In 2024, Lithuanian investment transactions market slumped by 43%

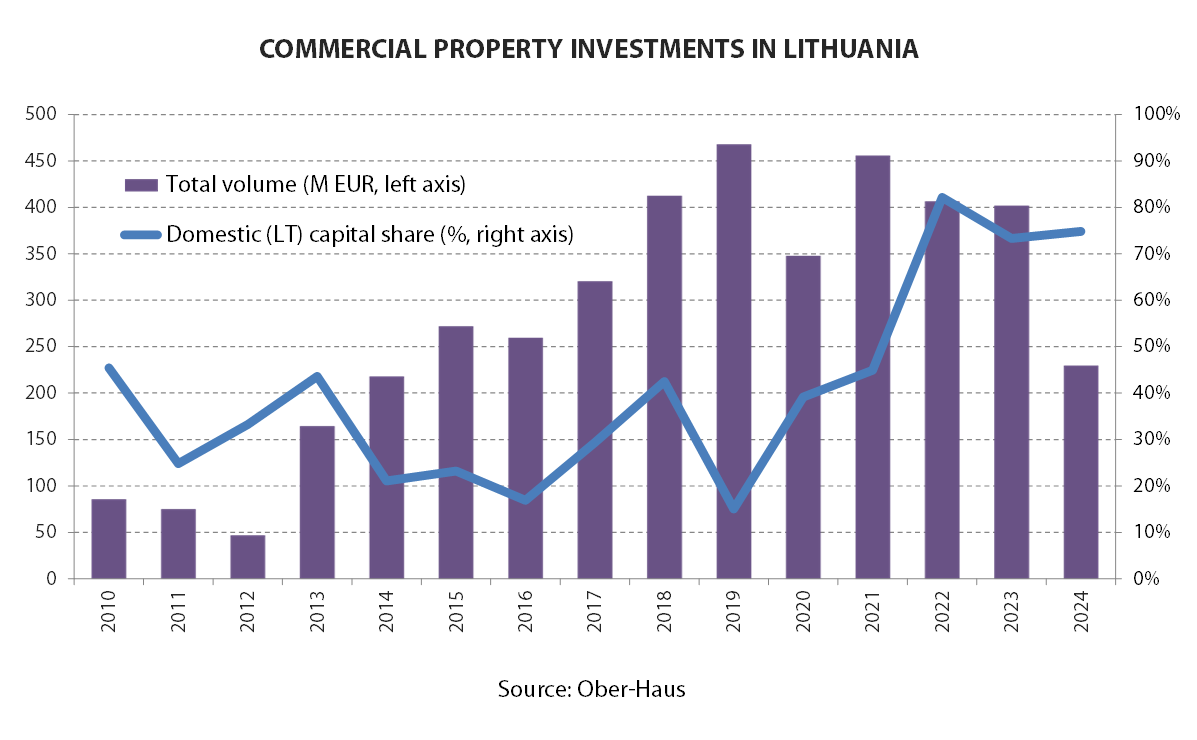

The general sentiment in the Lithuanian commercial property market in 2024 is well reflected in the volume of investments, which has declined to the levels last seen in 2014. According to the data of Ober-Haus, in 2024, the value of modern cash-flow commercial property (modern office, retail and industrial objects with the value of at least EUR 1.5 million) acquired amounted to EUR 230 million. This means that the annual volume of investments declined by 43% compared to 2023 or 2022.

‘In 2024, only small and medium-sized transactions were recorded in Lithuania, whereas there had been no acquisitions of larger transactions at all. For the first time after a lengthy period, the value of the largest deal did not exceed EUR 30 million‘, said Raimondas Reginis, head of market research for the Baltics at Ober-Haus. According to Ober-Haus, deals up to EUR 10 million in value represented 40% of total investments in Lithuania, whereas deals valued at EUR 10–30 million – the rest (60%).

Retail properties attracted the largest share of investments, with investors primarily focusing on supermarkets

The largest portion of investments befell to retail properties with EUR 134 million or 58% of all investments in commercial property in Lithuania spent for acquisitions. In 2024, this segment was noted for the most significant acquisitions as well as the biggest number of deals.

For example, a fund managed by Estonian company Eften Capital purchased Una retail park, opened in the middle of 2023, at the northern part of Vilnius (nearby Molėtų Road). In the meantime, a fund of Latvian investment management company, Provendi Asset Management, bought in Panevėžys the DYI shopping centre of the construction materials and household products chain Depo. Besides these larger transactions, in the retail segment, buyers were especially actively seeking small-format supermarkets (1,500–2,500 sqm), operated by the major grocery store chains. During 2024, as many as 10 objects of such format were purchased, while the largest transaction involved the sales of four newly constructed Lidl stores to a fund managed by the investment management company, DIFF Assets.

‘Broad geographical distribution also suggests that this kind of property remains particularly attractive to investors. Stores were purchased in the largest cities as well as in smaller towns of the country: Panevėžys, Molėtai, Alytus, Marijampolė, Prienai, Jurbarkas, and Vilnius and Klaipėda districts. This indicates that investors trust in the continued success of their tenants’ operations in such properties and are paying record-high prices for them, even during a period of weak market activity’, Mr Reginis said.

In 2024, office segment attracted EUR 70 million in investment

The second largest share of investments in 2024 went to the segment of office premises, with EUR 70 million spent or 31% of total investment in commercial property made in Lithuania.

The largest transaction in the office segment was concluded in the second half of the year, when the sale of a complex of administrative buildings on A. Juozapavičiaus Street and Žvejų Street in Vilnius was announced. Buildings with 16,000 sqm of floor space and a land plot in the central part of the city were bought by the real estate developer Realco, which sees new development opportunities in this area. In the middle of 2024, a fund of investment management company ZeroSum Asset Management purchased a complex of three office buildings from the Norwegian capital company AMG Property in Švitrigailos Street, in Vilnius. In the meantime, at the beginning of the year, a real estate development company Eriadas together with the closed-end investment fund for informed investors DIFF Develop acquired the buildings of the insurance company Ergo in Geležinio Vilko Street, in Vilnius.

‘The number of investment deals made and prices of property acquired in the recent years suggest that investors are still wary of the office segment. The slowing expansion of the business and growing level of vacant office premises reduced the attractiveness of this segment and led the investors to approach the assessments of this real estate segment more conservatively’, Mr Reginis explained. This is particularly the case in the capital city of the country, where office development has not stopped and the vacancy rate of premises over the last two years hopped from 5.9% to 8.8%, while the total area of vacant premises for the first time in history exceeded 100,000 sqm.

The remaining (11%) smallest share of investments traditionally went to the acquisition of warehousing and manufacturing premises. The largest deal of 2024 was concluded in Kaunas, where the fund of the investment company Eika Asset Management sold a 5,600 sqm logistics building to its tenant, Camelia pharmacy chain. Other smaller acquisitions were carried out in Vilnius and Kaunas and Klaipėda regions.

Local capital continues dominating the investment market

The most recent annual data suggest that local capital retains its predominant position in the commercial real estate transactions’ market. Sharp growth of local capital investments share recorded in the Lithuanian investment transactions’ market since 2022 remained at record high in 2024, too. According to Ober-Haus data, in 2022, the share of capital held by Lithuanians in investment transactions shot to 82%, in 2023 accounted for 73%, and in 2024 – for 75%. ‘For instance, over the period of 2012–2021, the share of local investors comprised 37% in total investments. This suggests that foreign investors have not yet returned to our country’s real estate market, and currently, only investors from other Baltic States – Latvia and Estonia – are interested in investing’, the analyst said.

More positive changes can finally be expected after a deep fall

Recent prices of commercial real estate suggest that there is still a wide variation in prices, both across individual segments and in terms of the quality of the properties. According to Mr Reginis, buyers are especially cautious about the prospects – potential lease revenues and likely additional investments – of older objects and those located in smaller towns of the country. Consequently, they seek to acquire such objects with the maximum yield possible that might even reach double figures (e.g. 10–11%). ‘In the meantime, new objects in the capital or strategically attractive locations of other cities receive greater interest from the buyers. Fully occupied objects guarantee for the buyers an indexed cash flow and minimum investments to the object maintenance in the medium or lengthier period; hence, such objects even now can be acquired with a 6.5–7.0% yield. Smaller objects, such as stand-alone supermarkets, can be bought with a yield slightly below 6.0%’, the representative of Ober-Haus explained.

In view of the overall situation in the commercial real estate market and specifically in the investment transactions’ market in 2024, more positive developments can be expended in 2025.

‘Irrespective of the persisting geopolitical tensions, the growing economy of the country and decreasing interest rates might enliven the business (tenants) expansion and boost up the overall activity of the commercial real estate market – in particular, in the segment of office or warehousing premises. For instance, as of the middle of 2024, clear positive trends have been seen in the housing market. This would enhance the investor confidence in the commercial real estate market, and higher activity could be expected in the investment transactions’ market as well. We are unlikely to see a more active return of foreign investors to our market; however, local investors should act with more courage’, Mr Reginis said.

Latest news

All news

All news

Rising house prices are not putting buyers off – transaction volumes remain strong

[caption id="attachment_69929" align="aligncenter" width="2048"] Edita Juočytė, Investment and Analysis Project Manager at Ober-Haus[/caption] The housing market continues to be boosted by loosening monetary conditions, positive population expectations and the outlook for price growth, as reflected in real transaction numbers. According to data from the State Enterprise Centre of Registers, an average of around 3,100 flats and 1,100 houses were registered for sale and purchase transactions per month in Lithuania in the second quarter of 2025, which is 27% and 17% more than in the same period of the previous year, respectively. Compared to the first quarter of this year, the total number of registered apartment and house transactions increased by 9% in Vilnius, 12% in Kaunas, 5% in Klaipėda and 4% in Šiauliai. In Panevėžys, housing market activity remained stable with 320 transactions in both quarters of the year. The increasing activity of homebuyers creates favourable conditions for house price growth. According to Ober-Haus, apartment prices in the country's major cities grew by 6.7% year on year at the end of the first half of 2025. In the second quarter of this year, apartment prices increased in all major Lithuanian cities: by 1.4% in Vilnius, by 3.3% in Kaunas, by…

Lithuania’s investment transaction market has been revitalised by local buyers

[caption id="" align="aligncenter" width="2000"] VMG TECHNICS building, company photo[/caption] Following an unsuccessful 2024, the Lithuanian commercial real estate investment market has shown growth in the first half of 2025. According to Ober-Haus, 183 million euros' worth of modern commercial property (offices, retail outlets, warehouses, industrial buildings and premises valued at at least 1.5 million euros) was acquired in Lithuania in the first half of 2025. Investment volumes in the first half of 2025 were 137% higher than in the first half of 2024, and 21% higher than in the second half of 2024. However, despite the recorded growth in volume, the investment transaction market remains largely dominated by local capital and small-to-medium-sized transactions, according to the Ober-Haus market review. Interest in small-format shops remains very high In the first half of 2025, the average value of an acquired property was just over €7 million, similar to 2024. The value of the largest transaction did not exceed €30 million. "The largest share of investments went to retail properties, with €86 million, or 47% of all investments in commercial real estate in Lithuania, being spent there. This segment also saw the largest investment transaction in the first half of this year," says…

The return of buyers to the housing market has caused prices to rise more quickly

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.7% in June 2025. The annual apartment price growth in the biggest cities of Lithuania was 6.7% (a 6.4% increase was recorded in May 2025). In June 2025 apartment prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys increased by 0.6%, 1.0%, 0.9%, 0.5% and 0.7%, respectively, with the average price per square meter reaching EUR 2,768 (+17 EUR/sqm), EUR 1,926 (+19 EUR/sqm), EUR 1,816 (+16 EUR/sqm), EUR 1,212 (+7 EUR/sqm) and EUR 1,192 (+8 EUR/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 5.8% in Vilnius, 8.4% in Kaunas, 7.6% in Klaipėda, 7.2% in Šiauliai and 8.1% in Panevėžys. "The country's housing market is showing an impressive recovery this year, characterised by increased sales volumes and accelerated price growth. Although the number of housing transactions fell by 13% in June compared to May, the annual growth rate remains in double digits. According to data from the State Enterprise Centre of Registers, the number of houses purchased in June this year was 13%…

All news

All news