Development of a new multi-apartment residential district, Liepų Terasos, has been launched near Liepų Street in the northern part of Klaipėda. A total of 12 A+ and A+++ energy performance class 4-storey apartment buildings will be built on a spacious site covering four hectares. The buildings will accommodate around 340 apartments and the project will be developed in four stages. In stage one, buyers will be offered 4-room apartments of 38–65 sqm and in subsequent stages, larger apartments of up to 100 sqm will be built. Investment in the project totals 21 million euros.

Development of a new multi-apartment residential district, Liepų Terasos, has been launched near Liepų Street in the northern part of Klaipėda. A total of 12 A+ and A+++ energy performance class 4-storey apartment buildings will be built on a spacious site covering four hectares. The buildings will accommodate around 340 apartments and the project will be developed in four stages. In stage one, buyers will be offered 4-room apartments of 38–65 sqm and in subsequent stages, larger apartments of up to 100 sqm will be built. Investment in the project totals 21 million euros.

Stage one of the project has already started. In the early summer of 2022, two apartment buildings will be completed totalling 3,200 sqm and offering 54 apartments, with 100 sqm available on the ground floor for commercial use. Stage two of the project will start in Q2 2022, stage three in 2023 and stage four in 2025.

“The new residential property market is constantly evolving and the size or energy performance class of the property is no longer the key criterion. Developers of this project focus on new solutions that meet the expectations of today’s buyers – primarily by investing in smart technologies and property solutions that enhance comfort levels,” Donatas Bulvydas, head of sales at Ober-Haus in Klaipėda, said.

The project includes all the required solutions to ensure the safety and comfort of residents: underfloor heating, energy recovery heat exchangers, infrastructure for the installation of air conditioners, and charging points for electric vehicles – which can be shared with other residents or installed for an individual user. According to Bulvydas, in many cases, residents of apartment buildings are hesitant regarding the purchase of electric vehicles, due to limited accessibility to charging points close to home.

“Investment in this project was primarily made by taking into account the location of the site. It is one of the greenest areas of Klaipėda, with convenient connection to the city centre, access to the beach on the Baltic Sea by bicycle or scooter or getting to Palanga quickly,” said Algirdas Stankus, Director of Liepų Terasos.

“We hope that all residents feel comfortable and enjoy life at Liepų Terasos. All ground floor apartments will have access to spacious 9 sqm individual terraces accessed from the living room, and the second and third floor apartments will have spacious loggias or balconies to enjoy the sunsets,” noted Stankus. The apartments on the fourth floor will have private roof terraces and winter gardens of over 23 sqm.

“We have noticed that residents in Klaipėda dislike underground parking, whereas outdoor parking does not protect against weather conditions—in summer cars get hot and in winter they are covered in snow or their windows get frosted. At Liepų Terasos, we opted for a compromise by offering car ports combined with storage spaces,” explained Evaldas Aukštuolis, Technical Construction Supervision Manager at Domus Basis.

The project development team and their partners have been providing services since 1991 and have extensive experience in the construction of residential and commercial buildings in Lithuania and abroad (implementing projects in Denmark, Russia and Austria). With over 30 years in the construction business, they have built more than 220,000 sqm of residential and commercial real estate.

Project developer – UAB Liepų Terasos, construction and technical supervision – UAB Domus Basis, main designer – UAB Vakarų Siluetas (project author – Mantas Daukšys), and concept development, marketing and sale – UAB OBER-HAUS nekilnojamas turtas.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 1.6% in October 2021 (1.6% increase was recorded in September 2021). The annual apartment price growth in the major cities of Lithuania was 20.8% (the annual apartment price growth in September 2021 was 19.4%).

In October 2021 apartment prices in the capital grew 2.1% with the average price per square meter reaching EUR 2,028 (+42 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys grew by 1.0%, 0.9%, 0.6% and 0.9% respectively with the average price per square meter reaching EUR 1,414 (+13 EUR/sqm), EUR 1,356 (+12 Eur/sqm), EUR 912 (+5 EUR/sqm) and EUR 900 (+8 EUR/sqm).

In the past 12 months, the prices of apartments increased in all major cities: 22.0% in Vilnius, 20.2% in Kaunas, 18.0% in Klaipėda, 19.3% in Šiauliai and 20.3% in Panevėžys.

The value of the Ober-Haus Apartment Price Index in Lithuania, which records changes in apartment prices in the five main cities of Lithuania (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), rose by 1.6% in October 2021 (growth in September 2021 was also 1.6%). The general level of apartment prices in the main Lithuanian cities has increased by 20.8% over the last 12 months (annual growth in September 2021 was 19.4%).

In October 2021, apartment sale prices grew by 2.1% in the capital city and the average price per square metre reached EUR 2.028 (+EUR 42/m²). In October, Kaunas, Klaipėda, Šiauliai and Panevėžys recorded increases in apartment prices equal to 1.0%, 0.9%, 0.6% and 0.9% respectively and the average price per square metre increased to EUR 1,414 (+ EUR 13 /m²), EUR 1,356 (+ EUR 12 /m²), EUR 912 (+ EUR 5/m²) and EUR 900 (+ EUR 8 /m²) respectively.

In one year (October 2021 compared to October 2020) apartment prices in the main cities showed a double-digit increase: 22.0% – in Vilnius, 20.2% – in Kaunas, 18.0% – in Klaipėda, 19.3% – in Šiauliai and 20.3% – in Panevėžys.

“After record activity in the Lithuanian apartment segment in the middle of this year, a slightly calmer period was recorded in the summer and the number of apartment transactions in the country fell from 3,900 in May to 3,000–3,200 this August and September. According to the latest data of the SE Centre of Registers, this October saw an increase in the number of apartment transactions to 3,500, which signals that activity in the housing market remains strong. For example, in 2019, on average, about 3,000 apartments were bought per month in Lithuania, and in 2020 – 2,750 apartments.

The growing interest in apartments continues to raise their sale prices, therefore, we have recorded solid growth in prices in the main cities this October. In Vilnius, where apartment sale prices continue to reach new heights, old construction apartments have become 19.7% more expensive, and new construction apartments – 24.8% over the last twelve months. New apartment acquisition transactions and the prices recorded in them show a sudden change in the general apartment price level in the country, and in the case of some individual prices it is hard to believe that the transaction is actually concluded under such conditions. For instance, an apartment in a new project was purchased this October in the country’s capital city for more than EUR 2.7 million – EUR 11,000 per square metre. This is a truly exceptional transaction as the price per square metre of the most expensive apartments sold recently only exceeded EUR 7,000 in rare cases. For this reason, the housing market continues to surprise us and it is becoming difficult to evaluate where the limits of the potential are,” Head of Market Research for Baltic Countries at Ober-Haus, Raimondas Reginis noted.

Full review (PDF): Lithuanian Apartment Price Index, October 2021

This year, with the main indicators of the Lithuanian housing market reaching new highs, market players have seen an extremely intense and exciting period. The substantial amounts poured into the housing market by purchasers, notably active purchase of land plots for the development of new projects and speedily growing residential property prices are reminiscent of the mood which prevailed in the real estate market over a decade ago. However, following the great leap in terms of activity in the housing market seen in the middle of 2021, the third quarter looked slightly calmer and it is expected that this might serve as a sign that the market is transiting to a period of more sustainable development.

This year, with the main indicators of the Lithuanian housing market reaching new highs, market players have seen an extremely intense and exciting period. The substantial amounts poured into the housing market by purchasers, notably active purchase of land plots for the development of new projects and speedily growing residential property prices are reminiscent of the mood which prevailed in the real estate market over a decade ago. However, following the great leap in terms of activity in the housing market seen in the middle of 2021, the third quarter looked slightly calmer and it is expected that this might serve as a sign that the market is transiting to a period of more sustainable development.

According to the data of the Centre of Registers, Q3 2021 saw 11% fewer apartment purchases and 2% more house purchase-sale transactions registered in Lithuania compared to Q2 2021. The decline of transactions was similar for the same period in the main cities of Lithuania both in the apartment segment apartment (22% – in Vilnius, 15% – in Kaunas, 9% – in Klaipėda, 11% – in Šiauliai, and 10% – in Panevėžys), and houses (9% – in Kaunas, 10% – in Klaipėda, 19% – in Šiauliai, and 28% – in Panevėžys). Only Vilnius‘s house segment demonstrated a 5% growth in transactions over this period. Compared to the total number of housing transactions concluded over nine months in 2020, this year 27% more apartments and 33% more houses were purchased in Lithuania.

“The year 2020, was certainly not noted for an abundance of transactions due to the pandemic, which explains why there has been such a fast relative growth in the number of transactions this year. However, if compare the activity of Lithuania‘s housing market in 2021 with the pre-pandemic period, this year growth in the housing market has been particularly fast and has reached new heights”, Head of Market Research for Baltic Countries at Ober-Haus Raimondas Reginis said. Comparing year 2021 with the same period in 2019 shows that this year the purchase of apartments was 11% higher, and 36% more houses were sold.

Slower growth in the prices of apartments is expected

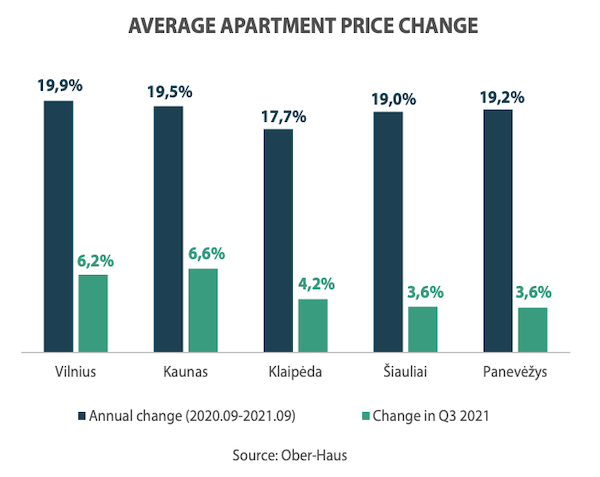

According to Ober-Haus data, the pace of growth of apartment sale prices in the biggest cities of the country in 2021 has evidently increased and significantly exceeded the previous price growth forecasts. Whereas apartment sale prices in the main cities increased by 1.9% on average over Q4 2020, the growth in Q1 2021 amounted to 4.3%, in Q2 – to 6.2%, and in Q3 – to 5.7%. Over Q3 2021, apartment sale prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys grew by 6.2%, 6.6%, 4.2%, 3.6% and 3.6%, respectively.

This scale of growth in the sales prices of apartments was last seen more than a decade ago; however, in September 2021, the average sale price in Vilnius reached an all-time high. Meanwhile, the other main cities of Lithuania see apartment prices ranging from 6% to 25% lower than in the late 2007–early 2008.

This scale of growth in the sales prices of apartments was last seen more than a decade ago; however, in September 2021, the average sale price in Vilnius reached an all-time high. Meanwhile, the other main cities of Lithuania see apartment prices ranging from 6% to 25% lower than in the late 2007–early 2008.

“Given the fact that after reaching its peak in Q2 2021 the activity in the apartment segment stabilised in Q3 2021 and that following a steep increase of prices in the market a considerably higher price level has been set, it is likely that in Q4 2021 and Q1 2022 more modest growth in apartment sale prices will be recorded,” Reginis said.

It should also be noted that expectations of residents have been lowering in recent months. Referring to the data provided by the Department of Statistics, the consumer confidence index reduced by 7 percentage points in the last three months of this year: from 4 in July to minus 3 in October. In October 2021, residents also demonstrated a more pessimistic view with regard to the financial and economic prospects in households.

Apartment rental market of the capital city successfully assimilating the new supply

The apartment rental market in the main cities of the country in 2021 looked as strong as the sales market. According to the data available on the housing rental sector, the current pandemic had no negative impact on the long-term apartment rental segment and the activity of the market this year has been even higher than before the pandemic. For instance, the total number of long-term housing rental transactions concluded by Ober-Haus in Vilnius, Kaunas and Klaipėda over the nine months of 2021, compared with the same period in 2019 and 2020, has increased by 14% and 9% accordingly. And the upsurge in activity of the housing rental market continued to reduce the number of objects available for rent.

Raimondas Reginis, Research Manager for the Baltics at Ober-Haus

At the end of Q3 2021, the number of apartments offered for rent in the real estate listing portal Aruodas in Vilnius, Kaunas and Klaipėda was 25–30% lower than a year ago. This decrease in supply of apartments offered for long-term rent should be assessed with consideration to a few other factors which demonstrate the potential of the Vilnius housing rental market – the biggest in the country.

First, the short-term rental market in Vilnius halved during the pandemic (based on the data of AirDNA), which means that a significant share of housing designated for short-term rent replenished the long-term apartment rental supply.

The housing developers who regularly supply the market of the capital city with new projects offering various sizes of housing should not be forgotten either. In 2021 alone, the rental market will offer about 350 units for rent and by the end of 2021 Vilnius will have slightly more than 700 mid- and long-term rental units managed by professional investors.

“The small investors must also be considered. They regularly increase the supply of rented apartments, for example, by buying apartments in newly constructed projects to let. Taking all these factors into consideration, it could be said that the present potential of the capital city market is more than sufficient to absorb the existing supply,” Reginis said.

High activity in the rental market continues to increase rent prices in the main cities of Lithuania. As the data of Ober-Haus illustrates, rental prices of apartments in Vilnius in Q3 2021 were 14% higher compared to the same period in 2020, and 8%higher in Kaunas and Klaipėda. To compare, the growth in annual sale prices this September was 19.9% in Vilnius, 19.5% – in Kaunas and 17.7 – in Klaipėda.

Record low in the choice of new housing

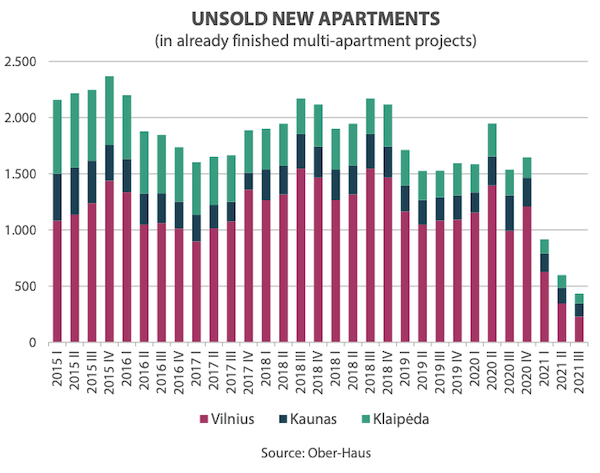

In 2021, the segment of newly built apartments, which attracts a lot of attention in the housing market, has demonstrated previously unseen potentials. Results of the primary market mainly decreased due to the shortage of supply rather than due to a fall in demand.

Ober-Haus data shows that in Q1 2021 as many as 2,343 apartments of in the primary market were purchased or reserved directly from developers in Vilnius in already built or still being built multi-apartment buildings, in Q2 2021 this number amounted to 2,008 apartments, and in Q3 2021 – 1,369 apartments. Regardless of the volumes of apartment sales that have declined in a year, the result of the nine months this year is truly exceptional – 76% more apartments were sold and reserved than in the same period of 2020, and 34% more than in the same period in 2019.

The fast realisation recorded in 2021 has reduced the supply to record lows. According to Ober-Haus, the total number of unsold newly built apartments in already constructed multi-apartment buildings in Vilnius in the end of Q3 2021 was around 250 apartments or almost 5 times less of that at the end of 2020 (around 1,200 apartments). The number of unsold apartments in multi-apartment projects being currently built has also considerably reduced and amounts to only 2,400 apartments. Evidently, the sales of new apartments in the primary market in Q3 2021 has declined, in principle, due to the shortage of supply.

The trends in the primary market of new apartments in Kaunas and Klaipėda were basically identical to the situation seen in Vilnius. According to Ober-Haus data, in Q1 2021 in Kaunas 434 new apartments were purchased or reserved directly from developers in already completed and ongoing projects, this number in Q2 2021 was 349, and 251 – in Q3 2021. In total, 73% more apartments were sold and reserved in nine months of 2021 than in the same period in 2020 and 42% more than in the same period in 2019. The total number of unsold new apartments in already built multi-apartment buildings in Kaunas in the end of Q3 2021 amounted to around 120 apartments or was 2.2 times lower than at the end of 2020.

The trends in the primary market of new apartments in Kaunas and Klaipėda were basically identical to the situation seen in Vilnius. According to Ober-Haus data, in Q1 2021 in Kaunas 434 new apartments were purchased or reserved directly from developers in already completed and ongoing projects, this number in Q2 2021 was 349, and 251 – in Q3 2021. In total, 73% more apartments were sold and reserved in nine months of 2021 than in the same period in 2020 and 42% more than in the same period in 2019. The total number of unsold new apartments in already built multi-apartment buildings in Kaunas in the end of Q3 2021 amounted to around 120 apartments or was 2.2 times lower than at the end of 2020.

Klaipėda saw 167 new apartments in already built or being built multi-apartment buildings purchased or reserved directly from the developers in Q1 2021, 128 apartments – in Q2 2021, and 81 apartments – in Q3 2021. The total number of apartments sold and reserved over nine months of 2021 in the port city was 41% higher compared to the same period in 2020 and 2% higher than over the same period of 2019. The total number of unsold new apartments in already constructed multi-apartment buildings in Klaipėda at the end of Q3 2021 amounted to around 90 apartments or was half the number at the end of 2020.

Private and business investment in housing at the coast has doubled during the pandemic

Indicators of the housing financing sector in Lithuania, like the entire housing market in the country, have demonstrated extremely high results this year. According to the data provided by the Bank of Lithuania, new (real) housing loans issued in the first nine months of 2021 in Lithuania amounted to EUR 1.44 billion or 51% more than in the same period in 2020 and 49% more than in the same period in 2019. The annually increasing scope of borrowing for the purchase of housing in Lithuania should not be surprising since the price of a housing loan remains very attractive. Although 2018-2019 recorded a rise in the interest rate of housing loans in Lithuania with regard to newly granted loans, since the end of 2020, the trend has been of consistently decreasing interest rates. The average annual interest rate of a housing loan was 2.21% in Q1 2021, 2.20% – in Q2 2021, and 2.14% – in Q3 2021. To compare, in 2019–2020, the average interest rate for newly issued housing loans in Lithuania amounted to 2.38%.

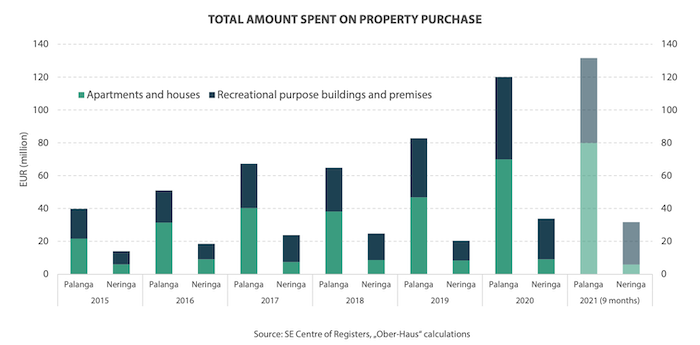

This year the Lithuanian housing market has gained momentum and optimistic views of the market participants have spread from the capital city to the coastal region. Whereas investments of developers in the big cities of the country (construction of residential project starts or purchases of land plots for future projects take place) are currently much needed to balance the ratio between supply and demand of housing, the expansion of the housing market in the coastal region, for example, does not look very sustainable.

“The Lithuanian coastal region is in its heyday due to the limited travelling abroad because of the pandemic, and the number of those who want to direct their investments in the housing sector has significantly increased,” Reginis said. According to the data of the Centre of Registers, in 2019 about EUR 103 million were spent on housing (apartments and houses) and premises/ buildings of recreational purpose purchase in Palanga and Neringa municipalities, in 2020, this number amounted to EUR 154 million, and in the first nine months of 2021 reached EUR 163 million. It means that investments from individuals and business in the coastal region of Lithuania have doubled in the last several years.

“It is likely that when travel abroad gets back on track, the attractiveness of this region might naturally decline as well as the newly found interest in its real estate. If investments in the coastal region of Lithuania will continue to rise further (development of new projects and purchases of housing), such likely “standoff” of demand may end in the unrealised exaggerated expectations of investors,” Reginis said. The extremely sudden growth of any real estate segment also increases the level of risk which becomes evident when the situation in the market changes, especially, when demand staggers.

Full review (PDF): Lithuania Residential Market Commentary Q3 2021

This year, with the main indicators of the Lithuanian housing market reaching new highs, market players have seen an extremely intense and exciting period. The substantial amounts poured into the housing market by purchasers, notably active purchase of land plots for the development of new projects and speedily growing residential property prices are reminiscent of the mood which prevailed in the real estate market over a decade ago. However, following the great leap in terms of activity in the housing market seen in the middle of 2021, the third quarter looked slightly calmer and it is expected that this might serve as a sign that the market is transiting to a period of more sustainable development.

This year, with the main indicators of the Lithuanian housing market reaching new highs, market players have seen an extremely intense and exciting period. The substantial amounts poured into the housing market by purchasers, notably active purchase of land plots for the development of new projects and speedily growing residential property prices are reminiscent of the mood which prevailed in the real estate market over a decade ago. However, following the great leap in terms of activity in the housing market seen in the middle of 2021, the third quarter looked slightly calmer and it is expected that this might serve as a sign that the market is transiting to a period of more sustainable development.

According to the data of the Centre of Registers, Q3 2021 saw 11% fewer apartment purchases and 2% more house purchase-sale transactions registered in Lithuania compared to Q2 2021. The decline of transactions was similar for the same period in the main cities of Lithuania both in the apartment segment apartment (22% – in Vilnius, 15% – in Kaunas, 9% – in Klaipėda, 11% – in Šiauliai, and 10% – in Panevėžys), and houses (9% – in Kaunas, 10% – in Klaipėda, 19% – in Šiauliai, and 28% – in Panevėžys). Only Vilnius‘s house segment demonstrated a 5% growth in transactions over this period. Compared to the total number of housing transactions concluded over nine months in 2020, this year 27% more apartments and 33% more houses were purchased in Lithuania.

The year 2020, was certainly not noted for an abundance of transactions due to the pandemic, which explains why there has been such a fast relative growth in the number of transactions this year. However, if compare the activity of Lithuania‘s housing market in 2021 with the pre-pandemic period, this year growth in the housing market has been particularly fast and has reached new heights. Comparing year 2021 with the same period in 2019 shows that this year the purchase of apartments was 11% higher, and 36% more houses were sold.

Slower growth in the prices of apartments is expected

According to Ober-Haus data, the pace of growth of apartment sale prices in the biggest cities of the country in 2021 has evidently increased and significantly exceeded the previous price growth forecasts. Whereas apartment sale prices in the main cities increased by 1.9% on average over Q4 2020, the growth in Q1 2021 amounted to 4.3%, in Q2 – to 6.2%, and in Q3 – to 5.7%. Over Q3 2021, apartment sale prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys grew by 6.2%, 6.6%, 4.2%, 3.6% and 3.6%, respectively.

This scale of growth in the sales prices of apartments was last seen more than a decade ago; however, in September 2021, the average sale price in Vilnius reached an all-time high. Meanwhile, the other main cities of Lithuania see apartment prices ranging from 6% to 25% lower than in the late 2007–early 2008.

Given the fact that after reaching its peak in Q2 2021 the activity in the apartment segment stabilised in Q3 2021 and that following a steep increase of prices in the market a considerably higher price level has been set, it is likely that in Q4 2021 and Q1 2022 more modest growth in apartment sale prices will be recorded. It should also be noted that expectations of residents have been lowering in recent months. Referring to the data provided by the Department of Statistics, the consumer confidence index reduced by 7 percentage points in the last three months of this year: from 4 in July to minus 3 in October. In October 2021, residents also demonstrated a more pessimistic view with regard to the financial and economic prospects in households.

Apartment rental market of the capital city successfully assimilating the new supply

The apartment rental market in the main cities of the country in 2021 looked as strong as the sales market. According to the data available on the housing rental sector, the current pandemic had no negative impact on the long-term apartment rental segment and the activity of the market this year has been even higher than before the pandemic. For instance, the total number of long-term housing rental transactions concluded by Ober-Haus in Vilnius, Kaunas and Klaipėda over the nine months of 2021, compared with the same period in 2019 and 2020, has increased by 14% and 9% accordingly. And the upsurge in activity of the housing rental market continued to reduce the number of objects available for rent. At the end of Q3 2021, the number of apartments offered for rent in the real estate listing portal Aruodas in Vilnius, Kaunas and Klaipėda was 25–30% lower than a year ago. This decrease in supply of apartments offered for long-term rent should be assessed with consideration to a few other factors which demonstrate the potential of the Vilnius housing rental market – the biggest in the country.

First, the short-term rental market in Vilnius halved during the pandemic (based on the data of AirDNA), which means that a significant share of housing designated for short-term rent replenished the long-term apartment rental supply. The housing developers who regularly supply the market of the capital city with new projects offering various sizes of housing should not be forgotten either. In 2021 alone, the rental market will offer about 350 units for rent and by the end of 2021 Vilnius will have slightly more than 700 mid- and long-term rental units managed by professional investors. The small investors must also be considered. They regularly increase the supply of rented apartments, for example, by buying apartments in newly constructed projects to let. Taking all these factors into consideration, it could be said that the present potential of the capital city market is more than sufficient to absorb the existing supply.

High activity in the rental market continues to increase rent prices in the main cities of Lithuania. As the data of Ober-Haus illustrates, rental prices of apartments in Vilnius in Q3 2021 were 14% higher compared to the same period in 2020, and 8%higher in Kaunas and Klaipėda. To compare, the growth in annual sale prices this September was 19.9% in Vilnius, 19.5% – in Kaunas and 17.7 – in Klaipėda.

Record low in the choice of new housing

In 2021, the segment of newly built apartments, which attracts a lot of attention in the housing market, has demonstrated previously unseen potentials. Results of the primary market mainly decreased due to the shortage of supply rather than due to a fall in demand. Ober-Haus data shows that in Q1 2021 as many as 2,343 apartments of in the primary market were purchased or reserved directly from developers in Vilnius in already built or still being built multi-apartment buildings, in Q2 2021 this number amounted to 2,008 apartments, and in Q3 2021 – 1,369 apartments. Regardless of the volumes of apartment sales that have declined in a year, the result of the nine months this year is truly exceptional – 76% more apartments were sold and reserved than in the same period of 2020, and 34% more than in the same period in 2019. The fast realisation recorded in 2021 has reduced the supply to record lows. According to Ober-Haus, the total number of unsold newly built apartments in already constructed multi-apartment buildings in Vilnius in the end of Q3 2021 was around 250 apartments or almost 5 times less of that at the end of 2020 (around 1,200 apartments). The number of unsold apartments in multi-apartment projects being currently built has also considerably reduced and amounts to only 2,400 apartments. Evidently, the sales of new apartments in the primary market in Q3 2021 has declined, in principle, due to the shortage of supply.

The trends in the primary market of new apartments in Kaunas and Klaipėda were basically identical to the situation seen in Vilnius. According to Ober-Haus data, in Q1 2021 in Kaunas 434 new apartments were purchased or reserved directly from developers in already completed and ongoing projects, this number in Q2 2021 was 349, and 251 – in Q3 2021. In total, 73% more apartments were sold and reserved in nine months of 2021 than in the same period in 2020 and 42% more than in the same period in 2019. The total number of unsold new apartments in already built multi-apartment buildings in Kaunas in the end of Q3 2021 amounted to around 120 apartments or was 2.2 times lower than at the end of 2020. Klaipėda saw 167 new apartments in already built or being built multi-apartment buildings purchased or reserved directly from the developers in Q1 2021, 128 apartments – in Q2 2021, and 81 apartments – in Q3 2021. The total number of apartments sold and reserved over nine months of 2021 in the port city was 41% higher compared to the same period in 2020 and 2% higher than over the same period of 2019. The total number of unsold new apartments in already constructed multi-apartment buildings in Klaipėda at the end of Q3 2021 amounted to around 90 apartments or was half the number at the end of 2020.

Private and business investment in housing at the coast has doubled during the pandemic

Indicators of the housing financing sector in Lithuania, like the entire housing market in the country, have demonstrated extremely high results this year. According to the data provided by the Bank of Lithuania, new (real) housing loans issued in the first nine months of 2021 in Lithuania amounted to EUR 1.44 billion or 51% more than in the same period in 2020 and 49% more than in the same period in 2019. The annually increasing scope of borrowing for the purchase of housing in Lithuania should not be surprising since the price of a housing loan remains very attractive. Although 2018-2019 recorded a rise in the interest rate of housing loans in Lithuania with regard to newly granted loans, since the end of 2020, the trend has been of consistently decreasing interest rates. The average annual interest rate of a housing loan was 2.21% in Q1 2021, 2.20% – in Q2 2021, and 2.14% – in Q3 2021. To compare, in 2019–2020, the average interest rate for newly issued housing loans in Lithuania amounted to 2.38%.

This year the Lithuanian housing market has gained momentum and optimistic views of the market participants have spread from the capital city to the coastal region. Whereas investments of developers in the big cities of the country (construction of residential project starts or purchases of land plots for future projects take place) are currently much needed to balance the ratio between supply and demand of housing, the expansion of the housing market in the coastal region, for example, does not look very sustainable. The Lithuanian coastal region is in its heyday due to the limited travelling abroad because of the pandemic, and the number of those who want to direct their investments in the housing sector has significantly increased. According to the data of the Centre of Registers, in 2019 about EUR 103 million were spent on housing (apartments and houses) and premises/ buildings of recreational purpose purchase in Palanga and Neringa municipalities, in 2020, this number amounted to EUR 154 million, and in the first nine months of 2021 reached EUR 163 million. It means that investments from individuals and business in the coastal region of Lithuania have doubled in the last several years.

It is likely that when travel abroad gets back on track, the attractiveness of this region might naturally decline as well as the newly found interest in its real estate. If investments in the coastal region of Lithuania will continue to rise further (development of new projects and purchases of housing), such likely “standoff” of demand may end in the unrealised exaggerated expectations of investors. The extremely sudden growth of any real estate segment also increases the level of risk which becomes evident when the situation in the market changes, especially, when demand staggers.

Full review (PDF): Lithuania Residential Market Commentary Q3 2021

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), was up by 1.6% in September 2021 (an increase of 2.4% was recorded in August 2021). The overall price level of apartments in the major cities has in the past 12 months increased by 19.4% (an increase of 17.9% was recorded in August 2021).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), was up by 1.6% in September 2021 (an increase of 2.4% was recorded in August 2021). The overall price level of apartments in the major cities has in the past 12 months increased by 19.4% (an increase of 17.9% was recorded in August 2021).

In September 2021, apartment prices in the capital city rose 1.8% and the average price per square meter reached EUR 1,986 (+35 EUR/sqm). In Kaunas, Klaipėda, Šiauliai and Panevėžys, prices in September increased by 2.0%, 0.8%, 0.8% and 0.6% respectively and the average price per square meter increased to EUR 1,401 (+28 EUR/sqm), EUR 1,344 (+10 EUR/sqm), EUR 907 (+7 EUR/sqm) and EUR 892 (+5 EUR/sqm) respectively.

The prices of apartments in the major cities saw a double digit increase on a year-over-year basis in September 2021: in Vilnius – 19.9%, Kaunas – 19.5%, Klaipėda – 17.7%, Šiauliai – 19.0% and Panevėžys – 19.2%.

“September 2021 was symbolic for the residential property market of the capital city of Lithuania – after a very rapid increase in sales prices of apartments, the average square meter price in Vilnius reached an all-time high,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

According to Ober-Haus, the highest price per square meter in Vilnius was last time recorded in December 2007 and stood at EUR 1,983 (EUR 1,986 in September 2021). However, a more detailed comparison of the prices of apartments shows that prices in different segments (both according to the year of construction and location) have increased at a different rate over the past decade. For example, at present, the prices of new apartments are on average by 3.5% higher than at the end of 2007, and the prices for older apartments are still by 2.6% lower.

Looking in greater detail, it is clear that the sales prices of apartments in both old and new apartment buildings located in the central part of the city (the Old Town, Užupis, Naujamiestis) and adjacent areas (Šnipiškės, Žvėrynas) have most rapidly increased and even exceeded the prices recorded at the end of 2007. “This is what could have been expected, because these urban areas have seen a lot of positive changes over the past decade, which also affected the attractiveness of property market. The conversion of industrial sites into new apartment blocks and business centres, new hard and soft landscaping and road infrastructure have attracted huge interest from people with higher incomes and caused an increase of real estate prices in these urban areas to unprecedented levels,” Reginis noted.

Record prices, however, were recorded not in all apartment segments in Vilnius. For example, the prices of apartments in the Soviet-era buildings, the largest segment of apartment buildings in the city, are slightly below the 2007–2008 level. According to Reginis, such apartments may be up to 10% cheaper than at the very peak of prices. This segment has the greatest impact on the estimates of the average sales price of apartments in Vilnius.

For example, the analysis of all recorded apartment purchase and sale transactions in Fabijoniškės district, one of the largest apartment building districts in Vilnius, shows that in July-September 2021, the median price per square meter of 1–4-room apartments in the buildings constructed in 1987–1991 was about 5% lower compared to the prices of apartments sold in November 2007–January 2008. At the end of 2007 and the beginning of 2008, a 2-room apartment sold on average for EUR 88,000, and in July-September 2021 – for EUR 75,000. Meanwhile, a 3-room apartment sold on average for EUR 101,000 and EUR 91,500 during the same period.

Karoliniškės district, for example, one of the oldest typical districts in Vilnius, were construction of multi-storey panel buildings started in the early 1970s. According to Ober-Haus, in July-September 2021, the median price per square meter of 1–4-room apartments in the buildings constructed in 1972–1975 was about 11% lower compared to the prices of apartments sold in November 2007–January 2008. At the end of 2007 and the beginning of 2008, a 2-room apartment sold on average for EUR 83,000, and in July-September 2021 – for EUR 73,000. Meanwhile, a 3-room apartment sold on average for EUR 94,000 and EUR 86,000 during the same period.

“We can see that over the past decade, Vilnius has been changing rapidly – it has expanded and has become more densely populated. In terms of the real estate market, certain districts became more attractive and buyers pay for the property more than ever before. Meanwhile, in the districts where there have been fewer changes, the same property costs less than before the global financial crisis,” Reginis commented.

It is obvious that typical apartment block districts in the city face major challenges, because they are already formed and changes that would make them more attractive and increase property prices are neither fast nor visible. It should also be taken into consideration that buildings are getting older. For example, this year, Vilnius City Municipality has launched the CITY+ programme for revitalising residential districts aimed at renewing apartments, buildings, yards, and streets and creating centres of attraction and identity of these districts. The renovation of old apartment buildings alone can increase their attractiveness on the market and increase the value of the apartments (even with investment costs in mind), furthermore, it will be beneficial to the residents of such districts who could live in more beautiful and warmer homes.

“Despite the slightly uneven increase in prices in different apartment segments of the capital city, it is clear that prices of apartments have been rapidly increasing across the city over the past decade. Since the lowest sales price level recorded in May 2010, prices have increased by as much as 72% on average. High market activity and optimistic expectations of market players allow us to predict even higher price levels at least in the near future,” Reginis said.

Full review (PDF): Lithuanian Apartment Price Index, September 2021

Euromoney, the international business and finance publication, has declared Ober-Haus the best real estate (RE) company in Lithuania in 2021.

Ober-Haus was the first in all categories of the annual Euromoney awards: the best in Agency-Letting/sales, the best in Property Valuation and the best in RE Research and Analytics in Lithuania, and, ultimately, the best RE services company overall in Lithuania.

“Our day-to-day work is based on competence, transparency and respect for business relationships and has determined the long-lasting trust of our clients and most market participants. We provide services to business, individuals and the public sector. Hence the evaluation of a wide circle of customers is very important to us. The Euromoney award is a pleasant recognition as well. It will motivate us to further develop new quality standards for complex RE services in the market,” Audrius Šapoka, general manager of Ober-Haus, said.

The Lithuanian team of Ober-Haus has more than 130 employees. The company provides around 12,000 RE services annually. Last year, the company concluded 1,200 transactions on the sale and rent of residential and commercial property, prepared more than 11,000 property evaluation reports, valuation expertise and consultations. Ober-Haus Market Research Department has accumulated unique data and prepared regular overviews which reflect relevant events and issues in the RE market for over 20 years. “Our impartiality and the significance of our data to the market is proven by the fact that we are most often quoted by the media, famous economists, the Bank of Lithuania and other leading commercial banks,” Šapoka noted. In 2020, Ober-Haus had a turnover of EUR 4.25 million, excl. VAT.

This was the 17th Euromoney awards. RE companies are assessed by means of a survey of Lithuanian RE market participants (RE experts, developers, representatives of construction companies and finance institutions), evaluation of their services, their managed property, the growth of the company and other indicators. Euromoney has given Ober-Haus top evaluations for the seventh year in a row; this is the fourth time Ober-Haus been chosen as best RE company in Lithuania.

Ober-Haus has operated in Lithuania since 1998 and is the biggest real estate service provider in Lithuania and the Baltic region. It belongs to one of the major Finnish brokerage and RE consulting services company, Kiinteistömaailma. The company provides brokerage services for buying, selling or renting commercial and residential property, as well as business evaluation, consulting and market research services in terms of immovable and movable property. Ober-Haus has 19 representative offices in the main cities of Lithuania, Latvia and Estonia with 220 employees in total.

With more than a year since the first wave of the COVID-19 pandemic, Ober-Haus experts have evaluated how the situation has changed in the main shopping streets of Vilnius where the mood has been largely changeable.

With more than a year since the first wave of the COVID-19 pandemic, Ober-Haus experts have evaluated how the situation has changed in the main shopping streets of Vilnius where the mood has been largely changeable.

“The entire retail and retail property sector in Lithuania has been facing a variety of challenges during this period. Smaller retailers found the period particularly difficult. The rapidly changing pandemic situation in the country, regular need to adapt to changing safety requirements and the limited financial capacity of small businesses have made the tenants of small retail premises particularly vulnerable,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

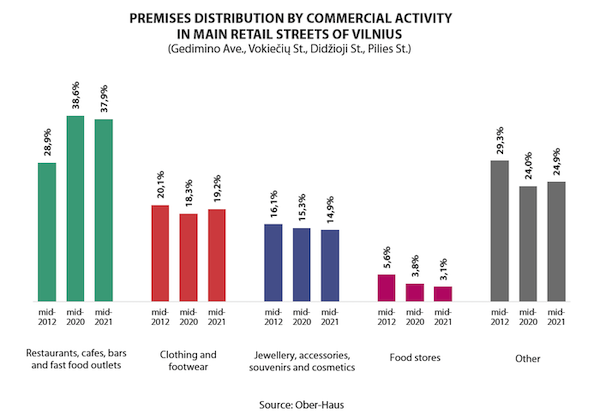

A survey on the situation in the main shopping streets (Gedimino Ave., Pilies St., Didžioji St., Vokiečių St.) of the city of Vilnius conducted by Ober-Haus in mid-2020 and mid-2021 shows that the situation is still stressful. If in mid-2020 the vacancy rate in these streets stood at 11.0%, so in mid-2021 it slightly increased to 11.9%.

“In the summer of 2020, people returned to shopping streets and injected optimism to retailers, particularly to the largest group of tenants – restaurants, cafes, bars and fast food outlets, which account for 38% of all retail premises in these streets of the capital city,” Reginis said.

With the lifting of the lockdown, people who have missed socializing and recreation occupied outdoor seating areas of retailers who provide food and beverage services and improved the performance indicators of such retailers. According to Statistics Lithuania, the turnover of food and beverage suppliers in Lithuania in H2 2020 increased by 27% compared to H1 2020. However, the overall performance in H2 2020 in this business sector remained 19% lower compared to record indicators in H2 2019. The second wave of the coronavirus made businesses essentially close again and at the end of 2020 the performance indicators noticeably declined again. In H1 2021, the performance indicators of food and beverage suppliers remained modest and were 9% lower than at the same time last year and 32% lower than in H1 2019.

According to Ober-Haus, in mid-2021, the highest vacancy rate was recorded in Pilies Street – at 18.5% and the lowest vacancy rate was recorded in Didžioji Street (9.1%). The vacancy rate in Gedimino Avenue stood at 11.0% and in Vokiečių Street – 10.2%.

Within a year, the highest increase in vacancy rate was in Pilies Street (from 11.3% to 18.5%), where over 50 retail units are based (located on the ground floor of the building, with at least one window facing the street and suitable for commercial activities).

Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus

“Since the overall number of retailers is not large, a few vacant retail premises can significantly change the relative indicator of the vacant space. On the other hand, Pilies Street is probably the most popular street visited by foreign tourists in Vilnius, so during the pandemic, the footfall decreased significantly affecting revenues of retailers,” Reginis noted.

Meanwhile, on Vokiečių Street there was one vacant space less in mid-2021 than a year ago, and the figure for the vacancy rate decreased from 12.5% to 10.2%. Despite the relatively small vacancy rate, the owners and tenants of this street will be facing additional challenges. This year, the renovation of the district heating system started on Vokiečių Street, and cafes and restaurants have to adapt to the works and to relocate or close their outdoor seating spaces. Once the renovation of the heating system is completed, the renovation of the entire Vokiečių Street will start, and the terms of the reconstruction have not yet been finalised.

“It is clear that the renovation works will significantly reduce the flow of potential customers in the street and this will affect all businesses located in the street, which, in addition, will have to deal with the challenges posed by the current pandemic. Therefore, the owners of retail premises on Vokiečių Street may expect the rise in the number of vacant premises in the coming years and the decrease in rental revenues,” Reginis said.

The structure of the tenants in the main shopping streets of the capital city has not changed substantially during the year. According to Ober-Haus, in mid-2021, most of the premises were occupied by restaurants, cafes, bars and fast food outlets and their share during the year decreased slightly from 38.6% to 37.9%. The share of clothing and footwear retailers accounted for 19.2%, jewellery, accessories, souvenirs and cosmetics – 14.9%, food stores – 3.1%, and the remaining 24.9% were beauty salons, offices, pharmacies, banks, bookstores and other retail or services units.

Given that the pandemic situation in the country is either improving or deteriorating, the expectations of the owners of retail premises in respect to the rental income remain uncertain. If some owners of such premises can offer lower rents than they were before to potential tenants, so other owners still expect to sign long-term lease contracts securing pre-pandemic rents.

In mid-2021, rents for medium-sized (about 100–300 sqm) retail premises in the main shopping streets of Vilnius (Gedimino Avenue, Pilies Street, Didžioji Street and Vokiečių Street) stood at 15.0–40.0 EUR/sqm and were on average 12% lower than those at the end of 2019. However, there are cases where owners of the premises sign long-term lease contracts with new tenants at 25-20% lower rents than they could lease before the pandemic started.

The overall indicators show that there is little optimism in the shopping streets of Vilnius, but interest in available retail space is not lost. “Some businesses see long-term prospects of these streets and the current market situation opens up much wider opportunities for them. If it was generally difficult to find suitable premises before the pandemic even by offering historically record rents, today the choice is wider and the rents are more attractive. Therefore, more daring entrepreneurs are trying not to miss their chance and are actively interested in their business development opportunities in the prestigious locations of the city,” Reginis said.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 1.6% in July 2021 (2.0% increase was recorded in June 2021). The annual apartment price growth in the major cities of Lithuania was 15.3% (the annual apartment price growth in June 2021 was 13.6%)

In July 2021 apartment prices in the capital grew 1.6% with the average price per square meter reaching EUR 1,901 (+30 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys grew by 1.8%, 1.5%, 1.2% and 1.5% respectively with the average price per square meter reaching EUR 1,336 (+23 EUR/sqm), EUR 1,309 (+19 Eur/sqm), EUR 885 (+10 EUR/sqm) and EUR 875 (+13 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 15.4% in Vilnius, 14.3% in Kaunas, 14.9% in Klaipėda, 16.9% in Šiauliai and 17.9% in Panevėžys.

“Summer season in the residential property market in Lithuania showed no major signs of cooling. In July 2021, we observed both high market activity and a steadily increase in apartment prices. According to the State Enterprise Centre of Registers, almost 3,600 apartments were purchased in Lithuania in July, or 2% more than in June 2021. Compared to the peak in the apartment market in May 2021, when over 3,900 apartments were purchased in Lithuania, the indicator in June and July is by 8-10% lower. Looking at the apartment market activity in individual cities, different trends can be observed. For example, in Panevėžys, the number of recorded apartment transactions has been decreasing for two consecutive months, while Klaipėda saw the highest activity recorded since 2007.

The high residential property market activity is maintained by expectations of the population which are improving. According to Statistics Lithuania, the consumer confidence rate increased by 1 percentage point to 4% in July 2021, which is the highest rate since February 2020. Also, July saw a significant increase in the share of the population planning larger purchases (furniture, home appliances) in the next 12 months. The general mood of the population and the indicators of the residential property market show that there is sufficient stimulus for a rise in home prices,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

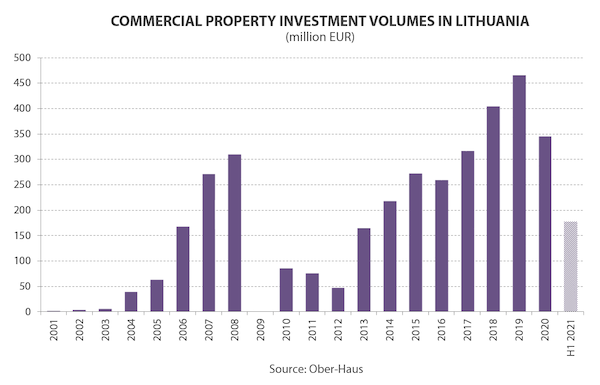

Although in monetary terms the overall indicators for investment transactions in traditional commercial real estate (modern offices, retail and industrial property) in Lithuania in H1 2021 were not impressive, the number of transactions gives optimism.

Although in monetary terms the overall indicators for investment transactions in traditional commercial real estate (modern offices, retail and industrial property) in Lithuania in H1 2021 were not impressive, the number of transactions gives optimism.

According to Ober-Haus, acquisitions of the modern commercial property (offices, retail, and industrial buildings and premises of at least EUR 1.5 million in value) in Lithuania stood at EUR 177 million in H1 2021. Investment volumes remained at a similar level as in the previous year, accounting for 51% of the total 2020 investment (EUR 345 million). However, compared to the half year average of the past three years (2018–2020), in H1 2021 investment volume was 12% lower.

“Although the amount of money invested in commercial real estate remained at the same level as in the previous year and was lower only than that in the record 2018–2019, but the number of transactions shows that interest in cash-flow generating commercial properties in Lithuania remains at a high level,” Audrius Šapoka, Managing Director of Ober-Haus, said. In H1 2021, 16 transactions were concluded for the acquisition of 20 different objects in various regions of Lithuania. For example, between 2018 and 2020, 18–25 transactions were concluded each year, so the number of transactions clearly signals a strong interest from investors in commercial real estate, even in the face of the pandemic.

According to Šapoka, there is no shortage of money in the market, the greater problem being the lack of real supply. “We notice a kind of tension not only among conservative investors who seek a lower but clear and guaranteed return, but also among investors who tolerate an average or higher risk, who find it difficult to employ the freed capital. It is clear that had the real supply not been short, we would have had far larger volumes of investment transactions both in terms of their number and size,” Šapoka noted.

Although in H1 2021, the majority of investments were made in properties in Vilnius, looking historically, the share of investments in other cities of the country increased significantly. According to Ober-Haus, over the past three years the capital city of the country has attracted about 70-80% of the total investment, whereas in H1 2021, it attracted 61% of the total investment with the remaining investment (39%) made in Kaunas, Klaipėda and Panevėžys.

“We notice greater interest from smaller–medium investors for real estate objects not only in Vilnius or Kaunas, but also in other major cities – Klaipėda, Panevėžys, Šiauliai. In particular, there is a strong demand for industrial properties, also for the retail schemes or office buildings with larger and more reliable tenants and longer term rental contracts, which are more difficult to terminate. In terms of the types of transactions in such cities, we can see at least 200–300 basis points lower yields than that compared to the 2018–2019 transactions,” Šapoka said.

Half of the money invested in H1 2021 in Lithuania went to the acquisition of retail properties. This sector also saw the largest investment transactions. At the beginning of this year, the French investment company Corum acquired two Depo shopping centres in Vilnius and Klaipėda, and currently manages four DIY type shopping centres of the Latvian chain of building materials and household goods in Lithuania (two shopping centres were purchased in 2019). Investment in these four shopping centres totalled just over EUR 100 million, and this is one of the largest sale-leaseback type continuous transactions in the history of Lithuania. Investors also continued to actively purchase smaller supermarkets with large food chain tenants and other premises suitable for retail trade.

In H1 2021, a large portion (31%) of investment in Lithuania went to the purchase of warehousing and production facilities. In mid-year, the Norwegian capital real estate developer Baltic Sea Properties announced the purchase of the companies that managed a business park in Klaipėda (total area of the buildings almost 24,000 sqm) mostly consisting of warehousing and production facilities. The real estate fund managed by the Estonian investment company Eften Capital purchased three buildings (total area more than 16,000 sqm) on Molėtai Road in Vilnius, mostly occupied by manufacturers. In mid-year, Eften Capital also announced of the acquisition of two more properties with mainly production facilities on Ramygalos Street in Panevėžys for a total of EUR 10 million. In May 2021, the Swedish investment fund East Capital Real Estate acquired a warehouse complex of almost 13,000 sqm on Jankiškių Street in Vilnius. Another smaller building housing a production facility was sold in Klaipėda Free Economic Zone.

The smallest portion of investment went to the office segment in H1 2021. According to Ober-Haus, EUR 34 million or 19% of the total half-yearly investment was spent in this segment. The largest investment transaction was concluded in Vilnius. The Swedish investment company Eastnine acquired the Uniq business centre of the total area of 6,900 sqm currently leased by Danske Bank IT services centre. Three smaller transactions for the acquisition of office buildings were concluded in Vilnius and Kaunas, ranging from EUR 2.5 to EUR 6 million.

According to Šapoka, the results of both the previous and this year show that the current pandemic did not deter investors prepared to invest in commercial real estate. “The pandemic made potential investors be a little more cautious than in the previous years and change their investment strategy,” Šapoka pointed out.

Unlike the Lithuanian residential property or land sectors, where record-breaking indicators have been recorded this year, the general mood in the commercial premises sector remains cautiously optimistic. Those investing in commercial objects must take into account the prospects of specific real estate in both the pandemic and post-pandemic period.

“We can see that in 2020–2021, the share of investment in production and warehousing facilities has increased significantly, because such real estate has recently been considered as one of the most promising investments,” Šapoka said. After the first wave of COVID-19, fast recovering economies and increasing consumption created demand for production and for warehousing and distribution of products to end users. In the meantime, as the pandemic continues, the overall volume of investment (or part of it) in offices or retail properties may remain slightly lower than it was usual before the pandemic period. The current pandemic imposes strict requirements on retailers and the physical use of offices has decreased, which makes these real estate segments less predictable than before.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 2.0% in June 2021 (2.7% increase was recorded in May 2021). The annual apartment price growth in the major cities of Lithuania was 13.6% (the annual apartment price growth in May 2021 was 11.6%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 2.0% in June 2021 (2.7% increase was recorded in May 2021). The annual apartment price growth in the major cities of Lithuania was 13.6% (the annual apartment price growth in May 2021 was 11.6%).

In June 2021 apartment prices in Vilnius and Kaunas grew by 2.1% respectively with the average price per square meter reaching EUR 1,871 (+39 EUR/sqm) and EUR 1,313 (+27 Eur/sqm). In Klaipėda, Šiauliai and Panevėžysapartment prices grew by 1.6%, 1.9% and 1.3% respectively with the average price per square meter reaching EUR 1,290 (+20 EUR/sqm), EUR 875 (+16 EUR/sqm) and EUR 862 (+11 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 13.7% in Vilnius, 12.5% in Kaunas, 13.1% in Klaipėda, 15.5% in Šiauliai and 16.6% in Panevėžys.

“The apartment sale price increase, which started at the end of 2020, shows no signs of abating, and we continue to record a rapid monthly and annual growth. The expectations of sellers are currently extremely high and this directly contributes to the further increase in apartment prices. In view of the recent rapid increase in residential property prices, many property owners tend to sell properties at higher than the market prices. With the rapid increase in apartment prices, even such offers eventually attract interest and real buyers. However, in this case, depending on the seller’s expectations, the sales process may take longer, for example, 1-2 months or 3-4 months. Despite the highly active residential property market in our country, buyers do not easily accept high prices and are always looking for alternatives. Only if they find no alternatives and see that prices continue to increase, do they return to the negotiating table with the property owners.

The latest figures show that the overall level of the residential market activity in the country is gradually cooling off and it is very likely that the next few months will be quieter than April-May this year. So the sale process for overly optimistic home sellers may take much longer than planned,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

Search

Search