We will take care of all

your real estate needs

Latest news

All news

All news

“e-market city” completes its second phase – the development of a modern “stock office” type shopping town continues

"e-market city", an online and wholesale shopping town located in a business-friendly location at the intersection of Eišiškių pl. and Geologų Street, is rapidly approaching the end of its second phase. The final construction works are currently underway and the first tenants of the new phase are preparing to move in as early as June-July. "The predominant floor areas of e-market city - ranging from 370 to 960 m² - are easily combinable and adaptable to a wide range of commercial activities. Existing and potential tenants appreciate the easy accessibility, high quality of construction and fitting-out, functional layout and solid neighbourhood, where well-known companies such as Assa Abloy, Dextera, Skuba, Skuba, Maidina, Šildymas plius, YE International, etc. are already located. The first phase is already 100% leased, while the second phase is still available - we invite you to get in touch", says Remigijus Valickas, Commercial Real Estate Projects Manager at Ober-Haus. The project is being developed in three phases on an area of 3.9 ha. The total area of the buildings will exceed 20,000 m² and the total investment in the project will amount to more than EUR 25 million. For more information about the project and leasing opportunities,…

The recovery of a very strong-looking housing market may slow down

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.5% in March 2025. The annual apartment price growth in the biggest cities of Lithuania was 4.3% (a 4.1% increase was recorded in February 2025). In March 2025 apartment prices in Vilnius, Kaunas, Šiauliai and Panevėžys increased by 0.4%, 1.3%, 0.4% and 0.2%, respectively, with the average price per square meter reaching EUR 2,680 (+10 EUR/sqm), EUR 1,846 (+24 EUR/sqm), EUR 1,172 (+4 EUR/sqm) and EUR 1,149 (+2 EUR/sqm). In the same month, apartment prices in Klaipėda decreased by 0.1% and the average price per square meter dropped to EUR 1,752 (-2 Eur/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 3.3% in Vilnius, 5.6% in Kaunas, 5.4% in Klaipėda, 6.5% in Šiauliai and 6.4% in Panevėžys. "At the beginning of 2025, the country's housing market is showing impressive results. After a very strong growth in housing transactions in January and February this year, the increase in the number of transactions continued in March. According to the data of the State Enterprise…

Housing market has woken up, but no faster price growth yet

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.4% in February 2025. The annual apartment price growth in the biggest cities of Lithuania was 4.1% (a 4.0% increase was recorded in January 2025). In February 2025 apartment prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys increased by 0.3%, 0.1%, 0.8%, 0.8% and 0.9%, respectively, with the average price per square meter reaching EUR 2,670 (+7 EUR/sqm), EUR 1,822 (+2 EUR/sqm), EUR 1,754 (+13 EUR/sqm), EUR 1,168 (+10 EUR/sqm) and EUR 1,147 (+10 EUR/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 3.2% in Vilnius, 4.1% in Kaunas, 6.2% in Klaipėda, 6.6% in Šiauliai and 6.7% in Panevėžys. ‘As predicted, a rapid annual growth in the number of housing transactions is recorded at the beginning of 2025. According to the data of the State Enterprise Centre of Registers, 40% more apartments were purchased in the country in January this year and 39% more in February this year than in the same month in 2024. It should be noted that in the…

All news

All news

Vilniaus Džiazas

K. Vanagėlio str., Oldtown, Vilnius

This is a housing project, changing the access to the Old Town and harmoniously integrating into the historic center of Vilnius – just a few minutes to the Gates of Dawn, Barbakanas Hill. Exclusive apartments in Vilnius Old Town invite residents to discover the highest standards of living quality

Read more

Read more

Gardino 22

Gardino str., Rasos, Vilnius

Created sustainably and with great respect for the environment, a small 15-apartment residential building is developed for those who want to feel a connection with nature. Spacious and rational apartment layouts, large balconies, and terraces will allow you to enjoy quality relaxation, forgetting about the daily chores and worries.

Read more

Read more

eMarketCity

Eišiškių pl., Kirtimai , Vilnius

The online and wholesale shopping town eMarketCity is oriented towards medium and small businesses that are looking for warehouse, office, and commercial spaces in one place. In a 3.9 ha territory, 7 buildings are being developed, totaling over 20,000 m² of spaces that can be adapted to specific business needs.

Read more

Read more

Liepų parko namai

J. Janonio str., Kačerginė

This is a project of two A++ class twin houses in the resort town of Kačerginė, in a quiet location in front of the Liepų Park. The project includes houses with an area of 147 m² with outdoor terraces and 4.2 a courtyards.

Read more

Read more

New Projects

This is a housing project, changing the access to the Old Town and harmoniously integrating into the historic center of Vilnius – just a few minutes to the Gates of Dawn, Barbakanas Hill. Exclusive apartments in Vilnius Old Town invite residents to discover the highest standards of living quality

Created sustainably and with great respect for the environment, a small 15-apartment residential building is developed for those who want to feel a connection with nature. Spacious and rational apartment layouts, large balconies, and terraces will allow you to enjoy quality relaxation, forgetting about the daily chores and worries.

The online and wholesale shopping town eMarketCity is oriented towards medium and small businesses that are looking for warehouse, office, and commercial spaces in one place. In a 3.9 ha territory, 7 buildings are being developed, totaling over 20,000 m² of spaces that can be adapted to specific business needs.

This is a project of two A++ class twin houses in the resort town of Kačerginė, in a quiet location in front of the Liepų Park. The project includes houses with an area of 147 m² with outdoor terraces and 4.2 a courtyards.

Market reviews

Looking for an expert?

Our team includes more than 140 real estate professionals throughout Lithuania

Find an expert

Find an expert

Come visit our office near you

The company’s wide geography allows it to provide the highest quality services in any area of Lithuania

Find an office

Find an office

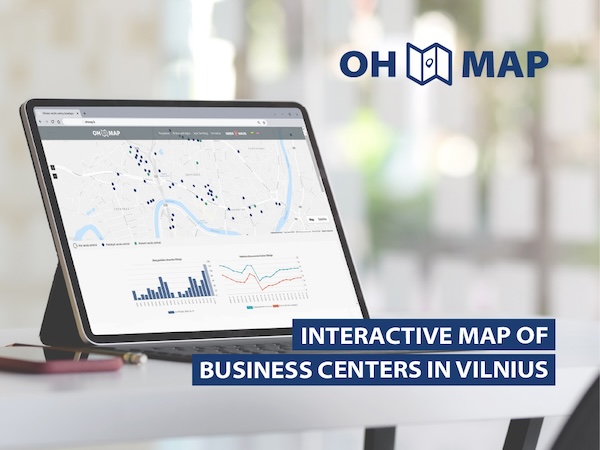

Interactive map of business centers in Vilnius

An interactive map of business centers OHMAP helps find all administrative buildings with a minimum of 1,000 sqm useful area in Vilnius built since 1999.

Go to OHmap.lt

Go to OHmap.lt

Lithuania/Vilnius Real Estate Market Report 2025

READ MORE

- 01/1994

- 100

- 100

- 100

- 100

- 100

- 100

- 02/1994

- 101.558474187152

- 102.521008403361

- 100.041340785598

- 101.466666666667

- 100

- 100

- 03/1994

- 104.011445099558

- 106.482593037215

- 100.041340785598

- 103.866666666667

- 100

- 100

- 04/1994

- 105.337328539832

- 107.683073229292

- 100.041340785598

- 106.8

- 103.060892059938

- 100

- 05/1994

- 106.274482628393

- 108.28331332533

- 100.041340785598

- 109.88532076444

- 103.060892059938

- 101.5

- 06/1994

- 107.610912861072

- 109.483793517407

- 100.041340785598

- 112.666666666667

- 104.236044763016

- 105.233101278188

- 07/1994

- 109.250066657148

- 109.723889555822

- 103.669783197511

- 116.666666666667

- 104.236044763016

- 105.233101278188

- 08/1994

- 110.939044016314

- 112.364945978391

- 104.857142857143

- 117.2

- 104.236044763016

- 105.233101278188

- 09/1994

- 113.045219745311

- 113.805522208884

- 107.142857142857

- 121.066666666667

- 106.222222222222

- 106.75

- 10/1994

- 115.650120162426

- 115.726290516206

- 111.571428571429

- 123.466666666667

- 108.666666666667

- 109.5

- 11/1994

- 118.118284025303

- 118.367346938775

- 113.857142857143

- 125.333333333333

- 113.111111111111

- 110.75

- 12/1994

- 118.118284025303

- 118.367346938775

- 113.857142857143

- 125.333333333333

- 113.111111111111

- 110.75

- 01/1995

- 116.82688323527

- 117.527010804322

- 111.714285714286

- 123.733333333333

- 111.111111111111

- 110.75

- 02/1995

- 114.842131432833

- 115.246098439376

- 110.285714285714

- 122.133333333333

- 109.111111111111

- 107.75

- 03/1995

- 113.41123173393

- 113.685474189676

- 109.142857142857

- 120

- 109.111111111111

- 107.75

- 04/1995

- 111.452892901378

- 111.764705882353

- 108

- 116.666666666667

- 107.459839961872

- 107

- 05/1995

- 110.276129828535

- 110.924369747899

- 107.428571428571

- 113.6

- 107.459839961872

- 105.5

- 06/1995

- 110.130452686728

- 110.924369747899

- 107.142857142857

- 113.2

- 107.459839961872

- 105.233101278188

- 07/1995

- 110.130452686728

- 110.924369747899

- 107.142857142857

- 113.2

- 107.459839961872

- 105.233101278188

- 08/1995

- 114.269944582689

- 116.206482593037

- 109.285714285714

- 117.2

- 110.783340166878

- 107.25

- 09/1995

- 120.600661720302

- 124.36974789916

- 111.571428571429

- 125.6

- 113.04422466008

- 107.75

- 10/1995

- 126.210272274428

- 132.052821128451

- 113.8426060528

- 131.466666666667

- 114.222222222222

- 109.75

- 11/1995

- 132.035101748644

- 136.494597839136

- 120.857142857143

- 140.341143467062

- 120

- 112.5

- 12/1995

- 139.75773378454

- 147.418967587035

- 123.746695107107

- 146.8

- 122.874157239217

- 118

- 01/1996

- 143.564940137901

- 152.34093637455

- 123.746695107107

- 152.54472115985

- 124.666666666667

- 121.727126984602

- 02/1996

- 148.147828853477

- 156.182472989196

- 123.746695107107

- 164.8

- 128.888888888889

- 124.75

- 03/1996

- 154.101798540066

- 164.345738295318

- 123.746695107107

- 173.346274045285

- 130.717188552359

- 128

- 04/1996

- 157.314910812445

- 166.266506602641

- 131.64542032671

- 173.346274045285

- 135.555555555556

- 135.5

- 05/1996

- 157.983043085432

- 166.266506602641

- 133.571428571429

- 173.346274045285

- 138.222222222222

- 138.32628066432

- 06/1996

- 164.672049537827

- 174.189675870348

- 137.857142857143

- 182.020158872418

- 140.888888888889

- 138.32628066432

- 07/1996

- 166.009441626313

- 174.189675870348

- 143.092848181206

- 182.020158872418

- 144.888888888889

- 138.32628066432

- 08/1996

- 167.000714491834

- 174.189675870348

- 147.285714285714

- 182.020158872418

- 146.666666666667

- 138.32628066432

- 09/1996

- 172.219112217606

- 180.912364945978

- 148.837077212136

- 189.604332158769

- 147.937062644136

- 138.32628066432

- 10/1996

- 172.442007525436

- 180.912364945978

- 148.837077212136

- 189.604332158769

- 147.937062644136

- 144.089875692

- 11/1996

- 172.555729621268

- 180.912364945978

- 148.837077212136

- 189.604332158769

- 147.937062644136

- 147.0304854

- 12/1996

- 172.559997610178

- 180.912364945978

- 148.857142857143

- 189.604332158769

- 147.937062644136

- 147.0304854

- 01/1997

- 172.563518179931

- 180.912364945978

- 148.857142857143

- 189.604332158769

- 148

- 147.0304854

- 02/1997

- 172.563518179931

- 180.912364945978

- 148.857142857143

- 189.604332158769

- 148

- 147.0304854

- 03/1997

- 171.972374288878

- 180.072028811525

- 148.428571428571

- 189.604332158769

- 146.666666666667

- 147.0304854

- 04/1997

- 170.533972679692

- 178.631452581032

- 146.857142857143

- 187.727061543335

- 146.222222222222

- 147.0304854

- 05/1997

- 169.91917942361

- 178.631452581032

- 145.907974621608

- 185.868377765678

- 145.036335925624

- 147.0304854

- 06/1997

- 169.719970840468

- 178.631452581032

- 145.907974621608

- 184.8

- 145.036335925624

- 147.0304854

- 07/1997

- 167.815996780927

- 175.870348139256

- 145.285714285714

- 183.039143689828

- 144.222222222222

- 147.0304854

- 08/1997

- 167.527538226508

- 175.870348139256

- 144.463341209512

- 183.039143689828

- 142.192486201592

- 147.0304854

- 09/1997

- 168.256799849115

- 177.310924369748

- 144.463341209512

- 183.039143689828

- 142.192486201592

- 147.0304854

- 10/1997

- 168.256799849115

- 177.310924369748

- 144.463341209512

- 183.039143689828

- 142.192486201592

- 147.0304854

- 11/1997

- 168.60154009428

- 177.310924369748

- 144.463341209512

- 184.888023929119

- 142.192486201592

- 147.0304854

- 12/1997

- 168.681882700073

- 177.310924369748

- 144.463341209512

- 184.888023929119

- 143.628773941002

- 147.0304854

- 01/1998

- 168.823808649222

- 177.430972388956

- 144.463341209512

- 184.888023929119

- 145.079569637376

- 147.0304854

- 02/1998

- 168.948316824134

- 177.430972388956

- 144.463341209512

- 184.888023929119

- 145.079569637376

- 150.25

- 03/1998

- 172.04169337494

- 180.072028811525

- 147.411572662768

- 188.661248907264

- 149.56656663647

- 154.768932

- 04/1998

- 173.986391035225

- 183.91356542617

- 147.411572662768

- 188.661248907264

- 149.56656663647

- 154.768932

- 05/1998

- 178.289837061423

- 190.996398559424

- 147.411572662768

- 192.5114784768

- 149.56656663647

- 154.768932

- 06/1998

- 182.826013197221

- 197.118847539016

- 153.23448301743

- 192.5114784768

- 153.111111111111

- 154.768932

- 07/1998

- 186.414848819486

- 202.761104441777

- 153.23448301743

- 196.44028416

- 153.111111111111

- 154.768932

- 08/1998

- 191.428367257534

- 208.403361344538

- 156.2014377

- 204.625296

- 153.111111111111

- 154.768932

- 09/1998

- 197.147090364631

- 218.967587034814

- 156.2014377

- 204.625296

- 155.777777777778

- 160.5

- 10/1998

- 205.086288729317

- 234.333733493397

- 156.2014377

- 204.625296

- 155.777777777778

- 164.6478

- 11/1998

- 216.922293044391

- 254.861944777911

- 159.389222142857

- 208

- 158.222222222222

- 164.6478

- 12/1998

- 226.63976133256

- 269.507803121249

- 161.285714285714

- 216

- 162

- 169.74

- 01/1999

- 230.18634070882

- 271.188475390156

- 164

- 227.36144

- 162

- 169.74

- 02/1999

- 239.296973011795

- 286.794717887155

- 167.714285714286

- 227.36144

- 166.222222222222

- 174.5

- 03/1999

- 243.124267009199

- 290.996398559424

- 167.778128571429

- 234.8

- 169.333333333333

- 177.75

- 04/1999

- 246.976354244358

- 290.996398559424

- 174.714285714286

- 247.132

- 169.333333333333

- 179.75

- 05/1999

- 247.436286290434

- 290.996398559424

- 174.714285714286

- 247.132

- 177.555555555556

- 179.75

- 06/1999

- 247.436286290434

- 290.996398559424

- 174.714285714286

- 247.132

- 177.555555555556

- 179.75

- 07/1999

- 247.436286290434

- 290.996398559424

- 174.714285714286

- 247.132

- 177.555555555556

- 179.75

- 08/1999

- 245.766691527858

- 288.115246098439

- 174.714285714286

- 246

- 177.555555555556

- 179.75

- 09/1999

- 244.027374934394

- 286.794717887155

- 171.428571428571

- 246

- 177.555555555556

- 179.775

- 10/1999

- 238.301704372807

- 276.230492196879

- 171.142857142857

- 244

- 174.222222222222

- 176.4

- 11/1999

- 234.232479765752

- 271.428571428571

- 164.285714285714

- 244

- 174.222222222222

- 171.75

- 12/1999

- 228.554459821552

- 264.22569027611

- 157.142857142857

- 244

- 168

- 167.5

- 01/2000

- 225.102759592277

- 259.315726290516

- 154.214285714286

- 244

- 163.333333333333

- 165.375

- 02/2000

- 223.702383912047

- 258.103241296519

- 154.214285714286

- 244

- 156.444444444444

- 155

- 03/2000

- 221.829369354438

- 257.860144057623

- 150.857142857143

- 244

- 144.666666666667

- 145.25

- 04/2000

- 214.762437501726

- 246.512605042017

- 150.857142857143

- 237.333333333333

- 143.333333333333

- 145.125

- 05/2000

- 214.762437501726

- 246.512605042017

- 150.857142857143

- 237.333333333333

- 143.333333333333

- 145.125

- 06/2000

- 212.662357393442

- 246.512605042017

- 143.142857142857

- 237.333333333333

- 140.222222222222

- 137.75

- 07/2000

- 208.140106626889

- 241.134453781513

- 140.714285714286

- 234.666666666667

- 133.777777777778

- 126.75

- 08/2000

- 205.846523576697

- 241.176470588235

- 137.285714285714

- 229.466666666667

- 127.777777777778

- 119.5

- 09/2000

- 203.652178116627

- 241.056422569028

- 135.053571428571

- 223.466666666667

- 119.333333333333

- 117.75

- 10/2000

- 201.236913344935

- 237.454981992797

- 135.053571428571

- 221.466666666667

- 115.777777777778

- 117.225

- 11/2000

- 200.629195326096

- 236.25450180072

- 135.053571428571

- 221.466666666667

- 115.777777777778

- 117.225

- 12/2000

- 198.927584873346

- 232.893157262905

- 135.053571428571

- 221.466666666667

- 115.777777777778

- 117.225

- 01/2001

- 197.529833430016

- 230.132052821128

- 135.053571428571

- 221.466666666667

- 115.777777777778

- 117.225

- 02/2001

- 197.529833430016

- 230.132052821128

- 135.053571428571

- 221.466666666667

- 115.777777777778

- 117.225

- 03/2001

- 195.706679373498

- 226.530612244898

- 135.053571428571

- 221.466666666667

- 115.777777777778

- 117.225

- 04/2001

- 195.706679373498

- 226.530612244898

- 135.053571428571

- 221.466666666667

- 115.777777777778

- 117.225

- 05/2001

- 195.58334023922

- 226.530612244898

- 135.053571428571

- 221.466666666667

- 113.555555555556

- 117.25

- 06/2001

- 195.573671998011

- 226.530612244898

- 135.053571428571

- 221.466666666667

- 113.555555555556

- 117

- 07/2001

- 195.124789370459

- 225.93037214886

- 135.053571428571

- 221.466666666667

- 113.555555555556

- 113.25

- 08/2001

- 195.441078975719

- 227.611044417767

- 135.053571428571

- 219.066666666667

- 112

- 113.25

- 09/2001

- 195.065053451562

- 227.731092436975

- 133.000000000000

- 219.066666666667

- 112.000000000000

- 113.250000000000

- 10/2001

- 195.429684262866

- 228.451380552221

- 133.000000000000

- 219.066666666667

- 112.000000000000

- 113.250000000000

- 11/2001

- 196.685050136737

- 232.797418967587

- 130.428571428571

- 216.933333333333

- 112.000000000000

- 113.250000000000

- 12/2001

- 196.685050136737

- 232.797418967587

- 130.428571428571

- 216.933333333333

- 112.000000000000

- 113.250000000000

- 01/2002

- 196.461299411619

- 232.797418967587

- 130.428571428571

- 216.933333333333

- 108.000000000000

- 113.250000000000

- 02/2002

- 197.120120991133

- 232.797418967587

- 134.000000000000

- 216.933333333333

- 106.888888888889

- 112.250000000000

- 03/2002

- 197.052443302671

- 232.797418967587

- 134.000000000000

- 216.933333333333

- 106.888888888889

- 110.500000000000

- 04/2002

- 197.013770337836

- 232.797418967587

- 134.000000000000

- 216.933333333333

- 106.888888888889

- 109.500000000000

- 05/2002

- 197.809742824784

- 232.797418967587

- 134.000000000000

- 221.466666666667

- 106.888888888889

- 108.225000000000

- 06/2002

- 198.158766332422

- 232.797418967587

- 134.000000000000

- 221.466666666667

- 113.111111111111

- 108.250000000000

- 07/2002

- 198.146460042540

- 232.773109243697

- 134.000000000000

- 221.466666666667

- 113.111111111111

- 108.250000000000

- 08/2002

- 199.969614099058

- 236.374549819928

- 134.000000000000

- 221.466666666667

- 113.111111111111

- 108.250000000000

- 09/2002

- 202.080053037209

- 239.735894357743

- 135.285714285714

- 221.466666666667

- 113.111111111111

- 111.750000000000

- 10/2002

- 205.438661915417

- 244.297719087635

- 139.714285714286

- 221.466666666667

- 113.111111111111

- 114.525000000000

- 11/2002

- 210.747230739482

- 252.083133253301

- 146.142857142857

- 221.466666666667

- 113.111111111111

- 114.525000000000

- 12/2002

- 211.354948758322

- 252.083133253301

- 149.000000000000

- 221.466666666667

- 113.111111111111

- 114.525000000000

- 01/2003

- 218.165050689208

- 262.273709483794

- 155.571428571429

- 221.466666666667

- 115.777777777778

- 117.225000000000

- 02/2003

- 219.532416231596

- 260.172869147659

- 167.000000000000

- 221.466666666667

- 115.777777777778

- 117.225000000000

- 03/2003

- 219.532416231596

- 260.172869147659

- 167.000000000000

- 221.466666666667

- 115.777777777778

- 117.225000000000

- 04/2003

- 219.532416231596

- 260.172869147659

- 167.000000000000

- 221.466666666667

- 115.777777777778

- 117.225000000000

- 05/2003

- 220.228529598630

- 260.172869147659

- 167.000000000000

- 225.200000000000

- 115.777777777778

- 117.225000000000

- 06/2003

- 220.576586282147

- 260.172869147659

- 167.000000000000

- 227.066666666667

- 115.777777777778

- 117.225000000000

- 07/2003

- 222.883152399105

- 260.172869147659

- 172.000000000000

- 233.733333333333

- 115.777777777778

- 117.225000000000

- 08/2003

- 224.537802823126

- 260.172869147659

- 175.571428571429

- 238.533333333333

- 115.777777777778

- 117.225000000000

- 09/2003

- 230.487293168697

- 263.694777911164

- 192.000000000000

- 240.933333333333

- 119.777777777778

- 117.250000000000

- 10/2003

- 234.487182674512

- 263.694777911164

- 201.285714285714

- 250.200000000000

- 122.666666666667

- 120.750000000000

- 11/2003

- 242.683420347504

- 264.710384153661

- 217.285714285714

- 268.533333333333

- 133.555555555556

- 127.250000000000

- 12/2003

- 259.818927653932

- 288.928571428571

- 230.142857142857

- 273.866666666667

- 144.888888888889

- 140.500000000000

- 01/2004

- 263.476561420955

- 292.433973589436

- 235.285714285714

- 273.866666666667

- 150.666666666667

- 152.550000000000

- 02/2004

- 271.721361288362

- 304.762905162065

- 242.571428571429

- 273.866666666667

- 154.666666666667

- 158.500000000000

- 03/2004

- 276.038783459021

- 312.112845138055

- 243.142857142857

- 276

- 154.666666666667

- 160.5

- 04/2004

- 276.542913179194

- 312.112845138055

- 243.142857142857

- 276

- 154.666666666667

- 167.75

- 05/2004

- 276.732134471423

- 312.112845138055

- 240.714285714286

- 276

- 166.444444444444

- 174.75

- 06/2004

- 277.88610811856

- 312.112845138055

- 240.714285714286

- 279.733333333333

- 166.333333333333

- 186.75

- 07/2004

- 278.526974392973

- 312.112845138055

- 243.142857142857

- 279.733333333333

- 168.555555555556

- 186.75

- 08/2004

- 287.545509792547

- 326.866746698679

- 250.428571428571

- 279.733333333333

- 168.555555555556

- 186.75

- 09/2004

- 295.75799011077

- 338.60144057623

- 260.428571428571

- 279.733333333333

- 168.555555555556

- 190.5

- 10/2004

- 299.303886632966

- 344.05762304922

- 260.428571428571

- 279.733333333333

- 177.555555555556

- 197.75

- 11/2004

- 308.874754841026

- 352.767106842737

- 270.857142857143

- 291.866666666667

- 184.377777777778

- 205.5

- 12/2004

- 322.578588989254

- 370.77731092437

- 276.142857142857

- 303.066666666667

- 201.377777777778

- 216.4375

- 01/2005

- 329.78053092456

- 379.471788715486

- 276.142857142857

- 307.386666666667

- 230.777777777778

- 225.5

- 02/2005

- 346.51632551587

- 399.279711884754

- 285.857142857143

- 322.4

- 250.888888888889

- 244.0625

- 03/2005

- 362.092207397586

- 410.684273709484

- 296

- 352.506666666667

- 278.088888888889

- 257.25

- 04/2005

- 377.578243694926

- 432.03481392557

- 305.428571428571

- 357.746666666667

- 295

- 276.625

- 05/2005

- 398.73470346123

- 457.484993997599

- 327.142857142857

- 373.066666666667

- 295

- 297.25

- 06/2005

- 412.725546255628

- 465.340636254502

- 355.285714285714

- 389.44

- 306.555555555555

- 305.75

- 07/2005

- 425.703744371702

- 476.703931572629

- 377.428571428571

- 398.266666666667

- 306.555555555555

- 328.25

- 08/2005

- 440.382620645839

- 488.957833133253

- 402.142857142857

- 407.466666666667

- 306.555555555555

- 367.125

- 09/2005

- 468.700691969835

- 511.284513805522

- 448.491071428572

- 439.466666666667

- 312.388888888889

- 389.475

- 10/2005

- 491.17779895583

- 538.895558223289

- 476.178571428571

- 453.466666666667

- 312.388888888889

- 389.475

- 11/2005

- 506.221167923538

- 553.926320528211

- 493.116071428571

- 469

- 329.111111111111

- 389.475

- 12/2005

- 518.589334548769

- 566.375300120048

- 493.116071428571

- 494.933333333333

- 351.111111111111

- 389.475

- 01/2006

- 540.387247589846

- 596.788715486195

- 493.116071428571

- 517.2

- 391.333333333333

- 389.475

- 02/2006

- 568.898027678793

- 626.950780312125

- 509.196428571428

- 562

- 416.888888888889

- 390.475

- 03/2006

- 579.015892989289

- 641.619147659064

- 497.554135338346

- 581.453333333333

- 444.444444444444

- 390.475

- 04/2006

- 576.845303779047

- 639.990996398559

- 497.554135338346

- 570.333333333333

- 454.555555555555

- 394.65

- 05/2006

- 577.042052487646

- 641.514105642257

- 497.554135338346

- 567.253333333333

- 454.555555555555

- 394.65

- 06/2006

- 575.434625606446

- 636.920018007203

- 501.676315789474

- 564.826666666667

- 454.555555555555

- 402.25

- 07/2006

- 578.368660577856

- 637.865396158463

- 501.676315789474

- 572.8

- 454.555555555555

- 427.3

- 08/2006

- 581.463464588795

- 637.790366146459

- 501.676315789474

- 584.8

- 454.555555555555

- 450.45

- 09/2006

- 588.959668168515

- 645.145558223289

- 494.357330827068

- 607.453333333333

- 456.777777777778

- 475.825

- 10/2006

- 589.871245196774

- 646.946278511405

- 494.357330827068

- 607.453333333333

- 456.777777777778

- 475.825

- 11/2006

- 591.156430688888

- 648.341836734694

- 494.357330827068

- 607.453333333333

- 460.555555555556

- 485.325

- 12/2006

- 603.886218612745

- 653.879051620648

- 516

- 623.333333333333

- 489.166666666667

- 505.025

- 01/2007

- 621.430243639679

- 667.596788715486

- 542.714285714286

- 649.706666666667

- 489.166666666667

- 505.025

- 02/2007

- 639.7082869912

- 675.790066026411

- 570.149473684211

- 675.906666666667

- 520.444444444444

- 547.95

- 03/2007

- 669.239938123256

- 687.759603841537

- 601.428571428571

- 743.866666666667

- 558.5

- 600.15

- 04/2007

- 712.331652658621

- 733.478391356543

- 653.845864661654

- 779.466666666667

- 570.4

- 638.8

- 05/2007

- 737.161982294761

- 752.34843937575

- 692.534210526316

- 791.506666666667

- 603.111111111111

- 715.7

- 06/2007

- 745.409371869634

- 760.47043817527

- 694.677067669173

- 791.506666666667

- 624.444444444444

- 780

- 07/2007

- 757.542612954862

- 763.574429771909

- 727.404887218045

- 791.506666666667

- 639.277777777778

- 851.65

- 08/2007

- 774.548082417031

- 781.379051620648

- 727.404887218045

- 817.986666666667

- 693.888888888889

- 851.65

- 09/2007

- 781.012337548105

- 786.353541416567

- 727.404887218045

- 830.626666666667

- 716.888888888889

- 859.475

- 10/2007

- 786.974085842351

- 797.34168667467

- 733.176315789474

- 826

- 716.888888888889

- 860.3625

- 11/2007

- 794.655034609396

- 811.953031212485

- 728.906578947369

- 826

- 737.955555555556

- 860.725

- 12/2007

- 801.451704590888

- 822.088835534214

- 728.906578947369

- 826

- 768

- 860.3375

- 01/2008

- 797.437105546663

- 815.741296518608

- 726.278007518797

- 814.8

- 800.666666666667

- 860.825

- 02/2008

- 795.800306839445

- 813.738745498199

- 723.792293233083

- 814.32

- 800.666666666667

- 860.7

- 03/2008

- 789.406698928061

- 812.172118847539

- 721.349436090225

- 788.133333333333

- 800.666666666667

- 855.575

- 04/2008

- 777.265804121433

- 805.102791116447

- 698.924107142857

- 770.68

- 794.333333333333

- 850.825

- 05/2008

- 774.01603201569

- 800.904861944778

- 697.786607142857

- 770.68

- 794.333333333333

- 828

- 06/2008

- 761.388393967017

- 787.886404561825

- 694.203571428571

- 755.84

- 766.433333333333

- 803.5

- 07/2008

- 755.896315018922

- 779.716386554622

- 694.203571428571

- 754.013333333333

- 748.277777777778

- 803.5

- 08/2008

- 751.073520068506

- 774.614345738295

- 687.017857142857

- 754.013333333333

- 748.277777777778

- 785.1

- 09/2008

- 741.737866357283

- 766.422569027611

- 685.557142857143

- 730.413333333333

- 748.277777777778

- 772.75

- 10/2008

- 727.441921493881

- 743.650210084034

- 679.633928571429

- 725.12

- 745.366666666667

- 763.4875

- 11/2008

- 700.175651225104

- 719.879951980792

- 668.266071428571

- 670.2

- 710.666666666667

- 747.1

- 12/2008

- 679.648421314328

- 709.173169267707

- 644.571428571429

- 628.44

- 685

- 725.25

- 01/2009

- 652.801096654789

- 679.017106842737

- 619.571428571429

- 616.573333333333

- 625.555555555555

- 706.475

- 02/2009

- 633.210788376012

- 663.098739495798

- 618.533928571429

- 570.546666666667

- 583.333333333333

- 696.975

- 03/2009

- 603.439166045137

- 615.457683073229

- 614.601785714286

- 548.666666666667

- 579.555555555556

- 683.35

- 04/2009

- 584.446458661363

- 590.015756302521

- 604.339285714286

- 533.56

- 578.244444444444

- 656.45

- 05/2009

- 565.744316455347

- 571.360294117647

- 590.898214285714

- 507.773333333333

- 574.844444444444

- 620.225

- 06/2009

- 549.099196154802

- 550.77956182473

- 583.258928571429

- 497.946666666667

- 541.755555555556

- 596.475

- 07/2009

- 544.098160271816

- 544.99849939976

- 579.221428571429

- 491.693333333333

- 540.866666666667

- 596.475

- 08/2009

- 525.984779425983

- 525.229591836735

- 554.471428571429

- 488.653333333333

- 514.566666666667

- 575.7

- 09/2009

- 516.745497361951

- 514.22118847539

- 546.916071428571

- 488.52

- 508.233333333333

- 532.25

- 10/2009

- 507.425692660424

- 502.03556422569

- 542.791071428571

- 481.706666666667

- 503.433333333333

- 513.25

- 11/2009

- 501.609140631474

- 495.904861944778

- 536.985714285714

- 480.306666666667

- 500.444444444444

- 486.1

- 12/2009

- 497.22697577415

- 493.953331332533

- 534.782142857143

- 476.56

- 460.633333333333

- 486.1

- 01/2010

- 493.018424905389

- 491.835234093637

- 528.271428571428

- 470.6

- 449.188888888889

- 486.1

- 02/2010

- 486.211430623463

- 485.918367346939

- 513.039285714286

- 467.533333333333

- 449.188888888889

- 486.1

- 03/2010

- 483.057512223419

- 482.758853541417

- 507.473214285714

- 467.093333333333

- 448.3

- 479.925

- 04/2010

- 479.97178945333

- 479.84693877551

- 502.748214285714

- 463.84

- 448.3

- 479.925

- 05/2010

- 478.87061130908

- 478.501650660264

- 501.091071428571

- 463.84

- 448.3

- 478.175

- 06/2010

- 480.594424187177

- 483.509153661465

- 497.578571428571

- 460.813333333333

- 457.244444444445

- 478.175

- 07/2010

- 482.19386204801

- 487.288415366146

- 496.103571428571

- 460.813333333333

- 457.244444444445

- 478.175

- 08/2010

- 482.604209828458

- 488.383853541417

- 496.103571428571

- 460.04

- 457.244444444445

- 478.175

- 09/2010

- 481.833029474324

- 489.249699879952

- 493.082142857143

- 457

- 457.244444444445

- 478.175

- 10/2010

- 481.934442418718

- 490.615246098439

- 490.308928571429

- 457

- 457.244444444445

- 478.175

- 11/2010

- 481.366744012596

- 492.647058823529

- 489.871428571429

- 453.253333333333

- 446.922222222222

- 472.3

- 12/2010

- 482.433599900555

- 494.68637454982

- 490.423214285714

- 453.253333333333

- 446.477777777778

- 470.8

- 01/2011

- 481.203592442198

- 492.953181272509

- 489.951785714286

- 453.253333333333

- 443.522222222222

- 468.55

- 02/2011

- 481.122137510014

- 492.799369747899

- 489.951785714286

- 452.84

- 443.522222222222

- 470.45

- 03/2011

- 480.388318002265

- 493.665966386555

- 484.439285714286

- 452.84

- 443.522222222222

- 470.45

- 04/2011

- 480.736754509544

- 497.34618847539

- 482.689285714286

- 448.36

- 438.033333333333

- 470.45

- 05/2011

- 481.001491671501

- 498.420618247299

- 481.376785714286

- 448.36

- 438.033333333333

- 470.45

- 06/2011

- 481.693496036021

- 500.951380552221

- 480.519642857143

- 447.373333333333

- 437.333333333333

- 465.7

- 07/2011

- 482.041414601807

- 500.918367346939

- 482.233928571428

- 447.373333333333

- 437.333333333333

- 465.7

- 08/2011

- 482.182329217425

- 501.202731092437

- 482.219642857143

- 447.373333333333

- 437.333333333333

- 465.7

- 09/2011

- 482.178530979807

- 500.981392557023

- 482.728571428571

- 447.373333333333

- 437.333333333333

- 465.7

- 10/2011

- 481.372683075053

- 500.103541416567

- 482.542857142857

- 446.28

- 435.222222222222

- 465.7

- 11/2011

- 479.826869423497

- 498.44087635054

- 482.085714285714

- 443.773333333333

- 433.333333333333

- 464.825

- 12/2011

- 479.32115134941

- 498.157262905162

- 481.942857142857

- 444.386666666667

- 427

- 462.45

- 01/2012

- 479.140355238806

- 497.800120048019

- 481.942857142857

- 444.386666666667

- 427

- 462.45

- 02/2012

- 479.264799314936

- 498.840036014406

- 480.082142857143

- 444.386666666667

- 426.888888888889

- 462.45

- 03/2012

- 479.159277368028

- 499.245198079232

- 478.832142857143

- 444.146666666667

- 426.888888888889

- 462.45

- 04/2012

- 478.492237783487

- 498.041716686675

- 478.607142857143

- 444.093333333333

- 426.888888888889

- 462.45

- 05/2012

- 477.071627855584

- 496.150960384154

- 478.178571428571

- 443.133333333333

- 423.433333333333

- 462.45

- 06/2012

- 476.68451838347

- 495.93712484994

- 477.942857142857

- 442.92

- 420.055555555555

- 462.45

- 07/2012

- 476.108084030828

- 495.094537815126

- 477.301785714286

- 442.92

- 420.055555555555

- 462.1

- 08/2012

- 475.789584541863

- 495.024009603842

- 475.726785714286

- 443.2

- 420.055555555555

- 462.1

- 09/2012

- 474.147019419353

- 493.232292917167

- 472.873214285714

- 443.2

- 420.055555555555

- 458.775

- 10/2012

- 473.015075550399

- 492.831632653061

- 470.094642857143

- 441.333333333333

- 420.233333333333

- 458.775

- 11/2012

- 471.926604237452

- 491.88100240096

- 468.1125

- 441.333333333333

- 420.233333333333

- 453.975

- 12/2012

- 471.313465097649

- 491.237244897959

- 467.675

- 441.333333333333

- 419.388888888889

- 450.175

- 01/2013

- 471.022968978758

- 491.180972388956

- 466.875

- 441.333333333333

- 419.388888888889

- 447.8

- 02/2013

- 471.088367724648

- 492.310924369748

- 465.410714285714

- 440.986666666667

- 419.388888888889

- 444.425

- 03/2013

- 471.66228142869

- 493.644957983193

- 464.933928571429

- 440.986666666667

- 419.388888888889

- 444.425

- 04/2013

- 472.31291953261

- 495.450180072029

- 463.696428571429

- 440.986666666667

- 419.388888888889

- 444.425

- 05/2013

- 472.155983260131

- 495.964885954382

- 460.108928571429

- 442.84

- 419.388888888889

- 444.425

- 06/2013

- 472.359603325875

- 496.526860744298

- 460.283928571429

- 442.84

- 417.277777777778

- 444.425

- 07/2013

- 472.5051448855

- 496.837484993998

- 460.439285714286

- 442.6

- 417.277777777778

- 444.425

- 08/2013

- 473.205056490152

- 497.996698679472

- 460.123214285714

- 442.6

- 420.233333333333

- 444.8125

- 09/2013

- 473.567235711721

- 499.200180072029

- 459.335714285714

- 441.666666666667

- 421.922222222222

- 444.8125

- 10/2013

- 474.11853263722

- 500.757052821128

- 457.876785714286

- 441.666666666667

- 421.922222222222

- 446.7125

- 11/2013

- 475.999178199497

- 503.789765906363

- 459.451785714286

- 441.666666666667

- 422.35

- 446.3625

- 12/2013

- 476.692218447004

- 504.746398559424

- 459.3375

- 442.6

- 423.405555555556

- 446.3625

- 01/2014

- 478.291794425568

- 507.530012004802

- 458.408928571429

- 444

- 425.233333333333

- 447

- 02/2014

- 481.547091240574

- 512.309423769508

- 459.510714285714

- 445.96

- 427.594444444444

- 449.6875

- 03/2014

- 485.276166404243

- 518.576680672269

- 460.282142857143

- 447.173333333333

- 429.25

- 451.5875

- 04/2014

- 490.506063368415

- 526.793967587035

- 461.707142857143

- 449.84

- 430.805555555556

- 456.3125

- 05/2014

- 492.046317781277

- 529.53856542617

- 462.144642857143

- 450.106666666667

- 430.95

- 456.3125

- 06/2014

- 493.375459241457

- 531.884753901561

- 462.144642857143

- 450.813333333333

- 430.95

- 456.5625

- 07/2014

- 493.88998232093

- 531.890006002401

- 464.428571428571

- 450.813333333333

- 431.2

- 456.875

- 08/2014

- 495.329963260683

- 534.164915966387

- 465.566071428571

- 450.813333333333

- 431.2

- 458.075

- 09/2014

- 494.983563989945

- 533.230792316927

- 465.566071428571

- 451.746666666667

- 430.35

- 458.075

- 10/2014

- 494.257444545731

- 532.699579831933

- 464.6

- 450.44

- 430.205555555556

- 458.075

- 11/2014

- 492.958999751388

- 531.302521008403

- 463.785714285714

- 448.946666666667

- 427.883333333333

- 457.825

- 12/2014

- 492.59885776636

- 530.682773109244

- 463.785714285714

- 448.946666666667

- 427.883333333333

- 456.625

- 01/2015

- 492.530902533079

- 530.454080432173

- 463.709452285714

- 448.975543466667

- 427.265288888889

- 456.790868

- 02/2015

- 493.09374698489

- 531.53618607443

- 464.200867142857

- 448.975543466667

- 427.265288888889

- 456.721988

- 03/2015

- 493.242761730339

- 531.814679471789

- 463.855239714286

- 448.975543466667

- 428.723137777778

- 456.721988

- 04/2015

- 495.221085279412

- 535.695452581032

- 463.608963142857

- 449.205730133333

- 429.138353777778

- 456.721988

- 05/2015

- 495.626325024171

- 536.495959183673

- 463.608963142857

- 449.205730133333

- 429.138353777778

- 456.721988

- 06/2015

- 496.406831059915

- 538.093284513805

- 463.777498285714

- 448.8263552

- 428.919676444444

- 457.2137

- 07/2015

- 497.787978149775

- 540.567342136855

- 463.861341428571

- 449.30704

- 429.299484444444

- 457.2137

- 08/2015

- 500.791348316345

- 545.5361825

- 464.2426909

- 451.4892096

- 429.2994844

- 457.2137

- 09/2015

- 501.707054225021

- 547.186417767107

- 464.193365142857

- 451.4892096

- 430.803370666667

- 457.38634

- 10/2015

- 502.526761592221

- 548.283293157263

- 464.250089714286

- 452.8427072

- 430.803370666667

- 457.38634

- 11/2015

- 503.187282108229

- 549.133021848739

- 464.669358285714

- 452.8427072

- 432.587317333333

- 458.456708

- 12/2015

- 503.854498925444

- 549.710733733493

- 465.359918285714

- 453.901565866667

- 433.027157333333

- 458.607768

- 01/2016

- 505.013645877186

- 550.946208163265

- 466.155964

- 455.199818666667

- 435.213930666667

- 458.607768

- 02/2016

- 507.66556807823

- 555.247182472989

- 467.665518857143

- 455.360949333333

- 435.213930666667

- 461.801608

- 03/2016

- 509.100991873153

- 556.997157262905

- 468.80186

- 455.7844928

- 438.129628444444

- 463.502112

- 04/2016

- 511.972906704235

- 560.553841776711

- 472.153301714286

- 456.880744533333

- 439.829173333333

- 465.029976

- 05/2016

- 516.542526913621

- 566.086145498199

- 475.328404571429

- 459.912302933333

- 445.652896

- 470.2696

- 06/2016

- 519.9048961

- 570.424425

- 478.495732

- 461.2473856

- 448.933056

- 471.82336

- 07/2016

- 521.781672351592

- 573.411169507803

- 479.066677142857

- 461.546628266667

- 452.286108444444

- 471.82336

- 08/2016

- 524.099980652468

- 577.349195678271

- 480.034265714286

- 461.942549333333

- 452.286108444444

- 472.99044

- 09/2016

- 525.862231076489

- 580.009779111645

- 481.017697142857

- 462.287829333333

- 452.631388444444

- 476.158384

- 10/2016

- 527.403203193282

- 581.555093637455

- 483.377932571428

- 463.4848

- 453.229873777778

- 476.158384

- 11/2016

- 529.403172807381

- 584.80090180072

- 483.926064571429

- 464.4653952

- 453.229873777778

- 477.643088

- 12/2016

- 531.625207602

- 587.27547755102

- 485.270190285714

- 466.108928

- 456.836131555555

- 482.174888

- 01/2017

- 533.140582149664

- 589.872590396158

- 486.286802857143

- 466.201002666667

- 456.214627555556

- 482.22668

- 02/2017

- 534.442368630701

- 591.465831692677

- 486.899058285714

- 467.075712

- 457.795242666667

- 485.16156

- 03/2017

- 537.407867539571

- 594.92303577431

- 489.922724571428

- 469.101354666667

- 461.117603555555

- 485.385992

- 04/2017

- 538.072513179194

- 595.63416542617

- 490.721184571428

- 470.114176

- 461.255715555556

- 483.789072

- 05/2017

- 539.391122057402

- 596.981296278511

- 493.419301142857

- 470.114176

- 461.900238222222

- 484.479632

- 06/2017

- 541.415031695257

- 599.163648259304

- 495.616761714286

- 471.159223466667

- 464.075502222222

- 487.975592

- 07/2017

- 543.925050191984

- 602.399352941176

- 497.014529142857

- 474.087197866667

- 464.589585777778

- 487.975592

- 08/2017

- 545.058576934339

- 603.162295318127

- 499.679967428571

- 475.146056533333

- 464.934865777778

- 487.034704

- 09/2017

- 547.812919587857

- 606.258105642257

- 502.580319428571

- 477.2407552

- 467.371008

- 488.156864

- 10/2017

- 549.180696124416

- 607.34487755102

- 505.457858285714

- 477.415697066667

- 467.409372444444

- 492.878568

- 11/2017

- 550.40064778321

- 608.335795918367

- 507.519673142857

- 478.364066133333

- 467.785344

- 494.691288

- 12/2017

- 550.626194281926

- 608.335277791116

- 508.580176

- 477.4203008

- 469.312248888889

- 497.039192

- 01/2018

- 551.443302582802

- 608.859363505402

- 509.325610857143

- 478.046408533333

- 472.005432888889

- 500.293456

- 02/2018

- 551.736412883622

- 608.051084993998

- 510.560603428571

- 479.247982933333

- 474.038748444444

- 502.926216

- 03/2018

- 552.388960658545

- 608.995630972389

- 511.461414285714

- 478.769851733333

- 475.300938666667

- 502.960744

- 04/2018

- 553.761160376785

- 609.026718607443

- 514.188509714286

- 481.076322133333

- 478.604117333333

- 507.138632

- 05/2018

- 556.704746056739

- 611.750772629052

- 515.552365714286

- 485.095381333333

- 483.008355555556

- 514.346352

- 06/2018

- 558.262814784122

- 612.863969027611

- 517.167782857143

- 486.453482666667

- 485.690030222222

- 520.751296

- 07/2018

- 559.682775326649

- 613.951

- 518.71846

- 486.522538666667

- 489.357671111111

- 529.072544

- 08/2018

- 562.501975415044

- 617.147845138055

- 520.816036

- 488.649463466667

- 492.185130666667

- 534.243112

- 09/2018

- 565.221171061573

- 619.976819927971

- 522.978968571428

- 489.542587733333

- 497.356657777778

- 543.841896

- 10/2018

- 568.526968824066

- 622.023422569028

- 526.342982285714

- 494.086472533333

- 504.642065777778

- 551.5848

- 11/2018

- 571.248060119886

- 625.318711884754

- 528.361020571429

- 495.1177088

- 509.537368888889

- 555.659104

- 12/2018

- 572.336830463247

- 626.775167587035

- 529.690348571429

- 495.232802133333

- 510.949180444444

- 554.839064

- 01/2019

- 573.438178856938

- 628.149759183673

- 531.204031428571

- 494.947370666667

- 511.919800888889

- 556.971168

- 02/2019

- 576.464445844037

- 631.211891236494

- 533.428621142857

- 497.055880533333

- 519.6464

- 561.563392

- 03/2019

- 579.947206640701

- 634.625313565426

- 536.481266285714

- 499.3025024

- 524.794908444444

- 571.87

- 04/2019

- 581.770320521533

- 635.825814405762

- 540.316340571428

- 499.3025024

- 527.929283555555

- 577.670704

- 05/2019

- 584.890296964172

- 639.083539495798

- 543.439274857143

- 501.2636928

- 531.681326222222

- 583.644048

- 06/2019

- 589.544926692633

- 644.112741656663

- 545.662631428571

- 505.554372266667

- 540.021756444444

- 593.19104

- 07/2019

- 594.441400734786

- 649.253082112845

- 551.153816571428

- 507.414280533333

- 546.294343111111

- 604.274528

- 08/2019

- 598.762205430789

- 653.644469627851

- 554.088696571428

- 513.5832832

- 551.834168888889

- 604.619808

- 09/2019

- 601.072703859009

- 656.640540456182

- 557.205465142857

- 513.5832832

- 552.854663111111

- 606.52748

- 10/2019

- 603.711256915555

- 658.354505402161

- 560.966550857143

- 518.3481472

- 552.854663111111

- 608.659584

- 11/2019

- 607.24862194967

- 662.101860744298

- 563.610409142857

- 521.009105066667

- 559.687370666667

- 613.82152

- 12/2019

- 613.350514339383

- 669.931281632653

- 566.732726857143

- 523.214293333333

- 569.197916444444

- 627.555032

- 01/2020

- 616.856320985608

- 672.861032172869

- 571.717706857143

- 525.470122666667

- 574.162275555556

- 634.382944

- 02/2020

- 620.123812325626

- 677.92287635054

- 574.518174285714

- 525.341218133333

- 575.723708444444

- 635.57416

- 03/2020

- 620.912092450485

- 679.07363697479

- 575.475093142857

- 524.9775232

- 577.273632

- 635.14256

- 04/2020

- 621.400633463164

- 679.763264345738

- 575.846885714286

- 524.890052266667

- 577.170048

- 637.274664

- 05/2020

- 621.467470003591

- 680.12413997599

- 575.499756

- 524.181077333333

- 578.919466666667

- 637.076128

- 06/2020

- 622.742943918676

- 681.890953901561

- 575.616904571429

- 525.1432576

- 581.374791111111

- 638.094704

- 07/2020

- 623.29660465733

- 682.641202160864

- 576.712552

- 524.3836416

- 581.374791111111

- 640.226808

- 08/2020

- 624.18800095025

- 683.845848019208

- 576.644112571429

- 524.959108266667

- 584.601240888889

- 640.442608

- 09/2020

- 626.285662075633

- 686.574306122449

- 578.227468

- 525.8200064

- 584.532184888889

- 646.208784

- 10/2020

- 628.635575702329

- 688.930748859544

- 580.227625714286

- 529.070242133333

- 586.776504888889

- 646.208784

- 11/2020

- 632.327191746084

- 692.822920768307

- 583.983162285714

- 532.6841728

- 587.562976

- 651.5002

- 12/2020

- 638.2874707881

- 701.772532773109

- 585.978387428571

- 536.9656448

- 591.353383111111

- 651.37072

- 01/2021

- 647.278022717604

- 710.362046338535

- 593.999981714285

- 544.156676266667

- 607.029095111111

- 669.946784

- 02/2021

- 653.028898085688

- 716.381648739496

- 596.313357714286

- 548.755805866667

- 620.46816

- 685.518912

- 03/2021

- 665.734863014834

- 732.191006482593

- 603.501347428571

- 557.346372266667

- 637.371534222222

- 701.721176

- 04/2021

- 675.100801193337

- 742.070915966386

- 613.533581142857

- 565.3752832

- 642.105706666667

- 713.840504

- 05/2021

- 693.556699627082

- 759.350459783913

- 634.228184571428

- 584.5728512

- 658.725184

- 734.462352

- 06/2021

- 707.301861882268

- 775.326913565426

- 647.777341714286

- 593.6882432

- 671.435324444444

- 743.897128

- 07/2021

- 718.682803723654

- 788.044606002401

- 659.116090285714

- 602.5964672

- 679.369091555555

- 754.920192

- 08/2021

- 736.035505803707

- 808.495088595438

- 677.155737142857

- 614.064366933333

- 690.383523555555

- 765.48576

- 09/2021

- 747.719834987984

- 823.156794477791

- 690.829441714286

- 618.695722666667

- 695.804419555555

- 770.31968

- 10/2021

- 759.6062356178

- 840.739183673469

- 697.642556

- 624.2524288

- 699.982307555556

- 777.216648

- 11/2021

- 772.772485655092

- 856.000103721488

- 711.126973142857

- 633.9202688

- 710.022282666667

- 782.603016

- 12/2021

- 781.221752216789

- 865.010854741897

- 720.677048

- 641.3783168

- 713.551811555555

- 789.543144

- 01/2022

- 793.858090782022

- 879.648467707083

- 731.918994857143

- 648.357576533333

- 733.685472

- 800.082816

- 02/2022

- 800.325795795696

- 887.792909963986

- 737.547675428571

- 650.944874666667

- 743.295765333333

- 803.38024

- 03/2022

- 806.46067725201

- 894.614314285714

- 742.947608

- 657.942549333333

- 743.295765333333

- 809.284528

- 04/2022

- 819.25051572056

- 910.005025210084

- 754.698842857143

- 665.5479168

- 752.810147555556

- 823.475536

- 05/2022

- 833.283602066241

- 923.778142857143

- 769.134013142857

- 672.131255466667

- 781.445368888889

- 853.497632

- 06/2022

- 857.085195734924

- 956.554872749099

- 782.649875428571

- 688.451490133333

- 790.503214222222

- 873.782832

- 07/2022

- 879.004159288417

- 986.832933973589

- 796.752097142857

- 703.105173333333

- 798.306542222222

- 884.719576

- 08/2022

- 898.019321952432

- 1013.60068307323

- 808.495316571428

- 715.7240064

- 802.357827555555

- 894.732696

- 09/2022

- 917.713568188724

- 1037.7220972389

- 824.114304

- 731.210965333333

- 816.272611555555

- 907.533952

- 10/2022

- 930.570219353056

- 1055.11433373349

- 834.727348

- 739.7693056

- 818.236871111111

- 909.838696

- 11/2022

- 930.522279693931

- 1054.08844177671

- 835.319873142857

- 739.318139733333

- 824.214051555555

- 912.298816

- 12/2022

- 930.407944620314

- 1055.28790636254

- 833.979446857143

- 736.8689536

- 822.875132444444

- 914.758936

- 01/2023

- 929.835649291456

- 1053.03923409364

- 835.339603428572

- 738.834747733333

- 823.143683555555

- 912.048488

- 02/2023

- 930.756994458716

- 1054.08351956783

- 836.901995428571

- 738.254677333333

- 826.496736

- 911.556464

- 03/2023

- 931.630817248142

- 1054.50967923169

- 840.178456

- 737.384571733333

- 828.798602666667

- 911.418352

- 04/2023

- 934.091918455291

- 1057.00964321729

- 843.363664

- 739.842965333333

- 830.939338666667

- 909.864592

- 05/2023

- 936.093342592746

- 1059.51219783914

- 847.860936

- 739.4102144

- 826.592647111111

- 912.497352

- 06/2023

- 934.928972801856

- 1057.01611980792

- 849.798203428571

- 737.4075904

- 826.899562666667

- 913.619512

- 07/2023

- 938.097043893815

- 1060.04457358944

- 852.913122285714

- 737.775889066667

- 838.723484444444

- 919.886344

- 08/2023

- 941.691647998674

- 1065.51470204082

- 851.139246285714

- 741.085973333333

- 844.017777777778

- 927.370288

- 09/2023

- 941.654116527168

- 1064.60279807923

- 850.427722857143

- 742.743317333333

- 846.530648888889

- 930.624552

- 10/2023

- 941.016761083948

- 1063.17017623049

- 849.419628571428

- 745.247748266667

- 846.254424888889

- 926.766048

- 11/2023

- 942.012167719124

- 1062.82303097239

- 851.276125142857

- 748.9537536

- 848.345287111111

- 925.946008

- 12/2023

- 946.43909300848

- 1067.28540192077

- 856.473205714286

- 754.841928533333

- 842.813134222222

- 933.03288

- 01/2024

- 949.211998718267

- 1069.70117022809

- 860.746045714286

- 759.5055104

- 842.375779555556

- 927.758728

- 02/2024

- 951.494455843761

- 1072.99645954382

- 863.551445714286

- 760.103995733333

- 840.545795555555

- 927.974528

- 03/2024

- 953.697438766885

- 1074.99124945978

- 862.721540571428

- 765.343044266667

- 844.244128

- 932.782552

- 04/2024

- 960.086301461286

- 1079.87330348139

- 870.748684

- 773.9934592

- 851.284003555556

- 938.03944

- 05/2024

- 961.311296262534

- 1079.02590636254

- 871.046488

- 777.6534272

- 859.624433777778

- 949.459576

- 06/2024

- 965.405684130273

- 1083.88749435774

- 876.831161142857

- 776.815547733333

- 867.692476444444

- 952.247712

- 07/2024

- 968.150822750753

- 1083.47713757503

- 883.006740571429

- 784.5037824

- 867.623420444444

- 957.668608

- 08/2024

- 969.508334167564

- 1086.1773577431

- 882.480188571428

- 783.527790933333

- 872.710545777778

- 957.668608

- 09/2024

- 970.242057744261

- 1084.7991392557

- 885.383006857143

- 786.4373504

- 872.676017777778

- 964.738216

- 10/2024

- 972.999822104362

- 1086.86905762305

- 890.199046285714

- 788.670161066667

- 876.205546666667

- 966.594096

- 11/2024

- 975.489536885721

- 1090.86381872749

- 891.286678285714

- 790.4564096

- 875.039267555555

- 965.774056

- 12/2024

- 980.448400441977

- 1096.90777310924

- 897.473972571428

- 791.450816

- 879.781112888889

- 969.20096

- 01/2025

- 986.808458805005

- 1103.80534213685

- 897.625032571428

- 801.473143466667

- 888.374748444444

- 981.786416

- 02/2025

- 990.47242698268

- 1106.80270828331

- 898.879138857143

- 807.536260266667

- 895.886506666666

- 990.297568

- 03/2025

- 995.077161791111

- 1110.85575870348

- 910.613109714286

- 806.4083456

- 899.354652444444

- 992.196608

- 04/2025

- 1007.43097707798

- 1126.11590156062

- 920.164417714286

- 812.052522666667

- 916.119914666667

- 1007.889584

- 05/2025

- 1023.17315221127

- 1140.40973709484

- 940.808462285714

- 828.6581888

- 924.828643555555

- 1021.64036