The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in November 2018. The annual apartment price growth in the major cities of Lithuania was 3.8% (the annual apartment price growth in October 2018 was 3.5%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in November 2018. The annual apartment price growth in the major cities of Lithuania was 3.8% (the annual apartment price growth in October 2018 was 3.5%).

In November 2018 apartment prices in the capital grew 0.5% with the average price per square meter reaching EUR 1,509 (+8 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 30.7% (+354 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in November grew by 0.4%, 0.2%, 1.0% and 0.7% respectively with the average price per square meter reaching EUR 1,071 (+4 EUR/sqm), EUR 1,075 (+2 Eur/sqm), 664 (+6 EUR/sqm) and EUR 644 (+5 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 2.8% in Vilnius, 4.1% in Kaunas, 3.5% in Klaipėda, 8.9% in Šiauliai and 12.3% in Panevėžys.

‘The analysis of the situation in the major cities in Lithuania shows that during the past twelve months, prices increased for newly built apartments in Kaunas and Klaipėda and for old apartments in Vilnius. In 2018, prices for newly built apartments increased by 4.7% and 5.9% and for old apartments – by 3.8% and 2.1% in Kaunas and Klaipėda respectively. In the meantime, prices for newly built apartments in Vilnius increased by 1.1% and those of old construction – by 4.2%.

The volumes of construction of new apartment buildings are still on the rise in Vilnius and the share of new apartment sales in the total number of apartment transactions continues to grow steadily. At the same time we can see that developers increasingly invest in energy efficient and higher class (more expensive) projects and interior finish of apartments, however the average area of newly built apartments continues to decrease. It is obvious that development of such housing affects the final purchase price per square meter of new apartments which, according to the official information from authorities, continues to rise faster than the prices of old apartments. If we eliminate, at least partly, these quantitative and qualitative changes in the construction of new apartment buildings, the increase in the price for new apartments is moderate and, according to Ober-Haus, even lower than the sales prices of older apartments,’ Raimondas Reginis, Ober-Haus market research manager for the Baltics, said.

Full review: Lithuanian Apartment Price Index, November 2018

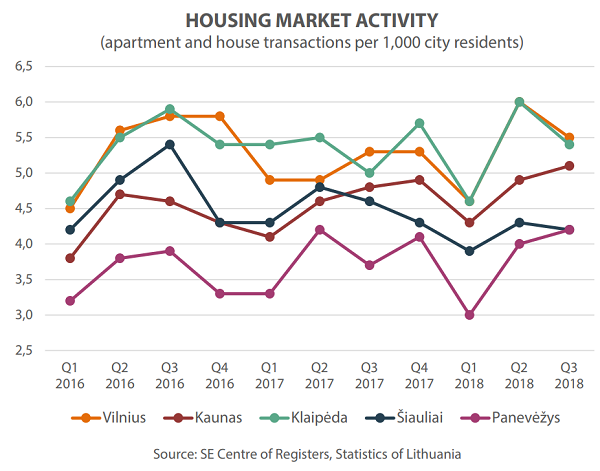

In Q3 2018, activity in the housing (apartment and house) market in Lithuania was at its highest in over ten years. In other words, over the third quarter of this year, the amount of housing acquired was the highest since Q3 2007. According to the data of the State Enterprise Centre of Registers, there were 4% more apartment and 3% more house sale and purchase transactions concluded over the third quarter compared to the third quarter in 2017. On average, 998 house and 2,988 apartment transactions were concluded per month in Lithuania in Q3 2018.

In Q3 2018, activity in the housing (apartment and house) market in Lithuania was at its highest in over ten years. In other words, over the third quarter of this year, the amount of housing acquired was the highest since Q3 2007. According to the data of the State Enterprise Centre of Registers, there were 4% more apartment and 3% more house sale and purchase transactions concluded over the third quarter compared to the third quarter in 2017. On average, 998 house and 2,988 apartment transactions were concluded per month in Lithuania in Q3 2018.

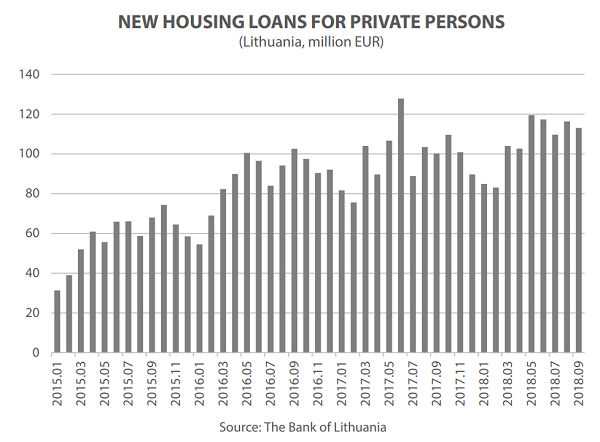

The volume of newly issued mortgages in Lithuania also remained high. Referring to the data of the Bank of Lithuania, new mortgages to the value of EUR 339 million were issued in Q3 2018; this figure is almost the same as in Q2 2018, however, it is 16% more than over the same period in 2017. In the first three quarters of 2018, the average of new mortgages issued per month was EUR 106 million, compared to EUR 98 million over the same period in 2017. Also the slight but constant growth in interest rates on newly issued mortgages recorded in Lithuania. The new average annual interest rate for mortgages in July–September 2018 was 2.32% or 0.27 percentage points more than a year ago.

In the third quarter this year apartment prices rose in all the main cities of the country; the fastest growth was observed in smaller cities. According to Ober-Haus data, the prices increased most in July, August and September in Panevėžys, where prices for apartments increased by 4.4% on average. The prices in Šiauliai over the same period grew by 2.4%, by 1.2% – in Vilnius, by 1.1% – in Kaunas, and by 0.6% – Klaipėda. Over a period of one year (September 2018 compared to September 2017), apartment prices grew by 11.4% – in Panevėžys, by 6.4% – in Šiauliai, by 4.1% – in Kaunas, by 2.6% – Klaipėda, and by 2.3% – in Vilnius. ‘Favourable economic situation and borrowing conditions create conditions for expansion of housing purchasers who continue to stimulate the capital city market as well as the housing markets of other regions. At the same, this is reflected in changes in housing prices,’ Raimondas Reginis, Ober-Haus market research manager for the Baltics, said.

The apartment rental market in the main cities remains active and rental prices have increased in line with sales prices. According to Ober-Haus data, in the period from January to September 2018, apartment rents increased on average by 3% – in Vilnius, 5% – in Kaunas, and 7% – in Klaipėda compared to the same period in 2017.

Sales of new construction apartments in Q3 2018 in the primary market were quite high in all three main cities of Lithuania. Referring to Ober-Haus data, over Q3 2018 in Vilnius, 1,195 newly constructed apartments were directly purchased or reserved in already constructed or being constructed multi-apartment buildings. This is 34% more than the number of apartments sold over Q2 2018 or even 48% more than in Q3 2017 (the number of apartments sold over three quarters of 2018 increased by 3% compared to the same period last year). At the same time, this is the best quarter result in ten years.

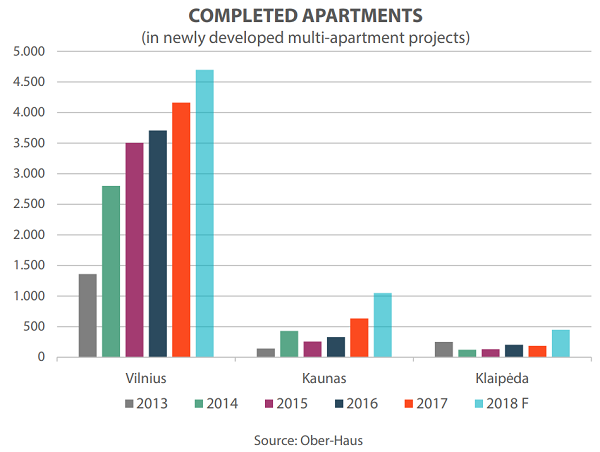

The main reasons for the high activity are the continued growth in the volume of new apartments being constructed and the remaining high demand for new housing. According to Ober-Haus data, over the three quarters of this year, developers in Vilnius have already built over 3,500 apartments in multi-apartment buildings. The total estimated number of apartments to be built in 2018 in the city amounts to 4,700 (the highest number since 2008). In 2017, Vilnius developers built 4,164 apartments. ‘In view of the high demand for new housing, developers are not slowing down and plan new projects for the years 2019–2020,’ Mr Reginis said.

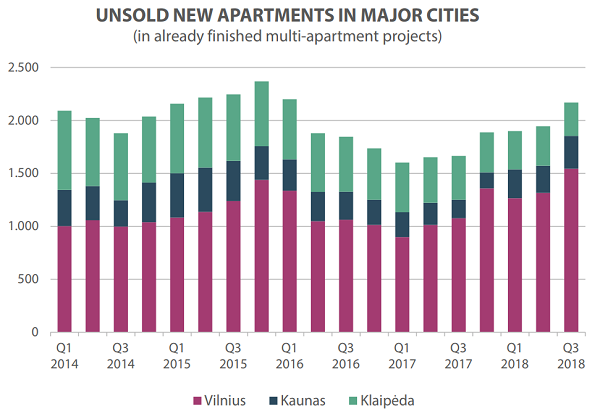

‘However, the large number of apartments and houses intended for sale (which results in competition among apartment developers) continues to increase the number of unsold apartments in the city which has been at the highest level since the end of 2012,’ Mr Reginis said. According to Ober-Haus calculations, the total number of unsold newly constructed apartments in Vilnius at the end of Q3 2018 was 1,545 or 43% more than a year ago. In other words, with the increase in supply of new housing, and the increasing volumes of sales and the number of vacant apartments continues to grow.

Construction volumes of new apartments continue to grow rapidly in Kaunas

Over the last few years, Kaunas has seen rapid construction of new multiapartment buildings, which, in turn, stimulates the rate of housing acquisition. According to Ober-Haus calculations, in Q3 2018, 191 newly constructed apartments were purchased or reserved directly from developers in already constructed or being constructed multi-apartment buildings. This is 10% more than in Q2 2018 and 19% more than in Q3 2017 (in three quarters of 2018, the number of apartments sold was 1% less compared to the same period last year). In the first three quarters of this year alone, Kaunas has built over 850 apartments, whereas, for instance, in 2017, the number was 633.

‘However, apartments in Kaunas already are being built both for sale and to rent. In September this year, Kaunas saw the official opening of a student-oriented project Solo Society, which involved the reconstruction of an old administrative building,’ Mr Reginis said. This project offers 150 premises of various size (from 14 to 47 m²) for rent; the premises are of interest both to local Kaunas residents and to foreigners studying in Kaunas. In 2019, there are plans to expand this project by offering about 100 more premises of the same type.

As in the capital, Kaunas is also seeing an increase in the number of unsold apartments. According to Ober-Haus data, at the end of Q3 2018, there were 309 newly constructed unsold apartments in already built multi-apartment buildings or 78% more than a year ago. ‘In the second half of 2017, Kaunas recorded the lowest number of unsold apartments in already built multiapartment buildings over the recent decade, but since the beginning of this period (in 2018), an increase in the number of vacant apartments has been noticed in Kaunas as well,’ Mr Reginis said.

Further positive prospects for the development of new apartments in Klaipėda

According to Ober-Haus data, over Q3 2018 in Klaipėda, 101 newly constructed apartments were purchased or reserved in already built or being built multi-apartment buildings. This is 29% greater than in Q2 2018 and 3% more than in Q3 2017 (over three quarters of 2018, the number of apartments sold compared to the same period last year decreased by 16%). ‘The relatively modest number of apartments sold (compared not only to the figures in Vilnius but to those in Kaunas also) has been determined by the smaller number of new apartments being constructed,’ Mr Reginis said. Over the first three quarters of this year, developers in Klaipėda have built almost 170 flats in multi-apartment buildings, and in 2018, it is estimated that the final figure for new apartments will be 400–450. For instance, for the full year of 2017 Klaipėda‘s developers built and offered for sale 186 apartments.

‘Increasingly courageous steps of developers allow to assume further moderate growth in the supply of new housing in the port city, however, it is unlikely to see any significant jump in the supply in the immediate future as it was recorded in Kaunas in 2017–2018. Nevertheless, it is safe to assume that the supply of new apartments will increase,’ Mr Reginis said. The housing market in Klaipėda continues to be one of the most intensive among all the big cities of the country (according to the number of apartment transactions per 1,000 city dwellers); meanwhile, the number of unsold flats in the city continues to shrink. According to Ober-Haus data, at the end of Q3 2018, the total number of unsold newly constructed apartments in already built multiapartment buildings was 316 or almost 24% less than a year ago.

Analysis of unsold apartments in already built multi-apartment buildings has shown that the majority of them (71%) include apartments which were built before 2015. Hence, developers who are currently constructing new housing in Klaipėda actually cause smaller competition than shown by the overall market figures. ‘In many cases, it is not easy to attract a modern-day buyers and to persuade them to buy an apartment in projects which were built earlier even at a lower price. Modern newly constructed projects offer purchasers more energy-efficient and rationally arranged housing in projects with a more attractive concept. The growing capacity of purchasers should encourage housing developers to look ahead and compete with existing projects, and not with projects of the previous decade,’ Mr Reginis said.

Full review: Lithuania Residential Market Commentary Q3 2018 (PDF)

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in October 2018. The annual apartment price growth in the major cities of Lithuania was 3.5% (the annual apartment price growth in September 2018 was 3.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in October 2018. The annual apartment price growth in the major cities of Lithuania was 3.5% (the annual apartment price growth in September 2018 was 3.2%).

In October 2018 apartment prices in the capital grew 0.3% with the average price per square meter reaching EUR 1,501 (+5 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 30.0% (+346 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Panevėžys and Šiauliai in October grew by 0.6%, 0.9%, 1.4% and 1.5% respectively with the average price per square meter reaching EUR 1,067 (+7 EUR/sqm), EUR 1,073 (+10 Eur/sqm), 639 (+9 EUR/sqm) and EUR 658 (+10 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 11.4% in Panevėžys, 6.4% in Šiauliai, 4.1% in Kaunas, 2.6% in Klaipėda and 2.3% in Vilnius.

‘Recent figures show that the activity of the Lithuanian apartment segment has not subsided. According to the State Enterprise Center of Registers, slightly more than 3,200 apartment acquisition transactions were concluded in Lithuania in October, the highest monthly indicator recorded over the past 25 months. Except for the capital city, October was most productive month of the year in the major cities in Lithuania. The number of apartments purchased in October was nearly the same as that in September in Vilnius, meanwhile the sales increased by 38% in Panevėžys, 24% – in Šiauliai, 22% – in Kaunas and 19% – in Klaipėda in October compared to September 2018.

The smallest relative price increase for apartments continues to be recorded in Vilnius, which is the result of a high price level, i.e. a huge gap between the prices in Vilnius and other cities of the country. Meanwhile, in smaller cities prices are growing at a faster rate and it is likely that similar trends will remain in the nearest future,’ Raimondas Reginis, Ober-Haus market research manager for the Baltics, said.

Full review: Lithuanian Apartment Price Index, October 2018 (PDF)

Construction works on the Antakalnio krantas project started in Vileišio Street of Antakalnis residential area in Vilnius. The four-storey apartment building will accommodate 43 apartments of 1.5 to 4 rooms, floor area from 36 to 102 sqm. The construction works are scheduled for completion in Q2 2019.

Construction works on the Antakalnio krantas project started in Vileišio Street of Antakalnis residential area in Vilnius. The four-storey apartment building will accommodate 43 apartments of 1.5 to 4 rooms, floor area from 36 to 102 sqm. The construction works are scheduled for completion in Q2 2019.

The Antakalnio krantas project has been designed by Algirdas Kaušpėdas architect studio. ‘I love Antakalnis for two reasons – beautiful nature and architectural diversity. I hope that Antakalnio krantas’ by our studio JP Architektūra will help combine these two characteristics of Antakalnis to offer comfortable and joyful living,’ Algirdas Kaušpėdas, the architect and co-author of the project, said.

The ground floor apartments will contain private, enclosed yards. Apartments on other floors will have balconies or spacious terraces of up to 28 sqm. The entire property will be secured with a fence and outdoor lighting, and a yard and a playground will be installed. The parking area will be monitored by video cameras and storage areas for residents will be provided in the underground parking.

The building is constructed just 70 m from the River Neris. ‘The project built in an exclusive location in the capital city will form part of the architectural and natural surroundings. Although it is a small-scale project, the team has invested a lot of effort in offering well-designed technical, engineering and interior planning solutions. These have already been evaluated by the first buyers. For the convenience of the residents, wide panoramic windows, underfloor heating to ensure even distribution of heat in the rooms, and charging points for electric vehicles will be installed,’ Audrius Šapoka, Ober-Haus Residential Real Estate Department Manager, said.

An integral part of the project is the riverside revival and its adaptation for recreation and leisure. The project developer will undertake to clean up the riverside in front of the building. ‘The adjacent riverside area will be cleaned up, so the residents of the first floor or higher will be able to enjoy the views of the river. The reconstruction of Vileišio Street and its adaptation for pedestrians and cyclists will be completed by the end of the completion of the project,’ Mr Šapoka noted. A section of the new pedestrian and cyclist path so popular with the cyclists in Vilnius has already been laid in Vileišio Street. In the future this path will serve as the main connection between Saulėtekis residential area, Antakalnis and the city centre.

Project developer – UAB Plėtros Projektai, construction works – UAB Binkauskas ir Stašinskas, architects – UAB JP Architektūra, and development of the concept, marketing and sales – UAB OBER-HAUS nekilnojamas turtas.

More information about the project is available at www.antakalniokrantas.lt

An overview of the developments in the most expensive residential housing segments in the three largest cities in Lithuania showed that Kaunas is steadily catching up with the capital. The most recent study of the luxury housing market in Vilnius, Kaunas and Klaipėda concluded that just like in the capital, the volumes of expensive housing acquired in Kaunas and the amounts paid were growing consistently. In the meantime, Klaipėda has been recording only some sporadic leaps in recorded deals.

An overview of the developments in the most expensive residential housing segments in the three largest cities in Lithuania showed that Kaunas is steadily catching up with the capital. The most recent study of the luxury housing market in Vilnius, Kaunas and Klaipėda concluded that just like in the capital, the volumes of expensive housing acquired in Kaunas and the amounts paid were growing consistently. In the meantime, Klaipėda has been recording only some sporadic leaps in recorded deals.

Part of the survey was a selection and an analysis of all the registered deals for old and new construction apartments concluded in Kaunas and Klaipėda during the period concerned (H2 2017-H1 2018) and for which the acquisition price per square meter exceeded EUR 1,800 (having deducted from the total transaction the price of the car park lots, warehouses or other accessories).

The results of the survey showed a consistent increase in the number and the value of the deals in Kaunas during 2017–2018. According to the data of Ober-House, during H1 2017, 39 apartments (with prices per square meter exceeding EUR 1,800) were purchased, against 40 such apartments purchased in H2 2017, and 55 during H2 2018;

The amounts paid for the purchases were increasing accordingly. According to the estimates of Ober-Haus, EUR 6.77 million waspaid for luxury housing purchased during H1 2017 (39 apartments and accessories), EUR 7.15 million (40 apartments and accessories) and EUR 8.16 million (55 apartments and accessories) respectively in H2 2017 and H1 2018.

However, the largest movement in the sale volume in luxury residential housing segment is evident in Kaunas when comparing the indicators of 2017–2018 with those of 2016. ‘Just to compare, as few as 12 such apartments were acquired in Kaunas during 2016 for the total value of EUR 1.7 million. Thus, the trends in Kaunas are more than evident and clearly demonstrate that for now there is no shortage of those able and willing to acquire more expensive housing’ – says Raimondas Reginis, Research Manager for the Baltics of Ober-Haus.

H2 2017 and H1 2018 in Kaunas were notable not only for the number of purchase deals, but also in terms of prices. The highest price per square meter recorded in 2016 and H1 2017 was EUR 2,400, while in H2 2017 and H1 2018 the same indicator was approaching EUR 2,800.

In terms of price per square meter the most expensive apartments in H2 2017 and H1 2018 in Kaunas were sold in the newly delivered multi-apartment unit. The most expensive apartment in terms of square meter price in Kaunas was sold in mid-2018 – a 74 sq.m apartment in a new construction project at Kumelių St. (Old Town) was purchased for EUR 210,000 (EUR 2,800/sq.m.).

During the period being surveyed, two new construction projects in Kaunas stood out for the largest number of purchased luxury-class apartments. During the period, 32 apartments with prices in excess of EUR 1,800/sq.m were sold in Piliamiestis quarter at Brastos St. in which the construction works started in 2015. The price per square meter for the most expensive apartments on the upper floors or larger in area was between EUR 2,400 and 2,650. The second project distinguished for the number of expensive apartments sold was a multi-apartment project ‘Ąžuolyno namai’. The project was completed at the beginning of the year and 19 apartments, each priced at more than EUR 1,800 per sq.m, were sold in the quarter during the period surveyed. The price of the most expensive apartments was EUR 2,200–2,450.

Just like in the capital of the country, the volumes of new construction projects in the central part of Kaunas, also the Old Town and Žaliakalnis were growing rapidly, as were the numbers of apartments sold in new buildings. According to Ober-Haus estimates, 84 per cent of the 95 most expensive flats sold during H2 2017 and H1 2018 were located in new residential quarters (built in 2016-2018). In Vilnius the same indicator was 60 per cent.

‘While in Kaunas the new construction housing has been fairly attractive to well-off buyers, just a few apartments exceeding EUR 1,800/sq.m were sold in old construction buildings, for instance, in historical buildings located in the most expensive parts of the city’ – says Raimondas Reginis.

‘Meanwhile in Klaipėda only some instant spikes in the number of transactions in the most expensive apartment segment were recorded in view of the several newly completed high end residential housing projects, while the overall trends in the segment have remained unchanged’, says Reginis. During H1 2017, 10 apartments were purchased in the expensive residential sector (with a price in excess of EUR 1,800/sq.m.) during H2 2017 29 such apartments were purchased, but in H1 2018 the volumes fell back to the previous levels, when only 11 such apartments were sold in Klaipėda.

Comparable trends were observable in terms of the money spent to acquire housing. According to the estimates of Ober-Haus, EUR 1.72 million were paid for luxury housing purchased during H1 2017 (10 apartments and accessories), EUR 4.53 million and EUR 1.96 million was paid for luxury residential housing respectively in H2 2017 and H1 2018.

‘While the volumes of deals in luxury category apartments in Klaipėda remain moderate as compared to Kaunas, the prices of the most luxurious apartments exceed EUR 3,000/sq.m, which is higher than the prices of the most expensive square metres in Kaunas’, – says Reginis.

Leading position among the most expensive housing on the market in Klaipėda is still retained by K ir D, a 20-storey commercial and residential building originally launched in 2006 and located at Naujojo Sodo St. Two particularly expensive apartments (in terms of a square meter price) were sold during the period surveyed; EUR 237,000 (nearly EUR 3,400/sq.m) was paid for the apartment – with an area of just over 70 sq.m – located on one of the top floors of the building, and EUR 590,000 was paid for another apartment also located on the top floor of the building and just over 200 sq.m in area (nearly EUR 3,000/sq.m). Another apartment which featured in the luxury sector was a 110 sq.m apartment with car parking which was sold for more than EUR 390,000 (about EUR 3,000 per square meter) in a multi apartment house at Ligoninės St. that was started to be built in 2009.

In terms of the number of the most expensive apartments sold in Klaipėda during the period being surveyed, two new construction buildings in which the largest number of flats was sold should be noted. Altogether 13 apartments were sold in the block of semi-detached houses and apartments ‘Kopų žuvėdra’ near the Baltic Sea (in Giruliai) completed in 2016-2017; the price of the apartments exceeded EUR 1,800/sq.m. The price of the most expensive units in the block was EUR 2,300–2,400/sq.m. The second project in Klaipėda that should be noted for the number of apartments sold was the ‘Dangės krantinė’ project refurbished and restored in the Old Town of Klaipėda in 2017. During the period being surveyed 10 apartments and recreational facilities exceeding EUR 1,800/sq.m were sold in the project. The price of the most expensive flats was EUR 2,500-2,700/sq.m.

‘Most probably in the foreseeable future we will see some isolated spikes in the volumes of most expensive housing purchase deals, as the number of new luxury project constructions in the city are still moderate as compared to Vilnius or Kaunas. The supply of old-construction luxury housing in Klaipėda, just like in Kaunas is particularly limited, so a well-off buyer looking for luxury is more likely to wait for new housing in the newly built and planned development projects in the central part of the city, the Old Town and other desirable areas of the city. The deals already concluded clearly show that there are people in Lithuania who can afford buying more expensive housing, so in the near future we can expect to see more deals of similar value’, – says Reginis.

The real estate company Ober-Haus is celebrating 20th anniversary of its operations in Lithuania. On 13 October 1998, the first office of Ober-Haus was opened in Kaštonų Street in Vilnius. Initially the company had four employees. Today Ober-Haus has 10 offices (in Vilnius, Kaunas, Klaipėda, Palanga, Šiauliai, Panevėžys and Druskininkai) and over 140 real estate experts.

The real estate company Ober-Haus is celebrating 20th anniversary of its operations in Lithuania. On 13 October 1998, the first office of Ober-Haus was opened in Kaštonų Street in Vilnius. Initially the company had four employees. Today Ober-Haus has 10 offices (in Vilnius, Kaunas, Klaipėda, Palanga, Šiauliai, Panevėžys and Druskininkai) and over 140 real estate experts.

Ober-Haus Real Estate Advisors is a highly experienced provider of the most complete property services including residential and commercial real estate services, property management, property and business valuation services. Ober-Haus is the largest real estate valuer in the county both by the number of valuers and by the scope of work. The Valuation Department of Ober-Haus in Lithuania employs over 50 qualified professionals. The company performs more than 7,000 valuations annually.

Each year the quality of services provided by Ober-Haus is assessed by the international capital and financial market magazine Euromoney. Ober-Haus has been rated the best real estate company in the following categories:

- Best Overall Advisor & Consultant in Lithuania 2018, 2015

- Best Valuation Advisor & Consultant in Lithuania 2018, 2017, 2015

- Best Research Advisor & Consultant in Lithuania 2018, 2016, 2015

- Best Agency/Letting Advisor & Consultant in Lithuania 2017, 2015

2007 was the year when Ober-Haus Real Estate Advisors and Realia Group, the real estate market leader in Finland, merged making the company not only the largest in the Baltic States but also in all of Middle and Eastern Europe. Annual revenues of Realia Group is approximately 100M€, and the Group employs some 1,900 persons.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in September 2018. The annual apartment price growth in the major cities of Lithuania was 3.2% (the annual apartment price growth in August 2018 was 3.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in September 2018. The annual apartment price growth in the major cities of Lithuania was 3.2% (the annual apartment price growth in August 2018 was 3.2%).

In September 2018 apartment prices in the capital grew 0.5% with the average price per square meter reaching EUR 1,496 (+7 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 29.6% (+341 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in September grew by 0.4%, 0.2%, 1.1% and 1.8% respectively with the average price per square meter reaching EUR 1,060 (+4 EUR/sqm), EUR 1,063 (+2 Eur/sqm), 648 (+7 EUR/sqm) and EUR 630 (+11 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 11.4% in Panevėžys, 6.4% in Šiauliai, 4.1% in Kaunas, 2.6% in Klaipėda and 2.3% in Vilnius.

‘The average apartment sales prices in the five major cities in the country can be essentially divided into three groups. The highest prices of apartments are certainly in the capital of the country. Meanwhile in Kaunas and Klaipėda the prices are almost identical and about 30% lower than those in Vilnius. In Šiauliai and Panevėžys, the sales prices of apartments are also very similar and, compared to the country’s capital, are by nearly 60% lower.

It is likely that in the near future this price gap among the cities will remain essentially unchanged. Even in Kaunas, with the rapid development shown in recent years, the prices will hardly manage to make a more noticeable break away from those in Klaipėda. The situation in Kaunas seems to be following the same path as in Vilnius: the growing demand for housing is offset by the rapidly growing supply of new housing both in the city and the district of Kaunas, which should prevent from sharper increase in housing sales prices,’ Raimondas Reginis, Ober-Haus market research manager for the Baltics, said.

Full review: Lithuanian Apartment Price Index, September 2018 (PDF)

The housing market in Vilnius has seen substantial changes in the past five years. One of the more significant trends is changes in the structure of supply of new housing. If during the time of the crisis and in its immediate aftermath developers of apartments diverted almost all their investments into the economy and middle class and apartments, so in the past five years a fast increase in the scope of the development of higher class apartments has been observed.

According to Ober-Haus, if in 2013–2015 upper class apartments accounted for 6–8% of the total number of newly built apartments, so in 2016 their share reached 13% and in 2017 – a sizeable 18%. The year 2018 will be notable for the construction of more expensive housing (the price of apartments without final fit-out in excess of 2,000 EUR/sqm), which, according to a preliminary estimate of Ober-Haus, will account for about 15–17% (about 700–800 apartments) of all apartments scheduled for construction in 2018 (4,600–4,700 apartments).

‘Since we live in the period when the housing market is particularly active, housing prices in the country’s capital, where one square meter price reaches EUR 2,000–3,000, come as no surprise. Yet we can look at even more expensive housing market segment to see the real potential of buyers and what they pay for the most expensive apartments in Vilnius,’ Raimondas Reginis, Ober-Haus market research manager for the Baltics, said.

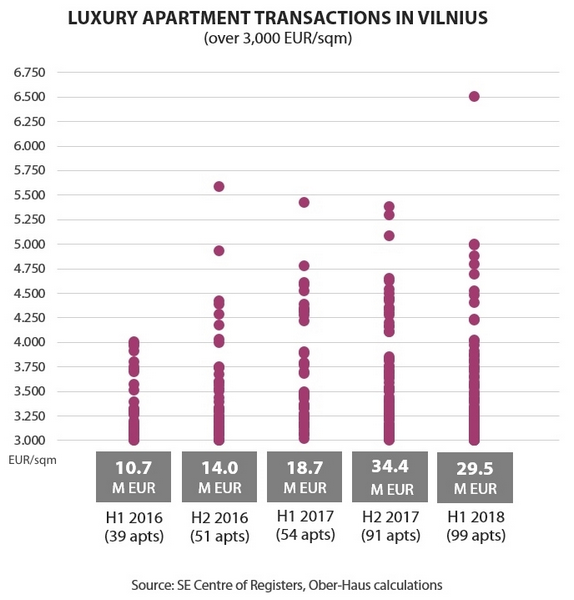

The last time Ober-Haus performed the analysis of this segment was a year ago (October 2017), so this time an overview of H2 2017 and H1 2018 is provided. In the period in question, all registered transactions for apartments in Vilnius were selected and analysed (data source: State Enterprise Centre of Registers), where the purchase price of one square meter was in excess of EUR 3,000 (eliminating the price of a car parking places, storage facilities and other apartment appurtenances from the total transaction price).

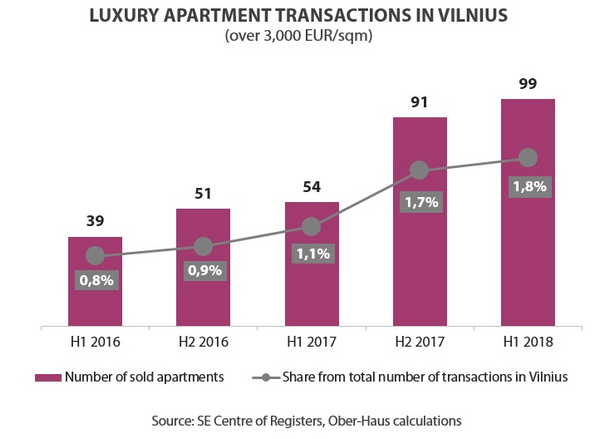

The obtained results suggest that in 2017–2018 there was a rapid increase in the share of the number of transactions of such housing and their value in the capital city. In H1 2017, 54 apartments with a price tag in excess of 3,000 EUR/sqm were purchased in Vilnius, in H2 2017 – 91 such apartments and in H1 2018 – 99 apartments.

The obtained results suggest that in 2017–2018 there was a rapid increase in the share of the number of transactions of such housing and their value in the capital city. In H1 2017, 54 apartments with a price tag in excess of 3,000 EUR/sqm were purchased in Vilnius, in H2 2017 – 91 such apartments and in H1 2018 – 99 apartments.

The total cumulative purchase price of such apartments has also increased. According to Ober-Haus, nearly EUR 18.7 million was paid for luxury apartments purchased in H1 2017 (54 apartments and their appurtenances), in H2 2017 – EUR 34.3 million and in H1 2018 – EUR 29.5 million. For a comparison, in 2016 a total of 90 such apartments were purchased for a total of EUR 24.7 million.

‘The analysis of the transactions for the purchase of the most expensive apartments over the past two half-year periods shows that only in exceptional cases the buyers paid in excess of 5,000 EUR/sqm,’ Mr Reginis said. In terms of the price per square meter, the most expensive apartment in Vilnius sold in H1 2018 was in a historic building on Etmonų Street (Old Town) – the buyer paid EUR 305,000 for a 47 sqm apartment (6,500 EUR/sqm). ‘By the way, one apartment was purchased in the same building in 2016 paying a high price of about EUR 5,600/sqm for it. This year’s transaction is, however, truly exceptional in the market, because the price of the square meter of the second most expensive transaction in the same period is by EUR 1,100 lower,’ Mr Reginis pointed out.

A 90 sqm apartment sold in H2 2017 in a reconstructed historical building on Gaono Street (Old Town) with the underground car parking spaces fetched EUR 530,000 (approximately 5,400 EUR/sqm, excluding the price of the parking spaces).

An apartment of over 300 sqm in a newly constructed building on Bokšto Street (Old Town) with parking spaces was sold in the H2 2017 for over EUR 1,700,000 (approximately 5,300 EUR/sqm, excluding the price of the parking spaces).

An apartment of over 370 sqm in a newly constructed building on A. Tumėno Street (next to the Parliament) with parking spaces fetched over EUR 2,200,000 (approximately 5,100 EUR/sqm, excluding the price of the parking spaces and other appurtenances of the apartment) in H2 2017.

In terms of the number of the transactions for the top price apartments in the overall statistics of apartment sales in Vilnius, their share in 2016–2018 has increased. If in H1 2016, the share of the transactions involving high-end apartments was 0.8% of the total amount of transactions, in H1 2017 it was 1.1%, in H2 2017 – 1.7%, and in H1 2018 – 1.8%.

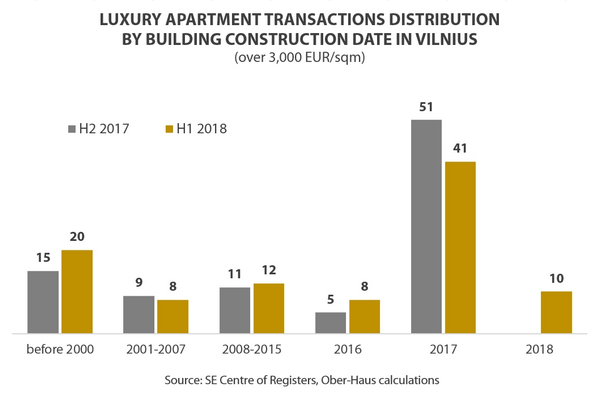

‘The analysis of the completed transactions shows that buyers mainly value and pay most for luxury apartments in historical buildings in good condition or apartments in newly constructed projects in the centre of the city of Vilnius and in the Old Town. Usually the most expensive apartments have a greater floor area and are located on the top floors of the buildings. For example, the average area of luxury apartments acquired in H2 2017 and in H1 2018 was 86 sqm,’ Mr Reginis said.

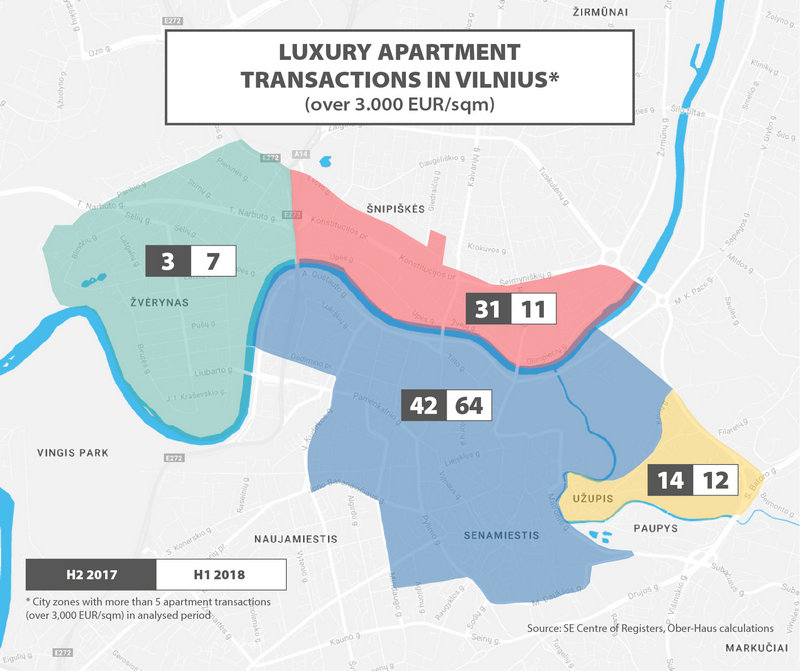

According to the representative of Ober-Haus, the rapidly growing number of projects of newly built apartment buildings in the centre of the city, the Old Town, and the area of Užupis has largely contributed to the growing sales volumes of such housing. New projects can offer new and broader choice options to wealthy customers who, as the official figures have showed, make use of them. For example, out of 190 most expensive apartments sold in Vilnius in H2 2017 and in H1 2018, 60% of them were in recently completed residential projects (year of construction 2016–2018).

With regard to specific residential apartment projects in Vilnius, the following fetched top prices: Grafų Pliaterių Rūmai (Bokšto Street), Magnus Residence (Gedimino Avenue), Pilies Apartamentai (Olimpiečių Street), Jogailos Rezidencija (Jogailos Street), Užupio Krantinės (Polocko Street), Čiurlionio 3 (M. K. Čiurlionio Street), K. Kalinausko 20 (K. Kalinausko Street), Užupio Citadelė (Malūnų Street) and several smaller projects. ‘High housing market activity, newly launched projects in the most prestigious locations of Vilnius and the number of most expensive apartments reserved in these projects lead to expect more impressive transactions in the near future. Affluent customers value exclusivity and are prepared to spend significant amounts for such properties,’ Mr Reginis said.

SPA Hotel Belvilis located in Molėtai District will be sold at a public auction organised by Ober-Haus. The asking price is EUR 2.5 million.

SPA Hotel Belvilis located in Molėtai District will be sold at a public auction organised by Ober-Haus. The asking price is EUR 2.5 million.

The Belvilis complex was built in 2005 as a SPA, hotel and conference centre. The complex is offered for sale together with its structures and parcels of land. The total area of the complex is nearly 2.300 sqm and the total area of the parcels of land is 3.8 ha. The complex consists of a hotel building, 7 holiday homes, tennis courts, an open-air stage and other engineering structures. All buildings are in good working order and are sold with all equipment, furniture, and elements of interior decor.

‘The project was implemented in a unique location in the neighbourhood of the Labanoras Regional Park, on the bank of the Lake Bebrusai. The hard and soft landscaping is in place on the property and includes bicycle paths, lakeside area and the beach, overall it is a modern centre,’ Darius Tumas, Ober-Haus Commercial Real Estate Senior Consultant, said.

The centre has been adapted to provide tourism services both in the summer time and wintertime: this is a venue for training sessions, conferences and seminars and accommodation, food catering services, swimming pool and sauna facilities are offered throughout the year.

‘The auction should be of interest to investors who have planned or considered a similar line of business. By acquiring the operating hotel, the buyer will skip the planning, design and construction stages and will have trained staff – the complex is geared up and running. The buyer will be able to continue successfully operating business under the reputable brand of SPA Hotel Belvilis, to develop the scope of services or to adapt the existing centre for own needs, for example, a sanatorium or a rehabilitation facility,’ Mr Tumas said.

Applications shall be submitted by 17 October 2018, 12.00 by email aukcionas@ober-haus.lt and raimundas.mickunas@baltichearts.lt.

More information about the sold object is available at www.ober-haus.lt/auction

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in August 2018. The annual apartment price growth in the major cities of Lithuania was 3.2% (the annual apartment price growth in July 2018 was 2.9%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in August 2018. The annual apartment price growth in the major cities of Lithuania was 3.2% (the annual apartment price growth in July 2018 was 2.9%).

In August 2018 apartment prices in the capital grew 0.5% with the average price per square meter reaching EUR 1,489 (+8 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 29.0% (+334 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in August grew by 0.4%, 0.4%, 0.6% and 1.0% respectively with the average price per square meter reaching EUR 1,056 (+4 EUR/sqm), EUR 1,061 (+4 Eur/sqm), 641 (+3 EUR/sqm) and EUR 619 (+6 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 9.7% in Panevėžys, 5.9% in Šiauliai, 4.2% in Kaunas, 2.8% in Klaipėda and 2.3% in Vilnius.

‘The indicators of the past years show that the average sales prices of apartments in the major cities of the country have increased faster than the prices of consumer goods and services in the country. According to Statistics Lithuania, in August 2018 the annual inflation rate calculated on the basis of the Harmonized Index of Consumer Prices was 1.8%. Meanwhile the price of apartments in the major cities of the country increased at a yearly average rate of 3.2%.

Over the past five years, i.e. in August 2018 compared to August 2013, the inflation rate was recorded at 6.2%, whereas the price of apartments in the major cities of the country over the same period has increased on average by 18.9%. This means that over the past five years the real sales prices of apartments in the major cities of the country increased by 11.9% adjusted for inflation.

Since sales prices of apartments have increased at a different rate in the major cities of the country, real apartment prices have also risen at different rates: 16.7% in Vilnius, 13.1% in Panevėžys, 10.3% in Šiauliai, 6.6% in Kaunas and 3.9% in Klaipėda. However, we must not forget that in the past five years the real wages in the country have grown by a third. Thus, although housing prices have increased faster than the prices of goods and services in the country, their increase does not match the statistical rate of pay growth,’ Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said.

Search

Search