In Q1 2017, the Lithuanian commercial real estate market witnessed increasing construction volumes and a further increase in the number of transactions. According to Statistics Lithuania, construction works worth EUR 177 million were carried out in the non-residential buildings sector in Q1 2017 or 20% more than in the same period in 2016. Although the results of Q1 2017 are the best since 2008 (compared to Q1 of the previous years at current prices), they are still behind the 2008 record by almost a half. In the meantime, the country’s market activity is seeing new heights. According to the data of the State Enterprise Centre of Registers, during the first three months this year 5% more transactions for non-residential properties (buildings and premises) were concluded in Lithuania compared with the same period in 2016. In Q1 2017, a total of 4,072 non-residential buildings and premises were acquired in Lithuania and this is the best result at the start of the year in the the entire history of the country.

In Q1 2017, the Lithuanian commercial real estate market witnessed increasing construction volumes and a further increase in the number of transactions. According to Statistics Lithuania, construction works worth EUR 177 million were carried out in the non-residential buildings sector in Q1 2017 or 20% more than in the same period in 2016. Although the results of Q1 2017 are the best since 2008 (compared to Q1 of the previous years at current prices), they are still behind the 2008 record by almost a half. In the meantime, the country’s market activity is seeing new heights. According to the data of the State Enterprise Centre of Registers, during the first three months this year 5% more transactions for non-residential properties (buildings and premises) were concluded in Lithuania compared with the same period in 2016. In Q1 2017, a total of 4,072 non-residential buildings and premises were acquired in Lithuania and this is the best result at the start of the year in the the entire history of the country.

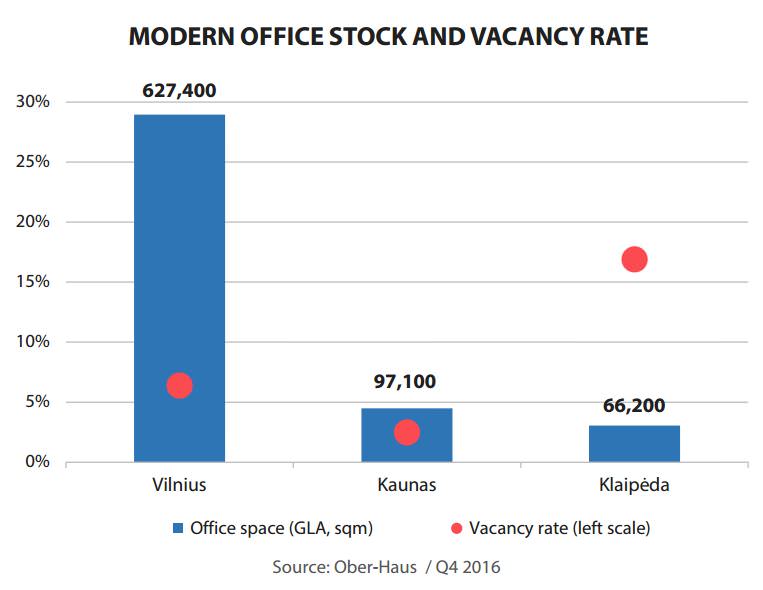

Developers continue to focus on the development of office buildings in Vilnius and Kaunas. In Q1 2017, construction of four new administrative buildings was completed in the country’s capital: the former building of DNB bank on Basanavičiaus Street was reconstructed and was opened as the business centre B NORDIC 26; a new office building Duetto (first stage) was completed next to the Vilnius Western Bypass; the construction of an administrative building for Maxima LT needs was completed on Naugarduko Street, and a small office building was finished on Verkių Street. A total of 18,000 sqm useful office area was offered in these buildings. As a result, the area of modern office space at the end of Q1 2017 in Vilnius totalled 645,400 sqm.

The expansion of international and local businesses matches the supply of premises, therefore the office market in the capital city is balanced at the moment. Since businesses actively look for premises in advance and sign preliminary lease contracts, newly opened buildings are largely full. For example, in Q1 2017 the occupancy rate of the four newly completed buildings mentioned above reached almost 70%. About 26,600 sqm of the office floor area was leased in Vilnius in Q1 and the total vacancy rate in the business centres in Vilnius fell from 6.4% to 5.8%. The vacancy rate of A class offices is 3.2% and that of B class offices – 7.1%.

Notwithstanding the activity of the tenants, more new business centres are being opened and announcements of new construction projects sometimes force developers to make comprises as regards the rents. Developers feel extremely positive about well known and financially strong companies, which ensure solid neighbourhood and guarantee a steady flow of rental income. International companies and strong local firms looking for a larger area in new business centres manage to negotiate more favourable rents than those publicly available. Smaller companies are currently in a less favourable negotiating position. In principle, rents for the top A class office space have remained unchanged since the end of 2015 and stand at EUR 13.5-16.5/sqm. In the meantime, it is observed that prices are falling in B class office premises and in Q1 2017 the lower end of the rent for such premises fell by around 0.5 EUR/sqm standing at 8.0-13.0 EUR/sqm. This can be explained by the recent faster development of this segment and rapidly growing competition between the buildings offering this class of offices.

Over the past five quarters, 9 buildings of B class offices were opened in Vilnius and only one building of A class (Quadrum). Out of almost 100,000 sqm of the office projects implemented since the end of 2015, B class office buildings accounted for 74% of the supply. Soon the structure of the supply will change significantly. In 2017–2019, much more top-class office space will be on offer in Vilnius. At the moment almost 110,000 sqm of A and B class office premises are being built, of which A class offices account for more than 70%. It is therefore likely that the total rent level (both publicly advertised and actually agreed) will be adjusted downwards in this segment. However, the remaining high demand for modern office space hardly allows to expect any major price changes in A class office rents in the short term. The very high and specific demands of large companies (in terms of the location, building and fitting-out of the premises, layout of the premises in the building, parking and potential expansion possibilities in the future) often leave companies with the choice of just a few options, which does not give them a strong negotiating position.

The market in Kaunas is still preparing for the arrival of new office buildings. In Q1 2017, no new projects for office space have been completed or opened. The total area of modern office premises therefore remains stable in Kaunas standing at 97,100 sqm. In the meantime, changes are expected in Q2 2017 in Kaunas with the completion of five new projects offering over 15,000 sqm modern office space to the market (blocks A and B of Business Park of Vytautas Avenue, Sitis, Žaliakalnio Terasos, B66, and Jonavos 30). So the vacancy rate in Q1 2017 remained at essentially the same level of 2.4% (2.5% at the end of 2016) in Kaunas. Greater changes in the occupancy of office space will be seen in Q2 2017. Although most of the space in the pending projects has already been leased, some vacant office space is expected to be offered to the market. The planned supply hike and competition between developers keeps office rents in Kaunas at a stable level. At the end of Q1 2017, A class offices in Kaunas were lease for 10.5- 13.5 EUR/sqm and B class – for 6.0-10.0 EUR/sqm. Compared to Vilnius, rents for modern office space in Kaunas remain very attractive, although changes will depend on the real demand. It is obvious that the real foundation has been laid for growth in supply in Kaunas and the market situation in the nearest future will largely depend on the number of potential tenants. In the second half of 2017, it will be possible to assess the potential of Kaunas and judge in greater details whether the expectations of developers have been fulfilled.

Lithuania Commercial Market Commentary Q1 2017

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.1% in April 2017. The annual apartment price growth in the major cities of Lithuania was 5.1% (the annual apartment price growth in March 2017 was 5.6%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.1% in April 2017. The annual apartment price growth in the major cities of Lithuania was 5.1% (the annual apartment price growth in March 2017 was 5.6%).

In April 2017 apartment prices in the capital grew 0.1% with the average price per square meter reaching EUR 1,437 (+2 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 24.5% (+283 EUR/sqm). Apartment prices in Kaunas and Klaipėda in March grew by 0.2%, respectively with the average price per square meter reaching EUR 995 (+2 EUR/sqm) and EUR 1,021 (+2 EUR/sqm). In Šiauliai apartment prices remained stable and the average price per square meter was the same as in March – EUR 601. Meanwhile, in Panevėžys was recorded 0.3% decrease with the average price per square meter reaching EUR 560 (-2 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 6.3% in Vilnius, 3.9% in Kaunas, 2.9% in Klaipėda, 4.9% in Šiauliai and 4.0% in Panevėžys.

‘In April 2017, the market was less active. The number of transactions for apartments concluded in all major cities of the country was smaller compared with both March 2017 (19%) and April 2016 (20%). Price changes in April were also considerably smaller than those either in early 2016 or 2017’, Saulius Vagonis, manager of the Valuation and Market Research Department at Ober-Haus, said.

Lithuanian Apartment Price Index, April 2017

The start of 2017 in the Lithuanian residential market can be characterised by a steady growth. Nearly all the main indicators show that the market in the major cities of the country remains particularly active. In addition to the most active market of Vilnius region, after a longer break, the market in Kaunas is showing high activity levels. The volume of sales and supply of new apartments in Kaunas has finally reached the stage of faster growth.

The start of 2017 in the Lithuanian residential market can be characterised by a steady growth. Nearly all the main indicators show that the market in the major cities of the country remains particularly active. In addition to the most active market of Vilnius region, after a longer break, the market in Kaunas is showing high activity levels. The volume of sales and supply of new apartments in Kaunas has finally reached the stage of faster growth.

According to the State Enterprise Centre of Registers, in Q1 2017, 9% more purchase and sale transactions of houses and apartments were concluded in Lithuania than in the same period in 2016. In Q1 2017, an average of 680 transactions for houses and 2,590 transactions for apartments were concluded per month in Lithuania. Since 2007, only Q1 2014 saw better results. The number of transactions of apartments was 5% smaller than in the same period in 2014, but the number of transactions of houses was the same as in 2014. In Q1 2017, different activity trends were recorded in the residential market of major cities of the country. The largest change in the number of transactions of apartments was recorded in Klaipėda (the number of transactions increased by 15% compared to Q1 2016) and the smallest change was recorded in Panevėžys (the same number of apartments was purchased as in 2016). The number of transactions of houses grew fastest in Klaipėda and Klaipėda District (57% compared to Q1 2016), while in Šiauliai and Panevėžys cities and districts a drop of 4% and 6% respectively in the number of transactions of houses was recorded.

The continuing construction of new apartments in the country’s capital and the recovering market of new apartments in the city of Kaunas offer new options for customers. It is therefore not surprising that under favourable purchase conditions and liberal supply, in the five major cities of Lithuania ever increasing overall sales volumes of new apartments have been recorded. According to Ober-Haus, in Q1 2017, 1,462 apartments in completed apartment buildings and apartment buildings in progress were sold or reserved directly from developers in the major cities. It is 13% more than in Q4 2016 and 9% more than the number of apartments realised in Q1 2016.

The sales volumes of new apartments in Kaunas have seen new heights this year. In the first three months of 2017, 201 apartments in completed apartment buildings and apartment buildings in progress were sold or reserved in Kaunas (38% more than the number of apartments realised in Q4 2016 and 51% more than the number of apartments realised in Q1 2016). This is the largest sales volume of new apartments in the post-crisis period in the city of Kaunas and its environs. The growing activity of home buyers throughout the country, including Kaunas (the number of new and old apartments sold in the city of Kaunas in 2016-2017 was only 5–10% smaller than that in 2005–2007) and the increasing price levels encourage developers not to miss the opportunity and offer modern housing to sufficiently active market in Kaunas.

As a result, a leap in the supply of new apartments in Kaunas and its environs is expected in 2017. In total, 15–20 projects (or their stages) could be completed this year offering 600–800 new apartments. This is 2–2.5 times more than the number of apartments built in 2016 (311 new apartments). The sales results of 2016 and in particular of Q1 2017 show that new projects, it seems, will have no greater problems in finding buyers.

Cautious developer steps in the Klaipėda real estate market

Although more modest performance was recorded in the new apartment market in Klaipėda than in Vilnius or Kaunas, considering the size of the population the situation may be described as moderately optimistic. Even though the port city cannot boast of the amount of the projects, this is the second consecutive year that the projected number of apartments is on the rise. In total, 8–9 projects (or their stages) could be completed this year offering 250–300 new apartments. This is 25–50% more than the number of apartments built in 2016 (over 200 new apartments). While developers are still cautious about the more vigorous development of new apartments (in particular the larger scale projects, when a larger number of apartments is offered), the current market situation creates sufficient premises for the implementation of small- or medium-scale projects. The overall activity of buyers in Klaipėda (both for old and new apartments) is an indication of the existing internal potential and opportunities for new investment in the city. The apartment market in the city of Klaipėda has always been most active among the major cities of the country in terms of the relative number of apartment transactions per citizen leaving the city of Vilnius behind. In Q1 2017, 117 apartments in completed apartment buildings and apartment buildings in progress were purchased or reserved in Klaipėda (30% more than the number of apartments realised in Q4 2016 and 56% more than the number of apartments realised in Q1 2016).

Meanwhile in Vilnius, the figure for the sale of new apartments is ten times higher than that in Klaipėda – during the first three months of this year 1,138 apartments in completed apartment buildings and apartment buildings in progress were sold or reserved. This is 8% more than the number of apartments realised in Q4 2016 and 1% more than the number of apartments realised in Q1 2016. Such results were anticipated, because each year the scale of construction noticeably increases and the growth in supply contributes to the growth of demand. Ober-Haus forecasts 20% growth in supply of new apartments in the capital city in 2017, i.e. up to 4,500 new apartments will be built. The figure for the new apartments for sale was higher only in 2006–2008 (4,800–5,800 new apartments per year). A total of 75% of the apartments sold/reserved in Q1 2017 were in newly developed projects (i.e. projects or their stages due to be completed in 2017–2018).

Decrease in the number of unsold apartments for the fifth consecutive quarter

High levels of apartment realisation in Vilnius, Kaunas and Klaipėda determined a decline in the number of unsold apartments in these cities. This is the fifth consecutive quarter that this trends has been recorded. At the end of Q1 2017, the number of unsold new apartments in the major cities of Lithuania totalled 1,652 or 6% less than at the end of 2016 and 27% less than a year ago. The number of unsold apartments in Vilnius totals 929, in Kaunas – 236, in Klaipėda – 469, and 18 new apartments in Šiauliai and Panevėžys together.

The trends in the holding prices remain sufficiently clear and should not change at least in the short term. Despite the demographic challenges in the country’s regions, positive economic indicators of the country have been recorded. Favourable conditions for the purchase of homes further stimulate the markets of major cities where a moderate increase in prices was recorded. In Q1 2017, prices of apartments in Vilnius increased on average 1.3%, in Kaunas – 1.0%, in Klaipėda – 0.6%, in Šiauliai – 0.9% and in Panevėžys – 0.7%. Rising prices should not come as a surprise because of the continuing rapid increase in the role of the mortgage lending market, which reflects the growing confidence of the population in their financial wellbeing and in the general economic prospects of the country. According to the data of the Bank of Lithuania, in Q1 2017 new mortgage loans totalling EUR 261 million were provided, which is 27% more than during the same period in 2016. Thus, in view of the positive immediate outlook of the country’s economic development, the residential market looks optimistic at least in three of the largest cities of the country.

Lithuania Residential Market Commentary Q1 2017

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in March 2017. The annual apartment price growth in the major cities of Lithuania was 5.6% (the annual apartment price growth in February 2017 was 5.3%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in March 2017. The annual apartment price growth in the major cities of Lithuania was 5.6% (the annual apartment price growth in February 2017 was 5.3%).

In March 2017 apartment prices in the capital grew 0.6% with the average price per square meter reaching EUR 1,435 (+8 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 24.3% (+281 EUR/sqm). Apartment prices in Kaunas, Klaipėda and Šiauliai in March grew by 0.6%, 0.4% and 0.7% respectively with the average price per square meter reaching EUR 993 (+6 EUR/sqm), EUR 1,019 (+4 EUR/sqm) and EUR 601 (+4 EUR/sqm). In Panevėžys apartment prices remained stable and were the same as in last month – EUR 562.

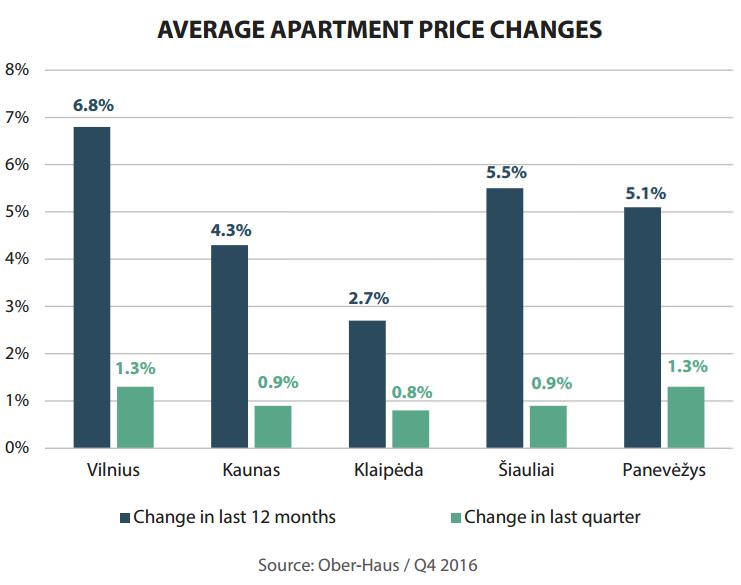

In the past 12 months, the prices of apartments grew in all major cities: 6.8% in Vilnius, 4.5% in Kaunas, 2.9% in Klaipėda, 5.2% in Šiauliai and 4.7% in Panevėžys.

“This year, March was particularly active in all big cities of Lithuania in terms of the housing market. Compared to February 2017, Lithuania‘s cities recorded a growth of 18-39% in apartment purchase and sale transactions. All indices of this year‘s March are also higher than of last year‘s March. Evidently, the activity of the housing market is intense, therefore, housing prices also continue to grow,” says Saulius Vagonis, Head of Valuation & Analysis at Ober-Haus.

Lithuanian Apartment Price Index, March 2017

The year 2016 was highly successful for the Lithuanian residential market. Given the current global challenges, the Lithuanian economy and the Lithuanian real estate market have demonstrated very good results. While 2013–2015 can be called the years of recovery of the real estate market, in 2016 the most economically active regions of the country passed to a quicker growth phase. Despite the overall positive moods in the country’s residential market however, the gap between the most economically active regions and regions experiencing serious demographic problems and main cities of these regions continued to widen. The number of operating construction cranes is a fairly accurate indicator of regions experiencing an economic growth and demonstrating a potential of development of residential projects. A positive factor was that, after a lengthy pause, Kaunas region, similarly to Vilnius, is demonstrating signs of recovery.

The year 2016 was highly successful for the Lithuanian residential market. Given the current global challenges, the Lithuanian economy and the Lithuanian real estate market have demonstrated very good results. While 2013–2015 can be called the years of recovery of the real estate market, in 2016 the most economically active regions of the country passed to a quicker growth phase. Despite the overall positive moods in the country’s residential market however, the gap between the most economically active regions and regions experiencing serious demographic problems and main cities of these regions continued to widen. The number of operating construction cranes is a fairly accurate indicator of regions experiencing an economic growth and demonstrating a potential of development of residential projects. A positive factor was that, after a lengthy pause, Kaunas region, similarly to Vilnius, is demonstrating signs of recovery.

According to data from the State Enterprise Centre of Registers, in 2016, the number of transactions of apartments in Lithuania was 13% higher and the number of transactions for houses was 7% higher than in 2015. The overall residential market activity in Lithuania in 2016 was only surpassed by indicators for the time period from 2004 to 2007. A historically high activity was recorded in Vilnius in 2016: in the course of the year, the number of transactions for apartments registered in the city increased by 13%, with the total number of sold apartments exceeding 11,000. This was historically the highest number of apartments sold per year, which exceeded the indicators of 2007 by 2%. The indicators of the other main Lithuanian cities for 2016 were also among the best over the past 9 years. The number of transactions for apartments in Kaunas and Klaipėda in 2016 increased by 10%; the growth was 9% in Šiauliai and 1% in Panevėžys. On the other hand, changes in the detached houses segment were both positive and negative, depending on the region. An increase in the number of transactions for houses was recorded in Kaunas, Šiauliai and Panevėžys – 10%, 28% and 34% respectively. A decrease in this number was recorded in Klaipėda and Vilnius – 5% and 9% respectively. However, despite the decrease in the number of transactions of houses in Vilnius, the 2016 results were among the best since 2004 (a higher number of transactions for houses was only registered in Vilnius in 2015).

The residential market activity, which grew or remained high depending on the location, has resulted in the growth of both selling prices and rents. In 2016, the highest growth of apartment prices in all main Lithuanian cities since 2007 was recorded. According to data from Ober-Haus, in 2016, apartment prices in Vilnius grew on average by 6.8%. Prices of new apartments in Vilnius grew on average by 6.3%, while prices of old apartments grew by 7.3%. In Kaunas, Klaipėda, Šiauliai and Panevėžys, the growth of apartment prices in 2016 was 4.3%, 2.7%, 5.5% and 5.1% respectively.

The fastest growth in the prices of houses was recorded in Vilnius and its surroundings, where in the course of the year the prices increased on average by 6%. An average growth of 2% of house selling prices was recorded in Kaunas and Klaipėda regions. Average prices of houses in Šiauliai and its suburbs did not change in 2016, and a decrease of 2% was recorded in Panevėžys.

In 2016, an average 2–5% growth of apartment rents was recorded in all main Lithuanian cities. Despite the growing supply of housing for rent in Vilnius, mainly positive changes in apartment rents were recorded in 2016. Although prices in the most expensive housing segment have remained stable, in the most active housing segment (in which rents are between 200 and 400 EUR per month) rents grew on average by 2–4%. The growth of rents in 2016 was slower than the growth of selling prices, but the growing apartment acquisition prices and the high demand for housing ensure a sufficiently high activity in the housing rental segment. In 2016, the average rent for a 1–3 room apartment in Vilnius was 379 EUR/month; this figure was 283 EUR/month for Kaunas, 272 EUR/month for Klaipėda, 150 EUR/month for Šiauliai, and 115 EUR/month for Panevėžys.

An increasing number of new market players undertake apartment building construction projects

In the current situation, the main reasons for the market activity and for the growth of housing prices remain the same as in previous years and include the growing incomes of the population, the ultra-low mortgage rates, and the stable interest in investing in housing on the part of the population. The population’s expectations about the future are also an important factor, as people continue to evaluate their financial well-being and price change trends. Population surveys show that people in the main regions of the country expect housing prices to continue to increase in the foreseeable future. SEB bank Housing Price Indicator shows that, at the end of 2016, as many as 55% of Lithuanian respondents expected housing prices to increase over the next twelve months (at the end of 2015, this figure was 52%). Only 12% of the respondents expected the prices to drop (this figure was 13% one year ago), while 23% of the respondents expected that the prices would not change (this figure was also 23% one year ago). Consideration of individual regions shows that the greatest share of residents expecting price growth – 69% – live in Vilnius County. Residents of the other counties are less optimistic and, depending on counties, 36% to 54% of residents expect an increase in housing prices. The percentage of people expecting a further increase in housing prices in some counties has even dropped.

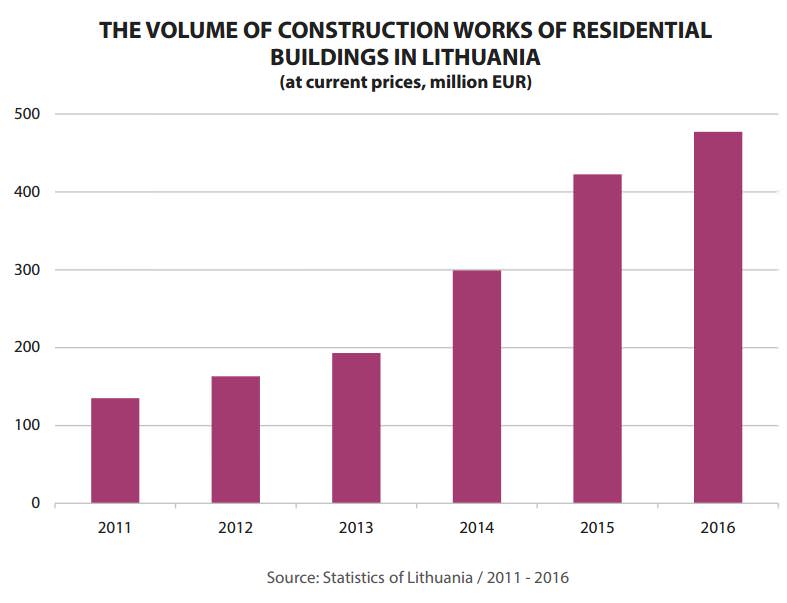

In 2016, growing investments in the Lithuanian residential sector were recorded once again, with investments in new buildings demonstrating the fastest growth pace. According to data from the Lithuanian Department of Statistics, in 2016, the works of construction (new construction, reconstruction, repair, restoration and other works) of residential buildings for EUR 477 million were performed (21% of all construction works), which is a 13% increase compared to 2015 (if 2015 prices are considered). If only the volume of new construction is taken into account, the growth in 2016 was as high as 32%.

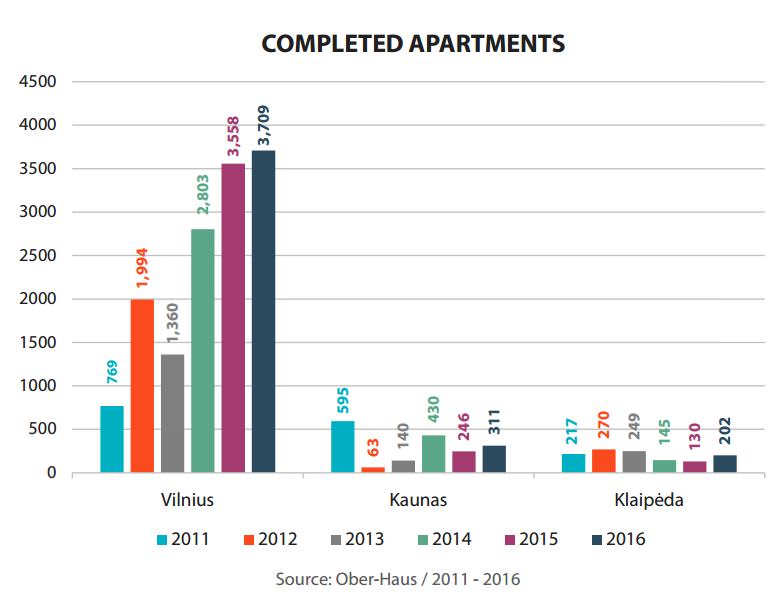

According to data from Ober-Haus, in 2016, 3,709 new apartments were constructed in Vilnius, which is a 4% increase compared to 2015. A total of 49 apartment building projects or project stages were implemented in Vilnius in 2016. The number of apartments built in 2016 was the highest since 2008, when developers built 5,471 apartments in Vilnius. The 2016 apartment building projects demonstrated a rich diversity (in terms of quantity, locations and quality). The growth of the share of prestigious (most expensive) apartments in the total annual supply (projects in which the price of apartments without final fit-out is above 2,000 EUR/sqm) was the most rapid: in 2016, it increased from 8% to 13%. These projects offer apartments in the most prestigious parts of Vilnius, i.e. the city centre, the Old Town, and other prestigious districts. The share of middle-class apartments (projects in which the price of apartments without final fit-out is from 1,450 EUR/sqm to 1,900 EUR/sqm) decreased from 59% to 48% in the course of the year. In 2016, the share of economy-class apartments (projects in which the price of apartments without final fit-out is up to 1,400 EUR/sqm) increased from 33% to 39%. The supply of apartments in Vilnius in 2016 can be viewed as fairly balanced, i.e. all the segments were able to offer buyers a sufficient number of apartments.

Although, in 2016, the apartment construction market in Vilnius was dominated by experienced developers, the number of apartment building projects developed by new companies without any history has also increased. Experienced companies, each of which has completed at least 3–4 apartment building projects, constructed 58% of apartments in Vilnius in 2016 (in 2015, this figure was 64%). Less experienced companies (each of which has completed 2–3 projects) constructed 21% of all apartments (the figure for 2015 was 26%). The share of apartments constructed by new companies, which do not have any reliable housing development history (i.e. have completed only one project or are only beginning their operations), has increased from 10% to 21%. It is therefore advisable for buyers to conduct a responsible evaluation of the seller of a particular housing they would like to buy. In 2017, developers will continue to attract buyers with a rich supply of properties: plans are to construct at least 4,000 new apartments in Vilnius in the course of the year.

Certain changes in the supply of new housing have been observed in recent years not only in the market for apartments but also in the market for detached and semi-detached houses. The increasing incomes of the population and the growing need for a larger living space encourage developers to direct some of their investments in the development of houses. Particularly distinct changes are recorded in Vilnius and its surroundings. While 2012 and 2013 can be viewed as the start of a recovery of construction of apartment buildings in Vilnius, an active development of neighbourhoods of detached and semidetached houses started in 2014 and 2015. In 2016, developers built nearly 320 new houses in Vilnius and its surroundings, which is a 39% increase compared to 2015. This was the highest annual supply indicator since 2007, when nearly 490 houses were supplied to the market. Developers are going to offer an even wider selection of both semi-detached and detached houses in the nearest future. In 2017, the total number of built and ready-to-sell houses in Vilnius and its region may reach 400. The new house selling indicators are viewed by developers fairly optimistically: by the end of 2016, 73% of houses constructed in the course of the year were either sold or reserved.

A leap in the supply of new apartments is expected in Kaunas in 2017

In 2016, a growth in the supply of new construction projects was also recorded in Kaunas and Klaipėda. According to data from Ober-Haus, 311 apartments were built in Kaunas in 2016, which is a 26% increase compared to 2015. Seven apartment building projects or project stages were implemented in Klaipėda in 2016, which offered 202 apartments (a 55% increase compared to 2015). Although a rapid relative growth in the supply was recorded in these cities in 2016, yet the total number of apartments constructed there has remained fairly modest compared to the 3,709 apartments built in Vilnius. The year 2017 may become a breakthrough year for Kaunas however, as developers’ plans and projects in progress promise a rocketing increase in the number of new apartments in this city. Fifteen to twenty new apartment building projects or project stages could be implemented in Kaunas in 2017, which could offer the market from 600 to 800 new apartments. If this happens, it will be a major supply leap since 2008. The abundance of projects in progress (in particular as far as large-scale and more expensive projects are concerned) shows that developers have regained trust in the Kaunas residential market. A growth in the apartment market in Klaipėda is also expected in 2017, but the total number of apartments built in the course of the year will hardly be above 300.

The growth in the volume of construction of new apartments in Šiauliai and Panevėžys in 2016 was very slow. No new apartment buildings were built in Šiauliai in the course of the year, and two new buildings of the low-rise construction project in Molainių Street were completed in Panevėžys. Despite investor promises to resume the construction of suspended apartment buildings or start some small-scale projects in these cities, the very low liquidity of new apartments hinders the development of any major projects. The year 2017 will not be absolutely resultless for Šiauliai and Panevėžys, and 4 small-scale projects or project stages with approximately 35 apartments are likely to be completed (in Dvaro Street in Šiauliai and in Molainių, Suvalkų and Kranto streets in Panevėžys).

The lowest number of unsold apartments over the past 9 years

The lowest number of unsold apartments over the past 9 years

The activity in the market for new apartments and the indicators achieved in 2016 were truly satisfactory for developers. According to data from Ober-Haus, over 5,229 new apartments in completed apartments buildings and apartment buildings in progress were purchased or reserved directly from developers in the five main Lithuanian cities in the course of 2016. This was a nearly 33% increase compared to 2015. The significant growth has resulted not only from the positive moods in the housing market, but also from the increasing apartment supply in Vilnius, Kaunas and Klaipėda. New projects expand the choice for potential buyers: whereas earlier some buyers were unable to find a property satisfying their needs, the current variety of locations and quality parameters can attract an increased number of buyers. In 2016, 4,341 new apartments were either sold or reserved in Vilnius, which is a 33% increase compared to 2015. In 2016, 514 new apartments (a 42% increase compared to 2015) were sold/reserved in Kaunas and 346 new apartments (a 22% increase compared to 2015) were sold/reserved in Klaipėda. 28 new apartments in completed apartment buildings or apartment buildings in progress were sold/reserved in Šiauliai and Panevėžys, and the same figure was recorded in these cities in 2015.

The active sales have resulted in a decrease of vacant apartments in completed apartment buildings in all main Lithuanian cities. By the end of 2016, the total number of unsold apartments in completed apartment buildings in the main Lithuanian cities was 1,741, which is a 28% decrease compared to the figure recorded one year ago. By the end of 2016, 1,016 apartments were offered for sale in apartment buildings in Vilnius built in 2007–2016 (there were 1,464 vacant apartments by the end of 2015); this figure was 239 for Kaunas, 466 for Klaipėda, and 20 for Šiauliai and Panevėžys taken together. This was the smallest number of unsold apartments since 2008, and it seems evident that, given the current market situation, developers are not pressed by the unsold ‘balance’ and are actively planning other residential projects.

Lithuania Residential Market Commentary Q4 2016

In 2016, the development of the commercial premises sector on the whole country’s scale was somewhat enlivened by new market players – the German retail chain Lidl and the Latvian retail chain Depo specialising in construction materials and household goods. However, in recent years, any active development of new commercial buildings has only been observed in the two largest Lithuanian cities, i.e. Vilnius and Kaunas. The development of commercial properties in the other cities and towns of the country remains fairly slow and does not show signs of any sustainable recovery. This to a certain extent is proved by the volumes of construction in Lithuania, which have been decreasing for the second consecutive year. According to data from the Lithuanian Department of Statistics, in 2016, works of construction of non-residential premises in Lithuania for EUR 862 million were performed, which is a nearly 7% decrease compared to 2015 (at current prices). The highest volumes of construction of non-residential buildings in Lithuania were recorded in 2008 (EUR 1,544 million).

In 2016, the development of the commercial premises sector on the whole country’s scale was somewhat enlivened by new market players – the German retail chain Lidl and the Latvian retail chain Depo specialising in construction materials and household goods. However, in recent years, any active development of new commercial buildings has only been observed in the two largest Lithuanian cities, i.e. Vilnius and Kaunas. The development of commercial properties in the other cities and towns of the country remains fairly slow and does not show signs of any sustainable recovery. This to a certain extent is proved by the volumes of construction in Lithuania, which have been decreasing for the second consecutive year. According to data from the Lithuanian Department of Statistics, in 2016, works of construction of non-residential premises in Lithuania for EUR 862 million were performed, which is a nearly 7% decrease compared to 2015 (at current prices). The highest volumes of construction of non-residential buildings in Lithuania were recorded in 2008 (EUR 1,544 million).

Although, in 2016, the volumes of construction on the whole country’s scale decreased, market activity indicators show different trends, and certain records pertaining to sale of non-residential properties were even recorded. According to data from the State Enterprise Centre of Registers, in 2016, 18,131 transactions for non-residential properties (buildings and premises) were concluded in Lithuania, which is a 12% increase compared to 2015. This was the highest activity indicator throughout the period since Lithuania regained independence, which also exceeded the average indicator for the years 2005– 2008 by nearly 16%. The total value of transactions has also increased. In 2016, the total value of the transactions for non-residential properties registered in Lithuania was 6% higher compared to 2015 (EUR 695 million in 2016 and EUR 655 million in 2015).

The rich supply of new offices has offered considerable selection opportunities and improved the office take-up figures. In 2016, a total of 75,900 sqm of office space was leased in Vilnius, which is a 44% increase compared to 2015. The overall office vacancy rate in Vilnius business centres continued to increase for the second consecutive year, i.e. in the course of the year increased from 4.1% to 6.4%. By the end of the year, the amount of vacant office space was 40,100 sqm. The vacancy rate for class A offices was 3.4%, while the vacancy rate for class B offices was 8.1%.

Although the demand for modern offices remains fairly high and developers could be satisfied with the lease pace (of the 2016 supply, 73% was leased by the end of the year), the growth in the vacancy rate was easily predictable. Some of the companies leave their previous offices and opt for new ones. But the 2016 projects were dominating by companies undergoing expansion, which either established their new units or transferred their individual units into a single building. Therefore, the expanding and newly establishing companies compensate for the office space of other companies (which move from one location to a different location) in other projects, and a fairly consistent growth in office vacancy rate in Vilnius could be observed in 2016. The year 2017 is also promising in terms of both supply and demand. Developers plan to implement as many as 15 various-scale projects or stages in the course of the year and offer the Vilnius market nearly 83,000 sqm of new modern office space. Therefore, even in case the demand for the offices remains the same as in 2016, the growth of office vacancy rate in 2017 is practically inevitable.

The wide selection of modern office premises has also slowed down the growth of rents. In 2016, rents for A class offices remained stable, while rents for B class offices increased by 2%. By the end of 2016, rents for A class offices were 13.5–16.5 EUR/sqm, while rents for B class offices were 8.5–13.0 EUR/sqm. The offer of new offices in 2017 is likely to be favourable to tenants, and any positive changes in rents are unlikely.

The supply of modern offices grew by 8% in Kaunas and by 5% Klaipėda

The development of new offices has finally started in Kaunas. The lengthy discussions about the insufficiency of offices in Lithuania’s second largest city have proven fruitful. In 2016, 5 small-scale office projects (in Neries Krantinės St., Taikos Ave., Pramonės Ave. and Partizanų St.) added up to the Kaunas market for modern offices. As a result, the Kaunas market for modern offices grew by 8% (7,550 sqm of useful office space) in a year, and the total supply by the end of 2016 was 97,100 sqm. Although the growth in supply in 2016 was only minor, the construction of some large business centres started in Kaunas in 2016 will, if completed, provide some good opportunities for the growth of the sector and attracting businesses in 2017 and 2018. In theory, the construction of 8 office projects might be completed in 2017, with the useful office space there amounting to 40,000 sqm. These projects include both the reconstruction of old administrative buildings of various size and the construction of new fairly large business centres, which will offer tenants over 5,000 sqm of office space per building. However, considering that the construction of modern buildings often takes longer than expected and that the pace of construction works also depends on demand (the real interest on the part of tenants), the completion of some of these projects might be postponed to 2018.

In any case, the new supply is likely to attract both local and international companies, which were unable to establish or expand in Kaunas earlier due to shortage of office space on offer. Regardless the fact that 5 small-scale new projects were implemented in Kaunas in 2016, the vacancy rate in the course of the year has remained stable and was 2.5% by the end of the year (the vacancy rate at the end of 2015 was 2.6%). By the end of 2016, the total area of vacant offices was nearly 2,500 sqm. It is evident that the currently available area of vacant premises is insufficient for companies which are looking for large office areas in a single building. Therefore, any major movement on the part of tenants is likely at the end of 2017 and in early 2018, when the first major projects will be completed and the actual demand for such properties in Kaunas will become clear. Although, in the course of 2016, rents for offices in Kaunas on average increased by nearly 6%, the current rent level is considerably lower compared to rents in Vilnius (in Kaunas, rents for modern offices are on average approximately 20% lower than in Vilnius). By the end of the year, rents for A class offices in Kaunas amounted to 10.5–13.5 EUR/sqm, while rents for B class offices amounted to 6.0–10.0 EUR/sqm.

Similarly to previous years, in 2016, the development of modern offices was the slowest in Klaipėda. In the course of the year, two small office buildings (M19 in Minijos St. and a small building in Taikos Ave.) with the total useful office space amounting to 3,100 sqm were built here. This means that, in 2016, the market for modern offices in Klaipėda grew only by 5%, and the total supply by the end of the year was 66,200 sqm. Although the implementation of any large-scale projects in Klaipėda in the nearest future seems unlikely, local investors are trying to revive the stagnating market for commercial premises in this city. In mid-2016, Viremidos Investicijos announced the envisaged transformation of an abandoned industrial site in Liepų Street. During the first stage, plans are to reconstruct the boiler-house and build a retail, warehousing and office building Kamino Biurai nearby; the new building will provide premises of various types (approximately 2,000 sqm will be allocated for offices).

No major changes in the office occupancy rate have been recorded in Klaipėda in 2016, although, in the course of the year, the overall office vacancy rate in the city decreased from 18.8% to 16.9%. Unlike Vilnius or Kaunas, the modern offices market in Klaipėda receives most interest from local companies. The lack of international companies and the fairly slow expansion of companies operating in the city do not provide any grounds for believing in any speedier development of this segment in the foreseeable future. However, with the growth of the national economy and the improvement of company performance, successful companies are able to pay higher rents for modern offices. In the course of 2016, rents for modern offices in Klaipėda on average grew by nearly 3%, but nevertheless remain nearly 20– 30% lower compared to Kaunas and Vilnius. By the end of 2016, rents for A class offices in Klaipėda amounted to 9.0–12.5 EUR/sqm, while rents for B class offices amounted to 6.0–9.0 EUR/sqm.

In 2016, retail areas in traditional shopping centres only grew thanks to the expansion of the already operating shopping centres

In 2016, new retail chains entered the Lithuanian market and operating shopping centres were expanding. In June 2016, the first shops of the German retail chain Lidl were opened in different locations in Lithuania. In the course of 2016, this retail chain opened 22 small shopping centres in Lithuania. Lidl continues to plan its further expansion in the country. Depo, the Latvian retail chain specialising in construction materials and household goods, has also started operations in Lithuania. The first shopping centre of the chain was opened in Klaipėda at the end of 2016. The retail chain plans to open another four new shopping centres in Vilnius, Kaunas and Panevėžys in 2017 and 2018. The total area of the five shopping centres will amount to approximately 100,000 sqm.

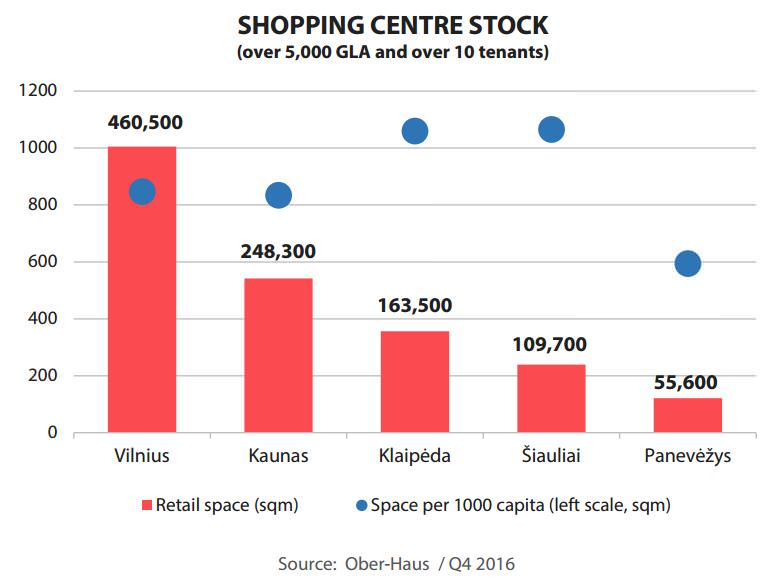

Among traditional and large shopping centres, in 2016, the renovation and expansion of operating shopping centres was mostly taking place. In 2016 three shopping centres in Vilnius have expanded and renovated their sites. In early 2016, the DomusPro shopping centre in Pašilaičiai district was expanded and supplemented with two new major tenants – Hansa Plytelių Turgus and Fitus gym. In May 2016, the second stage of the Nordika shopping centre was opened, which offered buyers 17 new shops (with Senukai becoming the anchor tenant) and completed the expansion of this shopping centre in the southern part of the city. At the end of the year, OUTLET PARK was renovated and expanded. This was the third stage of renovation and expansion of this outlet shopping centre located in Šiaurės Miestelis (Žirmūnai district), as a result of which not only retail premises on the ground floor were expanded and renovated but also additional commercial space was provided on the second floor of the building. A total of 25,100 sqm of new retail area was provided to the Vilnius market in 2016. By the end of 2016, there were 26 traditional shopping centres operating in Vilnius (with a useful area of at least 5,000 sqm and with at least 10 tenants per shopping centre), with the total leasable area there amounting to 460,500 sqm (847 sqm per 1,000 Vilnius residents).

Kaunas has also experienced a leap in the retail space in shopping centres. In late 2016, the renovated and expanded Mega shopping centre was opened. This shopping centre has offered buyers an additional 25,000 sqm of retail space and over 70 new shops, cafes and service points. On completion of the expansion, Mega has become the second largest shopping centre in Lithuania (in terms of leasable retail area) and the largest shopping centre in central Lithuania. By the end of 2016, there were 11 traditional shopping centres operating in Kaunas (with a useful area of at least 5,000 sqm and with at least 10 tenants per shopping centre), with the total leasable area there amounting to 248,300 sqm (834 sqm per 1,000 Kaunas residents).

No new projects have been implemented in the other main Lithuanian cities and the supply there has not changed during the year: the total leasable retail area in Klaipėda amounted to 163,500 sqm (1,059 sqm per 1,000 Klaipėda residents), 109,700 sqm in Šiauliai (1,065 sqm per 1,000 Šiauliai residents) and 55,600 sqm in Panevėžys (594 sqm per 1,000 Panevėžys residents). By the end of 2016, there were nearly 386 sqm of retail area in traditional and large shopping centres per 1,000 Lithuanian residents.

The rapid growth of retail trade volumes in 2016 has reinforced the positive expectations in the retail premises sector. The successfully operating shopping centres and their growing turnovers could further consistently raise rents. Most lease contracts are linked to tenant turnovers or national or EU inflation rates, which means that existing tenants of shopping centres had to accept rents which are at least 1–2% higher than rents a year ago. On the other hand, rents for new tenants were up to 3–7% higher than a year ago. New companies or companies undergoing expansion were actively looking for premises for their businesses in 2016, too. Fully leased out shopping centres and high rents for retail premises encourage entrepreneurs to look for alternatives in different parts of the city. The most attractive shopping streets in the main Lithuanian cities continue to receive tenant attention but cannot offer a wide selection of retail premises. Therefore, a growth of rents in the shopping streets of the main Lithuanian cities was also recorded in 2016. The greatest growth was recorded in the main shopping streets in Vilnius (Gedimino Ave., Pilies St., Didžioji St. and Vokiečių St.), where, in the course of the year, rents increased by a further 7%. In the main shopping streets in Kaunas, Klaipėda, Šiauliai and Panevėžys, in the course of the year, rents increased on average by 4–6%. By the end of 2016, rents for average-size (approximately 100– 300 sqm) retail premises in the main shopping streets in Vilnius amounted to 18.0–43.0 EUR/sqm; this figure was 10.0–20.0 EUR/sqm in Kaunas, 8.0–15.0 EUR/sqm in Klaipėda, and 5.0–12.0 EUR/sqm in Šiauliai and Panevėžys.

Seven warehousing and logistics projects were built in Lithuania in the course of the year, with the largest project located in Klaipėda

In 2016, the growth of revenues of companies providing warehousing and storage services was recorded once again. According to data from the Lithuanian Department of Statistics, in the course of 2016, the revenue of companies engaged in the sale of warehousing and storage services increased by 7.5% (compared to 2015). The development of warehouses in the main regions of the country continues to closely follow market needs. Just like in previous years, most of warehousing and logistics projects are undertaken by companies for their own needs.

In 2016, 7 new warehousing and logistics projects were completed in Vilnius, Kaunas and Klaipėda regions, with the total area of the warehouses amounting to 35,800 sqm. The greatest number of smallscale projects was implemented in Vilnius region (Layher Baltic, Litcargus, Woodline, Wirtgen Lietuva, Vilniaus Sigmos Sandėlių Centras) and, by the end of the year, the total area of warehousing premises here amounted to 481,400 sqm. In mid-2016, the brewery Volfas Engelman opened a warehouse for its produce in Kaunas, and, by the end of 2016, the total area of warehousing premises in this city was 279,700 sqm. The largest warehousing project of 2016 was implemented in Klaipėda region: the nearly 17,500 sqm warehouse with administrative premises was implemented by VPA Logistics; as a result, the total area of warehousing premises in Klaipėda region increased to 193,600 sqm. Of these all projects, 4 projects were built and intended exclusively for the needs of the companies that implemented them.

In 2017, plans are to implement at least 6 new projects in Vilnius and Klaipėda regions, with the total warehousing area of 56,000 sqm.

Similarly to what has been forecast, in 2016, a minor increase in rents for warehouses was recorded, which to some extent determines the fairly slow rate of development of this sector in Lithuania (in particular as far as warehouses for market needs (compared to own needs) are concerned). In 2016, rents for warehouses in Vilnius, Kaunas and Klaipėda regions on average increased by 1–3%. By the end of the year, new warehouses in Vilnius were offered for 3.7–5.2 EUR/sqm, while old warehouses were offered for 1.6–3.0 EUR/sqm. In Kaunas, the figure was 3.5–5.2 EUR/sqm for new warehouses and 1.5–3.0 EUR/sqm for old warehouse; in Klaipėda, new warehouses were offered for 3.4–4.8 EUR/sqm and old warehouses were offered for 1.4– 3.0 EUR/sqm.

Lithuania Commercial Market Commentary Q4 2016

Ober-Haus Real Estate Advisors presents its annual real estate market report 2017 on the Baltic States Capitals – Vilnius, Riga and Tallinn. The overview focuses on the office, commercial, storage and residential premises markets, as well as on land plots of each of the capital cities. The overview also includes information related to taxes, which was drawn up by PricewaterhouseCoopers – the audit, accounting and consulting company, while the part with legal information was prepared by the Sorainen law firm.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in February 2017. The annual apartment price growth in the major cities of Lithuania was 5.3% (the annual apartment price growth in January 2017 was 5.6%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in February 2017. The annual apartment price growth in the major cities of Lithuania was 5.3% (the annual apartment price growth in January 2017 was 5.6%).

In February 2017, apartment prices in the capital grew 0.3% with the average price per square meter reaching EUR 1,427 (+4 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 23.6% (+273 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in February grew by 0.1%, 0.2%, 0.3% and 0.6% respectively with the average price per square meter reaching EUR 987 (+1 EUR/sqm), EUR 1,015 (+2 EUR/sqm), EUR 597 (+2 EUR/sqm) and EUR 562 (+3 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 6.5% in Vilnius, 4.1% in Kaunas, 2.6% in Klaipėda, 5.2% in Šiauliai and 5.1% in Panevėžys.

“The growth in apartment prices recorded in February in all five main Lithuanian cities is a fairly good indicator of a revival of the residential real estate market taking place not only in Vilnius but also in other regions and, with the national economy growing and with the borrowing conditions remaining attractive, a consistent growth of apartment prices in all main Lithuanian cities is likely to continue throughout 2017,” says Saulius Vagonis, Head of Valuation & Analysis at Ober-Haus.

Lithuanian Apartment Price Index, February 2017

Realia Group, the largest service provider in real estate management and brokerage services in the Nordic countries has acquired the Swedish real estate management services company Hestia. The acquisition is part of Realia Group’s growth strategy and supports Realia Group’s plan to expand its international real estate management services to other Nordic countries.

Hestia, founded in 2007, operates in Sweden, Norway and Finland providing services in property management and corporate real estate management serving property investors, user-owners and tenants. The core of the company is strong expertise, personal service, and an emphasis on customer experience. Hestia employs approximately 170 people in 30 localities.

”Realia Group has a strong growth strategy and the acquisition supports in an excellent way our plan to expand our real estate management services in the Nordics. For Realia Group, 2016 was a year of rapid growth and I am confident that the acquisition strengthens our competitiveness as a provider of real estate management services,” says Matti Bergendahl, CEO of Realia Group.

”Expanding our business after Finland and the Baltic countries to the other Nordic countries, and especially to Sweden is and a significant step that makes Realia Group a strong partner for our clients in the Nordic area. We are very happy that Hestia, a company with excellent services and good reputation, is joining forces with Realia Group, continues Bergendahl.

I am really pleased that we are joining forces with Realia Group. We will now have an access to new markets and at the same time we can continue as the flexible and customer centric partner for our existing customers. We become a much stronger service provider for customers that operate on the Nordic and Baltic markets,” says Gunnar Isaksson, CEO of Hestia.

Hestia will operate as Realia Group’s Swedish subsidiary and continue its operations as before. All services for Hestia’s customers will continue as before and be further strengthened in the future.

For further information, please contact:

Realia Group Oy, Matti Bergendahl, CEO, +358 40 833 5461

Hestia Fastighetsförvaltning AB, Gunnar Isaksson, CEO, +46 (0) 73 357 26 26

Realia Group

Realia Group is the biggest service provider in real estate management and real estate brokerage services in Nordic and Baltic countries. Realia Group consists of Huoneistokeskus, SKV Kiinteistönvälitys, Huom! Huoneistomarkkinointi, Realia Isännöinti, and Realia Management in Finland, and Ober-Haus in Baltic countries. Annual revenues of Realia Group is approximately 100M€, and the Group employs some 1,900 persons. www.realiagroup.fi

Hestia

Hestia, founded in 2007, is the first real estate management company in Sweden to combine competence, openness and flexibility. The core of the company is strong expertise, personal service, and an emphasis on customer experience. Hestia employs approximately 170 people in 30 localities. www.hestia.se

The turnover of Ober-Haus, the largest real estate services company in the Baltic countries, totalled EUR 3.7 million in Lithuania in 2016 and was 19% higher than that in 2015 (EUR 3.11 million).

“Growth was determined not only by the active real estate market, but also by our focus on qualification training of our staff, improvement of the company’s motivational system, and nurturing of corporate values in daily activities. We’ve also expanded the scope of our services by offering a complex sales and marketing service portfolio to our project developers”, Remigijus Pleteras, General Manager of Ober-Haus, said.

The total number of services provided by the Lithuanian branch of Ober-Haus in 2016 was 9,400. The portfolio of services provided by the company consisted of the sale, purchase and lease mediation, valuation of immovable and movable property and business, consultancy and market research. Last year the company conducted nearly 800 real estate sales transactions and 500 lease transactions; the company’s Valuation Department prepared 8,040 property valuation reports, valuation expertise and consulting, 21% more than in 2015. Ober-Haus also provided property management services. The company currently manages more than 70 property units.

According to Mr Pleteras, one of the most important objectives of Ober-Haus in 2017 will be improvement of customer service quality. Starting from this year, the company has introduced performance evaluation criteria, such as the Balanced Scorecard (BSC) and the Net Promoter Score (NPT) for measuring customer loyalty, which will help implement and control the strategic aims of the company.

Search

Search