The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.7% in August 2019. The annual apartment price growth in the major cities of Lithuania was 6.4% (the annual apartment price growth in July 2019 was 6.2%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.7% in August 2019. The annual apartment price growth in the major cities of Lithuania was 6.4% (the annual apartment price growth in July 2019 was 6.2%).

In August 2019 apartment prices in the capital grew 0.7% with the average price per square meter reaching EUR 1,577 (+11 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 36.6% (+423 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in August grew by 0.5%, 1.2%, 1.0% and 0.1% respectively with the average price per square meter reaching EUR 1,123 (+6 EUR/sqm), EUR 1,116 (+14 Eur/sqm), 719 (+7 EUR/sqm) and EUR 700.

In the past 12 months, the prices of apartments grew in all major cities: 5.9% in Vilnius, 6.4% in Kaunas, 5.1% in Klaipėda, 12.1% in Šiauliai and 13.2% in Panevėžys.

“The housing market activity across the whole country and in major cities continues to increase – more and more housing properties are purchased each year. The growing demand continues to drive housing prices up in the cities. However, not only the financial capacities of buyers, but also the growing urban population increase demand in specific cities. According to Statistics Lithuania, in H1 2019 Vilnius, Kaunas, Klaipėda and Šiauliai city municipalities saw the growth in the number of inhabitants. A consistent increase in the number of inhabitants has been recorded in the country’s capital since 2012, meanwhile in other major cities the rise in the population has been recorded for the first time after a longer break. This is very important for the real estate market as a whole, because the growing urban population creates additional demand for both rented and purchased homes.

Based on the preliminary estimates provided by Statistics Lithuania, in H1 2019, the resident population grew by as many as 5,309 people in the city of Vilnius, 255 people in Kaunas, 614 people in Klaipėda and 608 people in Šiauliai. In Panevėžys, the population continued to decline and in mid-2019 there were 659 fewer inhabitants than at the start of the year. The city of Vilnius can be distinguished from the major cities for its highest recorded population increase both in relative terms over half year and in nominal terms over the last decade.

Despite the prevailing negative demographic trends both in the whole country and in specific cities, housing demand and sales prices in smaller cities of the country (e.g. Šiauliai and Panevėžys) have consistently increased over the past decade. The main reasons for it are small volumes of construction of multi-apartment buildings in such cities and much better statistical indicator of affordability than in Vilnius, Kaunas or Klaipėda. For example, due to much lower housing prices in Šiauliai and Panevėžys, it is easier to purchase it both for those who live and work there and those who emigrated abroad and who invest part of their earnings in their native cities. The returning urban population could revive the stagnating housing and commercial real estate development in these cities,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review: Lithuanian Apartment Price Index, August 2019 (PDF)

Euromoney, an international publisher on capital and financial markets, has ranked Ober-Haus the best property valuer (Property Valuation) and best real estate research and analytics agency (Research) in Lithuania. Ober-Haus has retained its leadership positions and has earned the award for the fourth time.

Euromoney, an international publisher on capital and financial markets, has ranked Ober-Haus the best property valuer (Property Valuation) and best real estate research and analytics agency (Research) in Lithuania. Ober-Haus has retained its leadership positions and has earned the award for the fourth time.

Ober-Haus was also recognized for excellence by the prestigious Euromoney survey in other categories, such as the best real estate advisor – overall (2nd place) and the best agency – letting/sales (2nd place) in Lithuania.

“This year, like in the past few years, we have been in the leading position in all categories of real estate services, and this year we are absolute leaders in property valuation and market research categories. We are pleased with the awards as they reflect the opinion of our customers and market participants about us. Orientation to the quality of services and professional insights for ensuring informed customer decision clearly reap the results. I am grateful to our team, whose involvement and excellence earned us these awards,” Audrius Šapoka, General Manager of Ober-Haus, said.

The 15th annual real estate survey conducted by Euromoney was based on the ratings submitted by the real estate market participants: real estate experts, developers, construction companies and representatives of financial institutions.

Ober-Haus has operated in Lithuania over 20 years and is the largest real estate services provider in Lithuania and the Baltic region. The company is part of the Realia Group, one of the largest Finnish real estate groups. The company’s services package consists of brokerage services in buying, selling or letting commercial and residential property, property and business valuation, consultancy and market research.

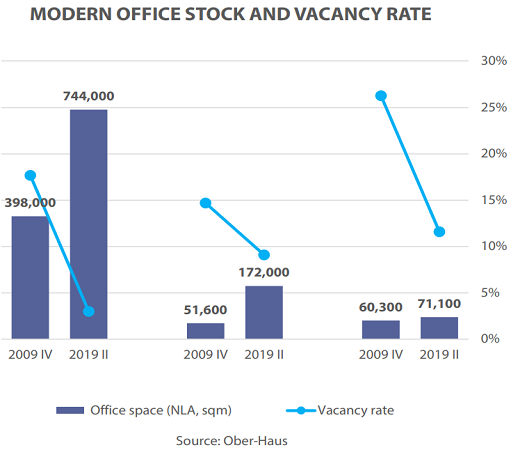

In the first half of 2019, construction of four office buildings was completed in Vilnius: the second building of S7 project (tenant – Telia Lietuva), the second building of Duetto project, an administrative building of the INHUS Group and a business centre in the multifunctional complex Live Square. As reported in the Ober-Haus H1 2019 office market overview, during the past decade, these projects supplemented the market of the capital city with 25,700 sqm of useful office space. At the end of H1 2019, the area of modern office space in Vilnius totalled 744,000 sqm.

Tenants of office premises have been very active this year and continued to reduce vacant spaces at newly opened office buildings and to sign preliminary lease agreements in the projects in progress. The total floor area of modern office space leased within the first half-year in the country’s capital amounted to almost 39,000 sqm or 5% more than during the same period last year.

The unfading interest of tenants further reduced vacancies in the completed office buildings. During the first half of 2019, the office space vacancy rate in Vilnius decreased from 3.7% to 3.0%. The vacancy rate of A class offices was 2.5% and B class – 3.3%. Over the past decade, the vacancy rate under 3% was recorded in Vilnius only in Q2 and Q3 2018.

The second half of 2019 promises to be even more active in the modern office market in Vilnius. With the planned completion of seven new office buildings, the modern office space market in Vilnius should be supplemented with nearly 67,000 sqm useful office space. The tenants moving into these new buildings will vacate their currently used premises in other buildings, giving space for other potential tenants. Since many projects are scheduled to be implemented in the second half-year, sufficient changes could be seen in the office rental market by the end of 2019 and the beginning of 2020.

If all these projects currently under construction are implemented as scheduled, the total annual supply will be the largest in history with over 90,000 sqm. The record year in the office market in Vilnius was considered to be the year 2008 when eleven administrative buildings were completed totalling 86,500 sqm of useful office space.

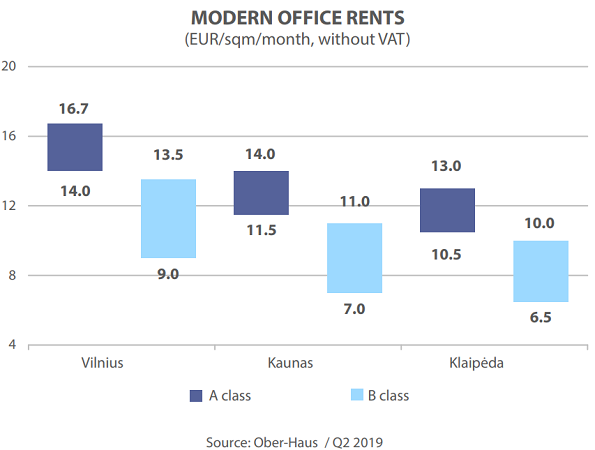

Despite continuing high office space demand and occupancy rates, the annual ample new office supply has substantially stabilized rents which have seen little increase since 2015. The year 2019 is no exception – in the first half of 2019 rents increased by 1-2% on average and currently rents for B class office space stand at 9.0–13.5 EUR/sqm and A class office space – at 14.0–16.7 EUR/sqm.

Since the real estate developers continue to be optimistic and continues to offer new projects to the market, stable rents could be expected in the future even under the conditions of the growing economy. In order to retain high occupancy rates, developers will continue to attract tenants by offering competitive rents and the latest office solutions in their developed projects.

Kaunas attracts tenants by almost one fifth lower office rents than those in the capital city

In the meantime, in H1 2019 in Kaunas no major changes in supply were recorded. Only two small buildings were completed in this city (commercial building with retail and office space Longas on Veiveriu Street and a commercial building on Statybininkų Street) offering almost 2,400 sqm of office space. The area of modern office space in Kaunas totalled 172,000 sqm in mid-2019.

Much larger changes in the office space supply is expected in Kaunas in H2 2019 – in total five new projects (including further phases of earlier projects) should be completed, as a result of which 27,000 sqm of new office space will be provided.

Continuing stable demand for modern office space and little new development in the first half of this year slightly reduced the vacancy rates in Kaunas. During the first half of 2019, the total vacancy rate of modern office space decreased from 9.7% to 9.1%. Since the start of the intensive development of the office sector in 2017, the vacancy rate of office space in Kaunas has never fallen below 7.5%. Since sizeable development of new offices is planned in H2 2019 and in 2020, the vacancy rate at the end of the year should exceed 10% and is likely to reach the level of 2018 (11–12%).

Like in the country’s capital city, the factor of increasing supply over the past three years in Kaunas has reduced opportunities for rent increase, so rents increased only slightly (in proportion to the country’s inflation rate). In H1 2019, rents for B class office space increased by 3% on average and rents for A class office space remained stable. In mid-year, B class rents in Kaunas stood at 7.0–11.0 EUR/sqm and A class rents – at 11.5–14.0 Eur/sqm. It is likely that in the nearest future office rents in Kaunas will remain at the same level and will attract tenants as they are by almost one fifth lower than those in the capital city.

The total area of modern office space increased by 18% in Klaipėda, 90% – in Vilnius and 230% – in Kaunas

The modern office space market in Klaipėda continues the tradition of symbolic development with only one new project offered each year. This year has been no exception and at the beginning of 2019 the first stage of the private capital research and innovation valley Baltic Tech Park on Liepų Street was completed. On the site of the former industrial building a 2-3-floor building of over 6,000 sqm was built offering retail and office space. The major part of the office space was occupied by Light House coworking space (1,500 sqm). The developer, Viremidos Investicijos, is planning further development of the Baltic Tech Park with potentially three more buildings for various research and business companies.

Although this innovative project has brought new developments in the business and property markets in the city of Klaipėda, this had no major impact on the modern office market statistics in this city. The total area of modern office space has increased by only 18% in the past decade in this city and by mid-2019 totalled to 71,100 sqm. By way of comparison, during the same period the total area of modern office space increased by almost 90% in Vilnius and by 230% in Kaunas.

The first half-year of 2019 saw no major changes in office vacancy levels in the city of Klaipėda, which has consistently decreased over the past ten years, but still is over 10%. During the first half of 2019, the vacancy rate fell from 11.8% to 11.6% and this is the lowest rate since the end of 2008.

In the same period rents for B class office space increased by 3% on average, while the prices for A class office space remained stable. Rents are lower than in Vilnius or Kaunas: B class offices rent are for 6.5–10.0 EUR/sqm and A class offices rent for 10.5–13.0 Eur/sqm.

Unlike Vilnius or Kaunas, Klaipėda cannot boast of a leap in supply or demand of office space making it difficult to forecast any faster growth in rents than the general price level of goods and services in the country.

Full review: Lithuania Commercial Market Commentary H1 2019 (PDF)

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.8% in July 2019. The annual apartment price growth in the major cities of Lithuania was 6.2% (the annual apartment price growth in June 2019 was 5.6%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.8% in July 2019. The annual apartment price growth in the major cities of Lithuania was 6.2% (the annual apartment price growth in June 2019 was 5.6%).

In July 2019 apartment prices in the capital grew 0.8% with the average price per square meter reaching EUR 1,566 (+12 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 35.7% (+412 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in July grew by 1.0%, 0.4%, 1.2% and 1.9% respectively with the average price per square meter reaching EUR 1,117 (+11 EUR/sqm), EUR 1,102 (+4 Eur/sqm), 712 (+8 EUR/sqm) and EUR 700 (+13 EUR/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 5.7% in Vilnius, 6.3% in Kaunas, 4.3% in Klaipėda, 11.6% in Šiauliai and 14.2% in Panevėžys.

“The month of July in the Lithuanian apartment market was really exclusive. According to the State Enterprise Center of Registers, over 3,060 apartments were purchased in July in Lithuania, which is the best monthly performance in the market’s history. A further increase in the apartment sales prices has been recorded in all major cities of the country. The price increase in all major cities combined was the same as that in June, while the annual growth rate was the highest since mid-2008. The housing market is certainly buzzing,” Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said.

Full review: Lithuanian Apartment Price Index, July 2019 (PDF)

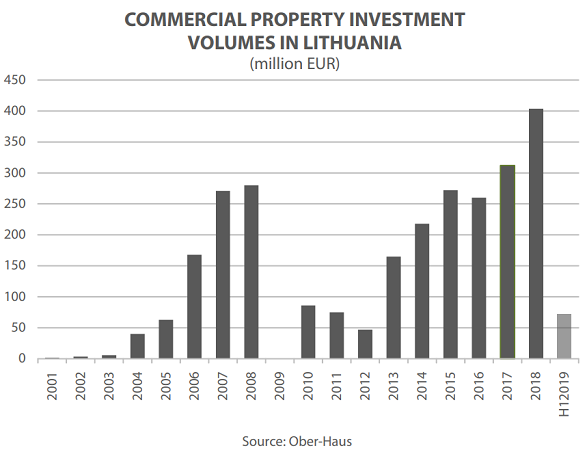

The transaction volume in the Lithuanian commercial property investment market in the first half of 2019 was much lower than expected in the sector which is currently rapidly developing and is highly active.

Although the beginning of the year saw an announcement of one of the largest investment transactions in the history of Lithuania, where the Swedish investment company Eastnine signed an agreement with the developer M.M.M. Projektai for the acquisition of three office buildings in S7 project in Vilnius, this did not significantly improve the overall investment market performance of the first half of 2019. The value of the transaction for the three office buildings on Saltoniškių Street totalled slightly over EUR 128 million, but in the first half-year an acquisition transaction for only one of the buildings was finalised (tenant – Danske Bank Global Service Centre). It is likely that the acquisition of the second building (tenant – Telia Lietuva) will be finalised in the second half of 2019 and the third building (tenant – Danske Bank) – in early 2020, i. e. after the conditions of this truly significant transaction are implemented. Therefore, only the sum of the first transaction was included in the results of the first half-year.

According to Ober-Haus, acquisitions of the modern commercial property (office, retail and industrial buildings/premises with a value of at least EUR 1.5 million) in Lithuania in H1 2019 totalled EUR 72 million, the poorest half-year indicator since 2013. The purchase transaction for the first S7 building in Vilnius accounted for half that sum. The second highest value transaction was the acquisition of the second Duetto building in Vilnius. In December 2018 it was announced that the Baltic Horizon Fund managed by the Danish investment company Northern Capital Fund would purchase an office building from the developer YIT Lietuva for EUR 18.3 million and that the transaction would be finalised after the completion of the construction of the building and moving in of the tenants, i.e. at the beginning of 2019. The remaining acquisitions ranged from EUR 2 million to EUR 4 million and involved smaller office and retail properties in the country’s capital and other cities.

After a moderate H1 2019 in the commercial real estate market for investment, large volumes of transactions are expected in H2

Looking at the prospects for H2 2019, higher sales volumes in the investment transaction market can be expected. In August 2019, a large investment transaction was announced in Kaunas, where Eften Real Estate Fund 4, managed by the Estonian commercial real estate fund management company Eften Capital, acquired the shopping centre River Mall and the business centre River Hall from Sirin Development. In addition to the transaction for the second S7 office building on Saltoniškių Street in Vilnius, which will be finalised in H2 2019, the acquisition of the second office building of the Park Town project that is nearing completion may be expected as announced earlier by its developer Darnu Group.

The acquisition of these four objects should contribute over EUR 120 million to the investment transaction volumes this year. However, looking at the record investment transactions volumes in Lithuania recorded in 2017–2018 (in 2017 – EUR 312 million and in 2018 – EUR 404 million), the data currently available suggest that it will be difficult to achieve similar volumes this year. Specifically, at least 2 to 3 large commercial property acquisitions would be required (for at least EUR 30–50 million each) in order to achieve the 2017 indicator (i.e. at least EUR 300 million).

Under the current conditions in the commercial real estate market this is achievable, because the commercial property portfolio continues to expand quite rapidly in Lithuania. It is particularly noticeable in Vilnius and Kaunas regions where new business or logistics centres are being built at a fast pace and could attract potential investors. In the meantime, property owners have real opportunities to make use of the current market rise and sell their commercial real estate at top prices of the past decade.

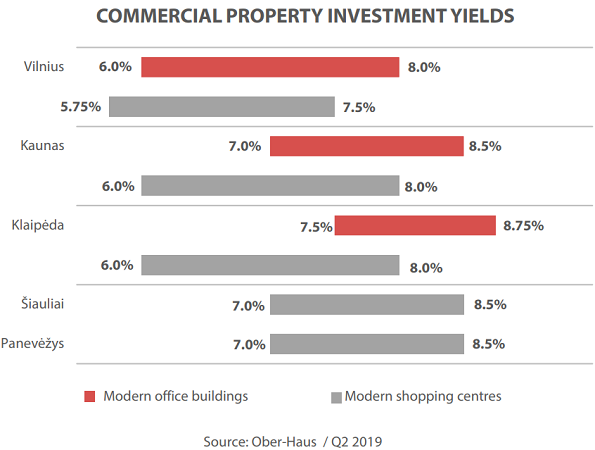

The lowest yields have been recorded in the office market of the capital city in history

The developments in the most rapidly expanding commercial property sector in the country – offices in the country’s capital – in the past 12 months show that the rapid investment value growth potential in this segment has already reached its limits and any more noticeable positive change in the nearest future is hardly expected.

Although the lowest investment yield indicators during the entire history of modern commercial real estate are reported in the office market in the country’s capital (e.g. the acquisition yield for three S7 office buildings is 5.8%), we can see that in the competitive environment office rents in the country’s capital, including the rents of A class offices, have not essentially changed for four consecutive quarters. The growth in the property value has been lately determined by slightly declining yield indicators and a symbolic increase in rents in one of the most attractive segments – the top class office buildings. During the past 12 months, the capital value index for A class offices in Vilnius has increased by 3%.

Despite the recorded very low yields in individual transactions involving the newest and the most modern buildings, in the case of the acquisition of older A or B class office buildings the buyers assess the prospects of such property (potential rental income in the future and the likely additional costs to achieve it) much more carefully and this reflects in the proposals made to property owners. That is why the investment yield gap is expanding to the detriment of older buildings.

If in the country’s capital the biggest property value hike has been recorded in the office premises sector in the past decade, so the more noticeable property value growth could be expected in the regions of the country with a faster growth potential (e.g., Kaunas) resulting both from the moderate rents increase and the decreasing yields in the most attractive office, warehousing or retail properties (most technologically advanced buildings with strong tenants).

Only after the evaluation of the data for H2 2019 and H1 2020 will it be possible to say whether the activity in the commercial property investment market manages to exceed the record highs achieved in 2017–2018.

Due to the relatively small size of the Lithuanian commercial real estate market and lower liquidity, greater activity fluctuations in small markets are a frequent and natural occurrence. However, it is likely that in the nearest future the negotiations between property owners and potential buyers will be more difficult than in the previous years. On the one hand there are the sellers who can see a very active commercial real estate market with the best historical indicators, on the other hand there are buyers who can see increasingly lower growth potential in certain property segments and a more conservative traditional financing environment.

Full review: Lithuania Commercial Market Commentary H1 2019 (PDF)

The Lithuanian residential property market, growing for the ninth year in a row, is showing no surprises this year – the general market indicators demonstrate as always that the housing market has been experiencing its heyday over the last decade. The first six months of 2019 were especially productive – compared to the same period in previous years, the number of purchased housing (apartments and houses) was the highest the country had seen since 2007. “Positive trends were recorded in all of the five major cities: the number of purchased apartments and houses was bigger than in the first half-year of 2018, and the total amount spent on such properties was also greater than a year ago,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

The Lithuanian residential property market, growing for the ninth year in a row, is showing no surprises this year – the general market indicators demonstrate as always that the housing market has been experiencing its heyday over the last decade. The first six months of 2019 were especially productive – compared to the same period in previous years, the number of purchased housing (apartments and houses) was the highest the country had seen since 2007. “Positive trends were recorded in all of the five major cities: the number of purchased apartments and houses was bigger than in the first half-year of 2018, and the total amount spent on such properties was also greater than a year ago,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

According to the data of the State Enterprise Centre of Registers, the number of purchase and sale transactions of apartments in the first half of 2019 in Lithuania was 4.6% higher, and houses 8.1% higher, compared to the same period in 2018. Over the first six months of this year, 2,793 apartment purchase transactions and 887 house purchase transactions were concluded per month on average. To compare the first half-year of 2019 with the same period in 2018, the fastest (over 20%) general relative growth in the number of apartment and house transactions was recorded in Birštonas municipality (81.3%), Širvintos district municipality (65.4%), Alytus district municipality (54.5%), Panevėžys district municipality (49.6%), Kupiškis district municipality (32.9%), Zarasai district municipality (31.8%), Ignalina district municipality (29.7%), Ukmergė district municipality (23.5%), Anykščiai district municipality (23.4%), and Vilnius district municipality (23.3%).

Meanwhile, the number of purchased housing was reducing the fastest during the same period in the following municipalities of Lithuania: Neringa municipality (33.3%), Švenčionys district municipality (18.1%), Mažeikiai district municipality (15.1%), Druskininkai municipality (14.5%), Kelmė district municipality (14.3%), Molėtai district municipality (13.0%), Kretinga district municipality (12.1%), and Rietavas municipality (11.1%). “The greatest changes in housing market activity were most often recorded in the municipalities of smaller towns (e.g., Neringa, Birštonas), which are characteristic of a small housing fund and a modest number of transactions concluded, accordingly. For this reason, due to the small sample size of the transactions in such municipalities, the biggest statistical deviations from the average for the country are regularly being recorded,” Mr Reginis said.

The greatest change in the amounts spent for housing purchase was recorded in Panevėžys

The total amount of money being spent on housing purchase across the country continues to increase. According to the data of the SE Centre of Registers, over EUR 1.07 billion was spent on housing (flats and houses) in Lithuania during the first half-year of 2019, or 10.2% more than the same period last year. In 2019, an increase in the amount of money in the housing market was observed, in principle, on the scale of the entire country, i.e. compared to the same period in 2018, growth was recorded in 51 out of Lithuania’s 60 municipalities.

“The fastest growth in the money being spent on housing in 2019 in terms of the main cities in Lithuania was recorded in the smaller cities,” – Mr. Reginis noted. The biggest change this year was recorded in Panevėžys. There, almost EUR 22 million was spent on acquiring housing in the first six months of the year, which is 24.6% more than the same period in 2018. Šiauliai recorded growth of 17.4% (amounting to almost EUR 32 million), Klaipėda 14.1% (almost EUR 88 million), and Kaunas 8.9% (over EUR 139 million), while in Vilnius 5.1% more was spent on housing than in 2018, totalling almost EUR 504 million.

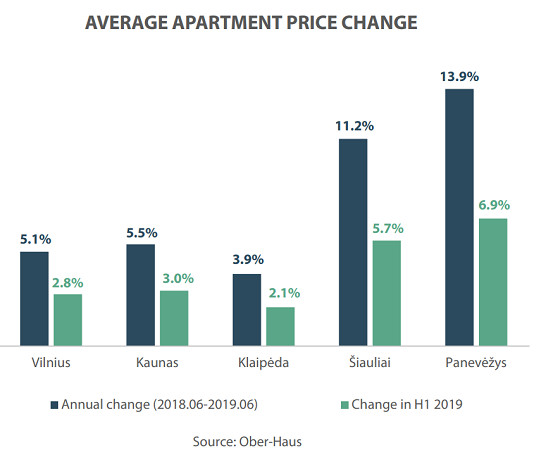

Apartment prices increased faster in smaller cities of the country

In 2019, trends of faster growth in the sales price of apartments were also observed in smaller cities across the country. According to the data of Ober-Haus, over the first half of 2019 prices of flats in Panevėžys increased by 6.9% on average, in Šiauliai 5.7%, Kaunas 3.0%, and Vilnius 2.8%, while in Klaipėda flat prices increased the least, by 2.1%. Whereas steady growth in the sales prices of apartments continued to be recorded in Lithuania’s biggest cities, the segment of houses did not record any major changes. In the first six months of 2019, sales prices of houses in Kaunas, Šiauliai and Panevėžys and their surroundings increased by 1-2% on average. No changes were recorded in Vilnius and Klaipėda and their surroundings over the same period.

Rents of apartments in Lithuania’s three main cities grew in 2019 at a pace similar to their sales prices, a fact which demonstrates that the demand for the housing offered for rental remains on a very high level. “Traditionally, potential tenants are mostly interested in the segment of cheaper housing, which is in greatest demand among residents who earn lower or average incomes and among people who arrive to work temporarily or to study,” Mr Reginis said.

According to the data of Ober-Haus, rents in Vilnius (in the first half of 2019 compared to the first half of 2018) increased by 5.5% on average, in Kaunas by 6.5%, and in Klaipėda by 5.3%. In the middle of 2019, the average rent for 1-3 room apartments in Vilnius constituted EUR 413/month, in Kaunas EUR 321/month, in Klaipėda EUR 320/month, in Šiauliai EUR 229/month, and in Panevėžys EUR 227/month.

One more record half year in the apartment market of the capital city

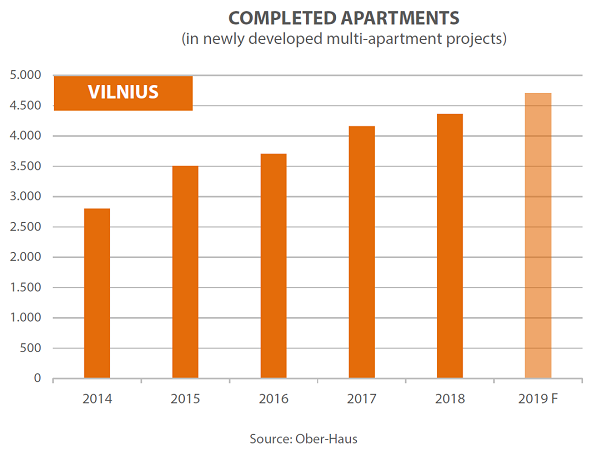

As the biggest scope for the construction of housing in 2018-2019 was recorded in Vilnius, Kaunas and Klaipėda in terms of the recent decade, and the general economic situation in the country as well as the financial situation of purchasers continues to maintain the activity of the market, growth in the volumes of sales of not only already registered but also of pre-constructed apartments and houses is being recorded. “The expanding opportunities in the choice of new housing encourage customers to buy new housing and increasingly encouraging results have been recorded in this segment,” Mr Reginis said.

According to the data of Ober-Haus, in the first half of 2019, 2,890 new apartments in multi-apartment buildings that have been completed or are being constructed were purchased or reserved in Vilnius directly from developers. This is almost 25% more than the number of flats sold or reserved in the second half of 2018 and 55% more than in the first half of 2018. At the same time, the results of this year’s first six months are the best for a decade.

According to the data of Ober-Haus, in the first half of 2019, 2,890 new apartments in multi-apartment buildings that have been completed or are being constructed were purchased or reserved in Vilnius directly from developers. This is almost 25% more than the number of flats sold or reserved in the second half of 2018 and 55% more than in the first half of 2018. At the same time, the results of this year’s first six months are the best for a decade.

With such a high demand for new and modern housing, developers have no wish to reduce their development plans in the capital city and, in fact, estimate that in 2019 the construction of 4,600 to 4,800 apartments in multi-apartment buildings will be completed. This would be 5-10% more than were built in 2018 and the highest number since 2008.

The developers of private houses also plans a high output. According to the data of Ober-Haus, in 2019, it is planned to build about 700 houses in the city of Vilnius and its surroundings. “Although this would be about 10% less than in 2018, it would be one of the biggest annual indicators of supply in the entire history of the Lithuanian real estate market,” Mr. Reginis noted.

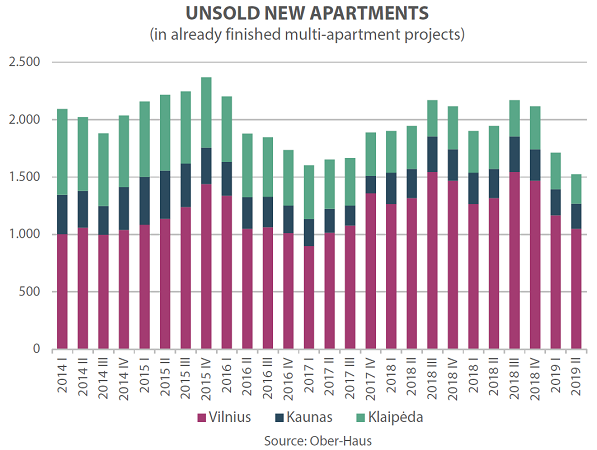

The number of unsold apartments in Vilnius has remained unchanged for the eighth consecutive year

Regardless of the growing competition among apartment housing developers in Vilnius, where increasing numbers of apartments and houses are being built for sale, the number of unsold apartments in already constructed multi-apartment buildings has in principle remained stable and within the limits of 1,000 to 1,400 for eight years in a row. According to the data of Ober-Haus,, the number of such apartments in Vilnius in mid-2019 was about 1,050.

The number of unsold flats and the change in this number in already completed projects is one of the most important indictors when assessing the balance between supply and demand in the primary market. Too high a number of unsold flats in a specific project might indicate that the wrong sales strategy was chosen (sale prices, marketing, and etc.), which prevented the implementation of targeted goals.

“Despite a high general sales results in Vilnius’ primary apartment market, different developers’ results vary. For instance, looking at individual projects, it can be seen that some projects can boast of all apartments sold or reserved even before the completion of construction, whereas in other projects the volume of sales does not make up one third of the apartments constructed,” the representative of Ober-Haus noted. E.g., in the first half of 2019, 25 projects of multi-apartment buildings were implemented; at the end of construction, almost 72% of flats were sold or reserved in total. Projects in which less than 40% of apartments were sold accounted for 20% of all such projects (5). Projects, in which between 40% and 80% of apartments were sold, constituted 40% of all projects (10). The remaining 40% of projects (10) had over 80% of the apartments sold or reserved at the end of construction.

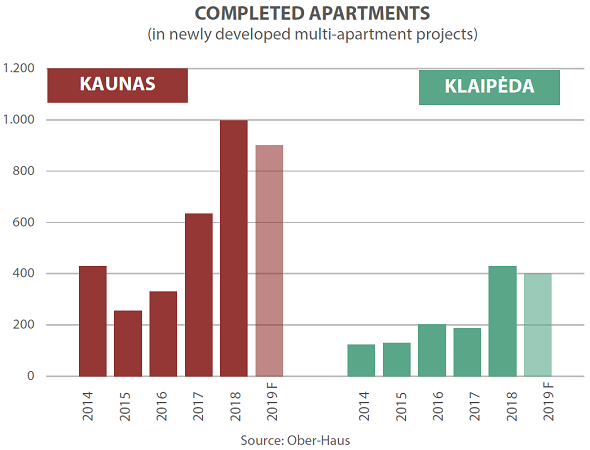

The housing market in Kaunas and Klaipėda is in its prime in the past decade

Numerous constructions of new multi-apartment buildings in Kaunas in 2017 – 2019 determined record numbers of sales of new apartments during the period. According to the data of Ober-Haus, in the first half of 2019, 497 new apartments in multi-apartment buildings that have been completed or are being constructed were purchased or reserved in Kaunas directly from developers. This is almost 37% more than the number of apartments sold in the second half of 2018 and 34% more than in the first half of 2018. Just like in the capital city, the result of this year’s first six months is the best over the last decade.

Whereas almost 1,000 apartments were built in multi-apartment buildings in Kaunas for sale in 2018, this year the number of apartments is not going to be much smaller (about 900). “For this reason, Kaunas city dwellers can be delighted with the really wide choice of new housing in recent years, which is reflected in the statistical data of early and final transactions,” Mr Reginis said.

Whereas almost 1,000 apartments were built in multi-apartment buildings in Kaunas for sale in 2018, this year the number of apartments is not going to be much smaller (about 900). “For this reason, Kaunas city dwellers can be delighted with the really wide choice of new housing in recent years, which is reflected in the statistical data of early and final transactions,” Mr Reginis said.

After a longer break, Klaipėda could also boast of greater apartment development volumes in 2018. A total of 11 projects offering 429 apartments were implemented in Klaipėda in 2018. This is 2.3 times as many as in 2017. In 2011–2017, only about 200 new apartments per year were built in Klaipėda on average.

Following a longer break, some life is being breathed into the city of Klaipėda, where almost 430 apartments were built and offered for sale in 2018. This year, developers plan to complete 400 more new flats in multi-apartment buildings. After the implementation of these projects, 2018 and 2019 will have been twice as rapid in terms of the development of multi-apartment buildings in Klaipėda than in the period from 2011 to 2017, when only 200 or so new apartments were built there per year on average.

The greater volumes of new housing developments are also being reflected in the statistical data of apartment sales. According to Ober-Haus, in the first half of 2019, 287 new apartments in multi-apartment buildings that have been completed or are being constructed were purchased or reserved in Klaipėda directly from developers. This is almost 30% more than the number of apartments sold in the second half of 2018 and 76% more than in the first half of 2018

The number of unsold apartments in Kaunas and Klaipėda has consistently decreased

Differently from the situation in the capital city, where the number of unsold apartments in already built multi-apartment buildings has remained within a similar range for eight years in a row, trends in Kaunas and Klaipėda are different. Analysis over a longer period shows that the number of unsold units in already built multi-apartment buildings in Kaunas and Klaipėda is gradually reducing.

Whereas in 2010–2012 the number of unsold apartments in Kaunas and Klaipėda ranged between 600 and 900, this number in 2017-2018 was about 200 to 250 in Kaunas and 350 to 400 in Klaipėda. According to Ober-Haus, in mid-2019, the number of such apartments in Kaunas was 220 and in Klaipėda almost 260.

“In other words, differently from the capital city, the market in the aforementioned two cities has focused on the sale of previously built vacant units and not on the development of new projects,” Mr Reginis said. In the last two or three years, the scope of new housing construction recorded in Kaunas and Klaipėda should stabilise the declining number of unsold apartments in already built multi-apartment buildings and in this way retain a balance between supply and demand.

Full review: Lithuania Residential Market Commentary H1 2019 (PDF)

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.8% in June 2019. The annual apartment price growth in the major cities of Lithuania was 5.6% (the annual apartment price growth in May 2019 was 5.1%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.8% in June 2019. The annual apartment price growth in the major cities of Lithuania was 5.6% (the annual apartment price growth in May 2019 was 5.1%).

In June 2019 apartment prices in the capital grew 0.8% with the average price per square meter reaching EUR 1,554

(+12 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 34.6% (+400 EUR/sqm). Apartment prices in Kaunas and Klaipėda in June grew by 0.4% and 0.9% respectively with the average price per square meter reaching EUR 1,106 (+4 EUR/sqm) and EUR 1,098 (+9 Eur/sqm). In Šiauliai and Panevėžys in June prices grew by 1.6% respectively with the average price per square meter reaching EUR 704 (+11 EUR/sqm) and EUR 687 (+11 Eur/sqm).

In the past 12 months, the prices of apartments grew in all major cities: 5.1% in Vilnius, 5.5% in Kaunas, 3.9% in Klaipėda, 11.2% in Šiauliai and 13.9%in Panevėžys.

‘Looking at the indicators of the past few years, the average apartment sales prices in the major cities of the country have continued to grow faster than the prices of consumer goods and services in the country. According to Statistics Lithuania, in June 2019 the annual inflation calculated on the basis of the Harmonized Index of Consumer Prices stood at 2.4%. At that same time, the average annual increase in prices of apartments in the country’s major cities stood at 5.6%.

Over the past five years, i.e. June 2019 compared with June 2014, the inflation in the country stood at 8.8% and the prices of apartments in major cities increased by 19.5% on average. This means that the real sales prices of apartments, inflation-adjusted, grew by 9.8% over the past five years or twice as fast as the prices of goods and services in the country.

Changes in sales prices of apartments in major cities of the country differ and therefore the real sales prices of apartments over the past five years have increased at a different pace: in Panevėžys – 19.4%, Šiauliai – 15.2%, Vilnius – 11.3%, Kaunas – 8.5% and in Klaipėda – 3.1%,’ Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said.

Full review: Lithuanian Apartment Price Index, June 2019 (PDF)

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in May 2019. The annual apartment price growth in the major cities of Lithuania was 5.1% (the annual apartment price growth in April 2019 was 5.1%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.5% in May 2019. The annual apartment price growth in the major cities of Lithuania was 5.1% (the annual apartment price growth in April 2019 was 5.1%).

In May 2019 apartment prices in the capital grew 0.5% with the average price per square meter reaching EUR 1,542 (+8 EUR/sqm). Apartment prices in Kaunas, Klaipėda, Šiauliai and Panevėžys in May grew by 0.6%, 0.4%, 0.7% and 1.0% respectively with the average price per square meter reaching EUR 1,102 (+7 EUR/sqm), EUR 1,089 (+4 Eur/sqm), 693 (+5 EUR/sqm) and EUR 676 (+7 EUR/sqm). In the past 12 months, the prices of apartments grew in all major cities: 4.5% in Vilnius, 5.4% in Kaunas, 3.3% in Klaipėda, 10.1% in Šiauliai and 13.5% in Panevėžys.

‘The market activity at least in the country’s major cities continues to be in recent decade highs. Official data shows that during the first five months of the year, compared to the same period in 2018, the number of purchased apartments has been increasing in all the major cities. If in the first five months the apartment sales figures in Klaipėda and Panevėžys were lower than those recorded in 2014, so in Vilnius, Kaunas and Šiauliai the overall result in the beginning of the year was the best in the past decade.

At the same time the apartment sales prices continue to reflect the growing or high overall market activity. Although the monthly price changes are not considerable, over a longer period the total nominal increase in prices of apartments is evident and more noticeable. If we calculate the change in sales prices since the lowest recent price level in major cities of the country, we will see that in 2019 buyers should be paying on average about EUR 17,700 more for a standard 50 sqm medium class apartment in Vilnius than for the same apartment in 2010 (nine years ago). Meanwhile in the remaining major cities of the country the lowest sales prices were recorded in 2013 and six years on buyers should be paying for the same apartment about EUR 7,700 more in Kaunas, EUR 7,200 more in Panevėžys, EUR 6,700 more in Šiauliai and about EUR 6,100 more in Klaipėda,” Raimondas Reginis, Ober-Haus Research Manager for the Baltics, said.

Full review: Lithuanian Apartment Price Index, May 2019 (PDF)

Ober-Haus has leased 1,000 sqm office premises in a new building of Radisson Blu Hotel Lietuva on Konstitucijos Avenue. The first three floors of the newly added building will accommodate commercial premises and offices and the hotel rooms will be located on 4th to 8th floors. With the completion of the new building, Radisson Blu Hotel Lietuva will become the largest hotel in Lithuania. It is planned to seek certification of this A+ energy efficiency building under the BTREEAM construction certification for sustainability and high standards. All commercial premises and offices are currently rented out.

Ober-Haus has leased 1,000 sqm office premises in a new building of Radisson Blu Hotel Lietuva on Konstitucijos Avenue. The first three floors of the newly added building will accommodate commercial premises and offices and the hotel rooms will be located on 4th to 8th floors. With the completion of the new building, Radisson Blu Hotel Lietuva will become the largest hotel in Lithuania. It is planned to seek certification of this A+ energy efficiency building under the BTREEAM construction certification for sustainability and high standards. All commercial premises and offices are currently rented out.

“The open office layout will be fitted out according to the needs of the tenants. The building is heated with geothermal energy and cooled with chilled beams. It contains a two level underground car park (109 parking spaces), a charging point for electric cars and parking spaces for bicycles. This is a perfect place for business in the central business district of the city with very convenient access,” Darius Tumas, senior consultant of commercial real estate at Ober-Haus, said.

Find out more: OHMAP helps to find all office and mixed-use buildings with a minimum of 1,000 sqm useful office area in Vilnius built since 1999 or currently under construction.

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in April 2019. The annual apartment price growth in the major cities of Lithuania was 5.1% (the annual apartment price growth in March 2019 was 5.0%).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), increased by 0.3% in April 2019. The annual apartment price growth in the major cities of Lithuania was 5.1% (the annual apartment price growth in March 2019 was 5.0%).

In April 2019 apartment prices in the capital grew 0.2% with the average price per square meter reaching EUR 1,534 (+3 EUR/sqm). Since the last lowest price level recorded in May 2010 prices have increased by 32.9% (+380 EUR/sqm). Apartment prices in Kaunas, Šiauliai and Panevėžys in April grew by 0.7%, 0.6% and 1.0% respectively with the average price per square meter reaching EUR 1,095 (+7 EUR/sqm), 688 (+4 EUR/sqm) and 669 (+6 EUR/sqm.). In Klaipėda no price changes were recorded and average apartment price remained the same as in November – EUR 1,085.

In the past 12 months, the prices of apartments grew in all major cities: 4.4% in Vilnius, 5.1% in Kaunas, 3.8% in Klaipėda, 10.3% in Šiauliai and 13.9% in Panevėžys.

“The analysis of changes in prices of old and new apartments shows that over the past 12 months a faster increase in sales prices of old apartments was recorded in Vilnius and Kaunas, while in Klaipėda the prices for new apartments increased. In a year, the price increase for old apartments in Vilnius and Kaunas stood at 5.2% and 5.6% and for new apartments – 3.5% and 4.2% respectively. At the same time in Klaipėda prices for old apartments grew by 3.0% and those for old apartments – by 5.3%.

Considerable and still growing volumes of construction of new apartments in the country’s capital city and a substantial rise in the number of newly completed apartments in Kaunas determined more moderate price growth for new apartments in these cities, compared with those for older apartments. It is obvious that increasing competition in the housing market affects sales prices. In the meantime in Klaipėda, despite larger volumes of construction of multi-apartment buildings in 2018, there has been no major breakthrough in the development of such real estate and the choice of new apartments is considerably smaller in Klaipėda than that in Vilnius or Kaunas. Smaller competition in Klaipėda therefore determined greater increase in prices for new apartments in this city”, Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said.

Full review: Lithuanian Apartment Price Index, April 2019 (PDF)

Search

Search