In Q2 2020, it was very obvious what challenges the entire retail and retail space sector was facing in Lithuania: essential closure of the major shopping centres, empty city streets and closed operations of small traders. It was really strange to see how the shopping streets of Vilnius, which attract the largest flows of people, became deserted.

In Q2 2020, it was very obvious what challenges the entire retail and retail space sector was facing in Lithuania: essential closure of the major shopping centres, empty city streets and closed operations of small traders. It was really strange to see how the shopping streets of Vilnius, which attract the largest flows of people, became deserted.

Last time similar moods prevailed was at the peak of the global financial crisis in 2010, when about 15–20% of the premises in the main shopping streets of Vilnius (Gedimino Avenue, Pilies Street, Didžioji Steet, and Vokiečių Street) were closed. However, as the country’s economy began to recover, businesses returned to the shopping streets of Vilnius and within two years (in mid-2012) the vacancy rates of the retail space in these streets fell to 7.6%.

What was the mood of retailers and the situation in the retail space sector in the shopping streets of the largest city in the country after the end of the lockdown? “A survey on the situation in the main shopping streets of Vilnius conducted by Ober-Haus at the end of June 2020 provides an opportunity not only for a detailed overview of the current situation, but also for an assessment of the structural changes that have taken place in the central part of the city over the past eight years. An identical study was also conducted in mid-2012,” Raimondas Reginis, Research Manager for the Baltics at Ober-Hause, introduced the survey.

With the official end of the lockdown in mid-June this year, most retail space users rushed to resume their operations. However, depending on the area of their activity, some delayed restarting their operations or were forced to close down altogether, as a result, the owners of the premises had to look for new tenants for the vacated premises. According to Ober-Haus, in mid-2020, the vacancy rate in these streets stood at 11.0%.

It is important to note that for the purpose of the survey “vacant premises” were considered those premises that had the essential characteristics of vacant premises: they were empty, vacated by former tenants or were officially or unofficially advertised as available for rent. According to Ober-Haus, the highest vacancy rate was recorded in Vokiečių Street (12.5%) and the lowest in Didžioji Street (7.3%). The vacancy rate in Gedimino Avenue stood at 11.8% and in Pilies Street – at 11.3%.

“Looking at the historic data concerning Vokiečių Street, this street has been undergoing significant changes. First of all, during the past eight years the vast majority of tenants have changed and it is likely that we will see further changes in this street when the reconstruction of the street initiated by Vilnius City Municipality starts,” Reginis said.

Although the vacancy rate is higher now than eight years ago, the number of retail units in these streets (located on the ground floor of the building, with at least one window facing the street and suitable for commercial activities) has increased by almost 11%. In mid-2012 there were 264 such units, in mid-2020 – 292.

“The supply of retail premises has increased as over the past eight years new buildings were built or old buildings were reconstructed on these streets or some of the premises were divided into smaller units, etc. Therefore, despite the higher vacancy rate, the number of retail or services units operating on these streets is higher than before,” Reginis explained.

Eateries replace clothing shops in shopping streets

The most interesting and noticeable are however the structural changes in these streets. The supermarket boom in the country’s capital prior to 2009 changed the face of shopping streets. Since then, the number of outlets selling clothing, footwear or accessories has decreased and they are being replaced by tenants providing entertainment, food catering and other services. Ober-Haus estimates that since 2012, the share of tenants selling clothing and footwear on these streets has fallen from 20.1% to 18.3%, while the share of restaurants, cafes, bars and fast food outlets has risen from 28.9% to 38.6%. In mid-2020, a little over 100 food and drink outlets were recorded on these four streets.

Meanwhile, the share of food and drink retailers decreased from 5.6% to 3.8%, jewellery, accessories, souvenirs and cosmetics retailers decreased from 16.1% to 15.3%, and the share of the rest of the tenants (beauty salons, offices, pharmacies, banks, bookstores and other retail or services units) decreased from 29.3% to 24.0%. The decrease in the number of banking and credit union customer service units is however most noticeable. If in mid-2012 there were 15 such units in the major shopping streets in Vilnius, so currently there are only 3.

“The ever-expanding opportunities for online shopping also determine noticeable changes in the shopping streets of the cities. Therefore, retailers in these streets face at least several challenges at the same time: reduced target flows of buyers, high rents of the premises and not flexible tenancy terms and conditions,” Reginis noted.

For example, if some tenancy agreements in supermarkets are fully or partially linked to the turnover of the tenants, so in the shopping streets of cities a fixed rent is usually agreed between the owner and the tenant. There is currently a global debate about what urban shopping streets will look like in the future, but there is general consensus that such streets will increasingly need to focus on a variety of services and experiences (food catering, entertainment, education, leisure and cultural activities, flexible workplaces, pop-up shops, etc.) rather than on traditional trade.

Interrupted activities and lower expectations have led to reduced rents for retail tenants

The lockdown and clear decline in tenants’ expectations for the future have also adjusted rents for retail premises in Q2 2020. According to Ober-Haus, in mid-2020, rents for medium-sized (about 100–300 sqm) retail premises in the main shopping streets of Vilnius (Gedimino Avenue, Pilies Street, Didžioji Street and Vokiečių Street) stood at 15.0–43.0 EUR/ sqm and were on average 6% lower than those at the end of 2019. Meanwhile, in Kaunas, Šiauliai and Panevėžys rents for retail premises in the main shopping streets of the cities fell by 3–5% in H1 2020, while in Klaipėda they remained largely stable. In mid-2020, rents for medium-sized retail premises in Kaunas stood at 11.0–18.0 EUR/sqm, in Klaipėda – 9.0–15.0 EUR/sqm, and in Šiauliai and Panevėžys – at 5.5–12.0 EUR/sqm. “Tenants of retail and services premises and owners of the premises were the first in the commercial real estate market to experience the consequences of the current pandemic and quarantine on their business. The abrupt closure of the business and vague prospects for the future forced many tenants to request for significant discounts from landlords, and some were even forced to close down altogether,” Reginis said.

Despite the end of the lockdown and the resumed activities, potential tenants of retail premises are much more cautious about their future prospects and see much higher risks than before the pandemic. As a result, landlords are also forced to reconsider their pricing and negotiate with long-term tenants on more flexible terms than before. As the virus and the various business constraints associated with it have not disappeared, and the situation may quickly change for the better or for the worse, there will be challenges to individual retail units in the retail segment in H2 2020.

Despite the challenges brought by the current pandemic to the entire economy and at the same time to the real estate market, the modern office sector in the major cities of Lithuania has not seen significant changes in H1, according to the office market review for Vilnius, Kaunas and Klaipėda for H1 2020 prepared by Ober-Haus.

“After the end of the lockdown, the employees returned to the vacated offices. The construction of projects successfully continues and the increase in office vacancies in business centres was due to the opening of newly completed projects. Meanwhile, the widely tested telecommuting opportunities have given rise to various considerations about the future prospects of offices: from declining overall demand for physical office space to increasing it to expand social distancing space for on-site employees,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

The uncertainty caused by the virus and the changing global situation are encouraging companies to try out different business models in their offices. According to Reginis, it is likely that in the near future it will be difficult to identify the office planning strategy that tenants will choose, as the current global health and economic crisis is still ongoing. However, regardless of when this crisis is going to be finally resolved, companies will anyway have to provide their employees with safe places of work.

“Looking at the history of modern offices in the major cities of Lithuania, the share of office rent and maintenance expenditure in the operating expenses is decreasing. Thus, in the long run it is unlikely that companies competing for labour force will decide to significantly reduce their office space further reducing social distance space between employees or asking some of them to work from home,” Reginis said. Therefore, financially strong companies will make every effort not to reduce the comfort of employees or their work efficiency. And with the current crisis still ongoing, the decision to reduce some or all office space is likely to be made due to financial problems of the companies, but not to changes in the organization of work.

The epidemic did not change the developers’ plans to offer a record supply of offices in Vilnius

Business center U219

In H1 2020, the construction of five office buildings was completed in Vilnius: Green Hall 3, U219, Uptown Park, SEB headquarters and the business centre in the multifunctional Paupys complex. According to Ober-Haus, these projects supplemented a total of 47,600 sqm of useful office space to the office market of the capital city, and the total area of modern office space in Vilnius increased by 6% to 832,000 sqm in H1 2020.

The abundant supply of new space and active tenants also determined high office occupancy rates. The area of rented modern office premises in H1 2020 in the capital city totalled 66,700 sqm or 20% more than in H2 2019. At the same time, the significant number of newly completed projects has slightly increased the vacancy rate in the existing office buildings. According to Ober-Haus, in H1 2020, the vacancy rate in the country’s capital increased from 3.0% to 3.8%. The vacancy rate for A class offices was 2.0% and for B class offices – 5.2%. The last time the higher vacancy rate of office space was recorded in Vilnius at the end of 2017 and amounted to 5.4%.

In H2 2020, a large number of new projects will be offered to the market – six more new buildings should be completed in the capital city and the modern office space market in Vilnius will be supplemented with 51,300 sqm of useful office space. If these projects, which are currently being completed or are nearing completion, are implemented as planned, the total area of new offices that will supplement the market in Vilnius in 2020 will be the largest in history totalling almost 99,000 sqm. To date, the year 2008 was considered a record year, when the construction of 11 projects for administrative use was completed in the capital of the country with the useful office space totalling 86,500 sqm.

According to Ober-Haus, office rents in the country’s capital in H1 2020 remained stable and currently rents for B class offices stand at 9.0–13.5 EUR/sqm and rents for A class offices stand at 14.0–16.7 EUR/sqm.

“Even before the current pandemic, the prospects for increase in office rents were extremely vague, because particularly large volumes of new premises offered to the market each year did not allow developers to increase office rents. Meanwhile, the current situation has further reduced the likelihood of increase in office rents, as tenants are currently more cautious and less optimistic about expanding their activities and increasing the rented space,” Reginis said. It is likely that in the next 12 months the pressure from tenants to reduce rents will intensify and some property owners will be forced to adapt to the changed situation and offer tenants more attractive rental terms than their competitors.

Record office vacancy rates in Kaunas

Developers in Kaunas also remain extremely active and for the fourth consecutive year offer more than 30,000 sqm of useful office space. In H1 2020, four new projects were completed in Kaunas with 31,000 sqm of useful office space offered to the market. According to Ober-Haus, the total area of modern office premises in Kaunas in H1 2020 increased by almost 16% totalling 230,500 sqm.

In mid-2020, the construction of the largest Magnum Business Centre was completed and about 18,000 sqm of office space was offered in this project. To date, the largest modern office project in Kaunas was the Senukai administrative building built in 2013, with useful office area of just over 15,000 sqm. No major changes in supply are expected in Kaunas in H2 2020, as only one small commercial project is planned to be completed which will provide about 1,200 sqm of offices.

Large volumes of new office space that opened in Kaunas at one time increased the level of office space vacancies to a record ten-year level. According to Ober-Haus, between the end of 2019 and mid-2020, the overall vacancy rate of modern office space in the city increased from 10.3% to 16.2%. The vacancy rate for A class offices amounted to 20.4% and for B class offices – 14.1%. This means that in the middle of this year, tenants in Kaunas could choose from the available record high completed office space of over 37,000 sqm.

The total amount of rented modern office premises in Kaunas in H1 2020 was 16,500 sqm or 6% less than the average of the last three half-years (2017–2019). “Considering that the construction of larger projects is not scheduled for completion in H2 2020 or H1 2021 in Kaunas, and the demand remains essentially stable, the vacancy rates should decrease again during this period. Such fluctuations in the vacancy rates of office space have been recorded in Kaunas before,” Reginis said.

The considerable increase in vacancy rates in Kaunas in H1 2020, and the postponed, at least temporarily, development plans by businesses in Kaunas at the height of the pandemic, slightly reduced office rents. In H1 2020, rents for A class office premises in Kaunas decreased on average by about 2%, while rents for B class office premises remained stable. According to Ober-Haus, in the mid-2020 rents for B class offices stood at 7.0–11.0 EUR/sqm and rents for A class offices stood at 11.5–13.5 EUR/sqm.

“Taking into account the current situation in the office market in Kaunas and the cautious approach of businesses to any further expansion of operations, office rents in the second half of this year should remain stable with a slight decrease in certain projects,” Reginis said.

Lower office rents did not give a boost to the office market in Klaipėda

The modern office market in Klaipėda continues its quiet period. In H1 2020, no new projects for office space were built. The area of modern office premises in Klaipėda has not changed since Q3 2019 (when a new commercial building with office premises was opened on Dubysos Street) and in mid-2020 totalled 72,800 sqm. According to Reginis, despite various initiatives and plans to invest in the construction of administrative buildings in Klaipėda, the planning process has been very slow and projects often remain only on paper. It is therefore unlikely that we will see any real impetus in the development of the office segment in this city in the near future.

The vacancy rates of office space in Klaipėda in H1 2020 increased from 13.7% to 15.3% and looking at the previous year the direction is not clear, i.e. in 2017–2020, it has ranged between 12–18%.

In H1 2020, rents for modern office premises in Klaipėda remained stable. According to Ober-Haus, in mid-2020, rents for B class offices stood at 6.5–10.0 EUR/sqm and rents for A class offices stood at 10.5–13.0 EUR/sqm.

“It is likely that a similar level of rents will remain in Klaipėda in the near future – there are almost no incentives for price increase and the current relatively low level of rents compared to Vilnius or Kaunas no longer solves the fundamental problem, i. e. the lack of potential tenants. Even if the rents are reduced, the number of potential tenants is unlikely to increase,” Reginis said.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.1% in July 2020 (0.2% increase was recorded in June 2020). The annual apartment price growth in the major cities of Lithuania was 4.9% (the annual apartment price growth in June 2020 was 5.6%).

In July 2020 apartment prices in Vilnius, Kaunas and Panevėžys grew by 0.1%, 0.2% and 0.3% respectively with the average price per square meter reaching EUR 1,647 (+2 EUR/sqm), EUR 1,169 (+2 Eur/sqm) and EUR 742 (+3 EUR/sqm). In Šiauliai no price changes were recorded and average apartment price remained the same as in June – EUR 758. Meanwhile in Klaipėda was recorded 0.1% price decrease and the average price per square meter dropped to EUR 1,139 (-2 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 5.1% in Vilnius, 4.6% in Kaunas, 3.3% in Klaipėda, 6.4% in Šiauliai and 5.9% in Panevėžys.

‘It is clear from figures that the Lithuanian housing market successfully withstood the first wave of the pandemic. Following the sudden decline during March-May, activity in the housing market is consistently reclaiming its previous position. While activity in the apartment segment increased by 14 per cent (as compared to May 2019) in June, apartment purchase transactions increased by 38 per cent this July (as compared to June 2020). It is important to note that this recovery in the housing market is visible in all cities of the country. According to the State Enterprise Centre of Registers, the number of apartment-related transactions concluded in July 2020, compared to June 2020, increased by 26 per cent in Vilnius, and by 49 per cent, 53 per cent, 22 per cent and 57 per cent respectively in Kaunas, Klaipėda, Šiauliai and Panevėžys.

This recovery in activity was seen in both the new and the older construction apartment segments. According to the State Enterprise Centre of Registers, the growth of transactions in older apartments (in buildings more than 2 years old) in July this year, as compared to June 2020, in the main cities of the country increased from 27 per cent to 67 per cent. This shows that the total volume of apartment sale deals in the country’s big cities was supplemented not only by new construction apartment transactions, which may have been agreed earlier (e.g. in 2019), but also by transactions in the secondary market, where decisions on apartment acquisition were made after the quarantine.

Meanwhile, apartment sales prices have successfully withstood the relatively short first wave of the pandemic and have remained at almost zero growth for the past five months, i.e. remained broadly stable. The current situation and the perspective of the activity in all segments of the housing market (apartments and houses) suggest that even small negative changes in sales prices in the near future are quite unlikely. However, if the number of cases of virus infection continues to grow both in Lithuania and in neighbouring countries, countries will be forced to enforce additional border controls or restrictions in certain sectors. All these circumstances would combine to subdue the expectations of residents, lead to a cooling of the Lithuanian housing market and increase the probability of negative movements in sales and rent prices’, – says Raimondas Reginis, Ober-Haus Research Manager for the Baltics.

Full review (PDF): Lithuanian Apartment Price Index, July 2020

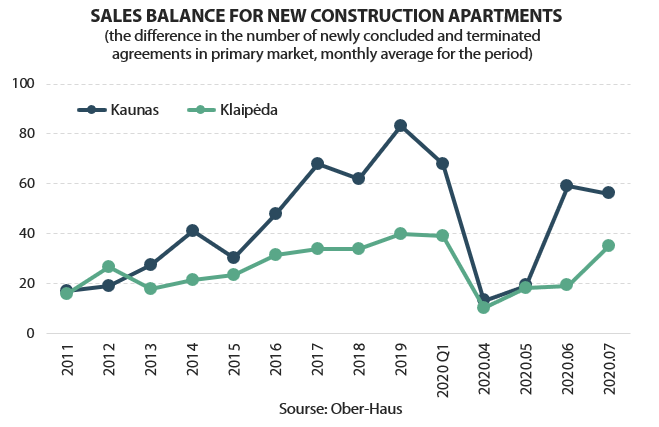

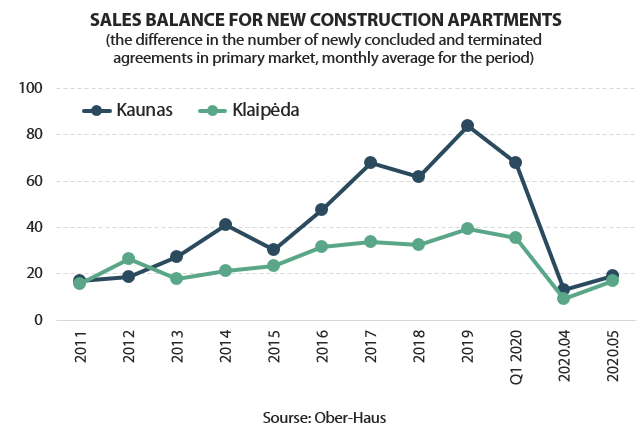

Over the last three months we have seen some consistent recovery in the new apartment market in the country’s major cities. This is particularly true in the country’s capital that is clearly outstanding in terms of volumes of new construction and the sufficient amount of data which makes it possible to discern the overall trend in the segment. In Kaunas and Klaipėda, mostly due to smaller volumes of new construction compared to those in the capital, we have seen larger fluctuations in the sales market, however, the overall trends are clear – sales volumes are growing, according to the new construction apartment market overview by Ober-Haus.

‘The growing sales of new construction apartments are consistent with the improving expectations of the country’s residents regarding their economic and personal financial standing’, – says Raimondas Reginis, Ober-Haus Research Manager for the Baltics. According to the data of Statistics Lithuania, the consumer confidence indicator has been growing for three successive months, and within that period (16 April–3 July) has increased by 13 percentage points. In the course of July the indicator increased by one percentage point.

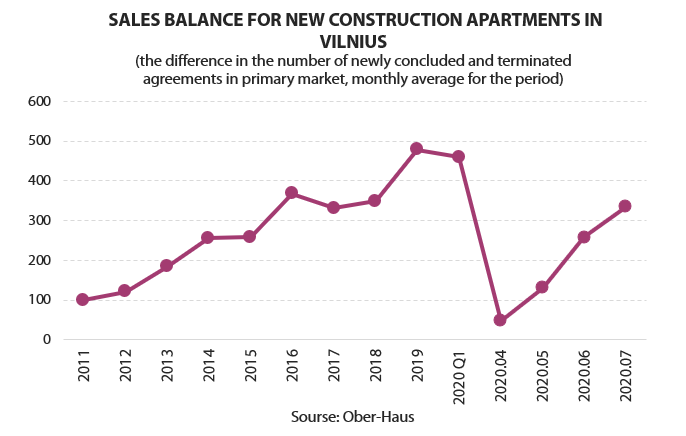

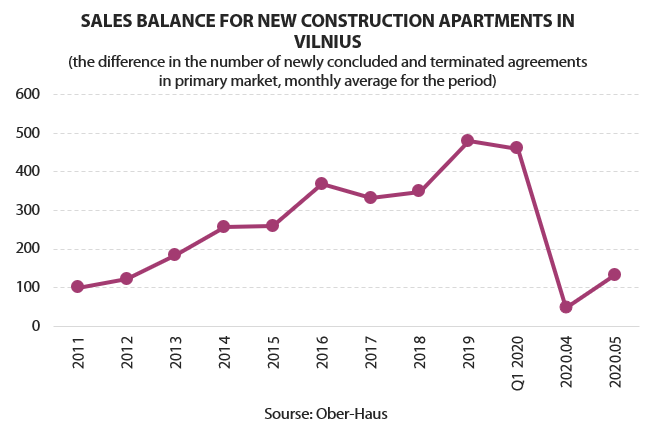

According to the Ober-Haus data, the overall sales balance this July in Vilnius multi-apartment houses in the primary market, including apartments already sold or reserved in completed multi-apartment houses (i.e. the difference between the newly concluded and terminated agreements) accounted for 335 apartments, i.e. an increase of 30 per cent compared to June 2019.

The new apartment sales indicators for April (48 apartments), May (132), June (258) and July (335) demonstrate that the recovery in the country’s capital is consistent, i.e. sale volumes grow appreciably every month. ‘Of course, if we compare the sales of new apartments in July of this year with the monthly average of the first quarter of this year, we see that July’s result is nevertheless 27 per cent lower’, – noted Reginis.

Following the significant and sudden leap in sales volumes this June in Kaunas, figures in July have stabilised. According to the data of Ober-Haus, the overall sales balance this July in the Kaunas market of multi-apartment houses in the primary market, including apartments already sold or reserved in the multi-apartment houses completed, accounted for 56 apartments, i.e. down by 5 per cent when compared to June 2020. In Q1 2020, on average 68 new apartments were sold per month, while this July’s result is 17 per cent lower.

Meanwhile, in Klaipėda, after a relatively poor result for this June, in July the sales volumes of new apartments increased significantly. According to the Ober-Haus data, the overall sales balance this July in the Klaipėda of multi-apartment houses including apartments already sold or reserved in completed multi-apartment houses accounted for 35 apartments, or 1.8 times more than in June 2020. Still if compared with the monthly average of the first quarter of this year the sales of new apartments this July have shown a decline of 9 per cent.’

The most recent data shows that following the specifically poor performance in Q2, there are signs of recovery not only in new construction, but also in the secondary housing market. It is reassuring to see similar tendencies not only in Vilnius, Kaunas or Klaipėda, but also in other regions of the country. According to Reginis, it is quite probable that the official July data will show growing trends in the sales of new apartments throughout the country.

‘The previous buyers of new apartments may encourage the developers of multi-apartment residential houses to commence projects which had been originally planned several months ago in Vilnius and in Kaunas. Not surprisingly, developers will be extremely cautious for now, as they will want to make sure that the current recovery in the housing market is sustainable and that their investments will come to the market at the right time. While developers see a clearly recovering market, at the same time the numbers of new infection cases are growing and there is increasingly frequent talk about a second wave of the pandemic. Developers are therefore, currently facing difficult decisions: whether to take advantage of the improving situation in the housing market and try to gain an advantage in mutual competition by offering a new product to potential buyers, or temporarily refrain from excessive risks and wait until the autumn, when the general situation in Lithuania and the rest of the world becomes clearer’, – says Reginis.

Park Town (West Hill & East Hill)

The latest data and surveys from multinational companies show that in the face of the pandemic commercial real estate investment markets are experiencing negative developments to a greater or lesser degree on a global scale. For example, according to the real estate services company Jones Lang LaSalle, a decline of one-third year-on-year in investment in commercial real estate was recorded in H1 2020 in the Asia-Pacific region. In Europe, the overall investment volumes in real estate remained high in H1 2020, but significant negative developments are already taking place in H2.

According to the latest Ober-Haus market review for commercial real estate investment transactions, the overall indicators of commercial real estate investment transactions in Lithuania in H1 2020 were not impressive and fell below long-term average.

In H1 2020, acquisitions of modern commercial real estate (offices, retail, warehousing and industrial buildings and premises with an estimated value of at least EUR 1.5 million) totalled EUR 138 million in Lithuania. “Due to the relatively small size of the Lithuanian commercial real estate market and lower liquidity, which leads to large fluctuations in activity in a shorter period, it is difficult to compare even half-yearly indices,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said. For example, in H1 2019, investment transactions (finalised) totalled EUR 77 million in Lithuania. This was the poorest half-year indicator since 2013. However, in H2 2019, the situation was the opposite and the most active half-year in the investment transactions market in Lithuania was recorded bringing the annual total to EUR 463 million.

Comparing the results of H1 2020 with the historical indicators, the amount of investments is 19% lower than the five-year average (2015–2019). “The investment market is inert – sometimes it may take a year or even longer from a strategic decision to acquire a particular real estate to its acquisition, so judging by the results of H1 it is still difficult to assess the impact of the pandemic on the sector. But one thing is obvious – the vast majority of investments in H1 2020 was determined by previous agreements for the acquisition of real estate,” Reginis said.

Like in the previous year, the major part of investments in Lithuania (86% of the total amount) accounted for the acquisitions of office buildings. In H1 2020, one of the largest office transactions in the history of Lithuania was finally completed when the third S7 office building was purchased by the Swedish investment company Eastnine. At the beginning of 2019, Eastnine signed an agreement with Galio Group regarding the acquisition of three S7 office buildings in Vilnius and these acquisitions were completed in stages (after the construction of each building was completed and the tenants moved into the building). In mid-2020, another large-scale transaction was announced, which had already been agreed in previous years. Investment company Zenith AM (jointly managed by Zenith Family Office and Dao Family Office) acquired the second building (East Hill) of the Park Town Business Centre in Vilnius from Darnu Group. According to Ober-Haus, the total value of these two transactions is EUR 86 million or 62% of the total investments in H1 2020.

The third largest investment transaction in the first half of this year was also executed in Vilnius. At the end of 2019, fund controlled by Lords LB Asset Management announced of its intention to acquire the IBC office building complex managed by INVL Baltic Real Estate. This EUR 33 million acquisition transaction was completed in March this year.

Acquisitions of smaller commercial and industrial real estate objects in the country’s capital and other cities of Lithuania, which ranged between EUR 3–6 million, accounted for the remaining part of the total H1 investment (EUR 19 million or the remaining 14% of all investments in H1 2020).

Surveys of the global market participants show that investment volumes in individual real estate segments (offices, logistics) are expected to grow in H2 2020. Meanwhile, expectations for the retail property sector are much more moderate and market participants expect recovery in 2021 at the earliest.

Looking at the results of H1 in Lithuania and the caution regarding the prospects of the country’s economy as well as the real estate development in the near future, it is very difficult to expect bolder steps by investors in both Lithuania and the Baltics. According to Reginis, in Q2 2020 of this year, due to the existing situation, both the buyers and sellers of commercial real estate remained passive, which means that strategic decisions regarding acquisitions made in H2 2020 will be reflected in the transaction statistics at the end of the year or in 2021.

Therefore, it is currently very difficult to expect another very productive year in the Lithuanian investment market and it is very likely that the total annual volumes of investment transactions this year will return to the level of 2014–2016 (EUR 220–270 million).

“Provided the overall performance is again significantly improved as a result of a larger investment in the office segment, as we have seen it in recent years. Despite the rapid growth in the global popularity of telecommuting, the high-end office segment is expected to remain among the most coveted investments among potential investors. Rapidly built office projects in Vilnius and Kaunas will offer a wider choice of quality real estate compared to other real estate segments, especially if such offices have financially sound tenants resistant to current pandemics,” Reginis said.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in June 2020. The annual apartment price growth in the major cities of Lithuania was 5.6% (the annual apartment price growth in May 2020 was 6.3%).

Apartment prices in Vilnius, Klaipėda, Šiauliai and Panevėžys in June grew by 0.3%, 0.2%, 0.4% and 0.2% respectively with the average price per square meter reaching EUR 1.645 (+6 EUR/sqm), 1.141 (+2 EUR/sqm), 758 (+3 EUR/sqm) and EUR 739 (+1 EUR/sqm). In Kaunas no price changes were recorded and average apartment price remained the same as in May – EUR 1.167.

In the past 12 months, the prices of apartments grew in all major cities: 5.9% in Vilnius, 5.5% in Kaunas, 3.9% in Klaipėda, 7.7% in Šiauliai and 7.6% in Panevėžys.

The analysis of the latest data in the apartment segment in the country’s major cities shows that, although the increase in sales prices of apartments has slowed down (the annual increase in sales prices decreased from 7.6% in February to 5.6% in June this year), we continue to record a symbolic increase each month. “The lockdown period was a strong blow to the whole real estate market, but with the end of the lockdown the expectations of the population regarding the economic situation and the real estate market started to grow,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

This is well illustrated by the consumer confidence index, which, according to Statistics Lithuania has been on the rise for two consecutive months. The consumer confidence index in the country has increased by 12% in the past two months from -16 in April to -4 in June (in January and February 2020, the consumer confidence index was positive and stood at 3–4). This shows that the population is already starting to be more positive about the country’s economic outlook and their own financial situation in the near future.

According to Reginis, the “rebound” in the market activity (number of transactions) in all major cities compared to the decade low indicators in April and May gives additional optimism to the housing market. According to the latest figures of the public enterprise Center of Registers, the number of transactions recorded in June 2020 increased by 5% in Vilnius, 6% in Kaunas, 3% in Klaipėda, 17% in Šiauliai and 13% in Panevėžys, compared to May 2020. The return of buyers to the sector of newly builds in Vilnius and Kaunas has also been recorded – the growing sales volumes of new apartments have been recorded for the second month in a row in these cities.

“Since the gloomiest forecasts of health professionals and economists in connection to the pandemic and the he country’s economic development have failed so far, the likelihood of negative changes in the sales prices of apartments in the country’s major cities in the near future has also decreased. However, if the overall activity of the housing market does not gather pace of recovery or stays at a relatively low current level, we are likely to see a stable price level in the near future with slight both positive and negative fluctuations,” Reginis added.

Full review (PDF): Lithuanian Apartment Price Index, June 2020

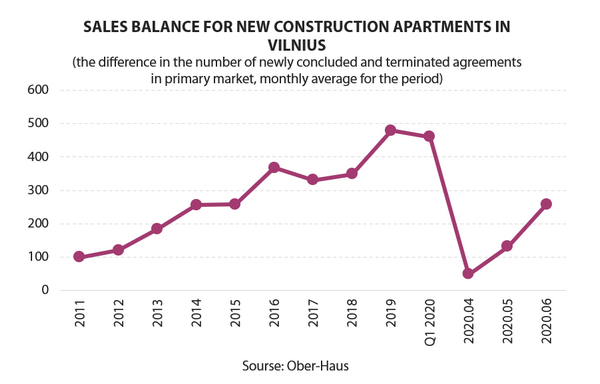

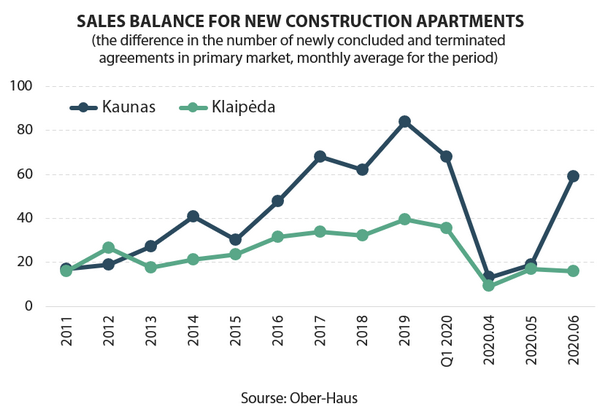

June 2020, the second month in a row, saw an increase in realization volumes in the market of newly built apartments in Vilnius and Kaunas. In contrast, in Klaipėda the volumes remained at a similar level as in May 2020.

According to Ober-Haus, in June this year, the sales balance (the difference in the number of newly concluded and terminated agreements) for apartments in already completed buildings or projects in progress in Vilnius was 258 apartments or 95% more compared to May 2020. Meanwhile, compared to April this year, the figure in June was 5.3 times higher in the capital city. Looking at the monthly sales indicators for new apartments in April (48 apartments), May (132 apartments) and June (258 apartments), it appears that, following a sharp decrease in activity in April, buyers started to return to the new build sector in Vilnius.

“It is clear that the overall sales indicators of Q2 2020 are extremely modest compared to previous periods. If in Q2 2019, deals for over 1,400 new apartments were concluded in the primary market in Vilnius, so the result this year is down by almost 70%,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

In recent months, the same market activity trends can be observed in Kaunas. According to Ober-Haus, in June, the overall sales balance for apartments in Kaunas, calculating sold and reserved apartments in already completed buildings or projects in progress, in the primary apartment market, was 59 apartments or 3.1 times more than in May. Compared to April 2020, 4.5 times more apartments were realized in Kaunas in June. Like it is the case in Vilnius, the overall sales indicators for Q2 2020 are also modest. If in 2019, deals for the purchase of nearly 250 new apartments were concluded in the primary market in Kaunas on average in a quarter, so the result of Q2 this year is down by 63%.

Meanwhile in Klaipėda, no major changes in the number of transactions for new apartments were recorded in June. According to Ober-Haus, in June the sales balance for apartments in Klaipėda, calculating sold and reserved apartments in already completed buildings or projects in progress, in the primary apartment market, was 16 apartments or 6% less than in May (17 apartments). If in 2019, deals for the purchase of nearly 120 new apartments were concluded in the primary market in Klaipėda on average in a quarter, so the result of Q2 this year is down by 64%.

Meanwhile in Klaipėda, no major changes in the number of transactions for new apartments were recorded in June. According to Ober-Haus, in June the sales balance for apartments in Klaipėda, calculating sold and reserved apartments in already completed buildings or projects in progress, in the primary apartment market, was 16 apartments or 6% less than in May (17 apartments). If in 2019, deals for the purchase of nearly 120 new apartments were concluded in the primary market in Klaipėda on average in a quarter, so the result of Q2 this year is down by 64%.

“One of the reasons why there is no faster recovery in the market activity in the city of Klaipėda over the past three months is much smaller construction volumes of apartment buildings than in other major cities,” Reginis pointed out. According to the representative of Ober-Haus, if the construction of apartment buildings in Vilnius and Kaunas has not stopped and developers regularly offer new projects to the market, the developers in Klaipėda are not so optimistic. Suspension of the construction of previously planned projects may lead to a very small number of apartments built in 2021, but the overall realization indicators have already been affected.

Sharp decline in the market activity increased sales of unsold apartments

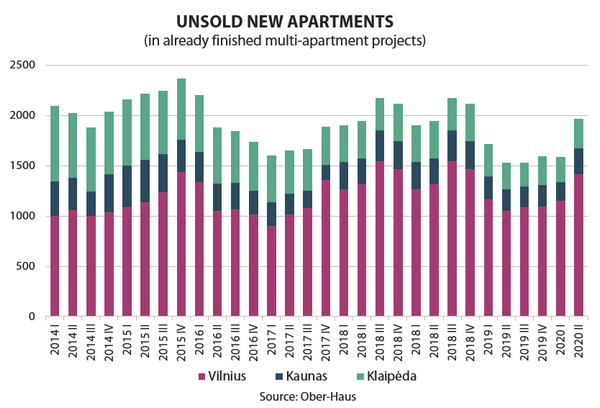

“Over the past three months or, we may say during the lockdown period, the developers have essentially not stopped their work and have tried to work normally. Since the overall market activity has decreased significantly, but the construction of apartments or their completion continued, an increase in the number of unsold apartments in already completed apartment buildings was observed in Q2 2020 in all major cities of the country,” Reginis pointed out.

According to Ober-Haus estimates, a total of 1,413 apartments were available for sale in Vilnius in the completed projects at the end of Q2 2020 or 22% more than at the end of Q1 2020. The figure in Kaunas at the end of Q2 2020 was 259 apartments or 43% more than at the end of at the end of Q1 2020 and in Klaipėda – 293 apartments or almost 17% more than at the end of Q1 2020.

“Historically, the number of unsold apartments should not yet give rise to greater concern of developers,” Reginis said. For example, in Vilnius and Kaunas more unsold apartments were recorded at the end of 2018 (1,467 and 276 apartments respectively), while in Klaipėda – at the end of Q1 2019 (318 apartments).

“Of course, the relatively slow demand for newly built apartments in the country’s major cities and the construction of projects at an undiminished pace are likely to lead to a further increase in the number of unsold apartments in the near future. However, as the figures for the past few months show, the confidence of buyers in the sector of newly built apartments is returning. At the same time, a clear message is sent to the market that this was a sudden, but short interruption in this sector. We can now observe how quickly the market will bounce back from the rock bottom of this decade in its activities,” Reginis said.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), remained unchanged in May 2020 (0.1% increase was recorded in April 2020). The annual apartment price growth in the major cities of Lithuania was 6.3% (the annual apartment price growth in April 2020 was 6.8%).

In May 2020 apartment prices in Vilnius and Šiauliai grew by 0.1% and 0.3% respectively with the average price per square meter reaching EUR 1,641 (+1 EUR/sqm) and EUR 755 (+3 EUR/sqm). Meanwhile in Kaunas and Klaipėda was recorded 0.1% price decrease with average price per square meter reaching EUR 1.167 and EUR 1.139 (-1 EUR/sqm). In Panevėžys no price changes were recorded and average apartment price remained the same as in April – EUR 738.

In the past 12 months, the prices of apartments grew in all major cities: 6.4% in Vilnius, 5.9% in Kaunas, 4.6% in Klaipėda, 8.9% in Šiauliai and 9.2% in Panevėžys.

The latest data on the apartment segment show that the market continues to operate in the waiting mode. The number of the registered transactions for apartment sales in May 2020 decreased by 37% in Lithuania compared to the monthly average last year. Some of the potential buyers who have withdrawn from the market are waiting for a more stable economic situation in the country and more certainty concerning the situation with the virus, while the rest of the buyers are expecting a fall in the housing prices and opportunities to take advantage of the situation.

“If some buyers have withdrawn from the market for personal financial reasons or poorer outlook in the economic future, other potential buyers are willing to wait for lower prices and are trying to push the home sellers further. The buyers who are currently planning to buy residential properties often suggest to sellers to reduce their prices by as much as one tenth in order to sell. However, the vast majority of sellers are reluctant to accept such offers today and the negotiations are often disrupted or a marginal discount is offered on the sales price like in previous years,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

As a result, sellers of residential property still feel strong enough and are reluctant to take any hasty decisions regarding significant reduction of sales prices. “The further direction of the price curve for apartments will depend on the extent to which the uncertainty due to the virus will continue (number of cases of infection, prospects for the tourism and accommodation sector, financing housing conditions, etc.) and the pace at which the economy will recover. This will determine the further mood of potential buyers who have withdrawn from the market and the specific decisions on purchasing housing. If the activity in the apartment sector in the country’s major cities starts to increase in the second half of this year, it will give additional optimism for the whole market and the likelihood of significant negative changes in sales prices will be significantly reduced,” Reginis noted.

Full review (PDF): Lithuanian Apartment Price Index, May 2020

Based on the latest data, both negative and positive indicators were recorded in the apartment sales in the country and major cities in May 2020. The overall decline in the market activity in this housing segment can still be observed. According to the public enterprise Center of Registers, a total 1,865 purchase and sale transactions were registered in Lithuania in May this year, a 4% decrease compared to April. At the same time, this was the worst monthly result since January 2015. In Vilnius, the number of such transactions in May 2020 decreased by almost 12% compared to April 2020 and in Kaunas – by almost 9%, but the figure in Klaipėda unexpectedly increased by 30%.

“To give an idea of the level of activity of currently the largest housing segment in Lithuania, the apartment sales indicators in May can be compared to those of previous years,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said. The number of apartment transactions recorded in May 2020 compared to the monthly average in 2019 decreased by 37% in Lithuania (33% in Vilnius, 36% in Kaunas and 42% in Klaipėda). Historically, the overall activity in the apartment market in Lithuania returned to the levels of May 2011.

“If the total number of registered transactions for the purchase of apartments in Lithuania continued to decrease, so the sales balance of newly built apartments – the difference between the numbers of newly concluded and terminated agreements – showed the first positive signs in Vilnius, Kaunas and Klaipėda,” Reginis noted.

According to Ober-Haus, in May 2020, the sales balance in the primary market of apartments, calculating sold and reserved apartments, in Vilnius was 132 apartments or 2.8 times more than in April 2020. In Kaunas the number stood at 19 apartments (46% more than in April 2020) and in Klaipėda – 17 apartments (89% more than in April 2020).

A number of factors have contributed to the rise in the sales in the primary market of apartments. “First, a decrease in the number of new COVID-19 cases and the easing of the lockdown have given a little more confidence to potential home buyers who, returning to their normal life rhythm, became more interested in purchasing homes than they did in April. This is also reflected in the statistics on preliminary agreements, both in terms of the sales published by developers and in reserved properties. Second, after the extremely poor, almost symbolic performance in April this year in the sale of newly built apartments, the statistical improvement in May in the country’s major cities was not difficult to achieve,” Reginis said.

A number of factors have contributed to the rise in the sales in the primary market of apartments. “First, a decrease in the number of new COVID-19 cases and the easing of the lockdown have given a little more confidence to potential home buyers who, returning to their normal life rhythm, became more interested in purchasing homes than they did in April. This is also reflected in the statistics on preliminary agreements, both in terms of the sales published by developers and in reserved properties. Second, after the extremely poor, almost symbolic performance in April this year in the sale of newly built apartments, the statistical improvement in May in the country’s major cities was not difficult to achieve,” Reginis said.

However, the overall sales volumes continue to be very low. If we compare the average realization indicators of May 2020 with those of May 2019, we can see that the sales volumes fell 3.6 times in Vilnius, 4.4 times in Kaunas and 2.3 times in Klaipėda.

“The decrease in the sales volumes of newly built apartments and the number of terminated sales agreements for apartments in specific objects indicate that we are faced with the exceptional situation in the housing market,” Reginis said. If, before the global pandemic, termination of agreements occurred only in special cases, currently there are projects in the market with a negative overall monthly sales result, that is the number of new agreements regarding the purchase of the apartments was smaller than the number of terminated agreements.

Looking at the indicators of May 2020, a number of positive trends can be observed. According to the representative of Ober-Haus, although the volume of purchases of apartments continues to decrease, there are signals of stabilization and slowing down of the decline. The volumes of sales in the primary market of newly built apartments, in contrast, show that the interest of potential buyers in the new housing has not stopped and a further moderate return of buyers to this housing segment could be expected.

“The data of the primary and secondary markets of apartments over the next few months will show more precisely whether some potential buyers have withdrawn from the sector for a longer period or whether they have put their intentions on the back burner. One thing is clear, however, is that, in the situation where we are coping with the consequences of the pandemic, the search for the rock bottom in the housing market is still ongoing,” Reginis said.

The year 2019 and the beginning of 2020 was an extremely active period in the Lithuanian housing market. The 2019 indicators stood out with record expenditure for the purchase of residential property, the overall housing market activity and changes in sales prices and rents of apartments. Q1 2020 promised another successful year for the housing market in Lithuania, however due to the global COVID-19 pandemic and the quarantine imposed in Lithuania in mid-March, the situation has changed dramatically in the entire real estate market, reported in the latest overview of the residential market in Lithuania by Ober-Haus.

“While the overall main indicators of the Lithuanian housing market in Q1 2020 were very optimistic, the first quarter should be divided into two periods – before imposing the quarantine (16 March 2020) and the second half of March. The second half of March was the opposite of what had been recorded in the Lithuanian housing market in 2019 or in January-February 2020,” Saulius Vagonis, Head of Valuation & Analysis at Ober-Haus, said.

In the second half of March, due to the suspension or restriction of the activities of notary offices, a decline in housing transactions was recorded. According to the Centre of Registers, in January-February 2020, 12% more purchase and sale transactions for apartments and almost 23% more transactions for houses were concluded in Lithuania compared to the same period in 2019. In March 2020, a decrease of 26% in transactions for apartments and 27% in transactions for houses was recorded compared to the monthly average in 2019. In March 2020, a fall in the number of transactions (apartments and houses) was recorded in all major cities of the country (compared to the monthly average in 2019): in Vilnius – 17%, in Kaunas – 32%, in Klaipėda – 40%, in Šiauliai – 24% and in Panevėžys – 30%.

Concluded in Lithuania compared to the same period in 2019. In March 2020, a decrease of 26% in transactions for apartments and 27% in transactions for houses was recorded compared to the monthly average in 2019. In March 2020, a fall in the number of transactions (apartments and houses) was recorded in all major cities of the country (compared to the monthly average in 2019): in Vilnius – 17%, in Kaunas – 32%, in Klaipėda – 40%, in Šiauliai – 24% and in Panevėžys – 30%.

A larger number of apartments for rent adjusted the price only marginally

In contrast to the housing sale segment, minor negative price developments were already recorded in the apartment rental market in Vilnius in March. Vilnius has the largest amount of rental property of all major cities in the country, and in the second half of March experienced the biggest drop in the customer traffic in the short-term rental segment.

“Some property owners realized that the closure of national borders and the sudden disappearance of the tourist traffic (which is the main drive for the short-term rental segment) as a result of the pandemic could cause short-term and even long-term problems in the entire accommodation sector. Some property owners applied significant discounts on the short-term rent of apartments, while other owners decided to offer them to local residents for a longer period of time. This resulted in additional volumes of long-term rental apartments on the market, which slightly adjusted the overall price level in the market,” Vagonis said.

According to Ober-Haus, in March 2020, rents for 1–2 room apartments in Vilnius decreased by an average of 1–2 %. Rents of apartments remained stable in Kaunas and Klaipėda in March.

New apartment construction in Kaunas and Klaipėda had stepped on the decrease path even before the pandemic

Looking at the realisation of newly built apartments it is also clear that March 2020 had a negative impact on the overall result of the first quarter. According to Ober-Haus, in Q1 2020, 1,380 newly built apartments were sold and reserved directly from developers in Vilnius, in Kaunas – 164 apartments and in Klaipėda – 107 apartments. Comparing Q1 2020 with the average of the four quarters of 2019, the sales volumes in the primary market decreased by 4% in Vilnius, in Kaunas – by 35%, and in Klaipėda – by 9%.

In Kaunas and Klaipėda, compared to Vilnius, a noticeable decline in the realization of newly built apartments is also linked to the recent decline in construction volumes, not only to the pandemic.

For example, the largest number of apartments since 2008 was built in Kaunas in 2018 (997 apartments), while in 2019 and 2020 a slowing down in apartment construction was recorded (836 apartments in 2019 and 750 apartments planned in 2020). Therefore, in 2017–2019, a significant surge in the realization of apartments in the primary market was recorded in Kaunas. The high realization indicator also cannot be repeated today due to the shrinking supply factor. In the meantime, it is the opposite in Vilnius, where we can see an increasing construction of apartments, which in 2020 should peak since 2008 (according to the estimates of February 2020, about 5,200 apartments are planned to be built in Vilnius). So buyers in the capital city have a very broad choice of new housing, which is reflected in the sales statistics. In Klaipėda, like in Kaunas, construction volumes are decreasing: According to Ober-Haus, if in 2019, 421 apartments were built for sale, so in 2020 it is planned to complete 350 apartments.

While the amount of mortgage loans increased in Q1 2020 compared to the same period a year ago, in March loans shrunk (the volume of new mortgage loans in March was lower than the monthly average in 2019). According to the Bank of Lithuania, in Q1 2020 new mortgage loans in the amount of EUR 340 million were granted in Lithuania or 14.4% more than at the same period of 2019. Interest rates for newly issued mortgage loans remained stable in Lithuania. The average annual interest rate for new mortgage loans in January to March 2020 was 2.39% or 0.04 percentage point higher than a year ago.

“Looking at the prospects of Q2 2020 in Lithuania’s housing market it is clear that we will record much poorer indicators than in Q1 2020. The prolonged period of quarantine, negative news flow about the overall economic situation in the country, more conservative funding for housing purchases and deteriorating expectations of the population may put the overall activity of the housing market in Q2 to long-unseen lows. At the same time, this may have a negative impact on the sales prices and rents of residential properties and call for adjustment in the plans for the development of new housing,” Vagonis said.

Full review (PDF): Lithuania Residential Market Commentary Q1 2020

Search

Search