The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 1.4% in January 2021 (0.9% increase was recorded in December 2020). The annual apartment price growth in the major cities of Lithuania was 4.9% (the annual apartment price growth in December 2020 was 4.1%).

In January 2021 apartment prices in the capital grew 1.2% with the average price per square meter reaching EUR 1,714 (+21 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in November grew by 1.4%, 1.3%, 2.7% and 2.9% respectively with the average price per square meter reaching EUR 1,204 (+16 EUR/sqm), EUR 1,182 (+16 Eur/sqm), 791 (+20 EUR/sqm) and EUR 776 (+21 EUR/sqm).

“Following a break in the growth of apartment prices in the middle of 2020, the end of the year saw a faster price growth in the main Lithuania’s cities again, and this January prices of apartments increased further. The firm financial basis of potential buyers, attractive lending conditions, positive expectation of most residents and the flow of positive news in the housing market have helped this particular real estate segment to develop a certain kind of resistance in this unsettled period.

Faster growth in prices comes as no surprise since the data on the activity of the housing market shows a strong internal demand for housing country-wide. Although, based on the data of the SE Centre of Registers, sales of apartments in Lithuania were 11% less this January compared to January 2020, it was the second best January since 2007 in terms of results. Meanwhile, the sales of private houses in Lithuania were extremely buoyant this January – it was the best January result since 2007.

There is a particularly big demand for housing in the rapidly growing capital city of Lithuania. Its initial market of new apartments demonstrated record high results of advance agreements on the purchase of new apartments this January. Non-declining demand for new housing and the falling number of unsold apartments in the country’s larger cities provide favourable conditions for the growth of prices of both new and old construction apartments,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review (PDF): Lithuanian Apartment Price Index, January 20201

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.9% in December 2020 (0.6% increase was recorded in November 2020). The annual apartment price growth in the major cities of Lithuania was 4.1% (the annual apartment price growth in November and October 2020 was 4.1%).

In December 2020 apartment prices in the capital grew 1.3% with the average price per square meter reaching EUR 1,931 (+22 EUR/sqm). Apartment prices in Kaunas, Klaipėda and Šiauliai in December grew by 0.3%, 0.8% and 0.6% respectively with the average price per square meter reaching EUR 1,188 (+4 EUR/sqm), EUR 1,166 (+9 Eur/sqm) and EUR 771 (+5 EUR/sqm). In Panevėžys no price changes were recorded and average apartment price remained the same as in November – EUR 755.

In the past 12 months, the prices of apartments grew in all major cities: 4.8% in Vilnius, 3.4% in Kaunas, 2.6% in Klaipėda, 3.9% in Šiauliai and 3.8% in Panevėžys.

“Although the pandemic in March-August 2020 largely stopped the increase in sales prices of apartments in the major cities of the country, a faster growth was again recorded at the end of the year. This resulted in a significantly lower annual price increase (4.1%) than in 2019, when apartment prices in the country’s major cities increased on average by 7.2%,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said. According to Statistics Lithuania, in December 2020, the annual inflation rate calculated according to the Harmonized Index of Consumer Prices was negative and stood at -0.1%, so the real sales prices of apartments (less inflation) increased even more rapidly – by 4.2%.

It is clear that the growing importance of housing in our daily lives during the pandemic and the financial capabilities of the population to purchase homes have protected the entire housing market against more serious negative consequences. According to the State Enterprise Centre of Registers, in 2020 almost 33,000 apartments were purchased in Lithuania, 8.4% less than in 2019. At the same time buyers spent 2% more on buying apartments in 2020 than in 2019. In H2 2020, the market activity bounced back and the number of purchased apartments was the same as in H2 2019.

Despite the second wave of the pandemic and the stringent containment of lockdown, the overall expectations of the population remain at a much higher level than those during the first lockdown. According to Statistics Lithuania, the consumer confidence index fell by five percentage points in November 2020 to minus 4, and in December it increased by one percentage point to minus 3. By comparison, in April and May 2020, the consumer confidence index dropped to minus 16 and minus 11, respectively.

“Therefore, despite the continuing challenges caused by the pandemic to the country’s economy and, in particular, to certain sectors of the economy, very good indicators of 2020 and the continuing positive moods in the housing market allow us to hope that we will avoid more serious negative consequences in the housing market in the near future. However, the decline in the overall activity of the housing market or the slowing down of price increase in the first half of this year is certainly possible,” Reginis said.

Full review (PDF): Lithuanian Apartment Price Index, December 2020

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in November 2020 (0.4% increase was recorded in October 2020). The annual apartment price growth in the major cities of Lithuania was 4.1% (the annual apartment price growth in October 2020 was 4.1%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in November 2020 (0.4% increase was recorded in October 2020). The annual apartment price growth in the major cities of Lithuania was 4.1% (the annual apartment price growth in October 2020 was 4.1%).

In November 2020 apartment prices in the capital grew 0.6% with the average price per square meter reaching EUR 1,671 (+9 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in November grew by 0.6%, 0.7%, 0.1% and 0.8% respectively with the average price per square meter reaching EUR 1,184 (+8 EUR/sqm), EUR 1,157 (+8 Eur/sqm), 766 (+1 EUR/sqm) and EUR 755 (+6 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 4.6% in Vilnius, 3.6% in Kaunas, 2.2% in Klaipėda, 5.0% in Šiauliai and 6.1% in Panevėžys.

“Despite fluctuations, both the activity of the housing market and the sales prices of apartments in Lithuania and the major cities of the country continue to show resistance to the current pandemic. Although the increase in the sales prices of apartments in major cities almost stalled in March-August 2020 (the average monthly growth was 0.1%), in September-November a faster increase in prices was recorded (the average monthly growth was 0.4%). Following the lifting of the first lockdown, the housing market saw a consistent and rapid recovery indicating the continuing need for housing property. The demand for isolation and work from home due to the pandemic also increased the importance of housing in the context of the real estate market,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

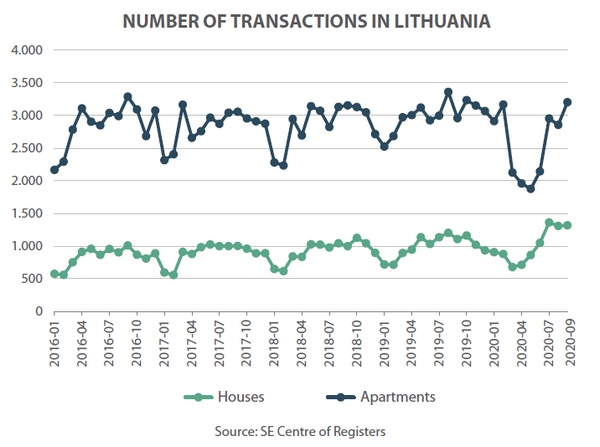

Changes in the prices of apartments remain positive this year, although the activity in the apartment market faces greater fluctuations. According to the State Enterprise Center of Registers, more than 2,800 apartments were purchased in Lithuania in November 2020 or 23% less than in October 2020. Looking at the long-term data, there is usually a slowdown in the activity in the apartment market in November and December, i.e. in 2004–2019, the number of apartment transactions in November compared to October tended to decrease by about 5% on average. However, in November 2020, a decrease of 23% in the number of transactions was recorded testifying to the rapidly deteriorating epidemiological situation in Lithuania. Of course, it must also be noted that, according to the number of apartments sold in Lithuania, October 2020 was historically one of the most successful months.

The recent change in population sentiment is well illustrated by the consumer confidence index, which, according to Statistics Lithuania, decreased by 5 percentage points in November 2020. “The most significant impact on the decline of this indicator in November was far more pessimistic forecasts for the country’s economic situation than in September or October. After assessing the overall epidemiological situation in the country and the overall negative mood, it is likely that in December the market activity will be even worse than in November 2020, and the increase in prices in the major cities may slow again,” Reginis added.

Full review (PDF): Lithuanian Apartment Price Index, November 2020

After record-high results of the warehousing and transportation companies in 2019 in Lithuania, a decline was recorded in Q2 and Q3 2020. According to Statistics Lithuania, sales revenues (excluding VAT) of the companies related to transportation services in Lithuania in the first nine months of 2020 totalled EUR 3.3 billion or 0.9% more than in the same period in 2019. However, looking only at the changes in the sales revenues of warehousing and storage companies during the same period, a decrease of 15.9% was recorded in 2020.

After record-high results of the warehousing and transportation companies in 2019 in Lithuania, a decline was recorded in Q2 and Q3 2020. According to Statistics Lithuania, sales revenues (excluding VAT) of the companies related to transportation services in Lithuania in the first nine months of 2020 totalled EUR 3.3 billion or 0.9% more than in the same period in 2019. However, looking only at the changes in the sales revenues of warehousing and storage companies during the same period, a decrease of 15.9% was recorded in 2020.

“If the official statistics shows a sufficiently significant decrease in the sales revenues of warehousing and storage companies this year, investments in the construction of new warehouses have been considerable” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

150,000 sqm of new warehouse space in the main regions of the country

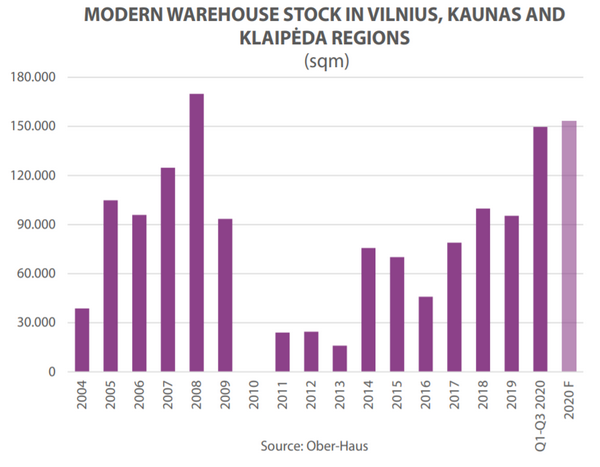

In the first three quarters of 2020, in Vilnius, Kaunas and Klaipėda regions, 12 projects (or their stages) were completed offering nearly 150,000 sqm of warehousing space. According to Ober-Haus, this is 57% more in these regions than in 2019. Klaipėda region stood out with the largest area of newly constructed warehousing premises in the history of the region.

After completion of the construction of another warehouse in Vilnius at the end of this year, the total area of warehouse space built in 2020 in Vilnius, Kaunas and Klaipėda will reach almost 154,000 sqm and will be one of the highest figures in the supply in history. “A higher figure was achieved in 2008, when 18 projects (or their stages) were completed in these regions with nearly 170,000 sqm of new warehouse space,” Reginis added.

“It should be noted that the new warehouse space in 2020 did not fill the market with vacant premises. A total of 75% of the new premises were built for own use, including the third-party logistics services (3PL) and the rest of the premises were either directly offered for rent or had been leased before the construction was started,” Reginis said.

Increasing investments in multi-functional projects closer to end users in Vilnius

In the first three quarters of 2020, five new projects were completed in Vilnius and its environs offering 49,300 sqm of warehousing premises.

The logistics services company, Transekspedicija, completed a large-scale project by implementing the third stage of its development on Ukmergės Road. This stage of development involved the construction of 25,000 sqm logistics centre with offices. Another major project was implemented in Kirtimai district, where 14,000 sqm sized logistics centre of the Lithuanian Post were completed. The centre will accommodate an automated line for distribution of parcels and correspondence.

Meanwhile, in Q3 the Norwegian capital real estate developer, Baltic Sea Properties, completed two warehouses next to Vilnius-Kaunas Motorway, which were leased to the pharmaceutical logistics company Oribalt Vilnius and the international freight company Delamode Baltics. JUNG Vilnius built a new 3,000 sqm commercial building on the old Ukmergės Road for own use. In addition to the administrative and other premises, it contains a 2,000 sqm warehousing area for the company’s production.

According to Ober-Haus, after the implementation of these projects, the total area of warehouses in Vilnius and its environs increased by 8% to 671,800 sqm in Q1-Q3 2020.

By the end of 2020 in Žemieji Paneriai district of Vilnius, a 3,600 sqm warehouse of Vilpak, producer of packaging, should be completed for its own use. The real estate development company, Sirin Development, is planning to implement the fourth stage of Liepkalnis Industrial Park in 2021 (over 25,000 sqm warehouse). In the meantime, the fund management company, Eika Asset Management, is planning to build a 4,700 sqm express parcel terminal that will be leased to DHL Lietuva in the territory of Vilnius Airport in 2022.

In addition to the development of traditional warehouses, developers are keen on launching the development of stock-office concept buildings. The real estate development company, Darnu Group, has announced further development of Vilnius Business Park on Ukmergės Street. The development will involve the construction of 24,000 sqm sized commercial complex that will offer tenants a variety of premises (offices, retail, storage and production) in one place. A few other companies are planning similar larger scale projects in different parts of Vilnius.

Developers of traditional and larger warehousing projects usually face the challenge of finding major tenants, therefore such projects start only where at least some of the tenants have been found. “In contrast, projects offering smaller floor area and multiple use in one place can attract a much wider range of potential tenants, thus allowing for more flexibility in planning such projects. In the context of rapidly growing e-commerce, demand for and supply of such projects should grow steadily as projects of this type that are closer to urban areas can improve the delivery of goods to end users,” Reginis said.

More significant growth of warehousing premises is expected in Kaunas next year

In the first three quarters of 2020, two new projects (or their stages) were completed in Kaunas and its environs with 14,200 sqm of new warehouse space in total.

Hegelmann Transporte completed the third extension of it’s logistics centre with of around 10,000 sqm in Kaunas District and a 5,000 sqm warehouse with offices in Petrašiūnai district, on Chemijos Street.

According to Ober-Haus, following the implementation of these projects, the total area of warehouses in Kaunas and its environs increased by 3% to 426,900 sqm in three quarters of 2020.

At the beginning of 2021, the Vičiūnai Group should complete nearly 12,000 sqm logistics centre in Kaunas FEZ. Another major project in Kaunas region is being implemented by the real estate development company, Sirin Development. In mid-2021, the company plans to complete the construction of the second warehouse for Kaunas Logistics Centre (total area of about 16,000 sqm). The first 24,000 sqm warehouse with offices was completed in 2019.

Total area of modern warehousing premises increased by 41% in Klaipėda

The year 2020 was exceptional for Klaipėda region as it saw the development of two largest warehouses in this region.

Vlantana, a transport and logistics company, expanded its storage complex next to Vilnius-Klaipėda Motorway by building another 32,000 sqm logistics centre.

In the meantime, the real estate development company, Urban Inventors, implemented an equally impressive project next to Vlantana’s warehouse. It completed the first stage of the SBA Technology and Innovation Park by building a 30,000 sqm logistics centre to be used by SBA and other companies.

Another three smaller projects were implemented in Klaipėda FEZ. Autoverslas completed the construction of a new 10,000 sqm warehouse, another company reconstructed a new 10,000 sqm warehouse with offices on Vilnius Road, and the international packaging producer, Retal, expanded its production base by building a new warehouse with offices totalling about 4,500 sqm.

According to Ober-Haus, completion of these projects increased the total area of warehouses in Klaipėda and its environs by 41% up to 296,500 sqm in Q1-Q3 2020.

The supply of warehousing space in Klaipėda region will increase in 2021 and subsequent years as further development of the Baltic Logistics Centre and SBA Technology and Innovation Park are planned, Vingės Logistika plans to expand the area of its warehouses in Klaipėda FEZ, etc.

“However, the specific deadlines for implementing new projects will still depend both on the situation in the transport and logistics sector and the opportunities in the real estate market, particularly as far as the development of projects for rent is concerned, because traditional bank financing without advance arrangements with tenants is almost impossible,” Reginis said.

COVID-19 pandemic and the new supply has kept rents flat

Rents for new warehouses remained stable in Vilnius, Kaunas and Klaipėda regions in 2020, while rents for old warehouses increased by 2-3% on average.

“The market of modern warehouses is regularly supplemented with new projects. In 2020, however, due to the uncertainty of the pandemic, tenants were particularly concerned with the costs of renting premises. The increase in rents of old warehouses is more attributed to a relatively low rent level which continues to increase within the limits of the inflation rate,” Reginis said.

According to Ober-Haus, at the end of Q3 2020, rents of new warehousing premises in Vilnius stood at 3.9–5.3 EUR/sqm and old warehousing premises – at 2.0–3.6 EUR/sqm. In Kaunas, new warehousing premises rented for 3.8–5.0 EUR/sqm and old warehousing premises – for 1,8–3,3 EUR/sqm, in Klaipėda new warehousing premises rented for 3.7–4.9 EUR/sqm, and old warehousing premises – for 1.8–3.3 EUR/sqm.

The prevailing strong domestic consumption and sufficient supply of warehousing space should keep rents stable in the short term. One of the more significant changes taking place is the gradual implementation of the provisions of the EU Mobility Package, which may have a significant impact on both the Lithuanian transport sector and the country’s overall economy. The development of the warehouses to a large extent depends on the operations of transport and logistics companies, which, having assessed the impact of the changes in practice, may in the future reduce investment not only in vehicle fleets, but also in this real estate segment.

On the other hand, warehouses, the more active development of which started in Lithuania 15 years ago, do not always meet the needs of today’s tenants. “For operational efficiency many tenants tend to renew storage facilities looking for more convenient transport or more modern building engineering infrastructure, a bigger height of the premises, etc. The rapid growth of e-commerce brings a demand for efficient and rapid delivery of goods to end users, which may lead to a more active development of compact and multifunctional projects located closer to consumers,” Reginis said.

According to Statistics Lithuania, the retail sale via mail order houses or via Internet in Lithuania in 2015–2019 grew on average by 28% annually. Meanwhile during the first nine months of 2020, a 44% growth compared to the same period of 2019 was recorded.

Full review (PDF): Lithuania Commercial Market Commentary Q3 2020

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.4% in October 2020 (0.3% increase was recorded in September 2020). The annual apartment price growth in the major cities of Lithuania was 4.1% (the annual apartment price growth in September 2020 was 4.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.4% in October 2020 (0.3% increase was recorded in September 2020). The annual apartment price growth in the major cities of Lithuania was 4.1% (the annual apartment price growth in September 2020 was 4.2%).

In October 2020 apartment prices in Vilnius, Kaunas, Klaipėda and Šiauliai grew by 0.3%, 0.3%, 0.6% and 0.4%

respectively with the average price per square meter reaching EUR 1,662 (+6 EUR/sqm), 1,176 (+4 EUR/sqm), 1,149 (+7 EUR/sqm) and EUR 765 (+3 EUR/sqm). In Panevėžys no price changes were recorded and average apartment price remained the same as in September – EUR 749.

In the past 12 months, the prices of apartments grew in all major cities: 4.6% in Vilnius, 3.4% in Kaunas, 2.1% in Klaipėda, 6.1% in Šiauliai and 6.2% in Panevėžys.

“Compared to March-August of 2020, in September-October the overall increase in prices in major cities of Lithuanian was slightly faster. Given the positive mood in the housing market in September and October, similar trends in price change could be expected. The numbers of housing transactions show that demand for housing and opportunities to purchase it remain high. For example, according to the State Enterprise Center of Registers, more than 3,600 apartments were purchased in Lithuania in October 2020 and historically this is one of the best results of the month.

However, the increase in the sales prices of apartments in 2020 is not as rapid as that in 2019 or early 2020 and it is likely that we will not see dramatic price changes in the remaining months of the year. Global lockdown introduced in November may again reduce the overall economic activity in the country and worsen the expectations of the population, which subsequently may lead to a further decline in the overall activity in the housing market in November and December. However, looking at the changes in the sales prices of apartments during the past ten months of the year, the overall annual result will in any case remain positive,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review (PDF): Lithuanian Apartment Price Index, October 2020

After the end of the lockdown, the period of uncertainty, the real estate market players felt more relaxed. In Q3 2020, the Lithuanian housing market did not hesitate and started an upward move. This largely compensated for the losses of Q2 2020.

After the end of the lockdown, the period of uncertainty, the real estate market players felt more relaxed. In Q3 2020, the Lithuanian housing market did not hesitate and started an upward move. This largely compensated for the losses of Q2 2020.

According to the state enterprise Centre of Registers, in Q3 2020, compared to Q2 2020, 51% more purchase and sale transactions for apartments and 52% more transactions for houses were recorded in Lithuania. In Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys an upward move in the number of transactions during the same period was recorded both in the segment of apartments (by 30% in Vilnius, 53% in Kaunas, 81% in Klaipėda, 66% in Šiauliai and 95% in Panevėžys) and houses (by 48% in Vilnius, 47% in Kaunas, 0% in Klaipėda, 37% in Šiauliai and 22% in Panevėžys). Comparing the activity of the Lithuanian housing market with the previous year, the activity in Q3 2020 was almost the same or even higher. The sales of apartments were down by 3%, meanwhile the sales of houses were up by 16% in Q3 2020 compared to Q3 2019. Also, the sales of houses reached all-time highs.

The decline in the activity in the apartment market in Q2 2020 sparked much public debate about the prospects of sales and rental prices. According to Ober-Haus, the decline in the housing market activity during the lockdown in Q2 and in Q3 2020 only slowed down the increase of apartment sales prices, but no negative changes were recorded. If in Q1 2020 the apartment sales prices in the county’s major cities increased by 1.2% on average so in Q2 the growth was 0.3%, and in Q3 – 0.6%. In Q3 2020, apartment sales prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys increased by 0.7%, 0.5%, 0.1%, 0.5% and 1.3% respectively.

“In Q3, the developments in the housing market were largely positive. The bounced back expectations of the country’s population regarding the country’s economic and it’s financial situation contributed to the overall growing activity in the housing market and helped avoid negative sales price changes,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said. According to Statistics Lithuania, the consumer confidence indicator in the country between April and September 2020 increased by 16 points.

In Q3 2020, positive changes were also recorded in the housing financing sector in Lithuania. According to the Bank of Lithuania, the number of newly issued mortgage loans in Q2 2020 compared to Q1 2020 decreased by 24%. New mortgages in the amount of EUR 113 million per month on average were issued in July-August in Lithuania, the same amount as average per month in Q1 2020. So borrowing in Lithuania is back to the levels at the start of the year. In the first eight months of 2020, new mortgages in the amount of EUR 824 million were issued in Lithuania or 4% less than in the same period last year.

Strong domestic demand put the rental market back on track

Meanwhile the apartment rental sector in the country’s major cities, especially in Vilnius, felt the impact of the lockdown, yet it bounced back in Q3 2020.

“Due to the consequences of the pandemic, the housing rental market in Vilnius came under greatest pressure because of the largest amount of properties for long-term and short-term rent in the country located in this city. While the sudden sharp decline of tenants in the short-term rental property segment caused anxiety and problems to property owners, this had little impact on the long-term rental properties,” Reginis said. According to Ober-Haus, in Q2 2020, rents in Vilnius decreased by around 2–3% on average, in Kaunas and Klaipėda this decline stood at around 1%. The strong domestic demand was able to compensate for the increased supply resulting from diminished flows of foreign tourists in the major cities.

Q3 2020 was significantly more active in the residential rental property market not only due to the resumed economic activity and improved confidence, but also due to the usual seasonality in this sector. The total number of residential rental property transactions completed by Ober-Haus in Vilnius, Kaunas and Klaipėda in Q3 2020, compared to Q2 2020, increased by more than 80%. If compare the figure of Q3 2020 for the number of transactions with that in the same quarter in 2018–2019, it is up by 13% on average.

“At the same time the increased activity in the residential property rental market in the country’s major cities significantly decreased the number of residential properties available for rent, which shot up during the lockdown. For example, in Q3 2020, the number of residential properties for rent in Vilnius and Kaunas offered on real estate listing portal Aruodas decreased by nearly 25%,” Reginis added.

Considerably more positive outlook in the entire real estate market and the increased activity of the residential property rental segment essentially brought back rents for apartments in the major cities to the price levels at the beginning of the year. If compare average rents for apartments in the country‘s major cities in Q3 2020 and in Q3 2019, rents this year are higher by 1–3%. According to Ober-Haus, in Q3 2020, a 1–3-room apartment rented for 450 EUR/month in Vilnius, 363 EUR/month in Kaunas, 362 EUR/month in Klaipėda, 254 EUR/month in Šiauliai and 255 EUR/month in Panevėžys.

The number of unsold apartments in Vilnius is the smallest since 2017

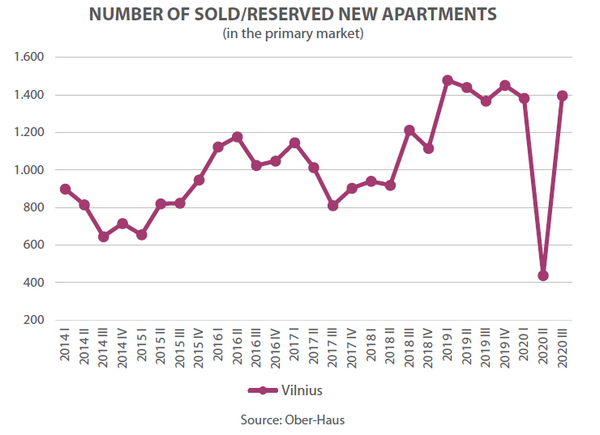

The apartment sales in the primary market (new construction) in the major cities showed a very rapid recovery. According to Ober-Haus, in Q3 2020 a total of 1,396 new apartments were purchased or reserved directly from developers in already completed and ongoing projects in Vilnius. This is 3.2 times as many as were realized in Q2 2020 and slightly more than in Q1 2020.

Since April 2020 (rock-bottom in activities), a particularly intensive growth in sales of newly built apartments has been recorded for the fifth consecutive month. The average monthly growth during this period was as high as 66%. Generally speaking, losses incurred during the lockdown were fully compensated for by October 2020 (in July 2020, 335 apartments were purchased/reserved in the primary market, in August – 449 apartments and in September – 612 apartments).

Since April 2020 (rock-bottom in activities), a particularly intensive growth in sales of newly built apartments has been recorded for the fifth consecutive month. The average monthly growth during this period was as high as 66%. Generally speaking, losses incurred during the lockdown were fully compensated for by October 2020 (in July 2020, 335 apartments were purchased/reserved in the primary market, in August – 449 apartments and in September – 612 apartments).

“Not only the activity of buyers, but also that of developers contributed to the positive performance in Q3 2020. Developers had noticed improvement in the housing market and, after the lifting of the lockdown, resumed project development thus increasing apartment supply and improving the overall market indicators,” Reginis said.

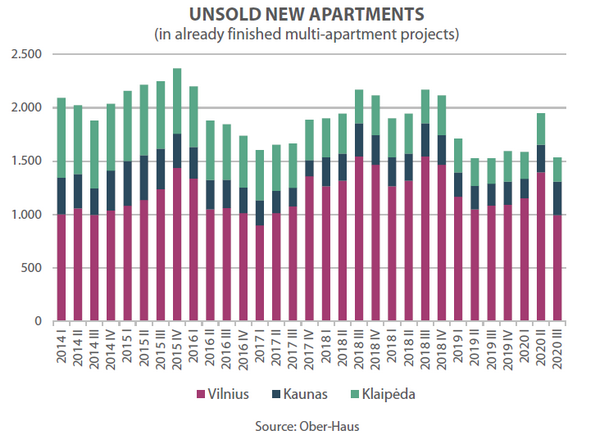

The increasing sales and declining numbers of unsold apartments show that developers are under less pressure than they were in mid-2020. According to Ober-Haus, at the end of Q3 2020 there were 993 unsold apartments in completed apartment buildings in Vilnius or 29% less than in Q2 2020. The figure for unsold apartments is the smallest since Q1 2017.

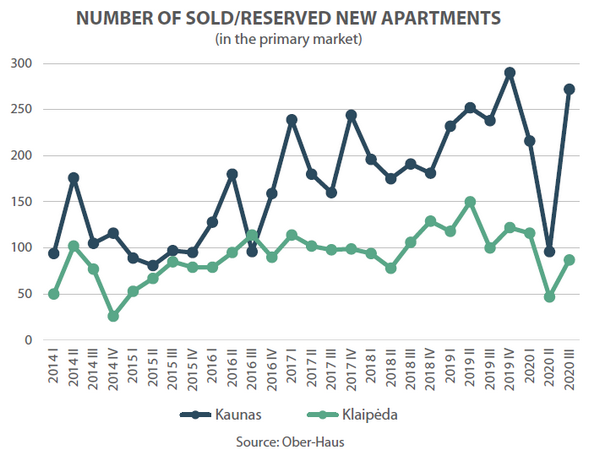

Increasing sales of new apartments in Kaunas encourage developers

In Q3 2020, sales of new apartments were also high in Kaunas. According to Ober-Haus, in Q3 2020, a total of 272 new apartments were purchased or reserved directly from developers in already completed or ongoing projects in Kaunas. This is 2.8 times as many as were realized in Q2 2020 and 26% more than those in Q1 2020. New residential projects offered to the market attract buyers and improve the overall sales indicators.

But unlike in the capital city, an increase in the number of unsold apartments in completed apartment buildings was recorded in Kaunas. At the end of Q3 2020, the number of unsold new apartments in Kaunas stood at 316 or 22% more than in Q2 2020. The number of unsold new apartments in Kaunas today is the highest since the end of 2015.

Favourable conditions for developer investment in Klaipėda

Meanwhile the sales in the primary market in Klaipėda bounced back to less impressive levels than in Vilnius or Kaunas. According to Ober-Haus, in Q3 2020 a total of 87 new apartments were purchased or reserved directly from developers in already completed or ongoing projects in Klaipėda. This is 1.8 times as many as were realized in Q2 2020 and 25% less than those in Q1 2020. “Less intensive activity in the sales of new apartments in the city is related not to slightly sluggish residential property market in Klaipėda, but to a smaller scale of residential property construction projects,” Reginis said.

According to the number of registered apartment transactions (both old and new) per 1,000 population, Klaipėda is on a par with the capital city (the figure for Vilnius and Klaipėda was 21.9 transactions/1,000 population in 2019) and was ahead of Kaunas (18.2 transactions/1,000 population in 2019). The total number of transactions per population and declining numbers of unsold apartments show high activity in both the old and new apartment segments in Klaipėda.

According to the number of registered apartment transactions (both old and new) per 1,000 population, Klaipėda is on a par with the capital city (the figure for Vilnius and Klaipėda was 21.9 transactions/1,000 population in 2019) and was ahead of Kaunas (18.2 transactions/1,000 population in 2019). The total number of transactions per population and declining numbers of unsold apartments show high activity in both the old and new apartment segments in Klaipėda.

At the end of Q3 2020, the number of unsold new apartments in completed apartment buildings in Klaipėda was 227 or 23% less than in Q2 2020. At the same time this figure is the smallest in the past decade. This shows that developers in Klaipėda could be bolder and invest more actively in the development of apartment buildings.

According to Ober-Haus, if the construction volumes of apartments in Vilnius and Kaunas in 2017–2019 were respectively 20% and 7% lower than in 2006–2008, the figure in Klaipėda is lower even by 61%

“This shows that Vilnius and Kaunas are already close to the record apartment construction volumes recorded more than a decade ago, whereas the construction volumes in Klaipėda are still by 2.5 times lower. This trend will remain unchanged at least in 2020–2021, so the least competition among housing developers will unequivocally be in Klaipėda,” the representative of Ober-Haus noted.

Tighter virus controls may once again affect the real estate market

To sum up the indicators of the housing market in Lithuania in Q3 2020, it is obvious that the market successfully confronted the global pandemic and its consequences. “Looking from the perspective of Q2 2020, it can be said that the housing market withstood the challenges much better than might have been expected without any major negative effects in this sector. Strong domestic demand for housing in Q3 2020 essentially compensated for the lockdown losses and restored the confidence of the market players to pre-lockdown levels. However, the real estate market players should not take it easy, because the ongoing virus threat and stricter measures of its control, at least in the short term, may have a negative impact on the general mood in the market and its indicators again,” Reginis said.

Full review (PDF): Lithuania Residential Market Commentary Q3 2020

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in September 2020 (0.1% increase was recorded in August 2020). The annual apartment price growth in the major cities of Lithuania was 4.2% (the annual apartment price growth in August 2020 was 4.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in September 2020 (0.1% increase was recorded in August 2020). The annual apartment price growth in the major cities of Lithuania was 4.2% (the annual apartment price growth in August 2020 was 4.2%).

In September 2020 apartment prices in Vilnius, Kaunas, Klaipėda and Panevėžys grew by 0.4%, 0.3%, 0.2% and 0.9% respectively with the average price per square meter reaching EUR 1,656 (+6 EUR/sqm), 1,172 (+3 EUR/sqm), 1,142 (+2 EUR/sqm) and EUR 749 (+7 EUR/sqm). In Šiauliai no price changes were recorded and average apartment price remained the same as in August – EUR 762.

In the past 12 months, the prices of apartments grew in all major cities: 4.6% in Vilnius, 3.8% in Kaunas, 2.4% in Klaipėda, 5.7% in Šiauliai and 6.5% in Panevėžys.

“Speaking about sales prices of apartments, it is important to understand that positive news has essentially prevailed in the past four months in the housing market of major cities. The real estate market halted during the lockdown reaching a very low point at which it was not difficult to recover once the economic engine was restarted.

In the context of the housing market, it is important to mention the improved expectations of the population regarding the economic situation of the country as reflected in the consumer confidence index, which has been rapidly on the rise for the fifth consecutive month. According to Statistics Lithuania, the consumer confidence index in the country has increased by 16% in the past five months from minus 16 in April to 0 in September this year (in January-February 2020, the consumer confidence index was positive scoring 3–4).

As a result of the overall improvement in the mood of the buyers, they became actively involved in the housing market and indicators improved. According to the State Enterprise Center of Registers, in the past four months, the number of apartment transactions recorded in five major cities of the country increased by 63%. In September this year, the number of apartments sold exceeded the monthly average of 2019.

In view of the number of transactions concluded for the sale and purchase of apartments and houses in Lithuania, we can see that in September this year a really significant amount of money was poured into the Lithuanian housing market affecting the prices of apartments which slightly increased. Meanwhile, the activity of the housing market and the prices in the coming months will largely depend on further situation concerning the virus and measures of its control. As the first half of this year showed, stricter measures to manage the spread of the virus have an immediately negative impact on the entire real estate market,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review (PDF): Lithuanian Apartment Price Index, September 2020

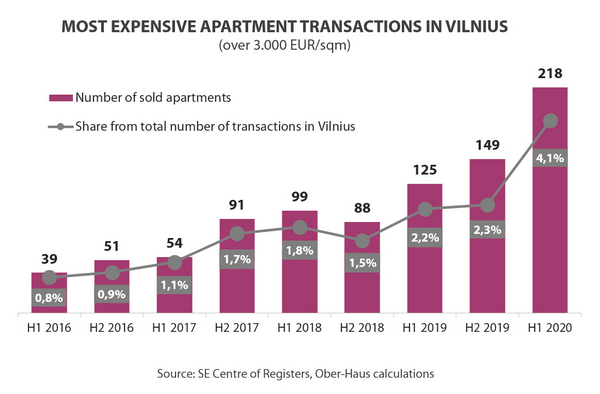

The fourth continuous analysis of the most expensive apartments carried out by Ober-Haus shows that sales of such apartments in the capital city have reached new record highs. The analysis covered the H2 2019 – H1 2020 period. All apartment transactions where the purchase price per square meter exceeded EUR 3,000 (excluding the price of parking spaces, storage rooms and other appurtenances) registered in Vilnius in this period were selected and analysed (source: State Enterprise Centre of Registers).

The fourth continuous analysis of the most expensive apartments carried out by Ober-Haus shows that sales of such apartments in the capital city have reached new record highs. The analysis covered the H2 2019 – H1 2020 period. All apartment transactions where the purchase price per square meter exceeded EUR 3,000 (excluding the price of parking spaces, storage rooms and other appurtenances) registered in Vilnius in this period were selected and analysed (source: State Enterprise Centre of Registers).

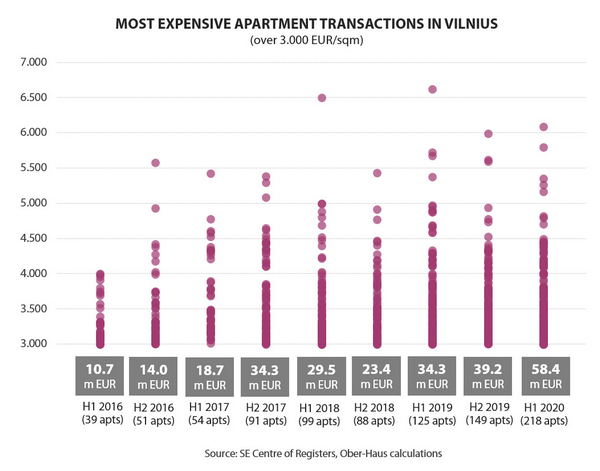

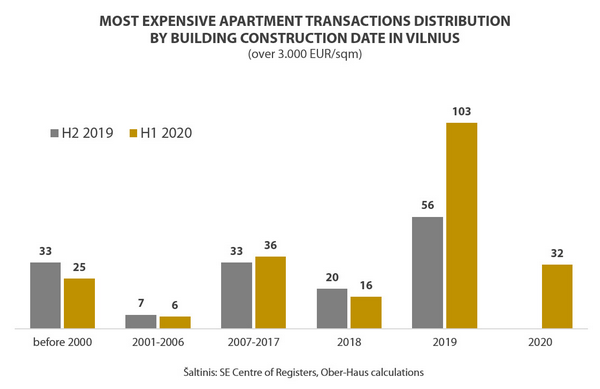

The obtained results of the analysis show a further rapid increase in the number of transactions and its value in this segment in Vilnius. According to Ober-Haus, in H2 2019, 149 apartments (over 3,000 EUR/sqm) were purchased for a total of EUR 39.2 million (including appurtenances). This is a significantly better result than that in H2 2018 or H1 2019, where 88 and 125 apartments were purchased respectively. In H1 2020, 218 such apartments were purchased, which is the highest recorded number since H1 2016 (when the analysis of the high-class apartment segment was launched). According to Ober-Haus, the value of the purchases totalled EUR 58.4 million, which is also the largest amount spent in this segment in six months in the capital city.

“The share of the high-class apartment transactions in the overall apartment sales statistics in Vilnius continues to increase,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said. In 2018, the share of such transactions was 1.7%, in 2019 – 2.3%, and in H1 2020 it peaked at 4.1%.

“However, when assessing these figures, it should be borne in mind that a significant overall decrease in the number of transactions for apartments was recorded in Vilnius during the pandemic lockdown. In the meantime, the share of newly built apartments increased significantly. Just within H1 2020, a large number of transactions for newly built apartments, which actually were agreed to purchase in the previous years, were registered. Given that a large portion of the most expensive apartments under analysis were sold in newly completed projects, this inertia concerning the transactions for newly built apartments led to a sharp rise in their share in the total apartment transactions,” Reginis added. Preliminary estimates suggest that if the overall activity of the apartment market were to remain at the same level as at the beginning of 2020 (before the start of the lockdown), the share of the most expensive apartments in the total transaction number would have been 3.4–3.6% rather than 4.1%. In general terms, the implementation of new ambitious projects in the most prestigious parts of the city in recent years has essentially programmed this increase.

The analysis of the transactions for the most expensive apartments recorded in the last two half years shows that in very few cases the price per square meter reached the EUR 6,000.

In terms of price per square meter, the most expensive apartment was sold in the Misionierių Sodai project on Subačiaus Street in Vilnius Old Town in H1 2020 in Vilnius. The apartment of almost 120 sqm with parking spaces sold for EUR 770,000 (nearly 6,100 EUR/sqm).

In H2 2019, the most expensive apartment was sold in the Šaltinių Namai | Attico project on Aguonų Street in Vilnius Old Town. The apartment of over 100 sqm with several parking places and a storage room sold for over EUR 670,000 (nearly 6,000 EUR/sqm, excluding the price of parking places and the storage room).

However, during the period under consideration, one apartment sale stood out for its price. In H2 2019, a nearly 340 sqm apartment with several parking spaces in the Pliaterių Rūmai project (completed in 2017) on Bokšto Street in Vilnius Old Town sold at over EUR 1.9 million. “Among the transactions for the most expensive apartments, this was the most expensive apartment sold in 2019 not only in the capital city, but also in Lithuania,” Reginis said.

According to Ober-Haus, in terms of the share per price per square meter in the segment of high-end apartments sold in Vilnius, in H2 2019 and H1 2020, the share of apartments that sold at 3,000–4,000 EUR/sqm amounted to 84%, 4,000–5,000 EUR/sqm – 14%, and over 5,000 EUR/sqm – 2%.

According to Reginis, like in previous years, the largest portion of the most expensive apartments is sold in the areas of the Old Town and Naujamiestis in Vilnius. “The central part of the city, the Old Town, and the area of Užupis are not only rich with historical buildings, but also with the record number of newly developed residential projects. The transactions for apartments in the southern part of Šnipiškės and Žirmūnai districts or Žvėrynas district in Vilnius increasingly supplement the statistics for the most expensive transactions. Residential projects developed in these urban areas get attention of buyers who pay up to 4,000–4,500 EUR/sqm for an exceptional apartment,” the representative of Ober-Haus noted.

According to Reginis, like in previous years, the largest portion of the most expensive apartments is sold in the areas of the Old Town and Naujamiestis in Vilnius. “The central part of the city, the Old Town, and the area of Užupis are not only rich with historical buildings, but also with the record number of newly developed residential projects. The transactions for apartments in the southern part of Šnipiškės and Žirmūnai districts or Žvėrynas district in Vilnius increasingly supplement the statistics for the most expensive transactions. Residential projects developed in these urban areas get attention of buyers who pay up to 4,000–4,500 EUR/sqm for an exceptional apartment,” the representative of Ober-Haus noted.

According to Ober-Haus, out of the 367 most expensive apartments sold in Vilnius in H2 2019 and H1 2020, 62% of them were in newly developed residential projects (in the apartment buildings built in 2018–2020). Looking at specific most recent residential projects in Vilnius in the period in question, the most expensive apartments (by price per sqm) were sold in the following projects: Paupys (Aukštaičių Street), Šaltinių Namai | Attico (Aguonų Street), Sierakausko 25 (Z. Sierakausko Street), and Misionierių Sodai (Subačiaus Street).

The rapidly increasing sales of the most expensive apartments and the record highs call for the question: what are the limits of the country’s capital city’s housing market? “The developing real estate market in Vilnius is being tested each year with an increasing number of upper-class residential projects which the market proves to be able to absorb. Even the most active 2006–2008 period of the development of apartment buildings in Vilnius cannot be compared to the development volumes in the most valuable and expensive areas of the city in recent years. If our economy is able to avoid greater losses in the near future, the prestigious housing market may again try to set new limits for its potential. The developers in this segment have determination and continue to compete for the remaining most valuable untapped spots in the city,” Reginis said.

Euromoney, an international publisher on capital and financial markets, has ranked Ober-Haus as the best real estate advisor and consultant in Lithuania in 2020.

Euromoney, an international publisher on capital and financial markets, has ranked Ober-Haus as the best real estate advisor and consultant in Lithuania in 2020.

Euromoney has named Ober-Haus the top real estate agency in Lithuania in these four categories: Overall, Property Valuation, Agency-Letting/sales and Research, according to the results of the magazine’s 16th annual Real Estate Survey of industry professionals for 2020.

“We have been in the real estate market for over 20 years now. We are pleased to retain the top ranking for the quality of our services. Staying in the leading positions each year shows the sustainability of our professional maturity and at the same time reflects what is most important – trust of our customers and market players. This achievement is an evaluation of the team’s professionalism and nurturing of a culture of high business standards,” Audrius Šapoka, general manager of Ober-Haus Lithuania, said.

Ober-Haus provides about 13,000 real estate related services per year. In 2019, Ober-Haus in Lithuania concluded nearly 1,300 real estate sales and lease deals. The company also prepared a record number – 11,500 – property valuation reports, valuation expert analyses and provided countless consultations to clients. In 2019, the Ober-Haus the real estate company had a turnover of €4.5 million excl. VAT, which is 13.5 per cent more than in 2018. Last year’s turnover of Ober-Haus was the highest since 2008.

The 16th annual real estate survey conducted by Euromoney was based on the ratings submitted by the real estate market participants: real estate experts, developers, construction companies and representatives of financial institutions. Ober-Haus has been ranked the best in various categories in 2015, 2016, 2017, 2018, 2019 and 2020.

Ober-Haus is operating in Lithuania since 1998 and is the largest real estate services provider in Lithuania and the Baltic region. The company is part of Realia Group – a Finnish real estate group which is the largest real estate group in north Europe. The company’s services package consists of brokerage services in buying, selling or letting commercial and residential property, property and business valuation, consultancy and market research.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.1% in August 2020 (0.1% increase was recorded in July 2020). The annual apartment price growth in the major cities of Lithuania was 4.2% (the annual apartment price growth in July 2020 was 4.9%).

In August 2020 apartment prices in Vilnius, Klaipėda and Šiauliai grew by 0.2%, 0.1% and 0.6% respectively with the average price per square meter reaching EUR 1,650 (+3 EUR/sqm), 1,140 (+1 EUR/sqm) and EUR 762 (+4 EUR/sqm). Meanwhile in Kaunas and Panevėžys apartment prices remained stable and were the same as in last month EUR 1.169 and EUR 758.

In the past 12 months, the prices of apartments grew in all major cities: 4.6% in Vilnius, 4.1% in Kaunas, 2.2% in Klaipėda, 5.9% in Šiauliai and Panevėžys.

“Except for a sudden fall in the total number of residential property transactions during the lockdown, the Lithuanian housing market has avoided other major shocks. Looking at the dynamics of apartment prices, the only signal that the market has been facing challenges in the past six months is a noticeable slowdown in the increase of prices of apartments in the major cities of the country. As a result, for the sixth consecutive month, the slowdown in the annual increase in apartment prices has been recorded from an increase of 7.6% in February 2020 to 4.2% in August. However, the overall price development during this period did not enter the negative figure and the sales prices of apartments essentially remained stable. The sales prices of apartments in the country’s major cities increased by 0.7% over the past six months.

In July and August this year, the traditional seasonal activity affected the apartment rental sector, where a much gloomier situation was expected at the start of the lockdown than it is at the moment. This injected optimism in the housing market of the country’s major cities and helped avoid major negative consequences both in the rental and sales market. After the end of the lockdown, the number of apartment transactions in these cities started to grow rapidly and significantly compensated for the temporary decline. According to the public enterprise Centre of Registers, the number of transactions recorded during eight months of 2020 in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys decreased by 15% compared to the same period in 2019. The market activity indicators over recent months, however, show that the demand for housing and financial capabilities of customers have not decreased significantly. The stalled home price growth has opened up more opportunities for potential buyers,” Raimondas Reiginis, Research Manager for the Baltics at Ober-Haus, said.

Search

Search