the Šilas retail chain and the remaining part will be rented out.

Larger investment in the port city warehousing market already on the way

In the meantime, development of warehousing premises in Klaipėda region compared to that in Vilnius or Kaunas regions is on a smaller scale. The AD REM Group plans to finish the construction of the new 6,000 sqm warehouse with administrative premises in Klaipėda FEZ by the end of 2018 and to expand its warehousing space to 14,000 sqm. Following the completion of this building, at the end of 2018 the total area of warehousing premises in Klaipėda region will total 200,000 sqm.

Klaipėda region is still expecting investment in warehousing and industrial premises, which was announced at the end of 2017. In the second half of this year, SBA Concern plans to start the construction of a logistics centre and a furniture component factory. In the first stage a central warehouse of 28,000 sqm and a factory of 12,000 sqm of the SBA furniture group are planned to be built. Over the next 10 years, both the logistics centre and the factory will be expanded. Vakarų Medienos Grupė plans to develop a large industrial park in Klaipėda district to accommodate industrial facilities and a logistics centre. While more active steps of larger investors both in the warehousing and industrial objects are yet to be seen, local companies continue to expand. The packaging manufacturer, RETAL, located in Klaipėda FEZ has announced about its investment in the construction of a new 4,000 sqm warehousing building with administrative premises.

Forecast for further moderate warehousing facility rent increase

The trend of a moderate increase in the rents of warehousing premises in the past few years continued in 2018. The demand for modern premises, increasing financial capabilities of the companies which use warehousing premises, and increasing construction costs contribute both to the development of this sector and to a small increase in rents. In the first half of 2018, rents for new and old warehousing premises in Vilnius and Kaunas regions increased by 2–3%, whereas due to the short supply of such premises in Klaipėda region rents increased by 5%. Currently rents for new warehousing premises in Vilnius stand at 3.9–5.3 EUR/sqm and rents for old warehousing premises stand at 1.8–3.5 per/sqm; in Kaunas rents are 3.8–5.2 EUR/sqm and 1.7–3.4 EUR/sqm respectively and in Klaipėda – 3.7–4.9 EUR/sqm and 1.6–3.2 EUR/sqm respectively. Increasing financial capabilities of the tenants and growing costs of construction create premises for further moderate increase in rents in the near future.

Lithuania Commercial Market Commentary H1 2018 (PDF)

The city of Kaunas saw the fastest development of office space in the first half of 2018. Real estate developers and companies actively implemented different projects in terms of their scope for both own needs and for the market, offering a large amount of new office space. Nine office buildings were completed in Kaunas totalling 36,000 sqm (River Hall, CUBE, Arka, Kalantos 49, Nemuno 3, Inovacijų 3, K26A, KONVERSUS and Karaliaus Mindaugo Business Centre). Following the implementation of these projects, the modern office space market in Kaunas over the first half of the year increased by almost 27% and the supply in the middle of the year totalled 171,400 sqm.

‘The breakthrough in the construction of the new administrative buildings has been observed in Kaunas since 2017 and it is obvious that the new projects offered to the market affect the overall occupancy indicators. Despite the interest of the tenants in the new office space resulting from the development of both local and international companies in Kaunas, which is reported regularly, the situation in the case of each specific project is entirely different. Some buildings are fully occupied upon their opening, yet in other projects most of the premises do not yet have tenants,’ Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said. In mid-2018, the overall occupancy rate of the office buildings built in the first half of the year in Kaunas was 67%.

According to Ober-Haus, a faster overall increase in the vacancy rate of modern office space in Kaunas has been recorded since Q2 2017, where over a period of a quarter it increased from 2.4 to 7.9%. In Q1 2018, it crossed the ten per cent threshold amounting to 10.8% and in mid-year reached a record high of 11.9% for this decade. The higher vacancy indicators were recorded in Kaunas only in 2009–2010.

Despite the high vacancy rate of office space, absorption levels of the premises in the city of Kaunas are the highest in the history of the modern office sector in the city. ‘In the first half of 2018, 31,000 sqm of modern office space was leased in the city of Kaunas. For example, a total of 33,600 sqm of modern office space was leased in the entire 2017 in Kaunas. Since no new larger administrative buildings are planned in the second half of 2018 in Kaunas, with the current interest levels in the new office space the vacancy rates are likely to decrease in the second half of the year,’ Mr Reginis said.

Greater changes in the modern office market in Kaunas are expected in 2019–2020, when the projects currently in progress or in planning will be completed. The plans are really ambitious. Given the construction progress of the current projects and the development opportunities for the scheduled projects, in 2019–2020 approximately 10–11 new projects or new development stages of already completed projects are expected to be implemented which will offer up to 70,000 sqm of the useful office area to the market in the city.

The rapidly increasing modern office space of Kaunas and the current high vacancy rate should be seen as a positive factor. Kaunas is actually using its potential and in terms of the business expansion or the arrival of new enterprises it can directly compete not only with the capital city of the country, but even with other cities of the neighboring countries. A wider choice of office premises is a prerequisite for attracting financially stronger enterprises which also guarantee higher wages for the citizens.

Despite a 3–4% increase in rents of modern offices in the first half of the year, the average rent remains a fifth lower than that in the country’s capital. According to Ober-Haus, in mid-2018, the rents in B class buildings stood at 6.5–11.0 EUR/sqm, and in A class buildings – 11.5–14.0 EUR/sqm.

High office occupancy rates promote further development in this sector in Vilnius

In the meantime, the construction of two projects was completed in the first half of this year in the country’s capital city: business centre LINK on Saltoniškių Street and the first phase of Vilnius Business Park on Ukmergės Street (built-to-suit project for Apranga Group). According to Ober-Haus, these projects supplemented 11,500 sqm of useful office area to the market of the city totalling 687,600 sqm of modern office space in Vilnius in the mid of 2018.

Tenants of office premises were very active and the vacancy rates in the operating office buildings were successfully reduced. A total of 37,300 sqm of modern office space was leased in the first half of 2018 in Vilnius (in the first half of 2017 the figure was 37,600 sqm) resulting in the decrease of the vacancy rate from 5.4% to 2.8%. The vacancy rate for A class offices was 0.9% and B class – 3.9%. ‘A lower vacancy rate in the country’s capital was recorded only in the period of 2006–2007. Given the development of office premises in recent years and their absorption indicators, it can be said that the development is more successful than it could have been anticipated,’ Mr Reginis said.

Completion of six new projects is expected in the second half of 2018 in the capital city offering almost 51,000 sqm useful office area. Developers have scheduled a sufficient number of projects for the choice of potential tenants in the coming 2 to 3 years. If taken only the projects currently in progress, in 2019–2020 the construction of at least nine new projects with over 80,000 sqm should be completed in Vilnius. At least 15 other projects (totalling approximately 150,000–160,000 sqm) are on the design phase and their construction progress will depend both on the capacities of developers and the overall situation in the market.

The well-balanced modern office space market is beneficial to both developers and tenants. The essentially stable situation in the levels of rents has been observed in the past three years and a wide choice has created good conditions for successful further development of this sector. The particularly high occupancy rates of office premises in Vilnius have determined an average rise of 2% in rents in the first half of this year. According to Ober-Haus, rents currently stand at 8.0–13.5 EUR/sqm for B class offices and 14.0–16.5 EUR/sqm for A class offices. In view of the current demand, the major portion of the premises in currently constructed buildings are likely to be successfully absorbed, which should further maintain essentially stable rents in the capital city.

A new project and decreasing office vacancy rate in Klaipėda

The office market in Klaipėda continues to fall short on major investment. ‘Little development in both local and international businesses in this city discourages further investment in the real estate sector. This is especially relevant in terms of the arrival and development of major international companies, which today essentially target only Vilnius and Kaunas. Since Klaipėda currently cannot compete for such companies with Vilnius and Kaunas, which have secured their solid positions, only symbolic investments in the development of office premises can be observed in Klaipėda since 2009,’ Mr Reginis said.

From time to time developers offer some small-scale projects to the market, bus they are essentially aimed at the businesses operating in Klaipėda region. The year 2018 is not an exception with only one project implemented in first half of the year. Stemma Management has completed renovation of an old administrative building (Business Centre 103) on the former site of Klaipėdos Kranai offering about 2,500 sqm of retail and office premises. According to Ober-Haus, in mid-2018, the modern office space area in Klaipėda totalled 68.600 sqm.

For a long time now Klaipėda has experienced a sluggish development in the offices sector and high vacancy rates. However, in the first half of 2018, the vacancy rate decreased from 17.1% to 13.4% and this is the lowest indicator since the end of 2008. One of the reasons for it was the decision of the managers of the largest Vitė Business Centre to offer vacant premises both for lease and for sale (this has reduced the amount of unoccupied premises in this business centre this year). ‘The lease of premises in this business centre built in 2009 has not been successful. For a long time a large amount of premises have been vacant in the building and this strongly contributed to high vacancy rates of modern office space in Klaipėda,’ Mr Reginis said.

No changes in rents have essentially been recorded in the first half of the year in Klaipėda. According to Ober-Haus, rents remain lower than those in Vilnius or Kaunas: in B class buildings they stand at 6.0–10.0 EUR/sqm, and in A class buildings – 10.0–13.0 EUR/sqm.

Lithuania Commercial Market Commentary H1 2018 (PDF)

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in July 2018. The annual apartment price growth in the major cities of Lithuania was 2.9% (the annual apartment price growth in June 2018 was 3.1%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in July 2018. The annual apartment price growth in the major cities of Lithuania was 2.9% (the annual apartment price growth in June 2018 was 3.1%).

In July 2018 apartment prices in the capital grew 0.2% with the average price per square meter reaching EUR 1,481 (+2 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 28.3% (+327 EUR/sqm). Apartment prices in Kaunas, Šiauliai and Panevėžys in July grew by 0.3%, 0.8% and 1.6% respectively with the average price per square meter reaching EUR 1,052 (+4 EUR/sqm), EUR 638 (+5 Eur/sqm) and EUR 613 (+10 EUR/sqm). In Klaipėda no price change was recorded and average apartment price remained the same as in June 2018 – EUR 1,057.

In the past 12 months, the prices of apartments grew in all major cities: 8.4% in Panevėžys, 5.3% in Šiauliai, 4.4 in Kaunas, 2.6% in Klaipėda and 1.9% in Vilnius.

“Positive indicators continue to be recorded in the segment of city apartments this year. Despite the different rate of change of the apartment prices in particular cities of the country in principle a further rise of their sales prices can be observed everywhere. While the annual growth of the apartment sales prices in the capital has decreased since the beginning of 2017, a stable growth in the remaining cities of the country and somewhere a more rapid one has been observed,” – said Raimondas Reginis, Ober-Haus Market Research Manager for the Baltics.

Meanwhile the amount of money spent for the acquisition of apartments in sufficient detail shows not only general quantitative, but also qualitative changes in the specific cities of the country. According to the data of the State Enterprise Centre of Registers during the first seven months of this year apartments for almost EUR 750 million have been acquired in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys or for 9% more than during the same period last year.

The biggest change during this period was recorded in Kaunas city and Vilnius city municipalities, where respectively 15% and 10% more money was spent. It is not surprising as the new housing supply in these cities was growing mostly and it increased the total amount of money spent in the market too. It means that the growth of the amount of money spent for the acquisition of apartments has been recorded not only due to bigger sales volumes (during January-July months of 2018 in Vilnius it was recorded 7% and in Kaunas 5% more apartment sales transactions than during the same period last year) or their rising prices, but also due to the increasing part of new apartments in the total number of transactions and changing qualitative parameters of new housing.

During the first seven months of this year it was spent 4% more money for the acquisition of apartments in Šiauliai and Panevėžys and in Klaipėda 2% reduction was recorded. Still slack development of new housing in these cities and at the same time especially small portion of new housing in the total number of transactions determine much more modest changes of the amounts of money compared to Vilnius and Kaunas this year. As in 2018 smaller number of apartment sales transactions was registered in these cities (during January-July months of 2018 in Klaipėda and Šiauliai it was recorded 8% and in Panevėžys 3% less apartment sales transactions than during the same period last year), therefore the total growth of the amount of money spent in Šiauliai and Panevėžys in principle was determined only by the more rapidly increasing apartment prices. Meanwhile in Klaipėda the rise of prices during the year was much slower and could not compensate the number of apartment sales transactions which reduced by 8%. Therefore in the seaport a smaller amount of money in the apartment segment has been recorded this year.

Lithuanian Apartment Price Index, July 2018 (PDF)

The volume of purchases of large commercial property in Lithuania over the first half 2018 was rather impressive. According to Ober-Haus data, in the first half of 2018, eight investment transactions totaling EUR 246 million were concluded in purchases of modern commercial property (offices, retail, warehousing and industrial buildings and premises with an estimated value of at least EUR 1.5 million). In comparison with the record year 2017, when annual purchases of modern commercial property in Lithuania accounted for EUR 312 million, the half-year results of this year are really impressive.

”It is hard to estimate annual results due to the small-scale of the Lithuanian investment market and inconstancy of investment transactions because just a few large-scale deals could have a huge impact on half yearly or annual results. However, taking into consideration investment transactions that were concluded at the beginning of the second half of 2018 and planned transactions it is obvious that the total amount spent on purchases of such property in 2018 will definitely exceed the amounts spent in 2015 and 2016 (EUR 272 million and EUR 260 million respectively). Also, there is a high chance that a new record high in investment transactions will be registered this yeare,’ Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said.

The purchase of Ozas shopping centre was a deciding factor in the results of H1 2018. NEPI Rockcastle, the commercial property investor and developer, acquired the holding company of Ozas shopping centre. The reported aggregate purchase price of the shopping centre was EUR 124.6 million. By purchasing Ozas shopping centre, NEPI Rockcastle, one of the largest investors in higher-class retail property in Central and Eastern Europe, guaranteed themselves a slightly higher than 7% annual yield (excluding potential income from premises in this shopping centre that have not yet been leased).

Based on property value, the second largest transaction was the acquisition of four Verslo Trikampis office buildings. LIM Verslo Trikampio Fondas, a property management company owned by the fund management company, Lewben Investment Management, bought the four office buildings from MG Valda. The acquisition price was not disclosed, but it is publicly known that at the beginning of the year the value of the assets managed by the newly established fund made over EUR 60 million. This closed-type property fund already has both private persons and legal entities as investors.

The third largest transaction was concluded in the middle of this year, when investment company Westerwijk Properties purchased the BIG shopping centre in Klaipėda for almost EUR 25 million. This shopping centre was part of a large commercial property portfolio that was purchased by the international investment company, Partners Group, in 2015.

Acquisition of Ozas shopping centre was also a deciding factor in the distribution of investments by property sectors over H1 2018. According to Ober-Haus, from the total amount of EUR 246 million of investments made in Lithuania, as much as 65% was in the retail sector. Over this period the share of investments made in office space was 29% and the remaining 6% was on warehousing and industrial premises.

Despite investors still showing considerable interest in commercial property in Lithuania, investors have been much more reserved lately. Recent more conservative bank financing policies, anticipated end of the era of record low interest rates and slowing growth potential of real estate market, forces some potential investors to rethink their investment strategies (expectations). It appears, based on this year’s completed investment transactions and ongoing negotiations, that commercial property yields in general are not declining any further (which was the trend in the past 8 years). This is particularly obvious when looking at the lower-class or older buildings and premises segment. ‘Potential investors are being particularly cautious when assessing the prospects of a specific object – current tenant base, future potential income from lease, additional investments in the building or premises, etc. – and add this to yield indicators offered by sellers,’ Mr Reginis said.

Large investors continue to prioritize higher-class commercial property with a strong tenant base not only in the capital city but also outside it. These buyers are still accept a lower yield. While higher-risk property does not get as much attention in the market. According to Ober-Haus data, in 2018, country-wide investment yield indicators for modern commercial property remained essentially unchanged and in the middle of the year, depending on the region, amounted to 5.75%–8.0% for offices and shopping centres and about 7.5%–8.5% in modern warehouse buildings.

Among larger investments, top-class business centres in Vilnius and the most popular and larger shopping centres in the larger Lithuanian cities continue to receive attention. For example, the growth in value of top-class offices in the capital city over H1 2018 was determined only by slight increase of rents. The record low vacancy rate in A class business centres in Vilnius (1.6% in Q1 2018 and 0.9% in Q2 2018) also contributed to a slight increase in their rents.

Since investment yield indicators were stable, it was only the change in rents that contributed to further growth of the capital value index, which increased by almost 2% for A class offices in Vilnius over H1 2018. According to Ober-Haus data, the value of such property has already grown from the lowest point (recorded in the middle of 2010) by almost 90% but is still 12% short of the highest level recorded at the beginning of 2008.

Lithuania Commercial Market Commentary H1 2018 (PDF)

The supply of new housing in the country’s capital and its suburbs has reached new heights. If over the past five years mainly new apartments have been constructed, so today record indicators of supply in the private house segment are recorded. The development of housing estates with detached and semi-detached houses, which started in 2015–2016, has not slackened its pace.

The supply of new housing in the country’s capital and its suburbs has reached new heights. If over the past five years mainly new apartments have been constructed, so today record indicators of supply in the private house segment are recorded. The development of housing estates with detached and semi-detached houses, which started in 2015–2016, has not slackened its pace.

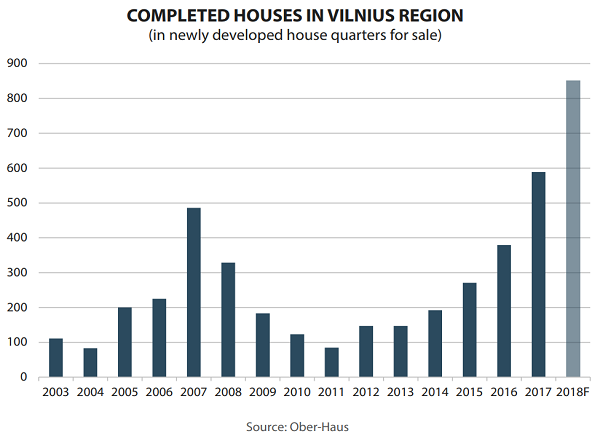

According to Ober-Haus, in 2017 developers in the city of Vilnius and its environs built and offered for sale nearly 590 new houses or as many as 55% more than in 2016, but the plans of developers for this year are even more impressive. In 2018, they plan to build more detached and semi-detached houses of various sizes totalling up to 850. At the same time the indicators of the annual supply of private houses for sale in 2017 and 2018 have been highest in the entire period since the restoration of Lithuania’s independence (e.g., about 440 private houses were built in the city of Vilnius and its environs for sale in 2007).

‘Although the number of private houses built for sale in Vilnius region cannot match the apartment construction volumes, over the past 3–4 years the pace of development of private houses has been considerably faster and the share of private houses in the total supply of housing has been on the rise,’ Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said.

If in 2014 the share of private houses built for sale in the total housing supply (apartments and houses) in the city of Vilnius and its environs accounted for only 6.4%, so in 2017 the figure increased to 12.4%. In 2018, it is planned to build about 4,500 apartments and about 850 houses in the city of Vilnius and its environs, so the share of private houses will be about 16% of all the housing supply. The following zones of the city of Vilnius have seen the fastest development of private houses for sale: the southeast (Pavilnys, Guriai, Kalnėnai) and the northwest (Pilaitė, Buivydiškės, Tarandė).

Area of new houses has reduced by one third

What determined such rapid development of private houses? Of course, one of the main reasons is the increasing number of home buyers in recent years who can afford a larger or more expensive housing. ‘Yet this is not the only reason which has determined development of this housing segment. With rapidly growing competition in the segment of apartments in the multi-apartment buildings, more developers and individual investors have decided to offer an affordable housing option to house buyers. I.e. currently small row houses dominate in the housing development market which offer essential attributes of a private house for an affordable price: a separate entrance to the property, some land, a parking space and a small number of neighbors,’ Mr Reginis said.

Of course, over the past 5-7 years, the mandatory dimensions of the houses have changed significantly: the house and the plot of land are relatively small and a parking space only for a single vehicle is provided. The change is particularly visible in the analysis of the total floor area of private houses over the past decade. According to Ober-Haus, the average floor area of the houses built in the housing estates in the suburbs of Vilnius in 2000–2010 was 160-180 sqm, but starting from 2011 a sudden reduction in the floor area has been recorded. For example, the average floor area of the houses built in the housing estates in the suburbs of Vilnius in 2015 was 119 sqm, in 2016 – 113 sqm, and in 2017 – 115 sqm. Comparing the period of 2000–2010 with that of 2011–2017, the average floor area of the houses decreased by 30%.

The sizes of house projects also differ: from ultra small 4–6 semi-detached house projects to large housing estates with 100 and more houses developed in stages (e.g., the newly introduced project Baltai in the vicinity of Lentvaris, where about 240 houses [floor area between 87 sqm and 129 sqm] will be built within the next 3–5 years).

Big house construction volumes slowed down the growth of prices

The development of new houses is also encouraged by their good sales indicators. According to Ober-Haus, 88% of houses built in 2017 were sold and reserved by mid-2018. This is also reflected in the official statistics – according to the State Enterprise Centre of Registers, about 1,200–1,250 houses were purchased each year in the municipal area of Vilnius city and district in 2015–2017, which is the greatest market activity indicator in history. The first half of 2018 was also most active in history (compared with the first half of 2017) when a total of 611 houses were sold.

‘However, even with good sales indicators, large scale construction of new houses has essentially stalled sales prices of houses in Vilnius and its environs. In the first half of 2018 the prices remained unchanged and compared with the same period in 2017 only 1% increase in sales prices was recorded,’ Mr Reginis said.

‘The prices of detached and semi-detached houses depend on the location, size and layout of the house, architectural solutions, building materials, a garage, a car port or a parking space near the house and the fitting-out level of the house. Therefore, the prices of houses built in the residential areas in Vilnius and its outskirts are very different,’ Mr Reginis noted.

At present, the economy class houses outside the boundaries of the city of Vilnius or in its suburbs with partial finish are usually sold for 800–1,200 EUR/sqm. The prices of the houses located in more attractive areas of the city with partial finishing usually range from 1,300 to 1,500 EUR/sqm and in the exclusive projects in prestigious areas of the capital city they may be in excess of 2,000 EUR/sqm.

Lithuania Residential Market Commentary H1 2018 (PDF)

The first half of 2018 in the Lithuanian housing market was one of the most active over the past decade and was comparable to those of 2016–2017 both in the apartment and private house sectors. Despite slightly pessimistic moods prevailing early in the year in the housing market of the major cities of Lithuania.

The first half of 2018 in the Lithuanian housing market was one of the most active over the past decade and was comparable to those of 2016–2017 both in the apartment and private house sectors. Despite slightly pessimistic moods prevailing early in the year in the housing market of the major cities of Lithuania.

‘In February, a record low activity in the apartment sector of the country’s capital and, for the first time after a longer period of time, a symbolic fall in sales prices were recorded), in the first six months of the year sales and prices shot up yet again. Of course, very different trends can be observed in different regions or cities of the country – from decreasing to rising indicators in the market activity and diverse price changes,’ Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said.

According to the State Enterprise Centre of Registers, 0.2% fewer purchase and sales transactions for apartments and 0.3% fewer transactions for private homes were concluded in the first half of 2018 than were concluded in the same period in 2017. In the first half of this year, on average 2,668 transactions for apartments and 820 transactions for houses were concluded per month. May saw the largest number of housing transactions totalling 4,148. This is the second best performance in the month in the Lithuanian housing transaction market since 2007. A larger figure was recorded in September 2016 (4,205).

Currently, sustainability of new housing developments in the capital city has been most debated, as since Q3 2017 the realization curve for newly constructed apartments (first-time sold and reserved new apartments in multi-apartment buildings that have been completed or are being constructed) has moved downward and over the past four quarters has remained stable with an average of 800–900 apartments per quarter. According to Ober-Haus, in the first half of 2018, 1,789 new apartments in multi-apartment buildings that have been completed or are being constructed were purchased or reserved in Vilnius directly from developers. This is 5% more than in the second half of 2017, but 17% less than in the first half of 2017.

The Ober-Haus estimates reflect the transactions which are immediately officially registered (on the purchase of the property in a completed building) and the transactions based on the preliminary contracts, which will be registered with the State Enterprise Centre of Registers in the future, after the completion of the multi-apartment buildings. Meanwhile the State Enterprise Centre of Registers in its statistics for apartment purchase and sale transactions records only final transactions, which shows the opposite situation – the increasing number of transactions for new apartments reaching record heights in Q2 2018 when the acquisition of 1,268 new apartments was recorded in the city of Vilnius (best quarterly result since 2007). Based on the data of the State Enterprise Centre of Registers, the result of the first half of 2018 is also the best since 2007–2008. This shows that currently finalised and recorded transactions for new apartments were recorded and figured in the Ober-Haus estimates back in 2016–2017, i.e. at the time when the preliminary purchase and sale contracts for these apartments were concluded. Thus the housing market is currently absorbing almost a record amount of borrowed or own cash spent on housing purchase over the past decade.

At the same time, slightly negative trends in the new apartment sales prices in Vilnius have been observed over the past six months. If the prices for old apartments in the capital city in the first half of 2018 increased by 1.6%, so the prices for new apartments fell by 0.3%. ‘Although this is a slight decrease in apartment prices, such trend has been recorded for the first time over the past three years. Last time the price decrease trend (for both new and old apartments) was recorded in Vilnius in the second half of 2014, when the then geopolitical situation had a negative impact on both the country’s business and people,’ Mr Reginis said. Current slight downward move in the price curve of newly constructed properties can be linked to a really significant and sufficient supply of new housing, which prevents a considerable portion of developers from increasing their sales prices as easily as they did before and they even have to compete for more attractive prices with other competitors.

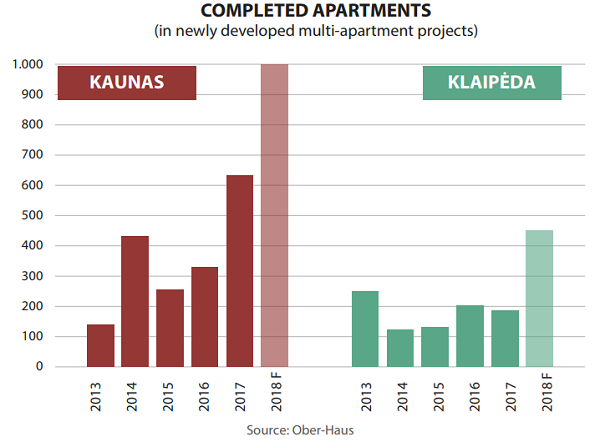

30 multi-apartment building projects to be implemented in Kaunas in 2018

The developers have also gained speed in the second largest city in the country. This is in particular visible in the development of multi-apartment buildings over the past few years. According to Ober-Haus, a total of 633 apartments were built in multi-apartment buildings in 2017 in Kaunas or 92% more than in 2016. In 2018, developers in Kaunas plan to complete up to 1,100 new apartments and thus repeat record development indicators recorded a decade ago. This year alone, apartments in 30 different projects will be offered to buyers. For example, in 2008, 1,070 apartments in 15 different multi-apartment building projects have been built for sale. This means that due to the abundance of different projects, customers this year will have even greater choice than 10 years ago.

Faster development of new multi-apartment buildings, which started in Kaunas in 2016 determined record new apartment realization indicators in 2017, when over 840 apartments were purchased or reserved directly from developers. I.e. buyers responded to the new supply with great interest and actively participated in purchasing completed apartments or apartments in progress. According to Ober-Haus, in the first half of 2018, 356 new apartments in multi-apartment buildings that have been completed or are being constructed were purchased or reserved in Kaunas directly from developers. This is 17% less than the number of apartments realized in the second half of 2017 and 15% less than the first half of 2017. Despite the more modest figure for the sale of new apartments in 2018, the overall housing market activity in the primary market is by a quarter higher than in 2016.

‘Further new housing realization indicators will depend not only on the overall economic situation both in the country and in Kaunas region, but also on the scale of further development of new projects. So far housing developers are seen to have put their trust in Kaunas and do not plan to stop. Positive trends in the sales prices of new apartments were recorded over the past six months in Kaunas,’ Mr Reginis said. In the first half of 2018, the prices of new apartments in Kaunas increased by 1.9%.

From non-standard to large projects offered to the market in Klaipėda

Although the scale of development of multi-apartment buildings in Klaipėda cannot be compared either to Vilnius or Kaunas, growth trends are visible here. On average only 200 apartments were built in Klaipėda in multi-apartment buildings annually in 2010–2017. ‘Since the number of newly built, but unsold apartments from previous projects is rapidly decreasing, quite favourable (low) competitive environment remains in the city. While the overall activity in the housing market has showed good results, developers in Klaipėda started developing new housing projects more actively. As a result, in 2018 much greater changes in supply have been recorded,’ Mr Reginis said.

According to Ober-Haus, this year 450 new apartments in 12 different projects should be completed in Klaipėda. For example, this year will see the completion of one of the largest multi-apartment buildings in the past 3–4 years in Klaipėda. The multi-apartment building Ravelino Namai in the Old Town will offer over 130 new apartments. Apartments for sale are offered not only in newly completed projects, but also in non-standard projects: apartments are reconstructed for sale in the former student hostel on Taikos Avenue or in place of the former Saturnas shopping centre (Saturno Namai).

According to Ober-Haus, this year 450 new apartments in 12 different projects should be completed in Klaipėda. For example, this year will see the completion of one of the largest multi-apartment buildings in the past 3–4 years in Klaipėda. The multi-apartment building Ravelino Namai in the Old Town will offer over 130 new apartments. Apartments for sale are offered not only in newly completed projects, but also in non-standard projects: apartments are reconstructed for sale in the former student hostel on Taikos Avenue or in place of the former Saturnas shopping centre (Saturno Namai).

According to Ober-Haus, in the first half of 2018, 163 new apartments in multi-apartment buildings that have been completed or are being constructed were purchased or reserved in Klaipėda directly from developers. This is almost 14% less than in the second half of 2017 and 22% less than in the first half of 2017. The relatively poorer indicators this year were partly determined by very large sales volumes of newer apartments in 2017, when the buyers showed great interest in both the newly constructed projects and the apartments built much earlier, but not sold yet. By mid-2018, 63% of the apartments planned to be built this year were sold or reserved. In the first half of 2018, the prices for new apartments in Klaipėda increased by 2.7%.

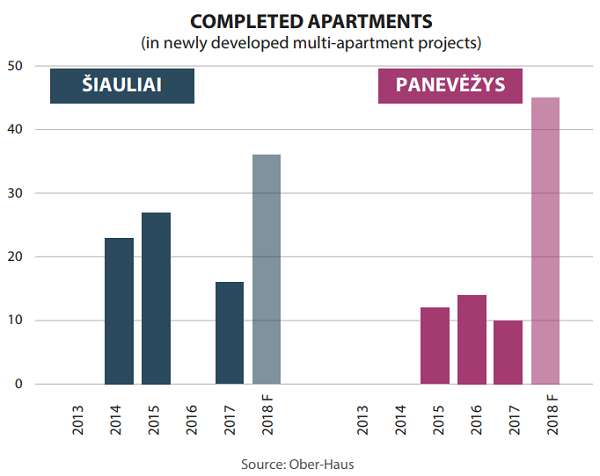

Developers in Šiauliai and Panevėžys take small steps forward

In Šiauliai and Panevėžys the volumes of development of new housing still remain very modest, but housing developers offer new apartments in small-scale projects. According to Ober-Haus, in 2014–2017, 1–3 new apartment development projects (or stages thereof) were implemented in Šiauliai and Panevėžys each year and in the past four years only slightly more than 100 apartments were built for sale. In 2018, four new small projects are planned in Panevėžys, which will offer 45 new apartments. In Šiauliai, a multi-apartment building which will offer 36 apartments is being built on Daukanto Street; its completion is scheduled for the end of this year or the beginning of 2019.

Recent growing supply of new apartments affects sales volumes of the new housing. According to Ober-Haus, in 2017, 35 new apartments in multi-apartment buildings that have been completed or are being constructed were purchased or reserved in Šiauliai and Panevėžys directly from developers. In the first six months alone, 32 of them were purchased or reserved. ‘It is clear that the newly built apartments in these cities have found their buyers. Although these figures indicate a growth trend and more new apartments are sold, they still do not match the sales volumes which were a decade ago,’ Mr Reginis said. The construction volumes of multi-apartment buildings in 2014–2017 in Šiauliai and Panevėžys were on average 8 times smaller than those in 2007–2008 when 430 apartments were built in these cities just over two years.

Lithuania Residential Market Commentary H1 2018

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in June 2018. The annual apartment price growth in the major cities of Lithuania was 3.1% (the annual apartment price growth in May 2018 was 3.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in June 2018. The annual apartment price growth in the major cities of Lithuania was 3.1% (the annual apartment price growth in May 2018 was 3.2%).

In June 2018 apartment prices in the capital grew 0.2% with the average price per square meter reaching EUR 1,479 (+3 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 28.1% (+324 EUR/sqm). In Kaunas and Klaipėda the same price growth was recorded and was 0.3% with the average price per square meter reaching EUR 1,048 (+3 EUR/sqm) and EUR 1,057 (+3 EUR/sqm) respectively. Apartment prices in Šiauliai and Panevėžys in June grew by 0.6% and 1.2% respectively with the average price per square meter reaching EUR 633 (+3 EUR/sqm) and EUR 603 (+7 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 6.7% in Panevėžys, 4.7% in Šiauliai, 4.3% in Kaunas, 3.2% in Klaipėda and 2.3% in Vilnius.

‘In 2018, a trend of a faster increase in apartment prices has been recorded in smaller cities of the country. If of all the major cities growth has been the smallest in the country’s capital over the past months, so, for example, in Panevėžys, Šiauliai or Kaunas apartment sales prices rose at a faster rate. In recent years, rapid development trends of the residential and commercial property have been recorded in the city of Kaunas in conjunction with positive expectations related to economic prospects of the city.

Positive changes in the real estate market in the larger cities partly spills over to smaller cities. This can be observed in Šiauliai and Panevėžys, which, after the last recession, showed poor indicators both in the increase in prices and new home construction volumes. Recently, however, these cities have finally seen faster relative price increase for apartments and a slight increase in the activities of the development of new housing. The sellers of older housing in these towns essentially do not experience competition from the builders of new housing and the overall economic situation, even despite the negative demographic changes, remains conducive to those who wish to sell their property at a higher price,’ Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said.

Lithuanian Apartment Price Index, June 2018 (PDF)

Apartment prices in Vilnius increased by 0.4% to 1,476 EUR/sqm in May 2018. During a year apartment prices in Vilnius increased by 2.5% and since the last lowest price level in May 2010, apartment prices are higher by 27.8% (by 321 EUR/sqm). In January-May 2018, the number of apartment transactions in Vilnius (4,432 transactions) increased by 9.0% compared with January-May 2017.

Apartment prices in Vilnius increased by 0.4% to 1,476 EUR/sqm in May 2018. During a year apartment prices in Vilnius increased by 2.5% and since the last lowest price level in May 2010, apartment prices are higher by 27.8% (by 321 EUR/sqm). In January-May 2018, the number of apartment transactions in Vilnius (4,432 transactions) increased by 9.0% compared with January-May 2017.

In May 2018 apartment prices in Riga increased by 0.1% to the average price of 1,228 EUR/sqm. Over the past 12 months, the average apartment price has increased 3.7%. In total there were 3,731 apartment transactions in January-May 2018 in Riga, which is less by 2.2% compared with January-May 2017.

The average apartment price in Tallinn increased by 1.0% to 1,849 EUR/sqm and reached all-time highs in May 2018. Over the past 12 months, the average apartment price has increased 7.9%. In total there were 4,140 apartment transactions in January-May 2018 in Tallinn, which is 3.3% more than in the same period of 2017.

“After a moderate growth of apartment prices at the beginning of the year in May Lithuanian cities recorded the biggest monthly growth of apartment prices this year.

Prices of older construction apartments in all cities of the country were increasing most rapidly in May this year. Looking at a long-term period, however, tendencies in separate cities of the country remain different. During the last twelve months prices of old construction apartments in Vilnius increased 3.5%, and those of new construction apartments – 1.3%. Meanwhile, during the same period prices of old construction apartments in Kaunas and Klaipėda got up 2.8% and 1.1% respectively, and those of new construction apartments – 8.3% and 7.4% respectively.

If in the capital of the country the pace of development (construction) of new construction apartments is slowing down, in Kaunas and Klaipėda a much more rapid development of this housing segment is already being recorded. For instance, this year in Vilnius it is planned to build almost 10% more apartments than in 2017, meanwhile in Kaunas and Klaipėda the annual growth of supply may reach even 80–100%. Therefore in Kaunas and even in Klaipėda it is possible to choose from an increasingly bigger number of new projects, which can offer potential customers a bigger variety of locations, conceptions and modern technical solutions. It also makes an impact on prices of new construction apartments in Kaunas and Klaipėda – a quantitative and qualitative jump up of supply determines their higher sales prices,” says Raimondas Reginis, Ober-Haus Market Research Manager for the Baltics.

Search

Search