On 2 May Audrius Šapoka took over as general manager of Ober-Haus in Lithuania from Remigijus Pleteras.

„I have been part of the Ober-Haus professional team for 14 years, and for the past 5 years I have had the honour and responsibility to head this wonderful team of specialists. Under my management, the turnover of the company has almost doubled and the number of teams has increased by several per cent. We focused on service quality, and consistent and well-thought-out development which helped ensure and maintain the position of leader in the market for many years. We devoted particular attention to team growth and reorganisation of a motivational system which helped contain employee turnover which in turn allowed the company to retain a strong position in the competitive environment,” Mr Pleteras, who headed Ober-Haus in Lithuania since 2014, said. Before that, the company was managed for 15 years by Vytas Zabilius, who was head of the company since its establishment in 1998.

“I am handing over to a strong, ambitious and outstanding leader who has accumulated firm knowledge and extensive experience in the field of real estate and who will make sure that the competitive advantage of the company remains sustainable. As regards myself, the time has come to take on new challenges and expand my knowledge with the Scandinavian real estate development company, Bonava by shaping the operations of the company in Lithuania virtually from scratch,” Mr Pleteras said.

The new general manager started working for Ober-Haus eight years ago. Since 2014, he has headed the company’s Residential Department. “I am delighted to have the opportunity to manage such a team of professionals as this one, and I accept it with a sense of responsibility. Just like before, we will take the road of a professional service provider which handles the most exhaustive information and provides expert insights and the most effective real estate operational solutions. We will strive for sustainable and long-term growth by concentrating our investment flows on human capital and organic development in the segments of valuation, brokerage, in particular, commercial real estate property and services,” Mr Šapoka noted.

The new general manager started working for Ober-Haus eight years ago. Since 2014, he has headed the company’s Residential Department. “I am delighted to have the opportunity to manage such a team of professionals as this one, and I accept it with a sense of responsibility. Just like before, we will take the road of a professional service provider which handles the most exhaustive information and provides expert insights and the most effective real estate operational solutions. We will strive for sustainable and long-term growth by concentrating our investment flows on human capital and organic development in the segments of valuation, brokerage, in particular, commercial real estate property and services,” Mr Šapoka noted.

Ober-Haus began its operations in Lithuania in 1998. The company has more than 140 real estate experts in its offices in Vilnius, Kaunas, Klaipėda, Šiauliai, Panevėžys, Palanga and Druskininkai. In 2007, Ober-Haus joined the Finnish real estate market leader Realia Group. Ober-Haus, which is celebrating its 20th anniversary in Lithuania, reached a turnover of EUR 3.95 million excl. VAT in 2018.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in March 2019. The annual apartment price growth in the major cities of Lithuania was 5.0% (the annual apartment price growth in February 2019 was 4.5%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in March 2019. The annual apartment price growth in the major cities of Lithuania was 5.0% (the annual apartment price growth in February 2019 was 4.5%).

In March apartment prices in Vilnius and Klaipėda grew by 0.5% with the average price per square meter reaching EUR 1,531 (+8 EUR/sqm) and EUR 1,085 (+5 Eur/sqm). Apartment prices in Kaunas, Šiauliai and Panevėžys in March grew by 0.6%, 1.0% and 1.8% respectively with the average price per square meter reaching EUR 1,088 (+7 EUR/sqm), 684 (+7 EUR/sqm) and 663 (+12 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 4.2% in Vilnius, 4.9% in Kaunas, 4.3% in Klaipėda, 10.4% in Šiauliai and 13.7% in Panevėžys.

“The housing market is in the springtime mood in the meantime. That is confirmed by both a continued increase in apartment prices and by market activity indicators. According to the data of the State Enterprise Centre of Registers, the purchases of apartments increased by 2 % in Kaunas, 11 % in Klaipėda and Šiauliai, 18 % in Vilnius and even 31 % in Panevėžys between January and March of this year comparing with the same period of 2018.

Increasing income of the population, favourable borrowing conditions, wide housing choices, increasing rent prices, positive expectations of people and businesses and population growth in some municipalities are the key factors supporting and promoting high activity on the housing market for which we can see the marathon in apartment purchases continue in all major cities of the country this year as well,” said Raimondas Reginis, Ober-Haus Research Manager for the Baltics.

As it was expected and forecast, the year 2018 was truly active in the real estate markets of the Baltics. In the environment of the growing economy, high supply and demand indicators continue to be recorded in the capitals of the Baltics and other major cities. As noted in the latest annual real estate market report of the capital cities of the Baltics by Ober-Haus, the upward trend is observed both in the commercial and residential property markets.

As it was expected and forecast, the year 2018 was truly active in the real estate markets of the Baltics. In the environment of the growing economy, high supply and demand indicators continue to be recorded in the capitals of the Baltics and other major cities. As noted in the latest annual real estate market report of the capital cities of the Baltics by Ober-Haus, the upward trend is observed both in the commercial and residential property markets.

“If since the last economic downturn we have seen a sufficiently rapid recovery in the real estate markets of the capital cities of Estonia and Lithuania, the capital of Latvia, Riga, could not boast of greater changes. It seems, however, that the largest city of the Baltic countries is finally entering into a faster development phase,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Leap in supply in the office market in Riga in 2019–2020

In 2018, 80,000 sqm of new office space was built in Tallinn, 43,000 sqm in Vilnius and nearly 25,000 sqm in Riga. Although in terms of the new office space, Riga was again behind Tallinn and Vilnius in 2018, according to Mr Reginis, the office sector in the biggest city in the Baltics is gaining momentum. According to Ober-Haus, a significant amount of office space of up to 140,000 sqm should supplement the market in Riga in 2019–2020.

“In the next two years developers in Riga plan to build as much office space as there was built in the past nine years (2010-2018). This is exactly what the capital city of Latvia lacked in order to compete with Vilnius and Tallinn for the attention of international companies. A possibility not only to get established, but also to plan any further expansion in modern buildings is one of the main factors for bringing larger companies to a specific region or city,’ Mr Reginis pointed out.

Vilnius and Tallinn, however, are not going to give up their positions as leaders in the office space development in the past decade easily and are also preparing for new impressive office developments. According to Ober-Haus, at least 15 projects are planned to be implemented in Vilnius in 2019–2020, offering a useful office space of about 160,000 sqm. In Tallinn, about 100,000 sqm are planned to be built during the same period.

Two new large shopping centres in Tallinn and Riga

In the sector of traditional larger shopping centres, Tallinn and Riga had the biggest news in 2018–2019. Following the opening of T1 Mall of Tallinn at the end of 2018 the market in Tallinn was supplemented with 55,000 sqm of retail space. According to Ober-Haus, the retail space in traditional shopping centres in the capital of Estonia at the end of 2018 totalled 665,300 sqm and with 1.54 sqm per capita remains the obvious leader among the capitals of the Baltics.

In the sector of traditional larger shopping centres, Tallinn and Riga had the biggest news in 2018–2019. Following the opening of T1 Mall of Tallinn at the end of 2018 the market in Tallinn was supplemented with 55,000 sqm of retail space. According to Ober-Haus, the retail space in traditional shopping centres in the capital of Estonia at the end of 2018 totalled 665,300 sqm and with 1.54 sqm per capita remains the obvious leader among the capitals of the Baltics.

In the meantime, after a long break one of the largest retail projects was implemented in Riga. In April 2019, Akropole shopping centre was opened supplementing the market in Riga with around 60,000 sqm of retail space. In terms of the retail space per capita, Riga came second in 2018 among the capitals of the Baltics (649,000 sqm or 1.02 sqm/capita). Following the opening of Akropole, the retail space indicators in Riga increased by a tenth.

“Despite the opening of smaller scale projects and DIY type schemes (Žali, Depo, Decathlon) in Vilnius in 2018, no larger traditional shopping centres were built,” Mr Reginis said. Opening of a larger project can be expected at the end of 2020, when the Vilnius Outlet shopping centre will be opened next to the western bypass of the city supplementing the market in the capital with about 35,000 sqm of retail space. The project of this type will be implemented in Vilnius after a break of 4.5 years (since the opening of the second stage of Nordika shopping centre in May 2016). According to Ober-Haus, the retail floor area in the traditional shopping centres in Vilnius at the end of 2018 totalled 453,000 sqm or 0.82 sqm per capita, the smallest figure out of the capital cities of the Baltic countries.

200,000 sqm new warehousing space in the capitals of the Baltics countries

In 2018, the capital cities of the Baltics and their environs saw particularly huge volumes of construction of warehousing facilities. “The growing demand for modern warehousing space and high occupancy rates create conditions for much faster expansion of this sector,” Mr Reginis said. The vacancy rate of modern warehousing premises in the Baltics is under 5%.

According to Ober-Haus, a total of 16 projects were implemented in the capital cities and their environs in 2018, offering a little over 200,000 sqm of warehousing premises: about 86,000 sqm in Tallinn, about 60,000 sqm in Riga and nearly 58,000 sqm in Vilnius.

The largest supply of modern warehousing facilities in the Baltic countries is in Tallinn and its environs. At the end of 2018, the total area of these premises in Tallinn was over 1.3 million sqm. Meanwhile in Riga and its environs the total area of warehousing premises increased by 9% in 2018 totalling almost 709,000 sqm. According to Ober-Haus, the supply of warehousing premises in Vilnius and its environs increased by 11% in 2018 and at the end of the year totalled slightly over 585,000 sqm.

“Unlike in Estonia and Latvia, where the warehousing sector is mainly concentrated in the country’s capitals and its surroundings, Lithuania has other regions with sufficiently active development of warehouses. The supply of warehousing premises in Kaunas and Klaipėda regions alone totals almost 550,000 sqm,” – Mr. Reginis noted.

According to the representative of Ober-Haus, the development of warehousing facilities gained impetus and shows no signs of stopping soon. In 2019, a considerable increase in such property is planned in the capitals of the Baltics. Projects of different size are planned which will offer approximately 130,000 sqm of warehousing space.

Tallinn is catching up with Vilnius according to the construction volumes of multi-apartment buildings

In 2018, the fastest leap in the supply of apartments in the capitals of the Baltic countries was recorded in Riga. A little over 2,400 apartments were built in a year or 65% more than in 2017. “Of course, the scale of apartment development in Riga still lags behind that in Vilnius and Tallinn, but the leap shows much more ambitious steps taken by developers,” the representative of Ober-Haus noted. In 2018, over 4,300 apartments (5% more than in 2017) were built in Vilnius and 3,100 apartments were built in Tallinn (7% more than in 2017).

In 2018, the fastest leap in the supply of apartments in the capitals of the Baltic countries was recorded in Riga. A little over 2,400 apartments were built in a year or 65% more than in 2017. “Of course, the scale of apartment development in Riga still lags behind that in Vilnius and Tallinn, but the leap shows much more ambitious steps taken by developers,” the representative of Ober-Haus noted. In 2018, over 4,300 apartments (5% more than in 2017) were built in Vilnius and 3,100 apartments were built in Tallinn (7% more than in 2017).

Despite the fact that according to the quantity of new apartments Vilnius retained the position of the leader among the capitals of the Baltics in 2018, Tallinn is rapidly catching up. According to Ober-Haus, in 2014–2016, on average 6.1 apartments were built per 1,000 population in Vilnius annually and in 2017–2019 the figure will increase to 7.9 apartments. At the same time in Tallinn on average 3.9 apartments per 1,000 population was built annually in 2014–2016 and in 2017–2019 the figure will jump to 7.1 apartments.

“It means that in terms of the number of apartments built in Tallinn, it is only by a tenth percentage points behind Vilnius,” Mr Reginis said. At the same time, despite a significant rise in the number of new apartments built in 2018 in Riga, the volumes of apartment construction in Riga remain modest and the figure is more than half that of Vilnius and Tallinn. According to Ober-Haus, in 2017–2019, the figure will be 3.1 completed apartments per 1,000 population in Riga.

“It is obvious that 2019–2020 will certainly not be boring in the real estate markets in the Baltic countries and will be eventful. The economic environment continues to remain favourable for active development of the market in the main regions of these countries. It is clear that developers are not going to miss this opportunity,” Mr Reginis said.

Baltics Real Estate Market Report 2019 (PDF)

Looking back at 2018 it can be said that the housing market of Lithuania is going through its second golden age. The level of housing market activity and financial indicators shot up and it looks like they are to going to surpass their all-time high.

Looking back at 2018 it can be said that the housing market of Lithuania is going through its second golden age. The level of housing market activity and financial indicators shot up and it looks like they are to going to surpass their all-time high.

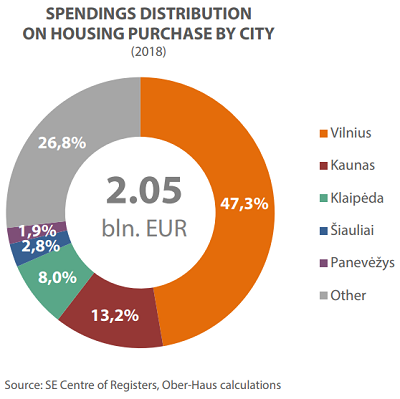

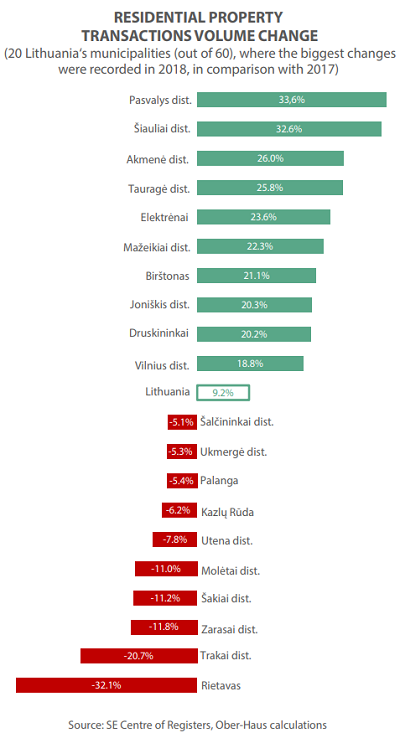

According to the State Enterprise Center of Registers, nearly EUR 2.05 billion was spent on buying residential property (apartments and houses) in Lithuania in 2018 or 9.2% more than in 2017. Looking at historical data, an even larger amount of money for buying homes in Lithuania was spent only in 2007 and totaled EUR 2.22 billion. In 2018, the increase in the amount of money in the housing market was observed essentially in the entire country, i.e. compared with 2017, growth was recorded in as many as 44 out of 60 municipalities in Lithuania. If in some municipalities positive change was only symbolic, in other municipalities the amounts spent on buying homes increased by a third.

Vilnius and Kaunas city municipalities particularly stood out in 2018. In the country’s capital city over EUR 970 million was spent on buying homes, which is all-time high, or 9% more than in 2017 and 2% more than in record 2007. The most rapid growth in Vilnius was recorded in the house segment, which over the past 5 years has seen new annual all-time records in the level of activity, volume of construction or spending. In the meantime, the biggest change among major cities in 2018 was recorded in Kaunas, where over EUR 271 million was spent on buying homes, almost 16% more than in 2017. In 2018, over 4% growth (nearly EUR 164 million) was recorded in Klaipėda, 4% (over EUR 57 million) in Šiauliai, and over 6% (nearly EUR 40 million) in Panevėžys for purchasing homes compared to 2017.

Vilnius and Kaunas city municipalities particularly stood out in 2018. In the country’s capital city over EUR 970 million was spent on buying homes, which is all-time high, or 9% more than in 2017 and 2% more than in record 2007. The most rapid growth in Vilnius was recorded in the house segment, which over the past 5 years has seen new annual all-time records in the level of activity, volume of construction or spending. In the meantime, the biggest change among major cities in 2018 was recorded in Kaunas, where over EUR 271 million was spent on buying homes, almost 16% more than in 2017. In 2018, over 4% growth (nearly EUR 164 million) was recorded in Klaipėda, 4% (over EUR 57 million) in Šiauliai, and over 6% (nearly EUR 40 million) in Panevėžys for purchasing homes compared to 2017.

In terms of investment in homes per capita, the leaders have not changed. In 2018, the residents of Vilnius spent the largest sum on apartments and houses – 1,766 EUR/capita on average. Klaipėda came second with 1,105 EUR/capita. Kaunas with 944 EUR/capita came third. During the same period, the residents of Šiauliai spent 569 EUR/capita and those in Panevėžys – 449 EUR/capita on average. In the rest of Lithuania (except for the municipalities of the five major cities of the country) the figure was 338 EUR/capita.

The housing sale and rent prices have been growing in all major cities of the country

Positive economic outlook of the country and continuing high activity in the housing market promoted further growth of sales prices in the major cities in 2018. “The fastest relative price change, however, was recorded in smaller cities, where the level of prices is much lower and there is room for faster percentage growth of sales prices,” said Raimondas Reginis, Ober-Haus Research Manager for the Baltics.

According to Ober-Haus, in 2018 in Panevėžys and Šiauliai an increase of 11.6% and 8.9% respectively was recorded in prices of apartments. In Kaunas, Klaipėda and Vilnius the apartment prices increased by 4.2%, 3.7% and 3.0% respectively. The fastest increase in the prices of houses in 2018 was recorded in the cities of Klaipėda and Šiauliai and their environs, totaling 6% on average. The prices of houses in Panevėžys and its environs increased by 4% on average, and in Vilnius and Kaunas by a mere 1% in 2018.

In the three major cities in the country apartments rents in 2018 increased at a similar rate as sales prices. In Vilnius rents over a year increased by 4%, in Kaunas – by 5% and in Klaipėda – by 6%. In 2018, the average rent of a 1-3 room apartment in Vilnius was 398 EUR/month, in Kaunas – EUR 308/month, in Klaipėda – EUR 308/month, in Šiauliai – 201 EUR/month 2005 and in Panevėžys – EUR 194/month.

“This shows that the activity in the apartment rental market continues to remain high. Even in the country’s capital where more and more apartments are built every year and a large portion of them is purchased for both short-term and long-term lease, the market is able to absorb apartments for rental offered to the market. The growing number of citizens and their income and also limited possibilities of some people to buy their own home supported the rental sector activity,” said Mr Reginis.

Record levels of housing construction volumes in the capital city and its surrounding areas

In 2018, Vilnius, Kaunas and Klaipėda saw particularly huge volumes of construction of multi-apartment buildings. According to Ober-Haus, in Vilnius developers built 4,355 new apartments or 5% more than in 2017. Although the volumes of apartment construction haven’t reached the 2006–2008 level (during that period 4,800–5,800 apartments were built annually), in terms of the diversity of new projects in Vilnius the year 2018 was truly exceptional.

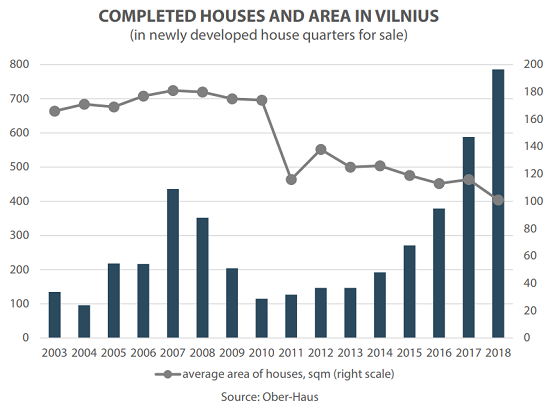

The construction of apartments in multi-apartment buildings in Vilnius has not yet reached record levels, but the construction of detached and semi-detached houses reached all-time record. In 2018, developers built nearly 790 new houses in the city of Vilnius and its environs or an impressive 34% more than in 2017 and more than twice as many as in 2016. The supply of houses for sale in 2018 was the highest annual supply indicator throughout the entire real estate market history in Lithuania. With the increasing competition in the segment of multi-apartment buildings, some developers and individual investors in recent years decided to offer an affordable housing option to customers. Currently, row houses with small floor area dominate in the house development market. Despite that over the last decade, the floor area of houses for sale decreased by an average of 30% (2000–2010 compared to 2011–2018), a detached or semi-detached house remains perhaps the only alternative for those looking for a larger newly built home. Although in 2018, the average floor area of houses for sale offered by developers was record small – 101 sqm, it is still twice as large as the floor area of an average apartment in newly constructed buildings (the average floor area of apartments in newly constructed multi-apartment buildings in 2018 was 50.2 sqm).

In 2018, Kaunas also entered a rapid housing development phase. According to Ober-Haus, a total of 997 apartments were built in a year in this city or 57% more than in 2017 and three times as many as in 2016. More apartments were built in Kaunas only in 2008, when developers completed 1,070 apartments for sale in multi-apartment buildings. The year 2018 was marked not only by abundance of newly constructed apartments, but also by a wide choice of projects – customers could choose from 24 different projects. It is obvious that developers of both the residential and commercial projects started to trust the prospects of the city of Kaunas and decided to exploit the growth potential of this city.

After a longer break, Klaipėda could also boast of greater apartment development volumes in 2018. A total of 11 projects offering 429 apartments were implemented in Klaipėda in 2018. This is 2.3 times as many as in 2017. In 2011–2017, only about 200 new apartments per year were built in Klaipėda on average.

The current construction of residential projects in Vilnius, Kaunas and Klaipėda shows that further increase in the construction of apartments in 2019 will be recorded only in the country’s capital. Ober-Haus forecasts that about 4,500–4,600 apartments should be built in the capital city in 2019 or about 5% more than in 2018; in Kaunas about 700–800 apartments (about 25% less than in 2018) and in Klaipėda about 300–350 apartments (about 25% less than in 2018) should be built in 2019.

Fewer purchases of new housing in Kaunas and Klaipėda in 2018

In the primary market of apartment buildings in Vilnius increasing sales volumes were recorded in 2018 not only because of active buyers, but also because of further increase in the construction volumes of apartments, i.e. choice options. According to Ober-Haus, 4,188 new apartments were sold and reserved in the capital city in 2018 or almost 6% more compared with 2017.

“In the meantime, in Kaunas and Klaipėda decreasing sales volumes were recorded in the primary market of apartments. Unlike in Vilnius, a decrease in the construction volumes of multi-apartment buildings by a quarter is forecast in 2019 in these cities, which could have affected sales in 2018 (particularly pre-sales in the projects under construction),” said Mr Reginis. In 2018, 735 new apartments were purchased directly from developers in Kaunas (10% less than in 2017) and 373 apartments in Klaipėda (8% less than in 2017).

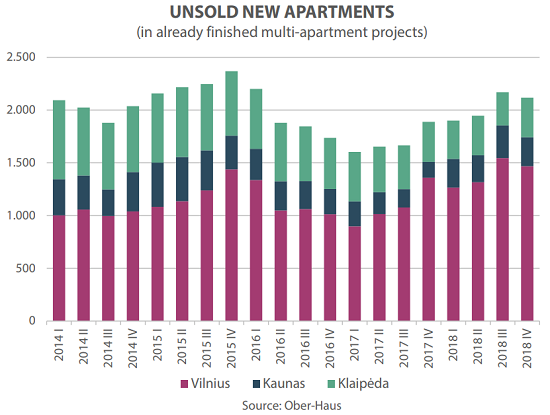

Despite the high degree of market activity in the primary market of apartments, further increase in vacant apartments in completed buildings was recorded in Vilnius and Kaunas in 2018. At the end of 2018, in the three major cities the total number of unsold new apartments in completed projects was 2,117 or 12% more than a year ago. At the end of 2018, 1,467 apartments were on offer in the completed new multi-apartment buildings in Vilnius (8% more than at the end of 2017), in Kaunas – 276 apartments (8% more than at the end of 2017), and in Klaipėda – 374 apartments (1% less than at the end of 2017). It is only natural that every year with the noticeably growing supply of new housing (especially in Vilnius and Kaunas) we can see an increase in the number of unsold properties.

Housing is most affordable for residents of Šiauliai and Panevėžys

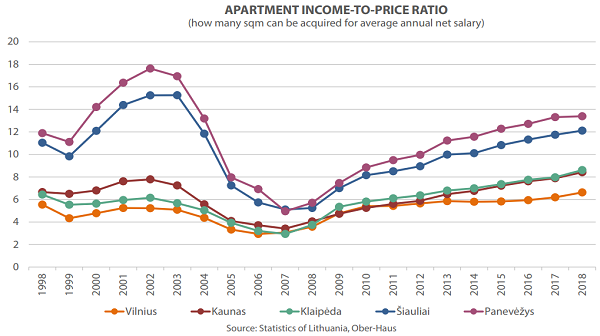

The ratio between the prices of apartments and wages in 2018 continued to improve for the benefit of buyers in almost all cities of the country. According to Statistics Lithuania, the net wages in the municipalities of the cities of Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys in 2018 increased by 7.2–9.8% on average compared with 2017. According to Ober-Haus, the average prices of apartments over the same period increased in these cities by 2.6–8.0% (the 2018 average compared with the 2017 average).

Statistically, in 2018 the residents of Vilnius, Kaunas, Klaipėda and Šiauliai could purchase more residential property than those in Panevėžys (due to faster increase in the prices of apartments compared with wages). A statistical resident of Vilnius was able to purchase 6.6 sqm of an average class apartment for his average net annual wages in 2018 (in 2017 – 6.2 sqm), the resident of Kaunas – 8.4 sqm (in 2017 – 8.0 sqm), the resident of Klaipėda – 8.6 sqm (in 2017 – 8.1 sqm), the resident of Šiauliai – 12.1 sqm (in 2017 –11.9 sqm) and the resident of Panevėžys – 13.4 sqm (in 2017 – 13.5 sqm).

“Looking at these indicators, statistically the least affordable housing is in the cities of highest economic activity where the prices of homes are noticeably higher than those in smaller cities. And the gap is really considerable. Statistically, a resident of Šiauliai and Panevėžys is able to purchase twice as much floor area of a medium class apartment on average than a resident of Vilnius,” said Mr Reginis.

Full review: Lithuania Residential Market Commentary Q4 2018 (PDF)

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in February 2019. The annual apartment price growth in the major cities of Lithuania was 4.5% (the annual apartment price growth in January 2019 was 4.0%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in February 2019. The annual apartment price growth in the major cities of Lithuania was 4.5% (the annual apartment price growth in January 2019 was 4.0%).

In February 2019 apartment prices in the capital grew 0.5% with the average price per square meter reaching EUR 1,523 (+8 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 31.9% (+368 EUR/sqm). Apartment prices in Kaunas and Klaipėda in February grew by 0.4% respectively with the average price per square meter reaching EUR 1,081 (+4 EUR/sqm) and EUR 1,080 (+5 Eur/sqm). Meanwhile in Šiauliai was recorded 1.5% price increase with average price per square meter reaching EUR 677 (+10 EUR/sqm), while apartment price in Panevėžys grew by 0.8% respectively with the average price per square meter reaching EUR 651 (+6 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 3.8% in Vilnius, 4.5% in Kaunas, 3.7% in Klaipėda, 9.6% in Šiauliai and 11.7% in Panevėžys.

“The beginning of this year in major cities of the country was marked not only by a high number of apartment sale transactions but also by a continued rise in their sales prices. The highest relative change in apartment prices is again recorded in smaller towns where the level of apartment prices is lower and there is still space for faster price growth.

The three largest cities of the country did not show any major surprises – the price growth remains moderate. And in terms of the overall price change of the five major cities of the country, apartment prices have been statistically increasing for 49 consecutive months,” notes Raimondas Reginis, Ober-Haus Research Manager for the Baltics.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in January 2019. The annual apartment price growth in the major cities of Lithuania was 4.0% (the annual apartment price growth in December 2018 was 3.9%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in January 2019. The annual apartment price growth in the major cities of Lithuania was 4.0% (the annual apartment price growth in December 2018 was 3.9%).

In January 2019 apartment prices in the capital grew 0.2% with the average price per square meter reaching EUR 1,515 (+3 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 31.3% (+361 EUR/sqm).

Apartment prices in Kaunas, Šiauliai and Panevėžys in January grew by 0.3%, 0.2% and 0.4% respectively with the average price per square meter reaching EUR 1,077 (+3 EUR/sqm), 667 (+1 EUR/sqm) and 645 (+2 EUR/sqm. Meanwhile in Klaipėda was recorded 0.1% price decrease with average price per square meter reaching EUR 1.075 (-1 EUR/sqm). In the past 12 months, the prices of apartments grew in all major cities: 3.2% in Vilnius, 4.3% in Kaunas, 3.5% in Klaipėda, 8.5% in Šiauliai and 11.3% in Panevėžys.

“This January Kaunas and Klaipėda changed position in terms of average apartment sales prices. Kaunas rose to second place among the five biggest cities of Lithuania after a break of more than six years. Average apartment prices in Kaunas overtook prices in Klaipėda only in the period 2009-2012, i.e. at the very peak of the prices dropping during the financial crisis, when the port city recorded an extremely steep and substantial price decline. From late 2012 to late 2018, the level of apartment prices in Kaunas was statistically lower than those in Klaipėda.

Admittedly, the price differences between Kaunas and Klaipėda are symbolic at the moment and in the immediate future we might see these cities changing positions once again. However, looking at the positive changes taking place in the real estate market in Kaunas over the last two or three years, it is likely that in the long run the potential for faster growth in housing prices will remain specifically in Kaunas,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review: Lithuanian Apartment Price Index, January 2019 (PDF)

Ober-Haus Lithuania, which is celebrating its 20th anniversary, in 2018 had a turnover of EUR 3.95 million (VAT excluded), which was 6% higher than in 2017.

“Having started with a team of 4 people 20 years ago, today we are celebrating our anniversary with 140 professionals throughout Lithuania. Along with Latvia and Estonia we are the biggest real estate company in the Baltic region. But we are proud not of our size but of our motivated team of employees and our positive organisational culture. They are our unique resources which create a sustainable competitive advantage in the real estate market,” noted Remigijus Pleteras, General Manager of Ober-Haus Lithuania.

In 2018, Ober-Haus Lithuania provided almost 11,000 services in Lithuania. The package of services provided by the Company encompasses mediation (brokerage) when selling, buying and renting real estate, valuation of movable and immovable property, property management and market surveys.

“In recent years, we have expanded our service package and have started providing complex real estate project development, sales and marketing management services. At the moment, we have 13 different apartment, house and office projects in Vilnius, Klaipėda and Druskininkai under our control”, Mr Pleteras said.

Last year, Ober-Haus Lithuania concluded more than 700 residential and commercial real estate sales transactions and 500 rental transactions, and the Company’s Property Valuation Department prepared 9,800 property appraisal reports and conducted appraisal expertise and consultations for customers making it the leading real estate company in Lithuania in terms of appraisals. In addition, Ober-Haus also provides property management service and currently manages more than 70 single assets.

To sum up the results of 2018, it can be said that the year was one of the most active for housing developers in Lithuania and the city of Vilnius continued to be in the lead among the capitals of the Baltics by the quantities of new housing. Ober-Haus has obtained the factual data on the completed multi-apartment buildings in 2018 in Vilnius. “We provide detailed data for the year 2018 and answers to the following key questions: how many and what type of apartments were built, who built them, and where they were built. At the same time we provide a review not only of the last year’s performance, but analyse it within the context of the past 15 years and offer this year’s forecasts,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

To sum up the results of 2018, it can be said that the year was one of the most active for housing developers in Lithuania and the city of Vilnius continued to be in the lead among the capitals of the Baltics by the quantities of new housing. Ober-Haus has obtained the factual data on the completed multi-apartment buildings in 2018 in Vilnius. “We provide detailed data for the year 2018 and answers to the following key questions: how many and what type of apartments were built, who built them, and where they were built. At the same time we provide a review not only of the last year’s performance, but analyse it within the context of the past 15 years and offer this year’s forecasts,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Ober-Haus has for more than 15 years collected comprehensive data on housing development both in Vilnius and in other major cities in Lithuania. Currently only the database of Vilnius city and its suburbs contains information about the multi-apartment building projects built in 2003–2018 when almost 50,000 apartments were offered for sale. The statistics on apartments in multi-apartment buildings in this overview does not include the data on private houses, terraced houses and non-standard projects (e.g. loft conversions). The data about the projects exclusively for rent or social housing are also outside the scope of this overview.

According to Ober-Haus, in Vilnius developers built 4,355 new apartments or 5% more than in 2017. Although the volumes of apartment construction haven’t reached the 2006–2008 level (during that period 4,800–5,800 apartments were built annually), in terms of the diversity of new projects in Vilnius the year 2018 was truly exceptional. If between 2003 and 2017, buyers could choose from not more than 50 different multi-apartment building projects, in 2018 they could choose from 58 different newly built projects.

A total of 43% of all apartments built in three urban neighbourhoods

In 2018, the multi-apartment building projects in Vilnius were very diverse (in terms of quantity, quality and geography). Developers built new multi-apartment buildings in 15 out of 21 neighbourhoods of Vilnius. Traditionally, the most popular and most rapidly developing areas of the city were most attractive to developers. Over 70% of all new apartments were built in seven urban neighbourhoods: Pašilaičiai (15.3%), Pilaitė (13.9%), Šnipiškės (13.5%), Verkiai (7.9%), Naujamiestis (7.8%), Žirmūnai (6.5%) and Lazdynai (6.5%).

According to Reginis, in recent years developers have been more active in investing in multi-apartment projects in the neighbourhoods of Vilnius where the new housing development has been scarce (e.g., Naujoji Vilnia, Naujininkai, Vilkpėdė, Lazdynėliai, Naujasis Antakalnis) or even in the neighbourhoods located outside the city (e.g., Klevinė Užubaliai, Naujasis Lentvaris). Developers try to offer apartments to customers in the locations where there is far less direct competition than in the most popular neighbourhoods of the city.

In 2018, economy class apartments dominated

In 2018, the fastest growth was recorded in the construction of economy class apartments in Vilnius. Ober-Haus estimates that the share of the economy class apartments (the price level of up to 1,500 EUR/sqm without final fit-out), increased from 30% to 45% compared with 2017. In the meantime, the share of the medium class apartments (the price level from 1,500 EUR/sqm to 2,000 EUR/sqm) decreased in a year from 52% to 36%. The most stable situation remained in the projects involving higher class apartments (the price level in excess of 2,000 EUR/sqm) – their share grew from 18% to 19% in 20188.

According to Reginis, looking at the distribution of apartments built in 2018 by classes, last year’s supply was really well balanced and sufficiently accurately reflected the structure of the purchasing power of the population.

Record small apartments were built

Over the past 15 years, the floor area of the new apartments has been steadily and rather quickly decreasing, which is no longer a surprise, but the year 2018 will go down in history for the smallest average size of apartments built in the multi-apartment buildings in Vilnius. According to Ober-Haus, in 2018, compared with 2017, the average size of apartments built in the multi-apartment buildings decreased by 3.5 sqm totalling 50.2 sqm. Compared with the size of multi-apartment buildings built in 2003–2009, the decrease is by one fifth on average or slightly over 12 sqm.

The rapid decrease in the average floor area of apartments in Vilnius has been recorded since the last economic downturn, when developers started to design and build greater numbers of smaller apartments and increase the share of such apartments in apartment buildings. This means that apartments with fewer rooms are offered more frequently, the floor planning of apartments has become more rational (inefficient and hardly used spaces in the apartments were eliminated or reduced), and sizes of the rooms became smaller. “It is no surprise, therefore, that there are 3-room apartments of 50-55 sqm on the market and that new apartments with a separate kitchen are a thing of the past. Therefore it comes as no surprise that the decreasing size of newly built apartments prompted the development of private or terraced houses offering more spacious housing for larger families,” Reginis pointed out.

The rapid decrease in the average floor area of apartments in Vilnius has been recorded since the last economic downturn, when developers started to design and build greater numbers of smaller apartments and increase the share of such apartments in apartment buildings. This means that apartments with fewer rooms are offered more frequently, the floor planning of apartments has become more rational (inefficient and hardly used spaces in the apartments were eliminated or reduced), and sizes of the rooms became smaller. “It is no surprise, therefore, that there are 3-room apartments of 50-55 sqm on the market and that new apartments with a separate kitchen are a thing of the past. Therefore it comes as no surprise that the decreasing size of newly built apartments prompted the development of private or terraced houses offering more spacious housing for larger families,” Reginis pointed out.

A profile of multi-apartment developers – the share of developers with average experience grew fastest

Most experienced developers on the market contributed most to the supply of new apartments in 2018, although their share decreased over a year. According to Ober-Haus, experienced real estate development companies with at least 4 different residential projects in their portfolio built 44% of apartments in the capital city in 2018 (in 2017 this indicator was 66%). Developers with less experience (2-3 completed projects) built 43% of all apartments and their share increased fastest within a year (in 2017 year this indicator was 24%). The share of the companies without longer history of housing development (not more than one implemented project) or the newcomers of the market increased from 10% to 13% in 2018.

Speaking about developers with less experience or first-time property developers in the housing market, it should be noted that a certain portion of such companies may be established by company groups with a firm financial backing, which specialise in other business segments or are better known as commercial property developers who in recent years have re-routed their investment into the housing development. Such companies can afford to recruit highly skilled service providers (designers, contractors, supervisors and other consultants) and successfully implement housing projects thus gaining experience and becoming known as housing developers in the market. However, the active housing market also attracts first-time developers who cannot prove in advance to the investor or the buyer that they will be able to manage the complex project planning and construction properly.

What lies ahead in the multi-apartment building market in Vilnius in 2019?

At the start of the year we are able to provide a sufficiently accurate forecast what to expect in the multi-apartment building market in the capital city. After assessing the construction of multi-apartment buildings in progress or pending, scheduled completion and historical experience in the housing development, Ober-Haus forecasts that a total of about 4,500-4,600 apartments will be built in 2019 or an average of 5% more than in 2018. “Of course, the main condition for such forecast is at least stable general economic situation,” Reginis added.

“Looking at the volume of housing construction which continues at an unabated pace, the question remains whether the volume meets the demand. Is the number of apartments being built too large or too little? Out of the total apartments built in 2018, 74% of them were sold or reserved at the end of 2018. In 2017, the indicator was almost the same totalling 75%. In 2016, the result was better and totalled 82%, while in 2015 it stood at 73%. Therefore, the results of 2018 are not somehow exceptional, but are an average of the past three years. This leads to the conclusion that developers build neither too much nor too little. This is really good news for the entire market,” Reginis said. To sum up the past year and looking at the year 2019, it is clear that the housing development “boom” continues and in the nearest future customers will certainly have plenty of options to choose from.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in December 2018. The annual apartment price growth in the major cities of Lithuania was 3.9% (the annual apartment price growth in November 2018 was 3.8%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.2% in December 2018. The annual apartment price growth in the major cities of Lithuania was 3.9% (the annual apartment price growth in November 2018 was 3.8%).

In December 2018 apartment prices in the capital grew 0.2% with the average price per square meter reaching EUR 1,512 (+3 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 31.0% (+358 EUR/sqm). Apartment prices in Kaunas and Šiauliai in December grew by 0.3% respectively with the average price per square meter reaching EUR 1,074 (+2 EUR/sqm) and EUR 666 (+2 Eur/sqm). Meanwhile in Panevėžys was recorded 0.1% price decrease with average price per square meter reaching EUR 643 (-1 EUR/sqm). In Klaipėda no price changes were recorded and average apartment price remained the same as in November – EUR 1,076.

In the past 12 months, the prices of apartments grew in all major cities: 3.0% in Vilnius, 4.2% in Kaunas, 3.7% in Klaipėda, 8.9% in Šiauliai and 11.6% in Panevėžys.

‘The year 2018 ended in a sufficiently calm mood and there were no significant changes in sales prices in the apartment market in major cities. Looking back at 2018, the year started with a very slow change in apartment prices in Vilnius, Kaunas and Klaipėda. In Q1, minor both positive and negative changes in prices were recorded. During the rest of the year, the apartment sales prices in major cities returned to moderate, but steady growth. The annual growth rate remained within the range of 3–4%, i.e. the prices increased at the same pace as in 2017.

Meanwhile in Šiauliai and Panevėžys, the cities with the smaller price levels, a higher growth rate of apartment sales prices was recorded in 2018, which resulted in a much higher annual figure compared to that in Vilnius, Kaunas and Klaipėda. This was the biggest positive annual apartment sales price change over a decade,’ Raimondas Reginis, Ober-Haus market research manager for the Baltics, said.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in November 2019. The annual apartment price growth in the major cities of Lithuania was 6.3% (the annual apartment price growth in October 2019 was 6.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.6% in November 2019. The annual apartment price growth in the major cities of Lithuania was 6.3% (the annual apartment price growth in October 2019 was 6.2%).

In November 2019 apartment prices in the capital grew 0.6% with the average price per square meter reaching EUR 1,597 (+9 EUR/sqm). Apartment prices in Kaunas and Klaipėda in November grew by 0.5% respectively with the average price per square meter reaching EUR 1,143 (+6 EUR/sqm) and EUR 1,132 (+6 Eur/sqm). Meanwhile in Šiauliai was recorded 1.2% price increase with average price per square meter reaching EUR 729 (+8 EUR/sqm), while apartment price in Panevėžys grew by 0.8% respectively with the average price per square meter reaching EUR 711 (+6 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 5.9% in Vilnius, 6.7% in Kaunas, 5.2% in Klaipėda, 9.8% in Šiauliai and 10.5% in Panevėžys.

“The past several years recorded accelerated growth in apartment sales prices in Kaunas, Šiauliai and Panevėžys, in addition to the shrinking difference in apartment prices between those cities and the capital. The one exception was Klaipėda, in which the apartment price increase was most moderate and the gap as compared to Vilnius remained in essence unchanged. Still, the fairly rapid growth in prices in Vilnius again increased the gap between the capital and the other major cities. While in 2018 the difference between the average apartment prices between the capital and the other major cities was 428–875 Eur/m², this year the figure was 455–886 Eur/m². One of the reasons potentially affecting the development was that wages in Vilnius grew more than in the country’s other large cities,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full article (PDF): Lithuanian Apartment Price Index, November 2019

Search

Search