The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.1% in April 2020. The annual apartment price growth in the major cities of Lithuania was 6.8% (the annual apartment price growth in March 2020 was 7.1%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.1% in April 2020. The annual apartment price growth in the major cities of Lithuania was 6.8% (the annual apartment price growth in March 2020 was 7.1%).

In April 2020 apartment prices in Vilnius and Kaunas grew by 0.1% respectively with the average price per square meter reaching EUR 1,640 (+2 EUR/sqm) and EUR 1,167. In Panevėžys price grew by 0.3% with the average price per square meter reaching EUR 738 (+2 EUR/sqm). Meanwhile in Klaipėda and Šiauliai apartment prices remained stable and were the same as in last month EUR 1.140 and EUR 752.

In the past 12 months, the prices of apartments grew in all major cities: 6.9% in Vilnius, 6.6% in Kaunas, 5.1% in Klaipėda, 9.3% in Šiauliai and 10.3% in Panevėžys.

Over the last few months, there have been clear trends in apartment sales prices – the relatively rapid and steady growth in apartment sales prices recorded in the country’s major cities at the beginning of this year has now come to a virtual halt. Due to the restrictions imposed by the coronavirus and the sharp decline in the population’s expectations regarding the country’s economic and financial situation, this April the overall housing market activity in Lithuania fell to the level of 2012,” says Raimondas Reginis, Ober-Haus Research Manager for the Baltics. According to the State Enterprise Centre of Registers, the number of apartment transactions concluded in April 2020, compared to the monthly average in 2019, decreased by 23% in Vilnius, and by 29%, 55%, 57% and 58% in Kaunas, Klaipėda, Šiauliai and Panevėžys respectively.

The numbers of agreements for purchasing new construction apartments plunged to record lows. According to Ober-Haus, the sales volumes of new construction apartments in Vilnius, Kaunas and Klaipėda in April this year, compared to the 2019 indicators, decreased on average by as much as 89% (91% in Vilnius, 85% in Kaunas and 77% in Klaipėda).

The sharp decline in housing market activity in March and April this year interrupted the ongoing price growth. While the sales prices of apartments (old and new construction) in the country’s larger cities grew at a rate of 0.5-0.6% per month in January and February 2020, in March and April of this year growth was only 0.1%.

“At present, sellers are generally reluctant to reduce the prices of homes for sale, as the current period of uncertainty is relatively new and most of them do not rush to sell urgently. The most negative changes in home sales prices were caused by the growing number of sellers who do need to sell their homes more quickly. If the number of such sellers in the market only increases, then the probability of seeing a decrease in the general level of housing prices will become more likely,” says R. Reginis.

“We are seeing that sellers who would normally want to sell their homes at an above-market prices are now much more flexible in responding to offers from potential buyers. In the growing real estate market environment, some sellers were very optimistic about the possible price they would get for their home, now such expectations are almost gone,” notes the Ober-Haus representative. As a result, such sellers are now forced to lower their exaggerated bar of expectations and are willing to reduce the price of their homes to more market-appropriate levels. If in the past the optimistic expectations of sellers were eventually met due to the rising level and the most positive sentiments regarding the housing prices throughout the market, this is no longer the case and such sellers are becoming more accommodating.

Full review (PDF): Lithuanian Apartment Price Index, April 2020

Ober-Haus presents its annual real estate market report 2020 on the Baltic States Capitals – Vilnius, Riga and Tallinn. The overview focuses on the office, commercial, storage and residential premises markets, as well as on land plots of each of the capital cities. The overview also includes information related to taxes, which was drawn up by PricewaterhouseCoopers – the audit, accounting and consulting company, while the part with legal information was prepared by the Sorainen law firm.

Full review (PDF): Baltics Real Estate Market Report 2020

After yet another productive year in the real estate market of the Baltic countries, at the beginning of 2020 the world became engulfed in the coronavirus disease (COVID-19). We therefore started this year with dual emotions: we still lived in an environment of growth yesterday, but today we face a great deal of uncertainty about our future. Looking at the various challenges facing the world today, the real estate market in the Baltic countries cannot remain immune from both negative and positive developments globally, reported in the latest real estate market overview of the capital cities of the Baltics by Ober-Haus, which presents a detailed analysis of the real estate market in 2019 and forecasts for the coming year.

After yet another productive year in the real estate market of the Baltic countries, at the beginning of 2020 the world became engulfed in the coronavirus disease (COVID-19). We therefore started this year with dual emotions: we still lived in an environment of growth yesterday, but today we face a great deal of uncertainty about our future. Looking at the various challenges facing the world today, the real estate market in the Baltic countries cannot remain immune from both negative and positive developments globally, reported in the latest real estate market overview of the capital cities of the Baltics by Ober-Haus, which presents a detailed analysis of the real estate market in 2019 and forecasts for the coming year.

“The rapid economic growth and growth in the real estate market in the past years have often compensated the decisions of market players, which were not always balanced and allowed them to proceed further with active business development. It is clear that in 2020 we will see a number of changes in the real estate markets, where each decision will be much more important than before. Still, various possible changes in the real estate market in the Baltic countries will certainly offer wider opportunities for both local and foreign capital investors,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

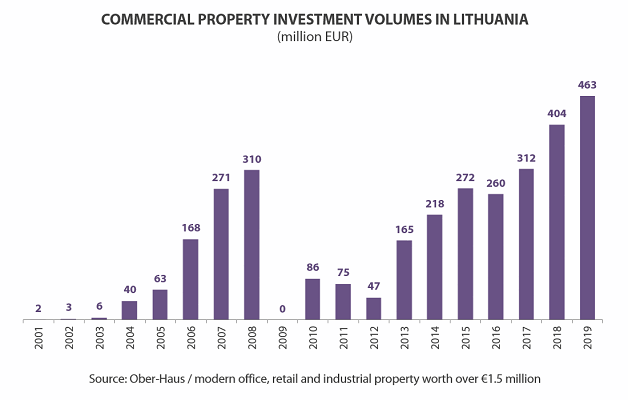

Speaking about 2019, the further impetus for the development of the real estate market in the Baltics was the significant economic growth of all three countries. The rapid increase in personal income, consumption and business development contributed to the development of both the commercial and residential real estate sectors. The situation in the real estate market in 2019 is well illustrated by at least two all-time records in Lithuania: according to Ober-Haus, investment volumes in core commercial property increased by almost 15% totalling €463 million, meanwhile investments in the residential sector reached a record €2.3 billion.

“Since the pandemic has hit the countries at the peak of activity in the past decade and the results of 2020 will be compared with very high figures of the previous year, it may be difficult for Baltic real estate market players to adapt psychologically to a reversal of the situation. If the real estate market in Latvia did not see a strong growth in the last decade, so the real estate market indicators in Estonia and Lithuania had a sizable increase,” Reginis said.

Baltic capitals start 2020 with a large supply of new housing

The capitals of the Baltic countries continue high development activities in the residential and commercial sectors. The development in the multi-apartment segment in Vilnius and Tallinn was exceptional with the highest construction volumes since 2007–2008. Meanwhile, the level of confidence of developers in the prospects of the residential sector in Riga remained much lower. This is also reflected in the figures on construction volumes in 2019 and in the 2020 projections. According to Ober-Haus estimates, in 2019–2020 developers will build about 17 apartments per 1,000 inhabitants in the city of Vilnius, while the figure in Tallinn is 14 apartments and in Riga the figure is half that, at 7 new apartments per 1,000 inhabitants.

The capitals of the Baltic countries continue high development activities in the residential and commercial sectors. The development in the multi-apartment segment in Vilnius and Tallinn was exceptional with the highest construction volumes since 2007–2008. Meanwhile, the level of confidence of developers in the prospects of the residential sector in Riga remained much lower. This is also reflected in the figures on construction volumes in 2019 and in the 2020 projections. According to Ober-Haus estimates, in 2019–2020 developers will build about 17 apartments per 1,000 inhabitants in the city of Vilnius, while the figure in Tallinn is 14 apartments and in Riga the figure is half that, at 7 new apartments per 1,000 inhabitants.

According to Reginis, one of the important reasons limiting the confidence of developers in the housing market in Riga is the continuous decline in the number of permanent residents in this largest city of the Baltic countries. If the population in Tallinn and Vilnius has risen in the past five years by 6% and 3% respectively, so the population in Riga has fallen by almost 2%. “It is clear that, among other indicators, the changing number of potential home buyers is essential for developers in assessing further development prospects of the sector in specific regions or cities,” the Ober-Haus expert said.

Most importantly, the capital cities of the Baltic countries started 2020 with a record supply of apartments over the past decade. The capital of Lithuania leads in this area with developers planning to build around 5,200 apartments in multi-apartment buildings in a year. According to Ober-Haus, approximately 3,000 apartments are scheduled for completion in Tallinn and just over 2,500 apartments in Riga in 2020. “Given the current situation caused by the pandemic and the uncertainty in the market, it is highly likely that some developers will adjust or will be forced to postpone their development plans to a later period. It will not be surprising, therefore, if the actual construction volumes this year will be more modest than planned,” Reginis pointed out.

The rate of increase in sales prices in the Baltic capital cities in 2019 was varied. In Riga the prices went up by only 2.3%, in Vilnius – by 6.9% and in Tallinn – by 9.7%. The high level of activity of the housing market in Vilnius and Tallinn at the beginning of 2020 led market players to expect another successful year and an increase of at least 4-6% in the sales prices of apartments.

“However, the consequences of the coronavirus pandemic may have a negative impact on housing prices in the second half of this year and the overall annual price change in the Baltic capitals may be negative. Depending on the duration of the pandemic and its impact on global and national economies, the fall in prices may be either limited to a symbolic decline of a few percent or we may see a double-digit fall in prices,” the representative of Ober-Haus said.

The recovering office space sector in Riga may slow down

Following active development in 2018–2019, the office segment was ready for a further significant leap in supply in all Baltic capitals. According to Ober-Haus, in 2018–2019, a total of 290,000 sqm office space was built in Tallinn, Riga and Vilnius, so it is realistic to expect that over 300,000 sqm of office space could be completed in 2020–2021.

The results in Riga are particularly promising as the lack of office supply previously prevented Riga from fully competing with Tallinn or Vilnius for the attention of international companies. According to Ober-Haus, in 2019 the market in Riga was supplemented with nearly 56,000 sqm of new office space (66,000 sqm in Vilnius and 20,000 sqm in Tallinn). In 2020–2021, more than 70,000 sqm of office space should be completed in the capital of Latvia, which would provide a solid basis for the city in its claim for potential tenants of foreign capital. It will therefore be very interesting to see how both domestic and foreign capital companies respond to the abundant new office space supply in Riga.

Raimondas Reginis, Research Manager for the Baltics at Ober-Haus

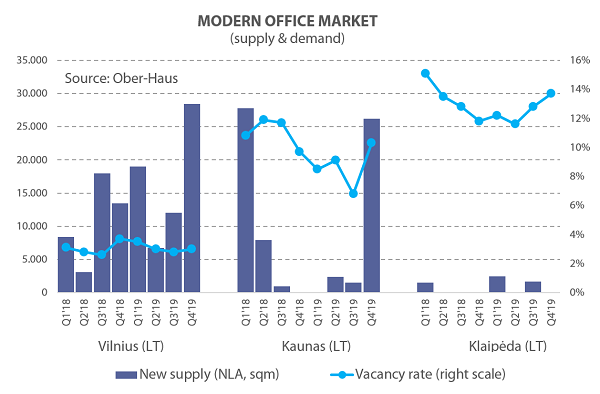

However, at the beginning of 2020, Riga faced two challenges: a significant sudden surge in supply and a coronavirus pandemic threatening the whole economy of the country. In 2019, the increase in the modern office space in Riga increased the office vacancy rate from 4.5% to 8.5% in a year. “A similar situation was recorded in Kaunas (Lithuania) in 2019, where a significant increase in the new office space increased the vacancy rate to double digits. In these cities it takes more time for the market to fully absorb the large supply than it does, for instance, in Vilnius or Tallinn,” Reginis pointed out.

Meanwhile, the vacancy rate in Tallinn and Vilnius did not change significantly in 2019 and at the end of the year stood at 3% in Vilnius and 4% in Tallinn. Encouraged by high absorption rates at business centres in Vilnius, developers are very enthusiastic in this city and plan to offer at least 170,000 sqm of office space to the market in 2020–2021 (in projects that are currently being completed and in progress).

According to the Ober-Haus expert, these development plans would be justified in a growing economic environment and would not be surprising, but the situation at the beginning of 2020 looks less optimistic. “Under the conditions of an increasingly fast-growing supply, further slowing down or even shrinking business development could significantly increase the modern office space vacancy rates in Vilnius, particularly since the current vacancy rate is the lowest in the past 12 years” Reginis said. Even if all business centres that opened in Vilnius in 2019 were fully leased, it would be much more difficult to expect the same situation in 2020 or 2021. Although some of the recently launched projects may yet be suspended or their construction may be postponed to a later period (not only because of the uncertainty in the real estate market, but also because of external financing), most of the projects currently under construction are already well under way and it seems that the developers will endeavour to complete them.

However, the overall vacancy rate may increase not only due to the new supply of office space, but also due to the migration of tenants, who will move to newly opened buildings leaving a significant amount of vacant premises in older buildings. “Therefore, if the forecasts of the country’s economic decline are confirmed and if we see the overall increase in vacancy rates of office space in the market in the near future, the situation may be very different for specific projects. While some property owners enjoy full occupancy with recession-resilient tenants, others may have to face, at least temporarily, high vacancy rates and a significant reduction in income,” Reginis said.

Full review (PDF): Baltics Real Estate Market Report 2020

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.1% in March 2020. The annual apartment price growth in the major cities of Lithuania was 7.1% (the annual apartment price growth in February 2020 was 7.6%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.1% in March 2020. The annual apartment price growth in the major cities of Lithuania was 7.1% (the annual apartment price growth in February 2020 was 7.6%).

In the past 12 months, the prices of apartments grew in all major cities: 7.0% in Vilnius, 7.3% in Kaunas, 5.1% in Klaipėda, 10.0% in Šiauliai and 11.1% in Panevėžys.

“March this year was exceptional for the Lithuanian real estate market, because after the introduction of the quarantine in mid-month, the entire real estate market simply halted. This is best illustrated by the number of transactions for apartments in March 2020, which, according to the data of the public enterprise Center of Registers, decreased by 26% in Lithuania compared to the monthly average of 2019: in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys the decrease of 19%, 29%, 39%, 23% and 26% respectively was recorded. The significant reduction in the housing market activity was largely due to the suspension of activities of notaries in the first week of the quarantine and partial operations of notaries in the second week,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

Meanwhile, both the sellers and the buyers lived in the mood of waiting in the second half of March. According to Reginis, due to the uncertain overall situation some sellers have suspended any action or withdrew the sale of their property altogether, while potential buyers are simply waiting and observing developments in the country’s economy and the real estate market. In March, therefore, we recorded very slight positive and negative changes in the sales prices of apartments in the country’s major cities, which led to a symbolic increase in the overall price level. According to Ober-Haus, in March 2020 the price index saw only a 0.1% increase, which was the lowest price increase in the past 24 months.

“Although we haven’t yet recorded any substantial change in the apartment sales, the mood in the market is getting gloomy,” the representative of Ober-Haus noted. The latest figures from Statistics Lithuania show that in March 2020 the consumer confidence index in the country decreased by 4 percentage points to 0. The last time a lower consumer confidence index was recorded was in December 2018 and stood at -1. Far more pessimistic forecasts of the country’s economic situation had the biggest impact on the drop in the index in March 2020. An opinion poll in Lithuania commissioned by SEB Bank at the end of March shows a rapid increase in the proportion of the population that forecasts a fall in home prices. If, in December 2019, those who thought that the housing prices will drop accounted for only 9%, so in March these accounted for 40%.

“It’s clear that we can expect considerable uncertainty in the housing market in the coming months. The extended quarantine period may reduce the overall activity in the market to new lows, because during a quarantine the vast majority of buyers and sellers simply cannot or are unwilling to carry on with active buying/selling of real estate. However, the shrinking market activity means the lack of reliable data, which will further increase the uncertainty in the entire real estate market and encourage various speculations. It will only be clearer how the housing market players have responded to the pandemic that has hit the world and Lithuania in May or June at best, when the quarantine period is likely to be over,” Reginis said.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in February 2020. The annual apartment price growth in the major cities of Lithuania was 7.6% (the annual apartment price growth in January 2020 was 7.6%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in February 2020. The annual apartment price growth in the major cities of Lithuania was 7.6% (the annual apartment price growth in January 2020 was 7.6%).

In February 2020 apartment prices in the capital grew 0.8% with the average price per square meter reaching EUR 1,636 (+13 EUR/sqm). Apartment prices in Kaunas, Šiauliai and Panevėžys in February grew by 0.5%, 0.3% and 0.2% respectively with the average price per square meter reaching EUR 1,165 (+6 EUR/sqm), 750 (+2 EUR/sqm) and EUR 736 (+1 EUR/sqm). In Klaipėda no price changes were recorded and average apartment price remained the same as in January – EUR 1,141.

In the past 12 months, the prices of apartments grew in all major cities: 7.4% in Vilnius, 7.7% in Kaunas, 5.7% in Klaipėda, 10.8% in Šiauliai and 13.2% in Panevėžys.

“The performance indicators of the beginning of the year promised one more successful year in the Lithuanian housing market. The very active country’s housing market and positive changes in the sales prices of the apartments in the major cities made the market participants optimistic. However, the worrying news of the coronavirus outbreak threatening public health may have a negative impact on the economy. The global stock markets were the first to respond to this epidemic with record lows. However, unlike the stock markets, markets for real estate are far less liquid (the selling/purchasing process is far more complex and longer than that involving financial assets) and the first signs of changes in the real estate market are usually a little later than one would expect looking at the ongoing changes in the world and local markets.

As far as the short-term development prospects of the Lithuanian economy are concerned, at this point it is still difficult to assess the impact of the virus on both individual economic sectors and the economy of the country in general. Even if the pessimistic forecasts do not come true and the key macroeconomic indicators remain positive, public expectations are an important factor in the real estate market. The most recent data of Statistics Lithuania show that in January and February 2020 the consumer confidence index increased slightly and remained positive (in December 2019 the indicator was 1, in January 2020 – 3 and in February 2020 – 4), but as history indicates, decreasing public expectations may affect the housing market. Last time the deteriorating expectations were recorded was in the second half of 2014 and to a large extent were determined by the geopolitical turmoil in Ukraine with all its consequences. For example, in September 2014 the consumer confidence index reached its lowest point in two years and stood at minus 11. At the same time, after a longer break negative apartment sales price changes were recorded in the country’s major cities. Although the price decrease was brief and insignificant (according to Ober-Haus, during September–December 2014, the sales prices index in the five major cities of Lithuania decreased by 0.6%), it showed that the negative public expectations might have a real impact on home prices even when the economic development indicators remain positive.

Due to the housing market inertia, the next few months may not necessarily show how the pandemic will affect the Lithuanian housing sector. However, now that the economists have become more cautious about the further positive economic development prospects in Lithuania, public confidence may also wane and determine poorer housing market indicators (number of transactions, price changes, etc.) than those in 2019 and early 2020. The performance indicators across economic sectors that will be recorded in the coming months both in other countries and Lithuania will allow to predict the direction of the Lithuanian real estate market development,” Raimondas Reginis, Research Manager for the Baltics, said.

Full review (PDF): Lithuanian Apartment Price Index, February 2020

Centro Duetas multi-apartment project in Snipiskes, Vilnius, has been successfully completed. Ober-Haus was behind the concept and successful realisation of the project. The project consists of two six- and nine-storeyed apartment buildings offering 94 apartments and three commercial premises. The total area of the project, development of which started in the early 2017, is 5,650 sqm.

Centro Duetas multi-apartment project in Snipiskes, Vilnius, has been successfully completed. Ober-Haus was behind the concept and successful realisation of the project. The project consists of two six- and nine-storeyed apartment buildings offering 94 apartments and three commercial premises. The total area of the project, development of which started in the early 2017, is 5,650 sqm.

The project was developed in a quiet and green Lvovo Street of the growing and rapidly changing neighbourhood of Snipiskes. Centro Duetas has contributed to the modernising and development of Snipiskes – soft and hard landscaping of the area surrounding the buildings was completed, the yard was fenced and a children’s playground was installed. Centro Duetas was one of the first housing projects after a long break in Snipiskes that gave impetus to active development of other projects.

Home buyers at Centro Duetas are mainly young families. The average age of the residents is 32–35 years. About 70% of the apartments in this project were purchased using a mortgage, and about 35% of the apartments were purchased for investment.

“The neighbourhood of Snipiskes is a rapidly growing, modernized area of the city which attracts both real estate developers and private investors. A broad range of modern business centres is being built in this area forming a new city’s urban centre with strong labour force willing not just to work, but also to spend their leisure and live in the area. Therefore the property value in this neighbourhood will remain stable in the future, and it will be easy, if necessary, to realise the property,” Audrius Šapoka, General Manager of Ober-Haus, said.

Ober-Haus provided consultancy on the project pricing, concept, marketing strategy and its implementation, and the management of the sales process. Project investor – UAB Spaineta, construction manager – UAB Incorpus, and the main construction works – UAB Naresta and UAB Vilniaus Rentinys.

Driven by strong demand the modern office premises sector continues to grow. However, any significant changes in the office space sector in the country are actually only evident in the country’s two major cities, Vilnius and Kaunas.

Driven by strong demand the modern office premises sector continues to grow. However, any significant changes in the office space sector in the country are actually only evident in the country’s two major cities, Vilnius and Kaunas.

In 2019, construction of eight office buildings were completed in Vilnius: The second and third buildings of the S7 project, the second building of the Duetto project, the administrative building of the INHUS group, a business centre in a multifunctional complex Live Square, the second building of the Part Town project, the Avia Solutions Group administrative building and the last building of the Quadrum project. According to Ober-Haus, these projects added another 66,100 sqm of useful office space to the capital’s market, and the total area of office premises increased by more than 9 % in 2019 to reach 784,400 sqm.

In the course of 2019, all the office premises completed in the year were fully leased or occupied by their own developers, thus the abundant supply of new office space did not shake up the capital’s market. Altogether 94,400 sqm of office space were leased in Vilnius during 2019, i.e. 34% more than in 2018. Only in 2017 was more office space leased in a single year (97,300 sqm). According to Ober-Haus, the office space vacancy rate in the country’s capital decreased from 3.7 % to 3.0 % in 2019. The vacancy rate of A class offices was 2.6 %, and 3.3 % of B class offices were still vacant. Over the last ten years a vacancy rate below 3% was recorded only in Q2 2018 (2.8 %), Q3 2018 (2.6 %), in Q3 2019 (2.8 %) and in Q3 2019.

Although it was expected that 2019 would see a record number of offices built in the city, the completion of some projects was brought forward to 2020. In view of the progress of current projects under construction it can be concluded that during 2020 the area of new offices premises to be introduced to the Vilnius market will be largest in history accounting for no less than 95,000 sqm.

Despite the continued strong demand for office space and record high occupancy rates, the abundant supply of new premises injected into the capital’s market every year has substantially stabilized office rents which have grown only marginally since 2015. The year 2019 was no exception, when the rents for offices increased on average by 1-2%. According to Ober-Haus, at the end of the year rents for B class offices were 9.0-13.5 EUR/sqm, and 14.0-16.7 EUR/sqm for A class offices.

Despite the significant volumes of office space projected for 2020, and considering the pre-lease contracts concluded regarding the projects under construction the situation in the office sector is expected to remain fairly balanced this year. It is hard to expect any faster increase in office rents, as despite the growth in construction costs, developers will be forced to make compromises in negotiations with potential tenants if they wish to maintain high office occupancy rates. And while the situation in 2020 looks fairly balanced, it is much more difficult to project any longer-term perspective.

The volumes of construction projects in progress or planned show that developers intend to ensure an abundant supply not only in 2020 but also for the next few years, thus the major unknown in this situation remains the demand factor. An overview of the projects in progress and those still in design stage and anticipated to be introduced to the market in 2021 and subsequent years shows that most of the projects were started without having any lease contracts with perspective tenants. Thus, if high occupancy rates are to be maintained, continuous rapid development of both local and foreign capital companies, and even decisions in the public sector are required.

The new office premises in Kaunas takes longer to rent than in Vilnius

The office premises sector in Kaunas is also developing rapidly. Seven projects in the country’s second largest city were completed during 2019, offering to the city a range of new and modern office premises: the business and retail centre Longas, a commercial building at Statybininkų Street, Verslo Parkas Aušra (C block), the second stage of Kauno dokas, BLC 2, Alia and Sqveras. According to Ober-Haus, these projects have added another 30,100 sqm of useful office space to the city’s market, and during 2019 the total office area increased by more than 18% reaching 199,400 sqm.

The Kaunas office space market retains a strong correlation between the newly implemented and still vacant office spaces. As a large amount of new office space came on the market during Q4 2019, the vacancy rates among office premises in Kaunas increased from 6.8% to 10.3%, as compared to 9.7 % at the end of 2018. Since the office sector in Kaunas is experiencing a period of intensive development, not all the newly opened office buildings can boast of high occupancy rates. The development of local and foreign capital entities in Kaunas is not as rapid as in, for example, Vilnius, thus the process of finding tenants for new premises takes longer thus causing observable fluctuations in vacancy rates.

Just like the country’s capital, last year Kaunas recorded only marginal changes in lease prices. During 2019, the rents for B class office premises increased by 3% on average, while the rents of the premises in A class office buildings remained stable. According to Ober-Haus, at the end of 2019 B class offices were offered for 7.0-11.0 EUR/sqm, while A class offices could be leased for 11.5-14.0 EUR/sqm.

Any prospects for an increase in office rents in Kaunas remain uncertain. Apparently, the continued influx of new office spaces to the market and not so fast take-up tie developers’ hands in negotiations with potential tenants. And meanwhile the tenants will continue enjoying an increasing choice of new office premises in the city.

Another six projects offering around 39,000 sqm of useful office space are projected to be completed in Kaunas during 2020. The highlight of this recent surge in office space will be Magnum, the largest business centre in Kaunas, which is planned for completion in the first half of 2020, with an above ground floor area of just over 21,000 sqm.

Klaipėda lacks bold solutions

During 2019, Klaipėda also enjoyed several completed projects that introduced to the market a range of modern office premises. At the beginning of 2019, the first stage of the private capital science and innovation valley Baltic Tech Park at Liepų Street was completed. A two and three-storey building was erected on the site of a former manufacturing complex housing different commercial and service companies, with the Light House coworking space occupying the largest share of office space. In Q3 2019, a commercial purpose building was opened at Dubysos Street accommodating a range of premises suited for retail activities, as well as storage facilities and office space. Ober-Haus estimates that these two projects added another 4,200 sqm of useful office space to the city’s market, and the total area of modern office space during 2019 increased by more than 6% to reach 72,800 sqm.

According to Ober-Haus, the office vacancy rate in Klaipėda increased from 11.8% to 13.7% in 2019. During the seven last quarters, the vacancy rate in the city remained within a 11-14% range and does not show any sign of clear path. The newly completed projects with modern office space do attract interest from the market, however, leasing is not always sufficiently expedient. It is obvious that the port city still shows little development on the part of existing businesses or the emergence of new companies, which creates a barrier for any faster development of the real estate sector. Still, more active developers seek to benefit from the opportunities offered by the land plots they own and promise to offer a range of new projects to the market. Klaipėda badly needs expedient, more interesting and ambitious solutions both on the part of investors and the city itself.

The second stage of the Baltic Tech Park project is anticipated to be completed on Liepų St. including the Light House Lab, a building of about 1,900 sqm that will facilitate the further development of technology and innovation companies. In the meantime, a company belonging to Stemma Group has already announced a tendering procedure for an office building in Memelio miestas project, on the right bank of the Dangė River, at Naujojo Uosto Street. The structure of about 10,000 sqm is designed to be one of the first in the Memelio miestas project to become a focal point in the further development of this 5-ha territory.

Just like Kaunas, during 2019, Klaipėda recorded some minor price changes only in the cheaper office premises segment. During 2019, the rents for B class offices increased by 3% on average, while the rents in A class office buildings remained stable. According to Ober-Haus, at the end of 2019 B class offices were offered for 6.5-10.0 EUR/sqm, while A class offices could be leased for 10.5-13.0 EUR/sqm. It is expected that prices will remain at a similar level during 2020.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in January 2020. The annual apartment price growth in the major cities of Lithuania was 7.6% (the annual apartment price growth in December 2019 was 7.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in January 2020. The annual apartment price growth in the major cities of Lithuania was 7.6% (the annual apartment price growth in December 2019 was 7.2%).

In January 2020 apartment prices in the capital grew 0.4% with the average price per square meter reaching EUR 1,623 (+7 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 40.6% (+469 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in January grew by 0.9%, 0.4%, 0.9% and 1.1% respectively with the average price per square meter reaching EUR 1,159 (+10 EUR/sqm), 1,141 (+4 EUR/sqm), 748 (+6 EUR/sqm) and EUR 735 (+8 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 7.1% in Vilnius, 7.6% in Kaunas, 6.2% in Klaipėda, 12.2% in Šiauliai and 13.9% in Panevėžys.

‘The year 2020 started in the Lithuanian real estate market with yet unseen optimism. According previous years, the January of 2020 was the most dynamic in history recording 2,865 apartment and 910 house purchase transactions – more than in January of any other year. If compared with January of 2019, the number of apartment deals in the country increased by 11 per cent, and, respectively, by 25 per cent in house purchase transactions.

For Vilnius this January was the most successful historically: 1,066 apartments and 96 houses sold in the city, respectively, by 10 and 55 per cent more than last January. In Kaunas the first month of the year was record-breaking if compared with the January of previous years both in terms of apartment and house sales deals. However in Klaipėda, Šiauliai and Panevėžys this January did not really perform that well, as fewer apartment and house sale transactions were concluded than last year. However, the general mood of buyers in all Lithuanian cities is expressly optimistic, so it is not surprising that at the beginning of this year all of the cities recorded a rise in apartment prices’, said Saulius Vagonis, Head of Valuation & Analysis at Ober-Haus.

Full review (PDF): Lithuanian Apartment Price Index, January 2020

In 2019, the Ober-Haus the real estate company had a turnover of €4.5 million excl. VAT, which is 13.5 per cent more than in 2018, when revenue was € 3.95 million. Last year’s turnover of Ober-Haus was the highest since 2008.

In 2019, the Ober-Haus the real estate company had a turnover of €4.5 million excl. VAT, which is 13.5 per cent more than in 2018, when revenue was € 3.95 million. Last year’s turnover of Ober-Haus was the highest since 2008.

‘The year 2019 was indisputably an active year both for the real estate market and our company. The result achieved by Ober-Haus is the highest of the past 12 years. We were growing in a consistent and stable pattern all due to our highly motivated, quality driven team inspired by genuine values’, says Audrius Šapoka, the General Manager of Ober-Haus.

In 2019, Ober-Haus in Lithuania concluded 13,000 transactions, among which nearly 1,000 non-commercial real estate sales and 500 lease deals. The company also prepared a record number – 11,500 – property valuation reports, valuation expert analyses and provided countless consultations to clients.

‘The growth of the past year was in essence shaped by the excellent results in valuation operations and specifically by the realisation of new housing projects. This year, we will also be strengthening our position in the commercial real estate sector, where we see space to expand and maximise experience, our business contacts and existing relationships with national and international companies, said Mr Šapoka.

Ober-Haus has operated in Lithuania since 1998 and has offices in Vilnius, Kaunas, Klaipėda, Palanga, Šiauliai, Panevėžys and Druskininkai, employing a total of more than 150 real estate experts. Among the services provided by the Company are real estate and moveable property valuations, business valuations, acting as intermediaries in buying, selling and leasing real estate, property management and market research.

For the Lithuanian commercial real estate investment sector, the sluggish first half of 2019 was more than offset by the second half of the year. According to Ober-Haus, acquisitions of the modern commercial property (office, retail and industrial buildings/premises with a value of at least EUR 1.5 million) amounted to EUR 463 million in Lithuania in 2019. Property sales in 2019 yielded 15% more than in 2018 and it is the best result for any year on record.

“The impressive results of 2019 are essentially due to the two biggest investment deals ever in the office sector,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said. At the end of 2019, the Quadrum business centre deal was finalised: one of the companies of the German Deka Group bought a complex with an area of about 70,000 sqm (including the underground area) in Vilnius from Schage Real Estate, the Norwegian real estate development company, for EUR 156 million.

The second substantial deal was the acquisition of three office buildings, S7 in Vilnius. At the beginning of 2019, it was announced that Eastnine, a Swedish investment company, had agreed to acquire these buildings from their developers M.M.M. projektai. It is reported that the total value of the deal concerning the three buildings in Saltoniškių Street is just over EUR 128 million. In 2019, the ownership of the two buildings was transferred to Eastnine, and they now house Danske Bank Global Services Lithuania and Telia Lietuva. Finalisation of the acquisition of the third building (tenant – Danske Bank) is expected at the beginning of 2020. The acquisition of Quadrum business centre and the two S7 office buildings alone accounted for more than 50% of all investment in commercial real estate market in Lithuania in 2019.

The third largest investment deal of 2019 was the acquisition of two properties in Kaunas. One of the funds of EfTEN Capital, the Estonian commercial real estate fund manager, purchased the River Mall shopping centre and River Hall business centre from SIRIN Development, a real estate development company. The total area of the two buildings located on Jonavos Street is approximately 20,000 sqm and although details of the deal have not been disclosed, it is expected that the total value of the deal was more than EUR 30 million.

The acquisition of the Duetto office building in Vilnius, two Depo shopping centres in Vilnius and Kaunas and the North Star business centre in Vilnius also contributed significantly to the total value of investment deals in 2019. It is thought that the value of each of these property acquisitions might have been between EUR 18-25 million. Other deals included office, retail and industrial objects in various Lithuanian cities (Vilnius, Kaunas, Klaipėda, Panevėžys, Šilutė, Radviliškis, Ukmergė, Molėtai, Kėdainiai), however with values of less than EUR 12 million per object.

“As far as smaller deals are concerned, the smaller-sized retail property segment was prominent in 2019. Buildings of between 2,000 and 4,000 sqm were popular among investors, where supermarket chains are already operating,” says Raimondas Reginis. One of the most active buyers in 2019 was Baltic Sea Properties, the Norwegian real estate company, which now manages about 40 retail and other commercial properties in Lithuania.

German investors dominate Lithuanian investment market

According to Ober-Haus, of EUR 463 million invested in Lithuania in 2019, the Lithuanian capital scooped an impressive 79% (Vilnius’s share was 70% back in 2018). Investment distribution by segments of real estate was largely decided by the two major deals in the office sector already mentioned and very stagnant investment in industrial sector. Hence, office sector saw the largest investment (71%) in 2019. Retail sector took a 27% share of investment and industrial a modest 2%.

As for the geography of investors, German investors spent the most in 2019, with Deka Group being the main contributor, and accounted for 35% of investment in Lithuania. Nordic and Baltic investors (Sweden, Denmark, Norway, and Estonia) were active as usual, making up 41% of all investment. According to Ober-Haus, the final 24% was shared by investors from Lithuania, France, and Russia.

“Looking at 2019, it is evident that the growth of the investment market should not be attributed only to investors being eager to invest in the active real estate market of Lithuania, but also to the rapidly increasing number of higher quality properties in the market. Larger real estate funds have eyes for new modern business and shopping centres with strong tenants,” Mr. Reginis noted. For example, the effect of the new supply has clearly manifested itself in Kaunas since 2017-2018, when investors started acquiring newly built business centres in the city. Such activity in the office sector of Kaunas was basically previously unheard of. Active development of warehousing and industrial objects in the regions of Vilnius, Kaunas, or Klaipėda could also add to greater investor interest in this segment, which did not receive proper attention in 2019.

Search

Search