Ober-Haus, the real estate services company in the Baltic countries, has been acquired by Kiinteistömaailma, a Finnish real estate company. Since 2007, Ober-Haus has been part of Realia Group, a leader in the Finnish real estate market. Following the change in company ownership, Tarmo Kase, general manager of Ober-Haus, and the remaining leadership of the company will continue their functions in the company.

Ober-Haus, the real estate services company in the Baltic countries, has been acquired by Kiinteistömaailma, a Finnish real estate company. Since 2007, Ober-Haus has been part of Realia Group, a leader in the Finnish real estate market. Following the change in company ownership, Tarmo Kase, general manager of Ober-Haus, and the remaining leadership of the company will continue their functions in the company.

Kiinteistömaailma seeks to expand operations and grow internationally. Ober-Haus is the main player in the Baltic real estate market and this leader position is the result of the targeted approach taken by the previous owners. Ober-Haus will complement the Kiinteistömaailma Group with its high quality knowledge-based real estate brokerage and valuation services,” Risto Kyhälä, general manager of Kiinteistömaailma, added.

“The deal with Realia Group is part of a strategy to focus on business development in the countries of Northern Europe by making use of the available strong market position in Finland. I am delighted that we have found good owners for Ober-Haus who will continue to strengthen corporate operations in the Baltic countries. I would also like to thank Tarmo Kase, general manager of Ober-Haus, for his contribution to the long-term development of the company,” Kari Virta, general manager of Realia Group, said.

Ober-Haus provides a wide range of real estate services in Lithuania and the Baltic region. The company opened its first office in Tallinn in 1994. Today Ober-Haus has 19 representative offices in the main cities of Lithuania, Latvia and Estonia with over 220 employees.

Realia Group is the biggest real estate group of companies in the Nordic countries. Realia Group owns Realia Isännöinti, Realia Management, Huoneistokeskus, Huom! Huoneistomarkkinointi in Finland, and Hestia – in Sweden. The Realia Group has over 1,800 experts; its annual turnover amounts to EUR 130 million.

Set up in 1990 Kiinteistömaailm is the broadest network of Finnish real estate agencies with almost 100 offices. The company offers consultancy and brokerage services in the residential housing and commercial real estate segments. Presently Kiinteistömaailma has more than 600 real estate experts. General turnover of the offices stands at EUR 70 million annually.

Ober-Haus has been voted the strongest brokerage company in the Baltic countries in the annual awards of the European real estate company brands.

Ober-Haus has been voted the strongest brokerage company in the Baltic countries in the annual awards of the European real estate company brands.

The European Real Estate Brand Institute selects the strongest European real estate company brands every year. Set in Berlin, this year, the Institute selected and evaluated over 1,400 different RE trademarks throughout Europe. The Ober-Haus brand took first place in the category of RE brokerage in the entire Baltic region.

„Strong, reliable and creating added value for its customer brand equals a successful business. Therefore, the top position in the major ranking of company brands providing RE services in Europe is a very important evaluation for us. I am truly delighted that the values fostered by the Ober-Haus team for more than 20 years – strong professional expertise, transparency, focus on business ethics, honest and well-organised work – have earned us customer trust and loyalty as well as leadership in the RE service market,“ – Audrius Šapoka, General Manager of Ober-Haus, said.

More than 109,000 business experts from 45 European countries voted on and assessed trademarks in the survey which was organised for the 12th time. Architects, analysts and valuers, property managers, representatives of commercial banks and other credit institutions, brokers, builders, developers, investors and lawyers all voted. Final evaluations were aggregated following analysis of the company position in the market, image of the employer, resistance and sustainability of the brand, communication, etc.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 2.7% in May 2021 (1.4% increase was recorded in April 2021). The annual apartment price growth in the major cities of Lithuania was 11.6% (the annual apartment price growth in April 2021 was 8.6%).

In May 2021 apartment prices in the capital grew 2.3% with the average price per square meter reaching EUR 1,832 (+42 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys grew by 3.4%, 3.4%, 2.6% and 2.9% respectively with the average price per square meter reaching EUR 1,286 (+42 EUR/sqm), EUR 1,270 (+42 Eur/sqm), EUR 859 (+22 EUR/sqm) and EUR 851 (+24 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 11.6% in Vilnius, 10.2% in Kaunas, 11.5% in Klaipėda, 13.8% in Šiauliai and 15.3% in Panevėžys.

“May of this year became symbolic, when after a faster monthly increase in apartment prices a double-digit annual price increase was recorded in all major cities of the country. In May, the annual increase of 11.6% in apartment prices in the major cities was recorded, the highest since March 2008. The monthly increase of 2.7% in apartment prices in the country’s major cities was really special within the context of the past decade. Higher monthly price increases were recorded only prior to 2008 (before the global financial crisis) and stood at 5-6%.

Although recent price increases are observed across old and new apartment segments, the price increase of new apartments is faster. For example, in Vilnius, the prices of apartments in older buildings increased by 9.5% per year and of new ones – by 14.3%. High demand for newly built residential properties and the decreasing supply of such properties in major cities of the country allow developers to sell at significantly higher prices than before and at least partially compensate for the rapidly increasing construction costs.

The rise in home prices in the country is further stimulated by unfading demand, which in May this year pushed sales figures to record heights. According to the State Enterprise Centre of Registers, in May 2021 about 3,900 apartments were sold in Lithuania and this is the best result in the entire history. Therefore, the extremely active residential property market may in the near future cool off for some time due to the holiday season, when people will direct their time and finances for planning their recreation,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

Full review (PDF): Lithuanian Apartment Price Index, May 2021

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 1.4% in April 2021 (1.9% increase was recorded in March 2020). The annual apartment price growth in the major cities of Lithuania was 8.6% (the annual apartment price growth in March 2020 was 7.2%).

In April 2021 apartment prices in the capital grew 1.3% with the average price per square meter reaching EUR 1,790 (+24 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys grew by 1.7%, 1.4%, 0.7% and 1.7% respectively with the average price per square meter reaching EUR 1,244 (+20 EUR/sqm), EUR 1,228 (+17 Eur/sqm), EUR 837 (+6 EUR/sqm) and EUR 827 (+14 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 9.2% in Vilnius, 6.5% in Kaunas, 7.7% in Klaipėda, 11.3% in Šiauliai and 12.0% in Panevėžys.

“The housing market in Lithuania has continued to grow over the last six months. The demand for housing has allowed vendors to sell for higher prices. According to the data of the SE Centre of Registers, in April 2021, over 3,600 apartments were sold in Lithuania, one of the highest numbers ever. Given the structure of the number of apartment transactions across the country, we can see that the market is active in all segments. While there has been a record number of purchase transactions in the new apartment segment, it is also clear from registered transactions that there has likewise been increasing sales of older construction flats throughout the country.

This increasing demand for apartments in all segments is determining the sales prices for both new and older apartments. Based on the figures for the first four months of this year, it can be assumed that prices this year will be exceptional. If this increase in prices continues, apartment prices will grow at a faster rate than wages. According to the latest forecast of SEB bank, the average wage should grow by 7.5% in 2021. Meanwhile, the increasing apartment prices might well exceed the forecasts for wage growth, possibly by more than 10%. For those on higher incomes or purchasers whose income is likely to grow, the rising apartment prices do not deter them from purchasing an apartment, as their current financial situation or their potential future financial situation allows them to compensate for the faster growth of apartment prices. However, this is bad news for purchasers whose income level and its growth potential is smaller. The faster the flat prices grow, the smaller the choice of housing they will have,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review (PDF): Lithuanian Apartment Price Index, April 2021

Looking back at 2020, we can see that both the global and the Baltic real estate markets largely withstood the challenges posed by the current pandemic. Cheap cash injections activated on a global scale were also directed at the real estate market, where the residential property remained at the forefront with record-breaking indicators at the end of 2020 and the beginning of 2021. Looking at the global map, we can see that the home prices have been given green light as we observe faster price increase in the USA, China and Europe, including the Baltic countries.

Looking back at 2020, we can see that both the global and the Baltic real estate markets largely withstood the challenges posed by the current pandemic. Cheap cash injections activated on a global scale were also directed at the real estate market, where the residential property remained at the forefront with record-breaking indicators at the end of 2020 and the beginning of 2021. Looking at the global map, we can see that the home prices have been given green light as we observe faster price increase in the USA, China and Europe, including the Baltic countries.

However, the current situation can hardly make us happy. The global health crisis has not only claimed human lives, but has also unbalanced the business environment, including the real estate market. If some business sectors have recovered quickly, the prospects of other sectors remain vague. The same can be said about real estate whose prospects are directly related to the viability of specific business sectors. So far, we can see what difficult situation the managers and owners of hotels, major shopping centres or individual commercial premises face. A notable increase in home prices may also offset the relatively sustainable development (before the pandemic) of this real estate sector. These insights have just been published in the latest annual review of the real estate market of the capital cities of the Baltic countries by Ober-Haus. The review provides a comprehensive picture of the situation in the real estate market for 2020 and forecasts for the coming year.

The slow-down of development may unbalance the housing market of the capital cities of the Baltic countries

In any case, the housing market of the Baltics “benefited” most from the pandemic period in 2020. “First of all, the housing sector in Lithuania and Estonia performed strongly and witnessed all-time records – the amount of money spent on housing (apartments and houses) in a year was the highest in the history of these countries,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

ODRA residential project in Tallinn

Despite that the number of sales transactions of apartments in the capital cities of the Baltic countries decreased from 4% to 10% in 2020, this did not have a negative impact on the sales prices of apartments. According to Ober-Haus, the sales prices of apartments in Vilnius and Tallinn continued to grow and increased by almost 5% in a year. Meanwhile in Riga, only symbolic decrease in the prices of older apartments in residential districts was noted.

Some greater negative changes were recorded in the housing rental segment of the capital cities, which in H1 2020 experienced an instantaneous increase in supply. “This led to a decrease in rents by a tenth in Riga and Tallinn over a year. Meanwhile, in Vilnius, rents for apartments slightly decreased in the middle of the year, but returned to the former level in H2 2020, which shows a strong internal demand in this fast-growing city,” Reginis said.

However, Riga’s performance seems to be the weakest among the capitals of the Baltic countries. It is affected by further deteriorating demographic indicators and the lack of confidence among the real estate market players with the lowest relative number of apartment transactions and new apartments built out of the three capitals. On the other hand, the indicators at the beginning of 2021 show that the situation in the housing markets of Vilnius and Tallinn has gained further optimism, which may lead to at least a momentary shortage of supply and greater home price increases. For example, in 2021, developers plan to build fewer apartments in all the capitals of the Baltic countries than they built in 2020. “In the meantime, Riga may benefit from a positive global mood in the housing sector by offering a significantly lower level of residential property prices and relatively faster potential for market growth and investment opportunities in the future than perhaps Vilnius or Tallinn,” Reginis noted.

Most severe disruption in the hotel sector due to the pandemic

In terms of the commercial real estate and the most affected segments by the pandemic, the advantage of the Baltic countries has been their little dependence on foreign tourism, which accounts for a relatively small part of the economy.

The hotels oriented to foreign tourists have suffered most during the pandemic across the globe, including in the Baltic countries. For example, the occupancy rates of the hotels of international hotel chains in Lithuania, Latvia and Estonia contracted almost threefold in 2020 compared to 2019. As a result, this business and the real estate segment experienced the steepest decline in 2020 and continues to stagnate under the current pandemic in 2021.

“It is not surprising that in 2020–2021 we saw the sale of some hotel buildings to new investors who are planning to adapt the buildings for different business activities, for example, housing for long-term or short-term rent,” Reginis pointed out.

Rental income of retail premises – from a double-digit decline to inflation rate size growth

Raimondas Reginis, Research Manager for the Baltics at Ober-Haus

The retail premises sector is also among the most affected real estate segments in the Baltic countries. Full or partial closure of retail outlets had a significant impact on the turnover of the major shopping centres, which resulted in significantly lower rental income for property owners in 2020.

“Depending on the shopping centre tenant mix structure, changes in occupancy and rent discounts granted to tenants, the operating income of companies managing such properties has shrunk from a few percent to a few dozen percent. We can imagine the situation in which the tenants and owners of individual commercial premises found themselves, where shops, cafes or bars could not carry out their activities or had a very small customer flow,” Reginis said.

However, not all businesses in the retail premises sector suffered losses in 2020. Supermarkets with large grocery store chains enjoyed a continuous flow of shoppers and the owners of such supermarkets were guaranteed even higher rental income than in 2019. Like in previous years, rents in such supermarkets were increased by landlords based on the inflation rate of the previous year.

Ample opportunities to office tenants in the face of the pandemic

The office sector also experienced significant changes in 2020. Although the offices were physically empty following the change in the work format, the companies did not start terminating tenancy contracts and managers of office buildings were able to maintain a stable flow of rental income.

However, in 2020 the markets of capital cities in the Baltics saw a significant increase in office supply, which coincided with the pandemic period. This raises legitimate concerns of market players regarding the sustainable development and prospects of this real estate segment in the near future. According to Ober-Haus, in 2020 developers built 186,100 sqm of office space in Vilnius, Riga and Tallinn, or 30% more than in 2019 (in Vilnius – 102,600 sqm, in Riga – 49,500 sqm, and in Tallinn – 34,000 sqm).

A significant proportion of the companies’ employees are currently fully or partly working from home, and the ongoing pandemic prevents companies from accurately assessing their needs for office space in the future. According to Reginis, under these uncertain conditions it is still difficult to assess the direction that the post-pandemic business model will take, on which the demand for office space will depend in the future.

“Looking at the current market, a significant number of companies are still delaying strategic decisions regarding further development of offices or optimization of the available space. However, regular offers of office sublease that appear on the market, where tenants are looking for sub-tenants for their rented premises, indicate that some companies have decided to reduce their office space without any delay,” the Ober-Haus representative said.

LVOVO office project in Vilnius

If there is still uncertainty about the future demand for offices, the supply factor is more predictable in the capital city of Lithuania. In 2020, the market in Vilnius saw a record supply of office space, which was successfully absorbed by the market and the office vacancy rate in Vilnius in 2020 increased relatively moderately – from 3.0% to 6.1%.

However, developers may expect greater challenges with further increase in office space in the market, which in 2021 will be at least 130,000 sqm. According to Reginis, such significant amount of office space in the context of the pandemic may pose challenges not only for the developers of the new projects but also for the owners of older buildings.

The risk of company office space optimization may only be compensated by newly arriving companies or expansion of already operating businesses in the capital cities of the Baltic countries. Yet the increasing vacancy rate in all capital cities of the Baltic countries shows that the new supply of offices comes under particularly unfavourable circumstances and tenants of the offices may be the ones to benefit from it.

Riga was the leader in warehouse development; developers in Vilnius embarked on the multi-functional projects

The industrial real estate sector in the Baltic countries had all the preconditions for further growth in 2020. According to Ober-Haus, 208,000 sqm of new warehouse space was built in Vilnius, Riga, Tallinn and their surroundings during the year, which is 46% more than in 2019.

RIMI LOGISTIC CENTRE, Riga

In 2020, the largest number of new warehouse space was built in Riga, including the development of the largest logistics centre in the Baltic countries. The Rimi warehousing and distribution centre was built by renovating some old space and adding some new buildings. The total area of the complex is 84,000 sqm, of which 74,000 sqm are dedicated to the production storage.

Meanwhile, in Vilnius, in addition to the relatively active development of traditional warehouses, in 2020 development of stock-office concept projects started. “If such projects have already been implemented in Tallinn for some time and in Riga for at least the past few years, so in Vilnius such first larger-scale projects will only be implemented in 2021,” Reginis noted.

Projects offering spaces of various sizes for various purposes under one roof may attract a much larger number of potential tenants, which allows for more flexible planning of the implementation of such projects. “Currently, near ten projects of this type are planned in Vilnius and construction of some of them is in progress. Rapidly expanding online sales and the need to deliver products to end users quickly or to have a suitable product pick-up point contributes to the development of these projects,” Reginis added.

According to Statistics Lithuania, the turnover of mail order or sale via internet businesses between 2015 and 2019 increased by 28% each year on average, while in 2020 an increase of 52% and the record turnover of EUR 814 million was recorded.

Full review (PDF): Baltics Real Estate Market Report 2021

Ober-Haus presents its annual real estate market report 2021 on the Baltic States Capitals – Vilnius, Riga and Tallinn. The overview focuses on the office, commercial, storage and residential premises markets, as well as on land plots of each of the capital cities. The overview also includes information related to taxes, which was drawn up by PricewaterhouseCoopers – the audit, accounting and consulting company, while the part with legal information was prepared by the Sorainen law firm.

Full review (PDF): Baltics Real Estate Market Report 2021

In the western part of Panevėžys, in Kniaudiškės district, development of Ainių Namai, the largest apartment building project in the city in the last decade, has been launched. Six A+ energy class 4-storey apartment buildings will be built on the spacious 1.2 ha site. A total of 114 apartments are planned in the project. Buyers will be able to choose 1.5–3 room apartments (34–86 sqm).

In the western part of Panevėžys, in Kniaudiškės district, development of Ainių Namai, the largest apartment building project in the city in the last decade, has been launched. Six A+ energy class 4-storey apartment buildings will be built on the spacious 1.2 ha site. A total of 114 apartments are planned in the project. Buyers will be able to choose 1.5–3 room apartments (34–86 sqm).

The Ainių Namai project is carried out on a plot of land that is special because there are no other apartment buildings nearby. Therefore, high-rise buildings will not block the sun at any time of the day. “A decade ago, the master plan of the city provided for the construction of apartment buildings in this part of Panevėžys. We are pleased that the developers of new housing will contribute to the renewal of the city of Panevėžys and will build the first two buildings this year,” Romualdas Paulauskas, Head of the Ober-Haus Office in Panevėžys, said.

Modern 4-storey buildings are designed to make it convenient for residents to access the buildings, there will be space for children’s playground and sports grounds. Apartments on the ground floor will have individual terraces, apartments on the first and second floors will have balconies and apartments on the top floor – roof terraces. Storage areas will be located on the ground floor. A parking space is planned for each apartment next to the buildings.

“The project developed in a new district of Panevėžys will blend in the surrounding architectural and natural environment. The team has put a lot of effort into planning technical, engineering, and internal layout solutions. For the convenience of the residents, wide panoramic windows will be installed in each apartment. Underfloor heating will distribute heat evenly,” Paulauskas said.

The site will be accessed via automated gate and will be lit to ensure privacy and security of the residents. The property will be complete with landscaping, pavements and green zones.

Kniaudiškės is a popular district with the residents of Panevėžys. It is in a convenient location with well-developed infrastructure – there are major shopping centers RYO, Babilonas, and Depo, grocery stores Maxima and Norfa, schools, kindergartens, medical institutions, bus stops, etc. nearby. Residents of Ainių Namai will be able reach any place in Panevėžys quickly and conveniently both by private and public transport. It is also convenient to reach the main roads to Vilnius, the seaside and Latvia.

The project will be developed in three stages. The first stage of construction works is scheduled for completion in Q1 2021. The second and third stages will be carried out in 2022.

Developer – MB Tadara, architects – UAB GA Projektai, concept, marketing and sales – Ober-Haus.

More than a year has passed since the start of the pandemic and the lockdown in Lithuania. This has affected all areas of our lives and made adjustments to the priorities of the population considering a new home. The need for more spacious homes has increased, buyers chose houses over apartments or opted for a second home. A home in the natural surroundings in the countryside or in a resort town became a more common purchase.

More than a year has passed since the start of the pandemic and the lockdown in Lithuania. This has affected all areas of our lives and made adjustments to the priorities of the population considering a new home. The need for more spacious homes has increased, buyers chose houses over apartments or opted for a second home. A home in the natural surroundings in the countryside or in a resort town became a more common purchase.

“The demand for a second home has revived the real estate market in the regions. Since last year, homes in picturesque locations have been actively purchased and investment in real estate in resort towns of Lithuania has been made,” Ričardas Klincaras, a real estate expert at Ober-Haus, said.

The seaside region was the first to see record numbers of transitions. At the time, only a small number of investors and buyers took interest in small resort towns, such as Birštonas and Druskininkai. “However, there was more and more visible activity in the real estate market in these resort towns, especially in Druskininkai. The spring therefore started robustly in Druskininkai,” Klincaras noted.

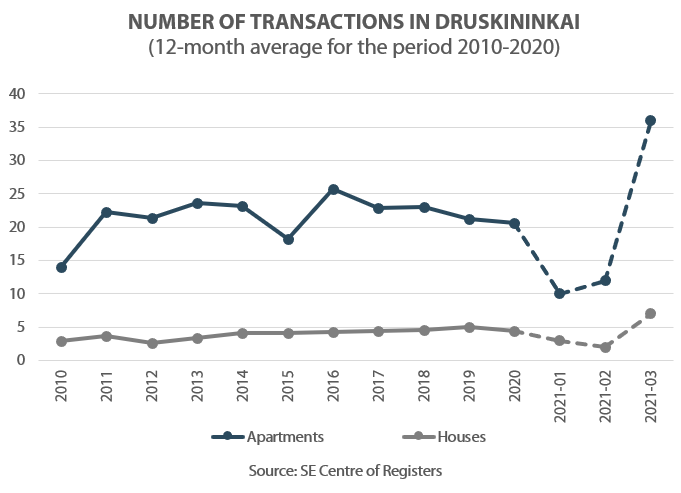

March this year was exceptional for Druskininkai. According to the State Enterprise Center of Registers, 36 purchase and sale transactions for apartments and 7 for houses were recorded in Druskininkai in March, while in February, 12 apartments and 2 houses were sold. According to the Ober-Haus expert, the housing market in Druskininkai is picking up speed with continuing activities of buyers in April.

As recorded by the State Enterprise Center of Registers, 11% more apartments and houses were sold in Druskininkai during Q1 2021 than during the same period in 2020.

According to Ober-Haus, the prices of apartments in Druskininkai increased by 2.4% per year (in March 2021 compared to March 2020). In March alone (in March 2021 compared to February 2021) the prices of apartments increased by 0.8%. At the same time last year, the lockdown not only slowed down the apartment price increase, but also negative changes were recorded – in March 2020, a decrease of 0.2% was recorded.

“The city is investing heavily each year by building new attractions. Recently, a sports training center has been opened, a culture center is being built and new investment in Karolis Dineika Park has been attracted. As the resort attractiveness grows, more buyers purchase real estate in Druskininkai not only as a second home for recreation, but also as an investment with a prospect of the price increase in the future,” Klincaras observed.

Most of the apartments sold in Druskininkai are located in the central part of the town. “A typical buyer of such a home is a 45–60-year-old resident of Vilnius, Kaunas, Marijampolė or Alytus, who uses his own savings or a small amount of borrowed money. Residents of Druskininkai are more active in purchasing property further away from the center usually with a mortgage,” Klincaras said.

“We also communicate with foreigners who know Druskininkai well for its spas and consider purchasing their own holiday home. Although their activity is not as high as 6–8 years ago, but some of them are still interested and we manage to attract some of them,” Klincaras explained.

There is a lack of supply of quality 35–45 sqm apartments in the primary market projects in Druskininkai and such apartments are currently hardly available. According to the Ober-Haus expert, this has not passed unnoticed by potential investors, who respond to the changing market situation and intensively absorb not only empty land plots suitable for building apartment buildings, but also purchase unfinished buildings or buildings that need reconstruction with an aim of developing apartment buildings.

Interest in individual and semi-detached houses, according to the number of transactions, equals to that in apartments and demand is noticeably growing, the only problem is the lack of supply. “Families from cities who can work remotely and plan to spend half their working week or to move to Druskininkai permanently are looking for such properties,” Klincaras said. These buyers opt for the new central part of the city (Baltašiškė) with its well-developed infrastructure and convenient access.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 1.9% in March 2021 (0.9% increase was recorded in February 2021). The annual apartment price growth in the major cities of Lithuania was 7.2% (the annual apartment price growth in February 2021 was 5.3%).

In March 2021 apartment prices in the capital grew 2.2% with the average price per square meter reaching EUR 1,766 (+38 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in March grew by 1.2%, 1.6%, 2.7% and 2.4% respectively with the average price per square meter reaching EUR 1,224 (+15 EUR/sqm), EUR 1,211 (+19 Eur/sqm), 831 (+22 EUR/sqm) and EUR 813 (+19 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 7.8% in Vilnius, 4.9% in Kaunas, 6.2% in Klaipėda, 10.4% in Šiauliai and 10.5% in Panevėžys.

“At the end of 2020/start of 2021, it seemed that after a sluggish period in mid-2020, we saw an instantaneous sales price rise, yet the performance in March 2021 shows that the price increase is accelerating. Looking at historical data, the monthly almost 2% increase in apartment prices is exceptional, because the last time such a monthly increase was recorded in the country’s cities only in 2007. The relatively high overall price change in March was due to the faster rise in prices in all major cities across various apartment segments.

This year we can see a faster increase in apartment prices in the segment of new housing. For example, in Q1 2021 the prices of older apartments in Vilnius, Kaunas and Klaipėda increased by 2.7–3.8% and the prices of new apartments in these cities increased by 3.7–4.9%. Every day, we witness rapid increase in the expectations of sellers and how the increasing prices of apartments still attract buyers. In particular, this is obvious in the new apartment segment, where there is a supply shortage at the moment and developers are sometimes unable to respond to the changing market situation. As a result, buyers looking for new homes in Vilnius face challenges. Due to the lack of apartments in already completed projects, they are forced to choose apartments in the planned projects or projects that have recently started.

The rising apartment prices in the cities are not exclusive to Lithuania. Similar trends can be observed across Europe. According to Eurostat, in Q4 2020, a total annual increase of 5.7% in home sales prices was recorded in 27 EU countries, which is the fastest increase since 2007.

This year’s record-breaking transactions for the acquisition of new homes in the capital city give reason to predict even faster increase in home prices later when the transactions are finalized and official statistics will record impressive amounts of cash. Thus, looking at the current situation in the European and Lithuanian housing market, it seems that the price increase is gaining momentum,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review (PDF): Lithuanian Apartment Price Index, March 2021

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.9% in February 2021 (1.4% increase was recorded in January 2021). The annual apartment price growth in the major cities of Lithuania was 5.3% (the annual apartment price growth in January 2021 was 4.9%).

In Februrary 2021 apartment prices in the capital grew 0.8% with the average price per square meter reaching EUR 1,728 (+14 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in February grew by 0.4%, 0.8%, 2.2% and 2.3% respectively with the average price per square meter reaching EUR 1,209 (+5 EUR/sqm), EUR 1,192 (+10 Eur/sqm), 809 (+18 EUR/sqm) and EUR 794 (+18 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 5.7% in Vilnius, 3.8% in Kaunas, 4.5% in Klaipėda, 7.8% in Šiauliai and 7.9% in Panevėžys.

“February’s output demonstrated that the pace of apartment price growth which gained momentum at the end of 2020 in the main Lithuanian cities was retained. In the last three months alone, the five biggest Lithuanian cities saw a steep jump in apartment sales prices reaching 3.3% on average. At the same time, it was the fastest price growth in three months since the 2007–2008 global financial crisis. It should be noted that apartment price growth was recorded in different cities and in different segments of apartments (both of new and older construction).

It seems that the present pandemic, which has significantly limited residents’ capacity for spending money on various forms of entertainment (hospitality, events, travels, etc.), encouraged some residents to further invest in the housing sector. We can see that Lithuanians are actively improving the housing they already own, that they acquire their first or not first home, they exchange their home for a newer or more spacious one, and so forth. The general high market activity, the increasing apartment prices and volumes of new loans as well as the growing or at least not decreasing number of residents in cities show that residents do not overestimate t the threats of the pandemic in the long term.

For this reason, developers of new housing gain a very important advantage in the present-day situation. By ensuring a sufficient amount of new housing developers can avail of the market potentials and at the same time contribute to the containment of price growth,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review (PDF): Lithuanian Apartment Price Index, February 2021

Search

Search