The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in January 2017. The annual apartment price growth in the major cities of Lithuania was 5.6% (the annual apartment price growth in December 2016 was 5.5%).

In January 2017 apartment prices in the capital grew 0.4% with the average price per square meter reaching EUR 1,423 (+6 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 23.3% (+269 EUR/sqm). Apartment prices in Kaunas in January grew by 0.2% with the average price per square meter reaching EUR 986 (+2 EUR/sqm). In Klaipėda and Panevėžys apartment prices remained stable and were the same as in December – 1.013 EUR/sqm and 559 EUR/sqm. After a drop in apartment prices in Šiauliai by 0.1%, the average price fell to 595 EUR/sqm.

In the past 12 months, the prices of apartments grew in all major cities: 7.1% in Vilnius, 4.3% in Kaunas, 2.4% in Klaipėda, 4.8% in Šiauliai and 5.2% in Panevėžys.

“The month of January is traditionally one of the least active periods in real estate market. For this reason, it is quite symbolic and logical to see that in January apartment prices increased in Lithuania‘s two biggest and currently most active cities – Vilnius and Kaunas. According to the data of the state enterprise Centre of Registers, this January Vilnius saw 11% more transactions of apartment purchases (792) than in January of 2016 (712). Meanwhile, the increase in transactions in Kaunas amounted to 19%: in January 2017 as many as 321 transactions were concluded, and in January 2016 – 269 transactions. Actually, the comparison of statistical data of January shows that the performance of January this year in Kaunas is the second best result in the history of the city. The biggest number of transactions was recorded back in January 2007 (370 transactions). These numbers once again demonstrate that Kaunas‘ housing market is starting to emerge from stagnation which persisted in the city until 2014,” says Saulius Vagonis, Head of Valuation & Analysis at Ober-Haus.

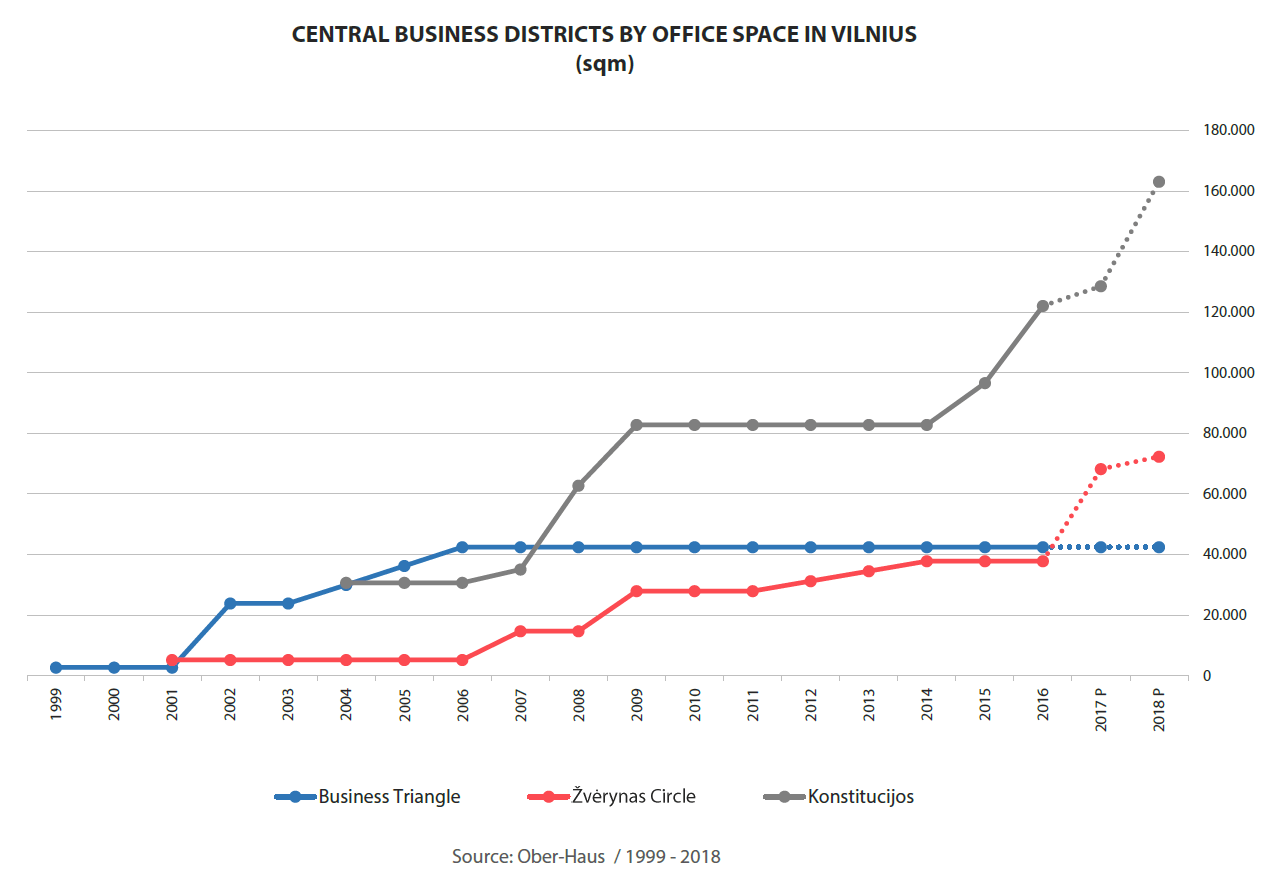

An assessment of commercial real estate development trends in Vilnius shows that in recent years the modern office space market in Vilnius has been getting increasing attention: since 2000, over 100 business centres or buildings of various purposes with modern administrative premises have been built in the city. At the end of 2016, the useful floor area of offices totalled 626,900 sqm. Real estate company Ober-Haus estimates that in 2017–2018 another 18–22 office buildings or office complex parts could supplement the market offering another 110,000-150,000 sqm of office space in Vilnius. Over a period of time, several central business districts (CBD), usually referred to as “financial centres” abroad, emerged in the city where office buildings dominate.

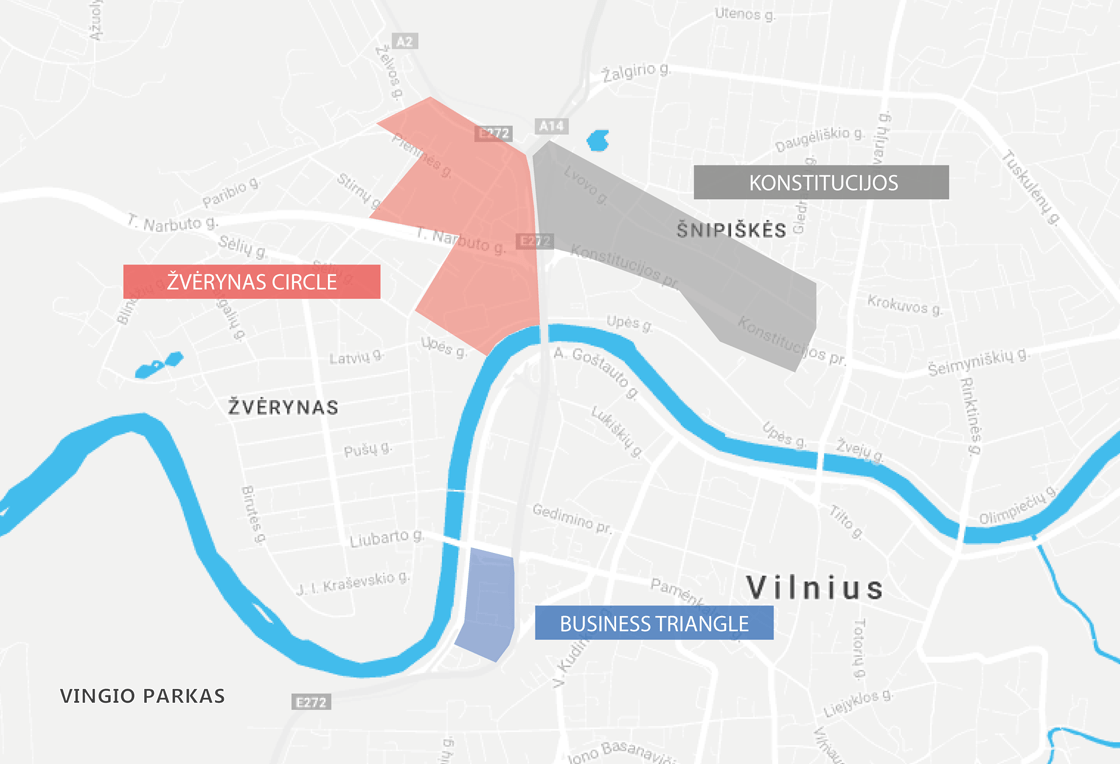

According to Saulius Vagonis, head of Ober-Haus Valuation and Market Research Department, three business districts in Vilnius can be identified with higher concentration of modern office buildings than in other parts of the city: Konstitucijos Avenue and its surroundings, the Business Triangle (Verslo trikampis) next to J. Jasinskio and A. Goštauto streets, and the northern part of the city district of Žvėrynas with the Žvėrynas Circle (Žvėryno žiedas) business district. According to Ober-Haus, at the end of 2016 the leased office space in these three business districts totalled 202,450 sqm. This is a third of A and B class office space facilities available in Vilnius.

Interestingly, the first buildings in all three of these districts were built by real estate development company Hanner. In 1999, Hanner built the first new concept modern office building on A. Goštauto Street in Vilnius. This gave impetus to construction or reconstruction of other buildings in the district, as a result, the first CBD (called Business Triangle) was born. Another business district is located in the northern part of the city district of Žvėrynas. The first business centre built here on Geležinio Vilko Street near Geležinio Vilko Roundabout in 2001 was a 16-storey razor-blade-shape glass ‘skyscraper’ (developer – Hanner). In 2004, Hanner completed the construction of a 33-storey Europa Shopping and Business Centre on Konstitucijos Avenue giving rise to yet another business district that became the largest accumulation of office buildings in Vilnius.

Up to 2007, the Business Triangle was the largest business district in Vilnius. Today it has 42,500 sqm modern offices space and this figure has remained unchanged since 2006, when the building company Eika completed the last office building in the district. Due to the lack of space it was simply impossible to develop any more offices here. Offices in this district continue to be renovated and reconstructed, however the size of the business district has not changed, so development has stopped. Therefore, when one of the largest business centres – Vilnius Business Harbour (currently called 3 BURĖS) – opened on Lvovo Street in 2008, the business district on Konstitucijos Avenue became the largest CBD in the capital city and retains its title. Although this was the latest CBD to be developed, it is the largest in Vilnius: Business Triangle (42,500 sqm) and Žvėrynas Circle (37.850 sqm) altogether are still smaller than Konstitucijos CBD (at the end of 2016 –122,100 sqm).

‘Konstitucijos CBD is special because a considerable part of modern office buildings here were built- to-suit rather than to let, i.e. were built for the builder’s own needs. Such buildings are those of Vilnius City Municipality, Vilnius County Governor’s Administration, Vilnius Branch of the State Enterprise Centre of Registers, and Swedbank, one of the largest banks in the country’, Vagonis said.

‘Expansion of companies operating in Vilnius, especially services centres of international companies, brings about the need for modern offices in the capital city and such need has increased over the past few years. As a result, real estate developers are planning new projects, looking for sites and spaces. For this purpose, the northern part of the city district of Žvėrynas between T. Narbuto, Ukmergės, Saltoniškių and Geležinio Vilko streets could be utilised’, Mr Vagonis said.

Compared to other Vilnius CBD, Žvėrynas Circle has the smallest modern office area, which at the end of 2016 amounted to 37,850 sqm. However, at the end of 2017, after completion of construction of four new business centres (Green Hall 2, Narbuto 5, Link and a business centre on Saltoniškių Street 7 developed by UAB M.M.M. projektai), the total area of office space in this district will reach 68,250 sqm. This will make Žvėrynas Circle the second largest CBD in Vilnius leaving the Business Triangle third.

Looking at future plans of developers, Ober-Haus experts observe that in 2017–2018 both Žvėrynas Circle and Konstitucijos CBD will see aggressive expansion. By the end of 2018, eight office buildings could be built in these two business districts with 75,500 sqm modern office space. So opportunities for prospective tenants wishing to settle in a CBD will definitely increase.

Real estate services company Ober-Haus presents an interactive map of business centers OHMAP (www.ohmap.lt/en). This is the first such virtual tool in Lithuania that helps find all administrative buildings with a minimum of 1,000 sqm useful area in Vilnius built since 1999 or currently under construction.

The interactive map offers the option of selecting the construction status of an office building: in progress or finished. The basic information about each object– a photograph of the building, name, address and year of construction – is provided and regularly updated on the map.

Statistical information about the modern office space market (floor area, price, vacancy rate, etc.) provided in the OHMAP website and other Ober-Haus reviews includes information about A and B class office buildings with a total useful office space of at least 1,500 sqm. The OHMAP website also publishes information on properties of smaller size and lower class.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.4% in December 2016. The annual apartment price growth in the major cities of Lithuania was 5.5% (the annual apartment price growth in November 2016 was 5.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.4% in December 2016. The annual apartment price growth in the major cities of Lithuania was 5.5% (the annual apartment price growth in November 2016 was 5.2%).

In December 2016 apartment prices in the capital grew 0.4% with the average price per square meter reaching EUR 1,417 (+6 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 22.7% (+263 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in December grew by 0.3%, 0.4%, 0.8% and 0.9% respectively with the average price per square meter reaching EUR 984 (+3 EUR/sqm), EUR 1,012 (+3 EUR/sqm), EUR 595(+4 EUR/sqm) and EUR 559 (+6 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 6.8% in Vilnius, 4.3% in Kaunas, 2.7% in Klaipėda, 5.5% in Šiauliai and 5.1% in Panevėžys.

“Last year can be considered exceptional in the country’s housing market in major cities. The highest positive annual apartment price change (+ 5.5%) was recorded in major cities culminating in a significant and fastest annual increase in prices in the country’s capital city (+6.8%) since 2007. In 2016, Vilnius saw the historical surge in market activity with the largest number of registered apartment transactions in a year exceeding even the 2007 figure by 2%. Market activity indicators in other major cities were some of the best in the past 9 years. It is clear that very high or even record demand for homes propelled the price rise,” says Saulius Vagonis, Head of Valuation & Analysis at Ober-Haus.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.4% in November 2016. The annual apartment price growth in the major cities of Lithuania was 5.2% (the annual apartment price growth in October 2016 was 5.0%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.4% in November 2016. The annual apartment price growth in the major cities of Lithuania was 5.2% (the annual apartment price growth in October 2016 was 5.0%).

In November 2016 apartment prices in the capital grew 0.6% with the average price per square meter reaching EUR 1,411 (+8 EUR/sqm). During a year the prices of apartments in Vilnius increased by 6.5% and since the last lowest price level recorded in May 2010 prices have increased by 22.2% (+257 EUR/sqm). Apartment prices in Kaunas, Klaipėda and Panevėžys in November grew by 0.1%, 0.2% and 0.3% respectively with the average price per square meter reaching EUR 981 (+1 EUR/sqm), EUR 1,009 (+2 EUR/sqm) and EUR 553 (+1 EUR/sqm). In Šiauliai apartment prices remained stable and were the same as in last month – 591 EUR/sqm.

In the past 12 months, the prices of apartments grew in all major cities: 6.5% in Vilnius, 4.1% in Kaunas, 2.6% in Klaipėda, 4.8% in Šiauliai and 4.2% in Panevėžys.

‘This year, only positive changes are recorded in the apartment market in the main Lithuanian cities: we can see not only the stable growth of apartment selling prices but also an increase in the market activity. Over eleven months of this year, compared to the same period in 2015, the number of contracts of purchase and sale of apartments in Vilnius increased by 12%; this figure was 11% for Kaunas and Šiauliai, 10% for Klaipėda, and 3% for Panevėžys. The stable interest in purchasing housings leads to the price increase. The overall level of apartment prices in the main Lithuanian cities over the past twelve months increased by 5.2%, which is the greatest annual growth since April 2008,’ – said Saulius Vagonis, Head of Valuation & Analysis at Ober-Haus.

Lithuanian Apartment Price Index, November 2016

For many people Žvėrynas is a synonym for a prestigious residential quarter. Over the past 15 years, however, it has also become a preferred location for offices and new business centres, which have actually divided Žvėrynas into two – the new and the old – parts. “The low-rise buildings, the abundance of green areas, and the small streets between T. Narbuto Street and the Neris River have remained the characteristics of the old, real Žvėrynas. A different, somewhat noisier and busier pace of life is dominating the new Žvėrynas – the northern part of Žvėrynas eldership between T. Narbuto and Ukmergės, Saltoniškių and Geležinio Vilko streets, next to the Panorama shopping centre,” said Darius Tumas, head of the Commercial Real Estate Department at Ober-Haus.

According to data from Ober-Haus, there are 7,500 sq m of modern office space in the old Žvėrynas. “Perhaps most people hardly notice the active development of commercial properties in this part of the city because fairly stringent construction intensity and tallness limitations apply in Žvėrynas. However, if you drive along the main streets of the quarter you will see a number of compact and successfully operating commercial buildings. Žvėrynas is also a preferred choice of embassies and specialised upmarket showrooms. A perfect example of a business centre typical of Žvėrynas is the L25A Business Centre being constructed in Liepyno Street, next to T. Narbuto Street, which will provide 1,700 sq m of new office space in May 2017,” said Mr Tumas.

The old Žvėrynas is attractive for real estate development both due to the convenient location and the positive image of the quarter. “From here, Konstitucijos and Gedimino avenues can be reached via bridges over the Neris River. The Old Town, Naujamiestis and the new business quarters are accessible in just a couple of minutes. You can also quickly reach main traffic lines from here. Public transport, cycling and car sharing spots are all available here. Furthermore, unlike the central part of the city, parking in Žvėrynas is free,” mentioned the benefits Mr Tumas. The high prestige of Žvėrynas also adds to its attractiveness: Vilnius residents have viewed this quarter as prestigious for many decades, in this regard it is only surpassed by the Old Town and the city centre.

A number of business centres have been completed in the new part of Žvėrynas, and construction of further facilities has been scheduled: in 2017, developers plan to provide the market with a further 34,900 sq m of useful office space here. In this manner, this territory densely covered with modern facilities seems to naturally break away from the old Žvėrynas and become a continuation of Konstitucijos Avenue. This northern part of Žvėrynas is also often called a central business district – similar to the Business Triangle located between J. Jasinskio and A. Goštauto streets.

“The old Žvėrynas will also remain a good alternative to the new part of the quarter. The old Žvėrynas has traditionally been a green quarter dominated by low-rise buildings, and the small office buildings completed and being constructed perfectly match the environment. On the whole, construction in the old part of the quarter is fairly rare, and the number of business centres here was and will be limited. On completion of the business centres currently in progress and with evaluation of the territory of Žvėrynas in mind, we will hardly see any further construction of this type here in the foreseeable future,” noted the representative of Ober-Haus.

According to data from Ober-Haus, rents for new offices in Žvėrynas are currently at EUR 13–16 per sq m.

The first stage of construction of Herkaus Alėjos, a settlement of detached houses, was commenced in Pilaitė quarter in Vilnius. It is the first project of detached houses of this scale in Vilnius over the past few years, and Herkaus Alėjos will become the first settlement of this size in Vilnius. The settlement will feature 82 detached residential houses with 4-are plots of land and modern architectural solutions.

Audrius Šapoka, head of the Housing Department at Ober-Haus, stated that it is the first project of this scale and type in Vilnius in many years. “The people’s growing incomes and their need for more spacious housings encourage developers to focus on and invest in projects of detached residential houses. Many buyers looking for a new apartment with 3 or 4 rooms increasingly prefer to look for alternatives, which means that a small and not excessively demanding detached house with an area of 90–110 sq m becomes a logical choice for them. These buyers are normally looking for affordable maintenance costs and the added value of the house, e.g. a fully ordered environment and common recreational areas,” added Mr Šapoka.

Audrius Šapoka, head of the Housing Department at Ober-Haus, stated that it is the first project of this scale and type in Vilnius in many years. “The people’s growing incomes and their need for more spacious housings encourage developers to focus on and invest in projects of detached residential houses. Many buyers looking for a new apartment with 3 or 4 rooms increasingly prefer to look for alternatives, which means that a small and not excessively demanding detached house with an area of 90–110 sq m becomes a logical choice for them. These buyers are normally looking for affordable maintenance costs and the added value of the house, e.g. a fully ordered environment and common recreational areas,” added Mr Šapoka.

Herkaus Alėjos include 7 types of detached houses with an area of 106–158 sq m. With buyer needs in mind, developers provide small houses, which reflects the current trends in the housing market: according to calculations from Ober-Haus, in 2007, the average total area of detached houses built by developers in Vilnius region was 186 sq m, while this year the average total area offered is 111 sq m – this is the lowest figure for the past 15 years and it will hardly change in the foreseeable future.

The settlement consists of streets with a width of nearly 12 metres. The streets are provided with plants and trees that remain green all year long; a team of landscape designers was hired to design the streets. Special attention is paid to the quality of the construction materials: clinker bricks are used for façade finish, the roofs are superposed, and class A windows are provided. Every house is provided with a terrace; sheds for parking and boxrooms are also provided.

Scheduled completion of construction of the first stage of Herkaus Alėjos: Q3 2017.

Assessing the general development trends of commercial property in Lithuania, it can be seen that currently the eyes of commercial property developers are essentially focused on only certain segments and certain cities – Vilnius and Kaunas. In Vilnius, the office and hotel segments are the subjects of special attention, whereas in Kaunas, it seems that there is a real boom in the construction of office projects. In other regions of the country, investments in the development of commercial property are substantially scarcer – generally, we see the construction of grocery and construction materials’ shops, as well as the renovation of already-existing shopping centres or a few industrial purpose projects in the free economic zones of Lithuania. Seeing that the number of commercial projects developed for market needs (seeking to lease or sell them) depends directly on the economic prospects of the regions, it makes sense that recently developers have been concentrating their investments on the centres of the strongest regions and we are unlikely to see this trend changing in the short run.

Assessing the general development trends of commercial property in Lithuania, it can be seen that currently the eyes of commercial property developers are essentially focused on only certain segments and certain cities – Vilnius and Kaunas. In Vilnius, the office and hotel segments are the subjects of special attention, whereas in Kaunas, it seems that there is a real boom in the construction of office projects. In other regions of the country, investments in the development of commercial property are substantially scarcer – generally, we see the construction of grocery and construction materials’ shops, as well as the renovation of already-existing shopping centres or a few industrial purpose projects in the free economic zones of Lithuania. Seeing that the number of commercial projects developed for market needs (seeking to lease or sell them) depends directly on the economic prospects of the regions, it makes sense that recently developers have been concentrating their investments on the centres of the strongest regions and we are unlikely to see this trend changing in the short run.

For the last five years, the warehousing and logistics sector has been and remains one of the “neglected” real property segments among developers. The rather uncertain demand for warehousing premises, specific requirements of tenants (location and technical parameters of the building) as well as the slow down in the growth of rents fail to create favourable conditions for developers to plan new projects. However, financial indicators of this sector, at least recently, have been stable. According to the data of Statistics Lithuania, during the first six months of 2016, sales revenues of warehousing and storage companies (excluding VAT) amounted to EUR 60.8 million or respectively 0.3% and 10.1% more compared to the same period of 2015 and 2014. Nevertheless, comparison of the indicators for the first half of this year with the same period of 2012–2013 shows that sales revenues of warehousing and storage companies have fallen by 14% on average.

For the last five years, the warehousing and logistics sector has been and remains one of the “neglected” real property segments among developers. The rather uncertain demand for warehousing premises, specific requirements of tenants (location and technical parameters of the building) as well as the slow down in the growth of rents fail to create favourable conditions for developers to plan new projects. However, financial indicators of this sector, at least recently, have been stable. According to the data of Statistics Lithuania, during the first six months of 2016, sales revenues of warehousing and storage companies (excluding VAT) amounted to EUR 60.8 million or respectively 0.3% and 10.1% more compared to the same period of 2015 and 2014. Nevertheless, comparison of the indicators for the first half of this year with the same period of 2012–2013 shows that sales revenues of warehousing and storage companies have fallen by 14% on average.

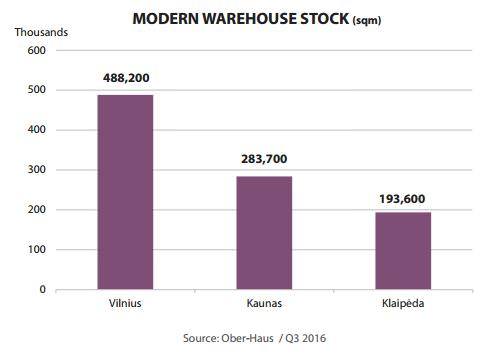

“However, as property developers view this sector indifferently, it cannot be said that the development of warehousing buildings has stopped altogether: financially stronger companies implement projects that meet their needs themselves,” says Saulius Vagonis, Head of Valuation & Analysis at Ober-Haus. Over the nine months of 2016, six new warehousing projects have been built in Vilnius, Kaunas and Klaipėda regions, with the total warehouse area comprising approximately 33,200 sqm. The largest number of projects were implemented in Vilnius region (Layher Baltic, Litcargus, Woodline, and Wirtgen Lietuva) and the total area of warehousing premises at the end of the third quarter of this year increased to 488,200 sqm. In the middle of this year, Volfas Engelman brewery opened a warehouse for its products in Kaunas, thus increasing the total area of warehousing premises in this city to 283,700 sqm. The largest warehousing project was implemented this year in Klaipėda district – a warehouse of 17,500 sqm with office premises was constructed by VPA Logistics, and the total area of warehousing premises in Klaipėda region went up to 193,600 sqm. Four of those projects were built and intended exclusively for the needs of the companies engaged in their development.

In 2017, at least 3 larger warehousing projects (or their stages) with a total area of 34,000 sqm should be implemented in Vilnius. These projects are being developed by Baltic Sea Properties, Ad Rem and Sirin Development. In the meantime, in Kaunas, a logistics centre for Aibė, the trading companies alliance, is under construction with the opening planned for July 2017.

Over the last 12 months, the rents of new and old warehousing premises in Vilnius region have increased by only 2-3%, whereas in Kaunas and Klaipėda regions the rents of warehousing premises remained unchanged. According to Ober-Haus, at present, warehousing premises of new construction in Vilnius are offered for rent at 3.7–5.2 EUR/sqm, old construction – at 1.6–3.0 EUR/sqm. In Kaunas, new warehouses are offered at 3.5–5.0 EUR/sqm, old ones – 1.5–3.0 EUR/sqm, while in Klaipėda new warehouses go for 3.4–4.7 EUR/sqm, old ones – 1.4–3.0 EUR/sqm. The stagnation of rents for warehousing premises also slows down the more active development of this sector. “The rapid rebound of rents of new warehouses from the latest lowest level in 2010 has been notably slower in recent years. From the end of 2014 (for almost two years) the rents of new warehousing premises in Vilnius, Kaunas and Klaipėda regions have increased on average by 3-4%. In contrast, rents of office and retail premises in the same regions over the same period increased by 8–10% on average,” says S. Vagonis.

Lithuania Commercial Market Commentary Q3 2016

Assessing the general development trends of commercial property in Lithuania, it can be seen that currently the eyes of commercial property developers are essentially focused on only certain segments and certain cities – Vilnius and Kaunas. In Vilnius, the office and hotel segments are the subjects of special attention, whereas in Kaunas, it seems that there is a real boom in the construction of office projects. In other regions of the country, investments in the development of commercial property are substantially scarcer – generally, we see the construction of grocery and construction materials’ shops, as well as the renovation of already-existing shopping centres or a few industrial purpose projects in the free economic zones of Lithuania. Seeing that the number of commercial projects developed for market needs (seeking to lease or sell them) depends directly on the economic prospects of the regions, it makes sense that recently developers have been concentrating their investments on the centres of the strongest regions and we are unlikely to see this trend changing in the short run, Ober-Haus writes in review of the commercial real estate market.

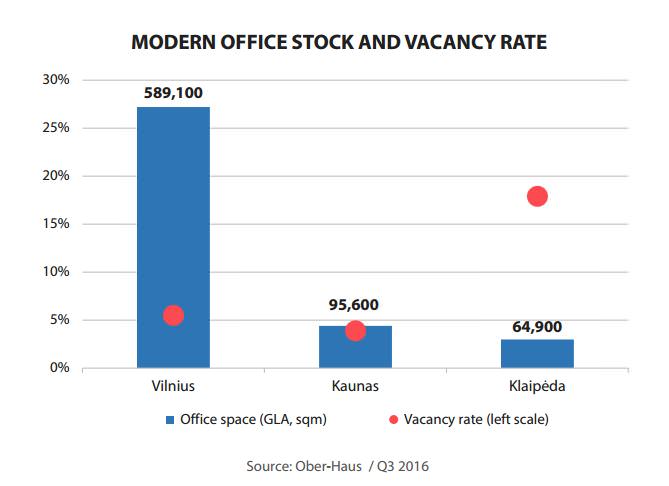

In Vilnius, 2 new business centres were completed in the third quarter of this year (business centre CITY at Žalgirio St. and the first stage of Quadrum at Konstitucijos Ave.), which became the first business centres opened this year in the capital city. Simultaneously, the market was supplemented by 42,500 sqm of useful office area and this also influenced the occupancy rates. Although the major share of premises have already been rented as on the opening date of these business centres, the remaining unoccupied area in the two business centres (about 14,000 sqm) increased the vacancy rate in Vilnius business centres during the third quarter of this year from 3.5% to 5.5% (i.e. to 32,400 sqm). Albeit the interest in office premises at new business centres remains rather high, the growth in vacancy rate will persist further. Four new projects should be launched by the end of this year in the capital city with the useful area of office premises amounting to 38,300 sqm.

Currently, in Vilnius, the occupancy rates of new office premises remain at a high level and are shown by the numbers of premises let. During the nine months of this year, 41,200 sqm of area have been rented in Vilnius business centres, representing an increase of 2% compared to the same period in 2015. The leap of new supply is also going to increase the take-up of office premises this year. Ober-Haus forecasts that this year about 70,000 sqm of modern office premises will be let in total (more by a third than in 2015). However, even greater challenges await the office premises market in the coming year. In 2017, the developers plan to offer the market another 85,000 sqm of useful area of premises through 15 projects (or their stages). Almost all of the new projects are in the construction stage; consequently, the resulting area of premises is highly likely. “If the market maintained the same office occupancy rates as this year, we could expect a sustainable development of this sector even with the current leap of supply. It is obvious that service centres of international companies expanding particularly rapidly in the capital city determined such a leap of supply and demand; however, it is rather difficult to anticipate their further expansion or the coming of new companies to the market of Lithuania. As can be seen from examples of projects pursued this year, newly opened business centres are not fully occupied on their opening dates and it is therefore likely that we will continue to see the newly launched projects increasing the vacancy rates,” said Saulius Vagonis, Ober-Haus Head of Valuation & Analysis.

A broad choice of office premises in Vilnius city is blocking the growth of rents that until now has been rapid. Over the first six months of this year, the rents of modern office premises in Vilnius went up by only 1% on average, whereas in the third quarter of this year, no changes in rents have been recorded. For comparison, in 2012–2015, the rents of modern offices in Vilnius have been increasing on average by 5% annually. Currently, in the capital city, offices of B class are offered for rent at 8.5-13.0 EUR/sqm, A class – 13.5-16.5 EUR/sqm. Nowadays developers infrequently talk about the increase of rents at office buildings operated by them, especially in case of projects under construction where they are eager to let as much of the area as possible before the completion of construction.

Finally, a breakthrough can be seen in the market of modern office premises in Kaunas. During the third quarter of this year, 3 small projects were completed (Daimonda at Taikos Ave., building on Pramonės Ave. and another building on Partizanų St.), offering almost 4,400 sqm of office premises to the market. The total useful area of modern office premises in Kaunas went up to 95,600 sqm. The newly offered projects also slightly increased the vacancy rates in Kaunas city: from 2.1% to 3.9% during the third quarter of this year. Nonetheless, the current vacancy rate remains the lowest among the three largest cities of the country, whereas the total area of vacant office premises comprises only 3,750 sqm. By the end of 2016, two more office projects or their stages should be completed in Kaunas (Prospekto Verslo Parkas at Vytauto Ave. and Elsis administrative building at Taikos Ave.). Upon completion of these projects, in total 6 different office projects will have been implemented in Kaunas in 2016 with a total area of office premises of 10,400 sqm.

Finally, a breakthrough can be seen in the market of modern office premises in Kaunas. During the third quarter of this year, 3 small projects were completed (Daimonda at Taikos Ave., building on Pramonės Ave. and another building on Partizanų St.), offering almost 4,400 sqm of office premises to the market. The total useful area of modern office premises in Kaunas went up to 95,600 sqm. The newly offered projects also slightly increased the vacancy rates in Kaunas city: from 2.1% to 3.9% during the third quarter of this year. Nonetheless, the current vacancy rate remains the lowest among the three largest cities of the country, whereas the total area of vacant office premises comprises only 3,750 sqm. By the end of 2016, two more office projects or their stages should be completed in Kaunas (Prospekto Verslo Parkas at Vytauto Ave. and Elsis administrative building at Taikos Ave.). Upon completion of these projects, in total 6 different office projects will have been implemented in Kaunas in 2016 with a total area of office premises of 10,400 sqm.

“Seeing the shortage of modern office premises in the second largest city of Lithuania while the expanding companies build the buildings themselves and the international companies establish their service centres in Vilnius, the developers decided not to miss the chance. It can be stated that the developers simultaneously decided to deal with the shortage of modern office premises in Kaunas city,” said S. Vagonis. The plans of the developers are indeed ambitious and real implementation has already started. The news about the office project Magnum at the site of unfinished development of Respublika Hotel attracted the greatest attention. Moreover, construction of another business centre Arka has also been commenced next to Magnum project. Just these two projects in the central part of Kaunas city could offer 20,000 sqm of modern office area. Although some of the premises in these projects are already booked by the developing companies, the major share of them are offered on the market.

Around the same time (end of 2017 – beginning of 2018) a company controlled by SBA Concern also plans to implement 2 large projects in Kaunas. The projects at Jonavos St. and K. Donelaičio St. will be able to offer yet more than 20,000 sqm of useful office area to Kaunas market. However, local and international companies will be able to choose from an even broader supply, seeing that it is planned to build 7 more administrative projects in 2017–2018, besides the mentioned ones, which should offer another 18,000 sqm of useful office area. In summary of the situation in Kaunas office market, it can be seen that during the coming few years the developers intend to increase the current office stock in Kaunas by as much as 60%.

It is obvious that the developers in Kaunas try to emulate Vilnius and increase the competition in the office market of this city as well as challenge the capital city. The expansion of local companies in Lithuania is not notably rapid and only financially strong companies can afford to rent office premises in modern business centres. Accordint to Ober-Haus, currently in Kaunas offices of B class are offered for rent at 6.0-10.0 EUR/sqm, A class – 10.5-13.0 EUR/sqm); as result, companies developing their projects in Kaunas probably expect that the service centres that are still undergoing expansion in Lithuania will decide to establish themselves in Kaunas too – previously, when the supply of office premises was not vast, this was hardly likely.

“The total development potential of office premises in Vilnius and Kaunas cities during the period of 2017–2018 constitutes in excess of 200,000 sqm. A portion of these premises have already been let; some of them are developed for the companies’ own needs, others should attract the interest of local companies in the coming few years, however, according to tentative estimates, at least a half of the planned area might require “external” assistance – i.e. newly coming international companies or expansion of the already established service centres,” said. S. Vagonis. According to the data of Invest Lithuania, service centres currently operating in Lithuania employ about 11,000 people, implying that the same number of workplaces should be created in order to attain successful implementation of all projects planned in Vilnius and Kaunas. Otherwise, ambitious plans of the developers might become significantly more modest. If the same rapid expansion of the service centres that we have seen to date does not continue and vacancy rates will increase substantially, it is likely that the developers would slow down the development of prospective projects.

Lithuania Commercial Market Commentary Q3 2016

In its overview report of the location spectrum that Europe offers to business service centres, the Polish organisation, ABSL has published a comprehensive report on the 10 most desirable destinations for the sector in Europe. The following countries were analysed: Lithuania, Poland, Slovakia, Czech Republic, Portugal, the United Kingdom, Ireland, Romania, Spain and Hungary. Two cities from every country participating in the analysis were reviewed.

In Lithuania, Vilnius and Kaunas were selected for the analysis. The cities were reviewed according to three indicators: HR landscape, payroll costs and office market. Data on the office market in these cities was provided by Ober-Haus.

High ranking of quality of life in Vilnius attracts young and educated employees

Vilnius continues to increase its attractiveness for business service centres due to its high number of multilingual and skilled employees. The report notes that Vilnius has the highest percentage of youth population in the Baltics and ranks high in the Quality of Life ranking – Vilnius has the fourth highest quality of life in the CEE, – this may help to attract talent from abroad.

Vilnius has the largest office market in Lithuania. The office market has been boosted over the last few years by the establishment of new and large service centres of international corporations and the expansion of well-known companies already operating in Vilnius. The current office space in Vilnius is approx. 547 000 sq. m. and it is expected to add on another 70 000 sq. m. by the end of 2016. Recent leasing activity in Vilnius has been subdued due to a lack of available space, and the office vacancy rate in Vilnius business centres has decreased to just 3.5% (A-class – 0.8%, B-class – 5.0%) or 19 000 sq. m. at the end of Q2 2016. It is forecasted that new developments to be completed before 2018 will offer over 150 000 sq. m. of additional office space. This level of development has not been seen since the onset of the global financial crisis in 2008–2009, ASBL states.

ABSL reports that office rents have been broadly unchanged since 2015. Compared to the lowest levels in 2010, rents for office space in Vilnius have, on average, increased by over 40%. Currently, rental costs for A-class premises range between €13-16 / sq. m. and between €8.5-13.0 / sq. m. for B-class office space. Analysts feel that the current and planned supply and demand ratio has determined the office rental market peak. Thus, it is unlikely that rents will increase much over the next few years. ABSL anticipates that the office market in Vilnius will slowly swing from a neutral market to a tenants’ market.

Kaunas – the best emerging city for business service centres in the CEE region

Meanwhile, Kaunas is presented to investors as a yet undiscovered destination for the business service sector in Europe. Due to its small size, it may not be suitable for large centres. However, it is well positioned to attract smaller scale operations, which is particularly attractive for IT companies. The report says, that the city’s untapped talent pool, progressive university community, and improving office real estate market is the reason why it was recently named as the best emerging city for business services centres in the CEE region.

Kaunas has the second largest office market in Lithuania, with an office stock of over 91 000 sq. m. – one sixth of that in Vilnius. To date, developers in Kaunas have been focused on smaller-sized (1 000-2 000 sq. m.) administrative buildings, but have been slowly preparing for larger projects. Currently there is very little choice of office space with vacant space at just 2.1% (2 000 sq. m.). The current volume under construction totals approximately 40 000 sq. m., and planned for delivery by the end of 2018. The report emphasises that Kaunas must use its potential to attract new businesses, as international companies considering a move to Lithuania typically analyse the possibilities of setting up operations in either the capital city or Kaunas.

Changes in office rental costs are also likely to encourage the development of new projects. Although there has not been an significant increase in rents (during the first half of the year rents for office space in Kaunas increased on average by 5%), this is an extra incentive for developers to commence planned projects. Currently, A-class rental costs range between €10.5-13.0 / sq. m. and between €6.0-10.0 / sq. m. in B-class office premises. ABSL forecasts that the office market in Kaunas is expected to remain neutral in the next two years.

Search

Search